The term decentralized finance or DeFi was first used on a Telegram chat between Ethereum developers and entrepreneurs, including Inje Yeo of Set Protocol, Brendan Forster of Dharma, and Blake Henderson of 0x in August 2018. DeFi takes the decentralized concept of the blockchain and applies it to the world of finance, including a range of services like savings, trading, insurance, and loans.

Today, the most popular application in the DeFi space is the cryptocurrency market. While individuals and organizations are interested in trading and saving crypto assets, the volatile nature of the market is a major deterrent. Crypto market volatility is largely caused by different perceptions about the value of crypto, as well as its unsteady legal status in various countries.

In an attempt to adapt to the volatility of the crypto market, many investors and traders have recently started considering the use of artificial intelligence (AI) to make more profitable trading decisions. AI generally refers to machines that respond to stimulation in a similar manner as humans, given the human abilities of contemplation, judgement, and intention. AI is not futuristic, but rather something already here today and integrated with fields like national security, health care, criminal justice, transportation, and smart cities.

This article will explain how AI can be applied in the DeFi space to make data-driven decisions for smarter cryptocurrency investments.

AI for accurate crypto market Predictions

With the upsurge in investment options, it is no longer efficient to conduct manual research, extraction, and analysis to identify investment opportunities and buy or sell indications.

Large mainstream financial organizations like Goldman, Citi, and Barclays, have already started implementing AI into their workflows, and small to medium-sized enterprises are following suit.

DeFi applications like cryptocurrency can also use AI to make smart investment decisions. The blockchain keeps a digital record of transactions and behavioural patterns that drive factors in the crypto market. Data analytics can then gather, clean, process, and analyze large data sets from these blockchain records to offer valuable insights into a digital currency. Data scientists can also construct neural networks or forecasting models that explore historical market data to predict significant crypto events.

AI for crypto market sentiment Analysis

Sentiment analysis involves using AI and natural language processing to analyze the opinions or sentiments of people about a particular topic. In cryptocurrency investing, analysts can use AI to detect investors’ thoughts about various cryptocurrencies. An overall positive opinion about a digital currency can indicate an increase in its price, while a general negative sentiment would predict a price drop. Potential investors can use these predictions to decide whether or not they would like to invest in a particular cryptocurrency.

Large amounts of data must be compiled, processed, and analyzed to determine sentiments in the crypto market. This data includes news, articles, blogs, forums, social posts, stock message boards, and related comments. AI can help process blockchain data and large data sets from the internet to identify the market sentiment – whether positive, negative, or neutral. Furthermore, AI and machine learning can identify market manipulations by analyzing unusual behaviours observed in the sentiment indicators. Once a sentiment is connected to the data, investors can understand what to do with the insights discovered. Following are the common types of sentiment analysis useful for interpreting the cryptocurrency market:

Polarity Analysis

Polarity analysis scrutinizes various statements and labels them according to whether they are positive, negative, or neutral. After considering the overall score, analysts and investors can establish a trend about other statements and labels that can be analyzed in the same manner.

Tone/Emotion Analysis

Natural language processing (NLP) is used to analyze the tone or emotion of any text. In the DeFi space, analysts can use NLP to study various emotions when users make crypto transactions or discuss a cryptocurrency online. Based on the resultant insights, potential investors can understand the general perceptions about a certain cryptocurrency and make their investment decision accordingly.

Aspect-Based Analysis

Aspect-based sentiment analysis organizes data by company or service and determines the sentiment attributed to each one. This analysis would involve studying customer feedback by associating particular sentiments with a product or service. In the crypto world, aspect-based analysis is ideal for potential investors who have a specific cryptocurrency in mind and want to understand what other investors like and don’t like about it.

AI for automating crypto trading Strategies

Traders who can execute trades quickly earn more profits than those who are slower to execute. Since AI can simulate human intelligence, investors and traders often use AI for high-frequency trading.

High-frequency trading is an algorithmic trading system used by investment funds where a computer executes many orders within fractions of a second.

High-frequency, automated cryptocurrency trading signals help maximize investments. Algorithms based on mathematical computation data, predictive analytics, and forecast methods can analyze markets and buy or sell cryptocurrencies within seconds.

Financial algorithms can deliver fast and efficient analyses to help investors make the most well-informed crypto trading decisions. Once a pattern is found, investors can also automate the process and execute high-frequency cryptocurrency trades.

While AI and data analytics have the potential to inspire smarter crypto decisions, many retail and institutional investors are still unaware of how it works.

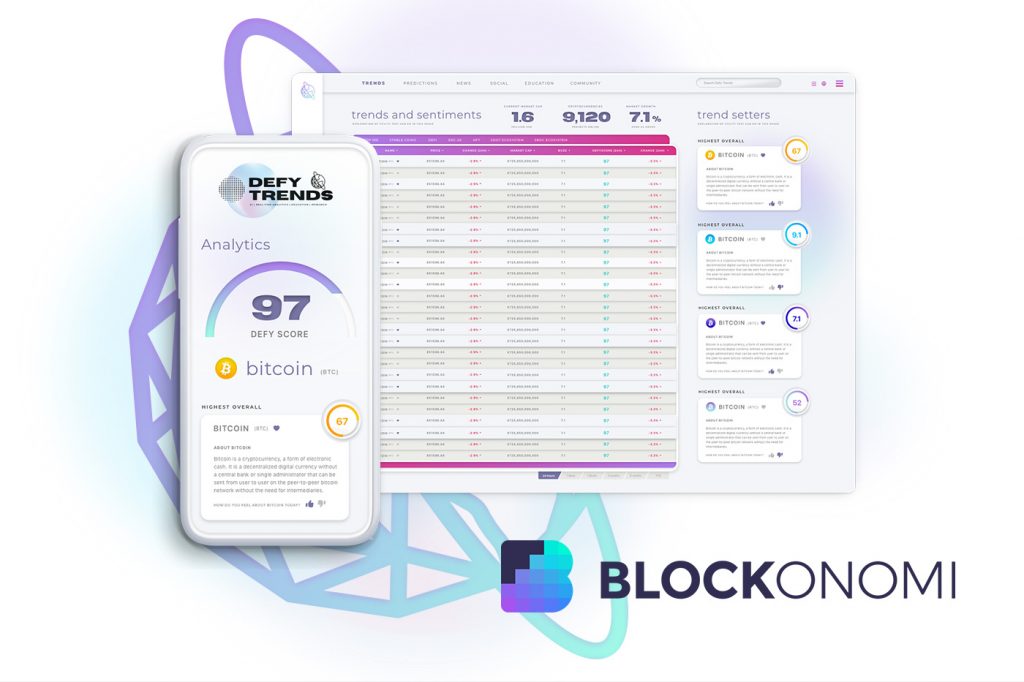

Platforms like Defy Trends, an intuitive, all-in-one crypto and NFT intelligence platform, empowers individual and institutional investors to make confident, data-backed investment decisions. The Defy Trends platform includes sentiment analysis, news aggregation, on-chain analysis, AI forecasts, in-depth educational materials, and crowd-sourced research.

In a recent interview Defy Trends founder and CEO Imgesu Cetin commented on the platform’s performance in predicting the crypto crash this past May. “We are very proud of how the algorithms we use perform in real-market situations, ” said Imgesu. “With these tools, investors are able to decide how to trade in a market that can be volatile at times. Some investors may not care about big moves in the market because they are in it for the long term. With DeFy Trends, the information is there to be used in any way our clients want.”

AI for monetizing crypto Insights

Crypto traders depend heavily on various market signals to make beneficial trades. However, unstructured data dominating the digital landscape has made it nearly impossible to yield accurate signals through manual techniques. While dealing with large data sets, the data points must be clean, relevant, and accurate to ensure that analyses uncover precise and useful investment insights.

With AI, data scientists and developers can build methods that traders can use to get clean and relevant information on a platform. AI’s natural language processing techniques enable data extraction and classification by specific characteristics like the currency name, currency founder, document type, etc.

Until now, crypto advisors would deliver predictions based on manual research and personal trading experience. While these predictions were beneficial to some, they weren’t accurate enough to be offered as a chargeable service. With AI’s capabilities, data scientists can deliver accurate trading insights in a manner that non-tech-savvy traders or investors can understand through an intuitive interface or dashboard. Considering the inherent accuracy of these AI-driven insights, potential investors and traders will be willing to pay for them as a regular service. They can then use these AI-driven insights to make smart crypto trades increase their cryptocurrency profits.

AI for the future of crypto Trading

AI’s ability to analyze large amounts of data accurately, work at high speeds, and learn and adapt continually makes it a valuable tool for cryptocurrency trading and revolutionary addition to the DeFi space.

While AI already has real applications in cryptocurrency, it can also be used to create crypto trading robots (cryptobots) that can analyze charts more accurately, make more efficient trades, and detect the best entry points for profitable trades.

A well-tuned cryptobot can identify chart patterns, candlestick patterns, quotation directions, and trend reversal points, which the trader usually doesn’t notice.

Using cryptobots to trade digital assets eliminates the fear factor and other emotional aspects that typically influence trading decisions. Moreover, the trader does not need to monitor the market constantly and calculate the moments to open positions, making the crypto trading process less time-consuming and more profitable.

Closing thoughts

Even if you are a newbie to crypto investing, platforms like Defy Trends will help make data-backed investment decisions accessible and actionable for everyone wanting to enter the cryptocurrency space.

Before jumping in, make sure to do your research and make sure you are not investing money you can’t afford to lose and be prepared to HODL if another crypto winter sets in.

The post A DeFi Revolution: Using AI & Data-Driven Insights for Smarter Crypto Investments appeared first on Blockonomi.