Pressure is mounting for SEC approval of Bitcoin Spot ETF in the U.S. following a new pending spot ETF approval in Canada spearheaded by none other than Fidelity Investments.

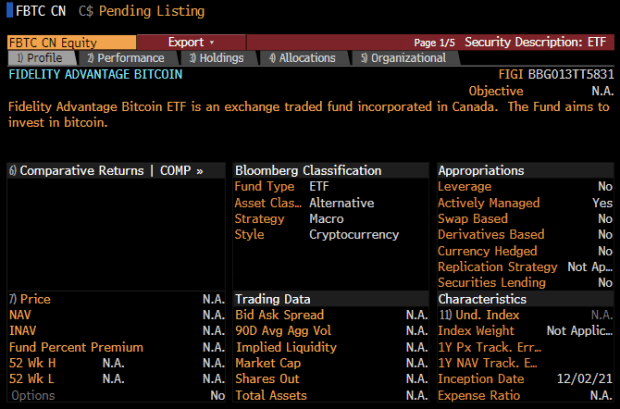

Fidelity’s Bitcoin Spot ETF product listing is titled “Fidelity Advantage Bitcoin” and pending approval to launch in Canada this week. According to Eric Balchunas, Bloomberg senior ETF analyst, the launch of Fidelity’s listing would immediately make them the largest asset manager offering a Bitcoin ETF.

Fidelity’s move for Bitcoin spot ETF approval in the Canadian market only further fuels the institutional push for approval of a spot-based Bitcoin ETF in U.S. markets. Perhaps the loudest proponent of which being Grayscale, who has been aggressively pushing for spot product approval, as they filed for the conversion of their popular investment trust $GBTC into a spot Bitcoin ETF product.

Grayscale has continued to be outspoken, publicly criticizing the SEC for their refusal to approve a spot product for U.S. markets and arguing that failure to approve a spot bitcoin ETF violates federal law. Davis Polk argues in the letter, which was publicly released by Grayscale on Tuesday, that approving futures-based products and not allowing for a spot ETF to enter the market is “arbitrary and capricious.” Davis Polk goes on to state:

“The commission has no basis for the position that investing in the derivatives market for an asset is acceptable for investors while investing in the asset itself is not.” — Davis Polk,

The approval of a bitcoin spot ETF product enables a more robust offering of investment vehicles for Bitcoin exposure. A Bitcoin spot ETF would help to unlock new pools of capital previously hesitant due to the futures-based fee structure

Being physically-settled, with instant delivery, a spot product would be able to more-closely track the price of Bitcoin and reduce uncertainty that comes with an ETF tracking projected future price.