John Law, a darling of the French king, wrote the blueprint for central banks, demonstrating the fiat flaws that Bitcoin solves as he did.

I always love writing about the bridge between current events and their (often entertaining) counterparts or parallels in history. The current “war-on-cash” we see by the nation states along with the planned economy of the Amazons, Googles, Alibabas and Facebooks of the world, is interesting enough in and of itself. According to me, it’s a product of our world moving from post-industrialism to post-scarcity (very slowly).

The rise of bitcoin especially added fuel to the fire, advancing the fight to get money out of states’ hands, and in control of the individuals themselves.

I’m from a generation (Gen X) that saw the rise of computer use, internet, cellphones, smartphones, mass media, live news reporting, social media, strong encryption, peer-to-peer networking and, not to forget, the most important invention of the last 250 years: Bitcoin. My generation usually forgets how all of these wonders rapidly changed our world and surrounded us with Twitter influencers, YouTube stars, Instagram yoga pants models and things like NFTs.

We sometimes forget that all of this technology and progress once found their equivalents in history — the first idea to get images from a distance transferred over a wire, or the idea of having computers connected to each other in order to survive a nuclear attack that never happened.

In the long list of technological advancements, there’s also monetary progress which has gone on for a few centuries now: banking and later, central banking, alongside fiat money.

The first paper money (jiaozi) was invented as a bearer (signed by hand by a government official) in order to overcome coinage for a short while while it was “out of stock,” promising the holder of such a document to have a certain amount being paid back by the government during the Song Dynasty.

On the European side, the introduction of some paper money equivalent — at least the one with the most impact — came during the rule of Louis XIII in 18th century France with all its turmoil, bloodshed and government experiments with money supply.

Louis, Louis And Louis

That more recent experiment — historically speaking, at least — can serve as a lesson in many respects. I’m especially eying the many experiments in the crypto space these days, also known as shitcoins, or “altcoins” to most people.

What France saw happen in the 18th century, has some interesting aspects related to our current fiat and crypto world.

Let’s first introduce the French currency at that time: le livre. This French coinage and official denomination existed from 781 to 1794 and had a few derived names — the name was derived from West-Francia roots and Roman influence (the word “libra” for weight measurements). Before that, there was a Spanish coin, of which their livre was a copy, design wise.

These coins were irregular at first, as they were minted by manual labor (something the French really like). This made these pre-1640 coins more irregular, and open to counterfeiting and the practice of shaving of some of the precious metals, a very common practice in France.

In came Jean Varin, a Liège-born engraver and medalist, who devised a system to make it much, much harder to shave off some metal from the coins without anyone noticing, a practice that was severely punished in 18th century France, but largely went unpunished. This way of manufacturing coinage would make it also more difficult for imitations to be reproduced, especially for the lighter form of le livre (as was also common practice).

The new coin for le livre was the Louis d’or, created with detailed engravings, depicting the king of France in more detail and having a very innovative row of small grains in relief, located on the edges of the coins, a true marvel of coinage at the time.

I make some parallels here with bitcoin, as the step forward from the old, irregular livre coins to the Louis d’or can be seen as an equivalent to the move from central bank fiat paper money to the invention of Bitcoin’s ledger in 2009. All of a sudden, something appeared on the market uplifting the whole sector, by technology and/or innovation.

The engraved, perfectly-round Louis d’or was not only a step forward in thwarting counterfeits, it was also a restoration of confidence for many citizens. You could easily trust and verify the coin, as you could inspect it with your own eyes and check if some “cutter” had chipped off some of the metal, or tried to replace it with a fake.

Again, this is the same with Bitcoin: a transaction is checked for its validity, and people’s transactions where they have tried to cheat the system or “chip off” some value will simply be rejected, just like a Parisian would reject a Louis d’or coin if parts were missing or the engravings were not intact.

The 23-carat gold coin that was used before also had the problem of being exported because it had a higher value than the 22-carat de facto standard of that time, dating back a century earlier. The French left that standard to do their own thing (as they often did throughout history) and this made them prone to a special form of capital flight. The Louis d’or fixed that problem as well, by going for the 22-carat gold initially, putting it on par with the Spanish coins used in trade.

17th Century French Altcoins

The appearance of the Louis d’or also gave way to another history lesson, one about trust.

These marvelous new coins were innovative and beautiful at the same time, they had one major flaw though: they required trust in the French monarchy and later, the French revolutionary government.

Upon introduction, they first devalued the real-life use of the much more eroded and old silver-based livre coins. These were less desirable than the equivalent in the Louis d’or coins, effectively making the denominations “less” than their face or even metal value. The government realized this and began to take these old coins out of circulation to be weighted (even foreign coins) for their silver value.

In the meantime, the different gold Louis d’or coins were minted in different places as well, creating two origin factories at first.

Although the French authority was centralized to ridiculous levels, we got some differences in valuations to their seemingly “identical” coins with the same denomination. With the different King Louises as the main stakeholders — as we would call them these days — the French still managed to have differences derived from real economic situations. Their real economy did not always reflect the coinage and without going into the very complex structure of the French state and the brewing revolution much later, there was an order to things when it came to monetary policy, which often clashed with the reality on the local markets within France.

So, with these “perfect” coins being minted at different locations, it also meant there would be different “mints” with different policies on deciding the production and inflation. You see where this is going.

The fact that one area had other minting rules from the next, in a different area with different economic performance and policies, tells a lot. The devaluation, coming from either loans taken out by the king or from changing the percentage of gold and silver in the coins over time, all played a role in the fluctuating real-life value.

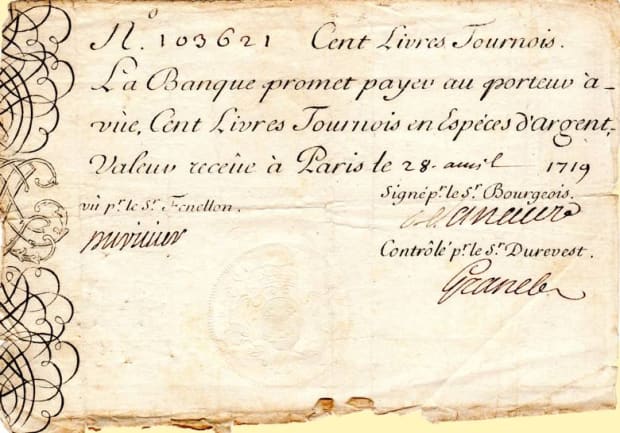

The silver Louis d’argent was introduced in 1641 by Louis XIII, to compete with the German thaler, and it contained about 25 grams of fine silver. This would make things complicated, as there was yet another coin, the livre tournois, which was an accounting unit pegged to one pound of silver originally dating back to the 13th century. It was eventually abolished and brought back, only to be left as an accounting unit in 1667.

To make things even more complicated, another accounting unit based on the Parisian Louis d’or was introduced as well. (No wonder these people started to revolt).

The Introduction Of Paper

It’s here that another solution was devised, not only for the coinage and the numeration, but also with the rising debt as a result of the loans that the French king took out, mostly for waging wars or building projects.

That solution, or an attempt at least, would be the introduction of paper money — a relative novelty, certainly in France up to then.

The main contributor to the introduction of paper money (as well as its subsequent, spectacular downfall) would be called “dodgy bookkeeping” (also something not entirely alien to the French). The practice of cooking the books would be rather obvious, since the one taking out all of the loans, was the same person with all of the power to keep things under wraps. This would even last until the Assemblée des Notables in 1787, where the nobility decided on things like the monetary policy, just had to accept that the books were “seen by the king… très bien.”

Of course they were.

The same French nobility that later would be overtaken by greed, by printing massive amounts of paper money to capitalize on a European stock frenzy following its own French-owned Mississippi Company, later called the Company of the West, stock.

This was an important experiment, as it would turn out that the bank behind all of this had John Law as its de facto head. Law was a smart guy, who could calculate odds and was a high-stakes gambler, but also had tremendous insight into derivatives and eventually kind of invented central banking (without realizing it).

The private bank he would oversee to back this paper money would also be functioning as a more trustworthy entity than the debt-laden French government. On top of that, the colonial efforts and their perceived or promised great returns would function as an underlying asset for the bank notes. The paper money itself would, in that way, be backed by a profitable company (on paper, literally and figuratively). That backing was of course necessary to incite trust with the public, which was used to having real coins with real 22-carat gold in their hands.

Even if the king was broke, or the government went bust, they still would have their gold coins. With paper money, this trust had to be earned another way.

Go West, Go broke

The two companies — Compagnie du Mississippi and the later Compagnie d’Occident — aided by a monopoly granted by the French government for trade in the West Indies and North America, would form the backbone of this trust. The paper money was printed, and pegged to this Mississippi endeavor. The majority of the financial backing came from the French government itself and the nobility.

Law managed to talk the regent of the French king into giving him more privileges as well. Not only would he introduce paper money, he would give something far, far more valuable to the state: trust.

In exchange, his private bank, Banque Générale — later the Banque Royale (with cheese) — would be taking over the horrible amounts of French debt as well. Talk about being a good guy. Law soon owned over 29 castles, and whole areas in the center of Paris.

His main “office” would be at the Place Vendôme, where most financial institutions, banks and bankers worked alongside the upper class.

The Banque Royale would be housed in the Rue Quincampoix, where almost everyone who had a stall, shop or other activities would eventually become a trader, broker or someone who helped with calculations (a modern cryptocurrency exchange, if you will, where everyone who even pretends to be a coder or market maker can get their voice heard and get subscribers and their own token).

The initial idea, 100 years earlier, to make the coinage more secure, safe and less prone to tampering brought stability, would spin out of control soon because it was done the wrong way. At the same time, these people, including Law, dared to experiment and try something new, a property that’s lost to most governments.

The national debt of France was huge after the reign of Louis XIII and Louis XIV, and it sunk further into dire straits during Louis XV (something that would eventually end in the French Revolution, among many other things that I’m not going to address here).

The national debt would be paid back by Law’s private company, in exchange for highly-unusual privileges on the monopoly on the colonial trade of France. Something that, in theory, would be enormously profitable. This made Law insanely rich and popular with the nobility — a wonderful guy comes in, takes over all of your debt and makes a profitable company even more powerful.

Law’s goal was to pay off all of the public debt that way. In order to do so, he launched a sale of the shares of his company. These public stocks (billets d’état) would be literal papers, stating that a private citizen would take over a part of the current debt, in exchange for future shares of the profit or value gains. These shares went up in value, as the company behind them was perceived as promising, or even highly profitable (spoiler alert: it wasn’t really).

This in itself wouldn’t have been that bad, as companies are IPO’ing all the time these days, and after a while the “real” price is discovered by the market. The initial rush on these French stocks would eventually be over and prices would soar initially, and come down afterwards, to swing back up again.

But…

In comes the French government, which saw this fanatical buying and value gain as a sign of good economic prospects. All over Europe, these gains would cause a positive ripple effect of more stock buying.

So, the French government did what most governments do: it wanted to take advantage and started to print more paper money, as it was pegged to these company shares anyway, it wouldn’t hurt to create more supply of the same “good stuff.” More and more paper money was brought into circulation in this economic boom.

Enter Cantillon

An early investor of that company was Richard Cantillon, lending his name later to the Cantillon effect of inflation, in which the people nearest to the source of the inflation (money printing) profit the earliest and the most by the rising prices.

This was a system used, although in a more crude manner, in the country Zaïre, of the late dictator Mobutu Sese Seko. He let his government print more money in enormous amounts and let his own entourage and family buy up plantations and useful agricultural land at the “old” prices in regions further away from the capital. This was done right before the effects of the newly-printed money would hit that region with inflation. So, buying a farm at a fraction of its real price with the old money allowed for profiting from the real economic value bought up at a fraction of the price.

The same goes for the current top of the European Union, by the way, whose upper class (and maybe other people in the know) can position their assets right before a new round of money printing/subsidies arrive. The euro’s early ancestor was also called the ecu, just like the early French money, a nod to the old French coinage. Maybe that’s not a coincidence.

Le livre was, of course, the coinage for one of the largest economies in the world at that time.

Mississippi Coin

The problem was that Law’s system was trying to be clever, as he tried to downsize the coinage in circulation, exchanging them for paper bills, or billets de banque.

The exchange wasn’t smooth, as this game with the supply was made more difficult by there being two coins in circulation with the same value, in theory, but not in economic reality — the Paris version of the livre, and the livre tournois. The latter had more “real” economic value and would be used as a guarantee by the bank (not the government!) to pay back the notes in real value at a later time.

The paper money was also meant to make trade and investing easier, which it actually did, for a short while between roughly 1717 and 1719.

If you held the Paris livre, you could be in trouble over time, not only due to inflation (they printed these whenever they deemed it necessary) but also from the perceived value. While parts of the Paris area were finally also seeing capital flight towards the much more trustworthy tournois livre.

Today’s euro, for example, also has different origin printers. It has a printer ID on the back, where you can check which country printed that particular euro bill. A “Z” indicator, for example, indicates the paper you’re holding was printed in Belgium, while “C” means you’re holding a euro printed elsewhere. In everyday life, no one is going to check these numbers, and certainly no one will give you a different value depending on which 50 euro bill you pay in (unless it’s a collector’s item from the Vatican or Monaco or something, although no one in their right mind will pay with these in a grocery store anyway). That’s because we trust the backing of the European Central Bank (ECB) on these notes, no matter where they come from or which country they were printed in. It doesn’t matter, as they’re fungible (safe for the marked-down notes known for criminal activity or whatever).

The French in the 17th and 18th century, however, didn’t have the luxury of having one central denominator, as the livre from one area of the country was actually valued differently than the same theoretical livre note from another area.

There were many versions of the French paper money and coinage (and don’t get me started on the ones created after the French Revolution started and the subsequent contra-revolutions, wars and eventual power grab by Napoleon)

We see parallels here with bitcoin and “other coins.” While they almost all claim to be the next money, the next digital cash, the next whatever, over time you see that people value the one that’s the most steady, long term and commonly regarded as “good.”

Whenever there’s a shitcoin apocalypse or a hack, downturn or bear market, we see the same two options return: people who — just like the French in the 1710s — exchange their local failing currency (shitcoins) to the tournois livre or the even more reliable Louis d’or (the bitcoin of its time, maybe); or those who just convert to their local fiat currency with whatever they have left after an 80% drop, be it euro, yen, dollar or otherwise. Those are the options when you realize your shitcoin is dying.

But the options are reduced to just one (choosing bitcoin) when you come to realize your local fiat currency is no better than the worthless notes some local nobility printed in 1717, to keep their soldiers paid and their peasants happy enough to keep planting potatoes or whatever.

Nous Sommes REKT

The Law system collapsed — first the notes would become backed by the king in 1718, while Law tried to send out more changes to the policy and face value of the notes, and partiuclarly the metal coins. This would introduce a constant flow of new lists with new theoretic values of notes and coins. He also injected more capital into the company, in the end merging with other colonial companies and, eventually, controlling much of the French side of the India trade, the tobacco trade, the French mint and tax firms. In essence, the Mississippi Company came to play the role of a central bank.

The banknotes in the meanwhile were traded on a secondary market, in the real shops and bakeries of Paris, at one-third of the face value. Many people started to exchange them for silver and gold again, even hoarding the metal coins or the poisonous metals themselves. Another edict would forbid households and private citizens to hold more than a certain amount of gold and silver.

The promised returns of the company turned out to be mostly propaganda, or promises. Like many “promise-coins” today, which talk about a great product being released for years, without delivering anything.

The propaganda about the amounts of gold being found and mined in the colonies were vastly overblown, and more and more insiders of the big company started to complain or openly call out the negative aspects of the situation. These people usually were rounded up and shipped to one of these colonies for forced labor, or ended up paying a hefty fine for spreading false information.

In the meantime, with the new bank notes flooding the market, prices kept rising, more than 20% in a month.

Eventually, some of the more notable names went to the Rue Quincampoix in person, and started to withdraw bigger amounts of the notes into gold coins. However, fewer and fewer banks had these coins in their vaults, as there were more and more people trying to exchange their notes for coins again. The supply of coins was going down fast as well, certainly the circulating supply was, as many were hoarding.

These bank runs and the inflation caused more than one riot, leaving many bankers and ordinary people dead on the nearby streets. By mid-1720, the system of the Banque Royal wasn’t sustainable anymore, as trust in these paper “bank notes” was close to non-existent with the public. They wanted their coins back and a bank run ensued in order to switch the notes over to the promised “100 livres,” backed by the company and the king.

Law tried to stabilize the situation with new edicts and throwing more people in jail, also proposing to deflate the number of shares issued by the Mississippi Company, but to no avail. Eventually, parliament had to intervene, from exile, as Paris was rioting.

Law apparently was dismissed from his position as minister of finance and had to flee Paris disguised as a woman, first getting into Brussels, later popping up in Venice.

In the end, aren’t we just all shifting back and forward between currencies and their perceived value anyway? Why don’t we just agree that our local livres and other currencies are dead as a concept, and move to the better choice?

The later paper money system that the Duke d’Orlean would try to set up would learn from earlier mistakes. L’opération du visa, as it was called, would try to replace the old notes with more trustworthy ones backed by the state itself in various ways.

By that time, however, most of the French (and their neighboring countries) wouldn’t trust the word “bank” at all. Therefore, most of the financial institutions and banks would call themselves “caisse” or something else that would obfuscate their bank-like natures, some lasting until today.

Law eventually died a poor man nine years later, having laid the questionable base for a central banking system, trying to introduce paper money and inflating the price of a colonial company.

The later, “real” central banks would recycle the Law methods, replacing the backing from a private bank and company like the Banque Royale (with cheese) and the colonial companies with their own asset portfolios and “invented money.” The question remains if our own version of the Louis d’or, made by special engraver Satoshi, can be perfect enough to overcome this theater of the central banks, with their many increasingly shrewd and shady Laws.

I think it can be. We have perfection (or close to it) now, with an ability to have a non-state entity creating underlying value with an efficient, reliable, confiscation-resistant and liquid asset, backed by an enormous amount of trust (by mathematics and an army of holders).

This should be enough to convince people to drop the debt-laden, government, printing disease that central banks always had, and always will have. We finally have, after 350 years, a digital, world-wide internet version of what the Louis d’or was in the 1640s — something to regain trust, a perfect coin that’s not reproducible and where no French merchants can shave some live-savings off in a dark alley.

These forms of counter coins are now shitcoins, altcoins and the many searches and experiments for “a better system.” We’ll see who’s next to hide between some crates and flee Paris — the central bankers, or the ordinary citizens searching for their real coins, in whatever form increases their wellbeing, trade, investment worth and society.

Additional References

This is a guest post by Manuel. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.