Bitcoin’s price plummeted in a day by losing $16,000 of value in hours, and the rest of the market followed. According to the analytics company CryptoQuant, there were several on-chain developments that flashed ahead of the crash that could have foreseen the dump.

The Three On-Chain Factors

As reported earlier today, BTC dumped from a daily high of $58,000 all the way down to $42,000, which became one of the worst crashes in terms of USD. While investors are looking into global developments for the reasoning, such as more fears from the new COVID-19 variant and the weekly stock market sell-off, CryptoQuant provided several on-chain possible reasons.

The first was the number of bitcoins sitting on exchanges, which spiked sharply hours ahead of the drop. This metric was declining gradually over the past several months, leading to new lows. However, as the graph below demonstrates, there were more than 45,000 bitcoins deposited in a day.

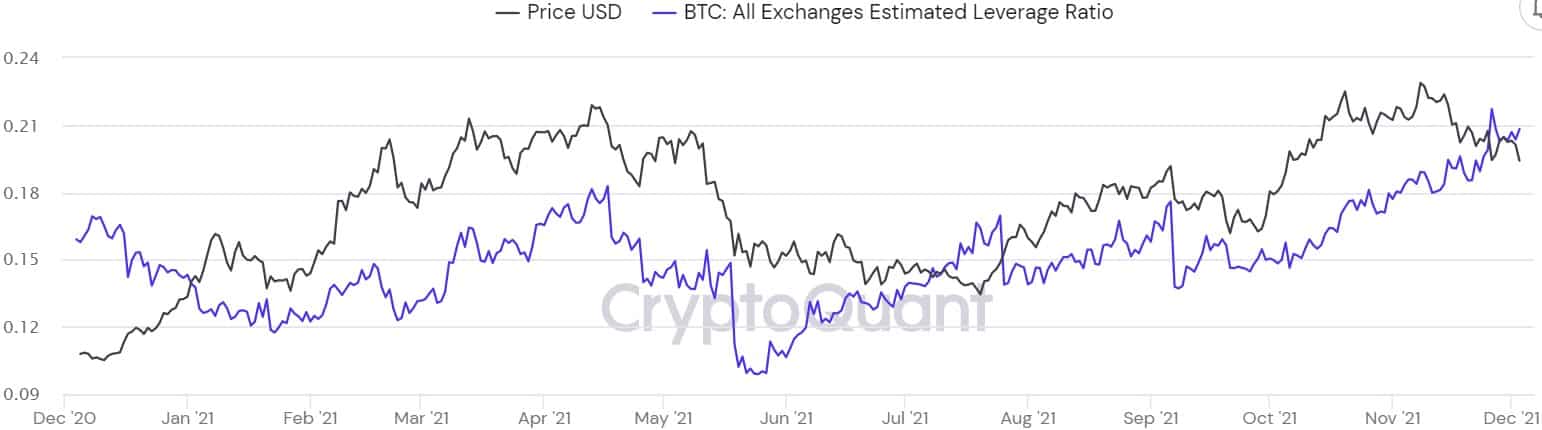

Secondly, the analytics company broached the All Exchanges Estimated Leverage Ratio, which tracks the open interest on all trading venues divided by their BTC reserve. Essentially, this metric shows the degree of leverage used by investors, which also spiked sharply hours before the crash.

As seen during the most severe hours of the crash, over-leveraged traders suffered the most, as the total liquidations exceeded $2.5 billion on a daily scale.

The third metric was the Exchange Whale Ratio, which compares the top 10 largest deposits to exchanges with all other deposits. According to CryptoQuant, the indicator tends to stay below 85% in bull markets, while it in bear markets drops below 85%.

Interestingly, it has remained above 85% for the past few weeks and even spiked to north of 90% in the past few days.

What Else Changed?

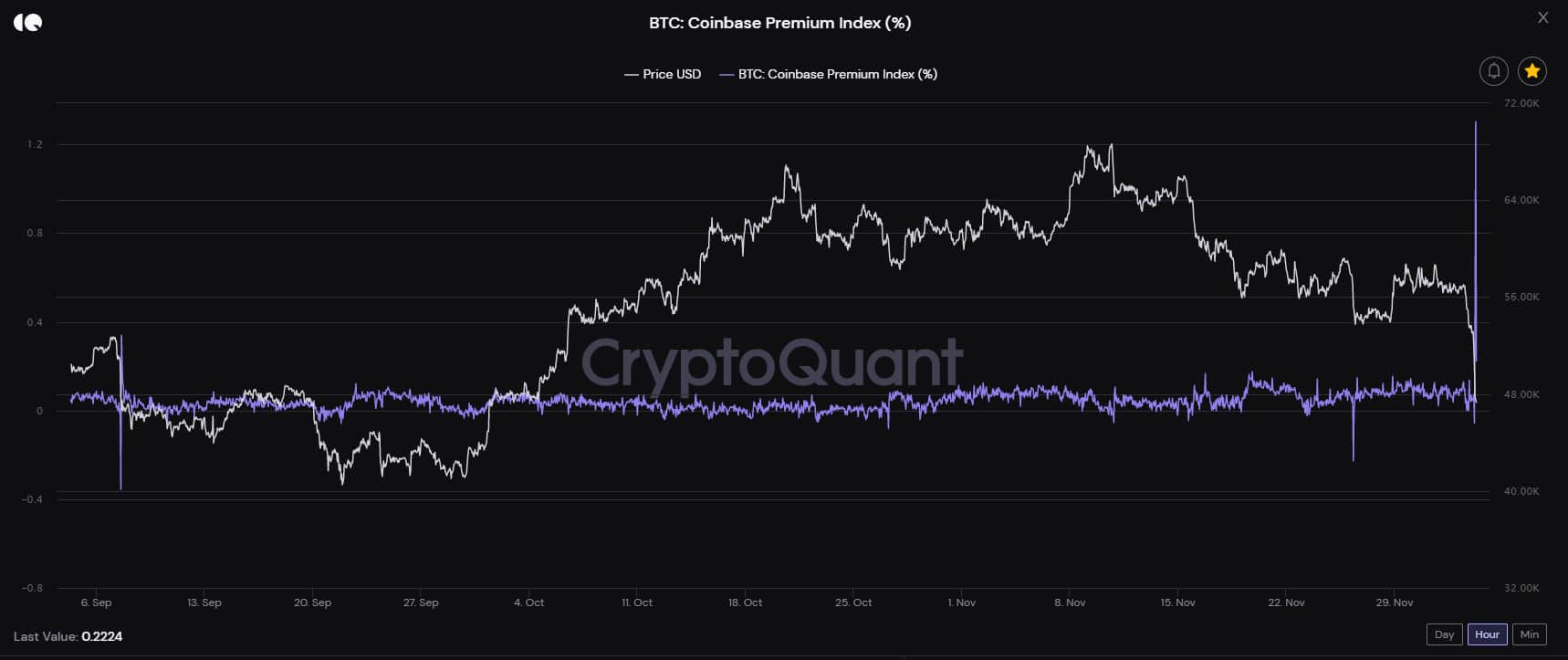

Such a massive price crash in a relatively short period led to other abnormal activities. For instance, the Coinbase Premium Index, showing the difference between the price of bitcoin on the largest US-based exchange and other trading venues, skyrocketed.

Typically, the higher the premium gets, the stronger the spot buying pressure is on Coinbase. Interestingly, Ethereum’s premium also surged.

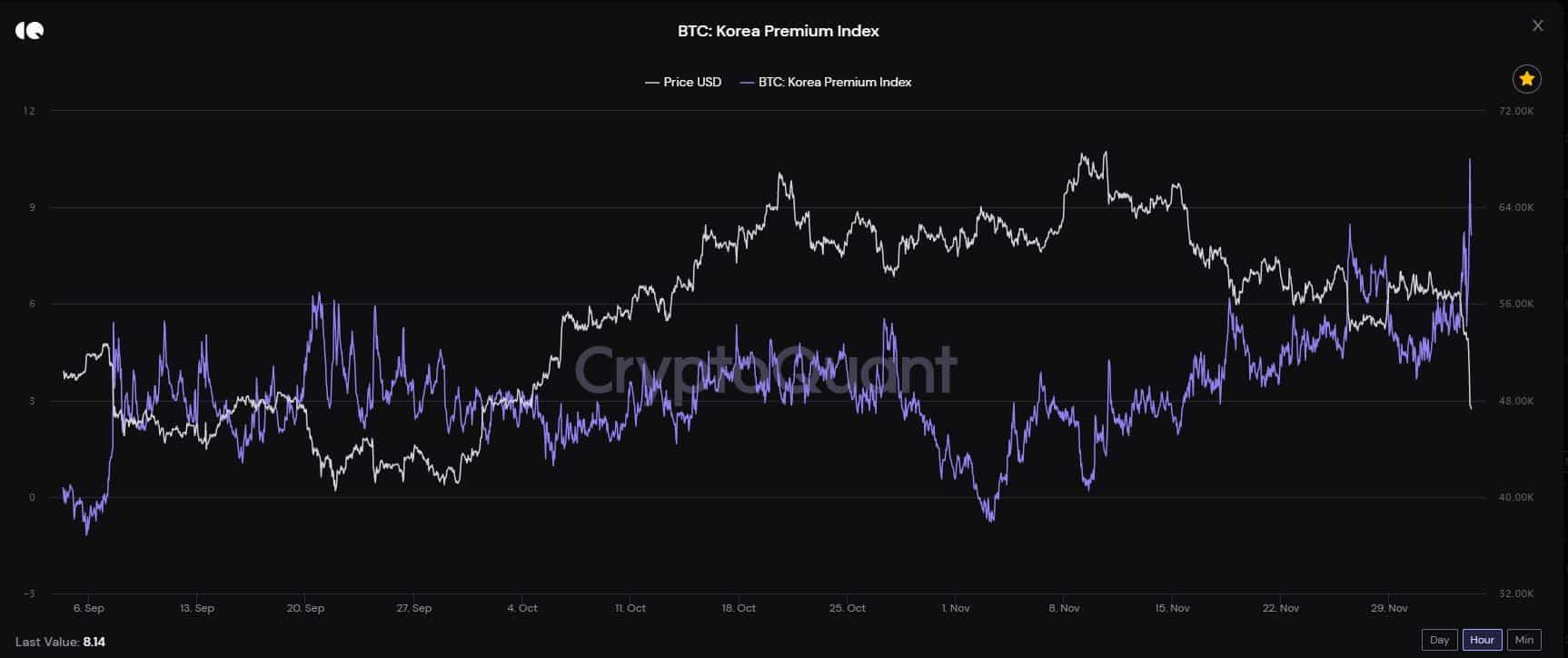

Wu Blockchain also outlined the premium on South Korean exchanges, which the journalist described as retail-oriented trading venues. As the picture below shows, this metric also increased rapidly, suggesting that retail investors rushed in to take a page out of El Salvador’s book and buy the dip.