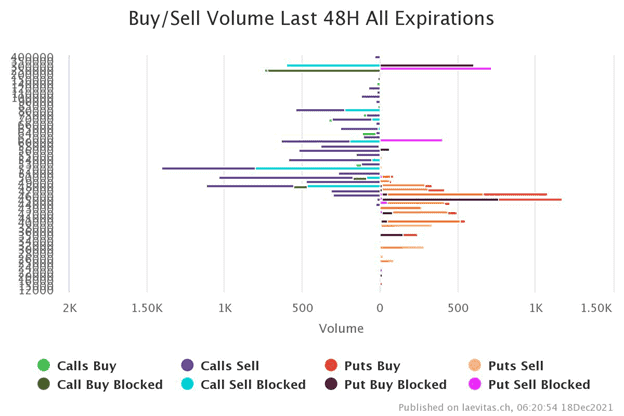

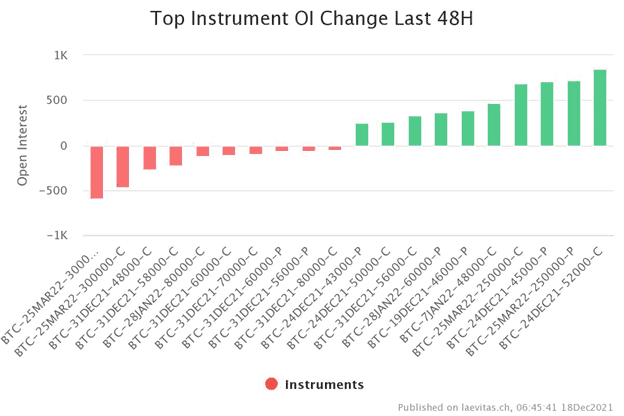

According to Reuters, the Russian central bank wants to ban investments in cryptocurrencies in the country. Following the bearish news, Bitcoin’s price fell to near $48.5k in the spot market. In the options market the last 48 hours, many options traders sold Calls and bought Puts to hedge for the near-term expiries.

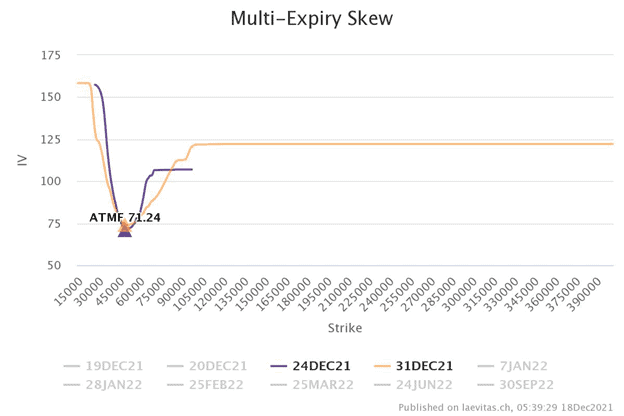

Multi expiry skew shows that traders seek downside protection. It seems that they are not optimistic about the rally in 2021:

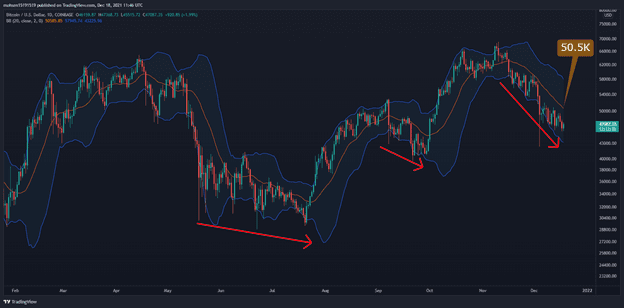

Technical Analysis

On a daily timeframe, according to the Bollinger Bands indicator, the short-term trend still seems to be to the downside, the lower band slope is more than the previous corrections, and the baseline has built a resistance at $50.5k. The price seems to be entering a long-term erosive correction phase, and most likely, it will make retail investors disappointed and frustrating.

On the 1-hour timeframe, the price is going down and forming a falling wedge (a technical pattern that is usually bullish), creating a lower low and lower high. One can expect the price to rise to this wedge, but if it passes, the resistance of $50K on the way of Bitcoin to form a higher high.

Onchain Analysis

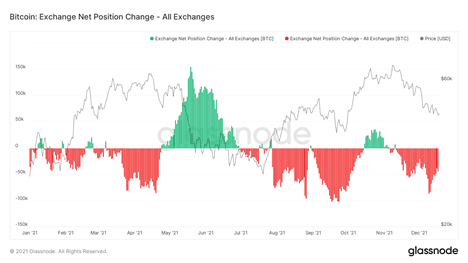

Probably the most bullish point is from an onchian analyst perspective. At the moment is a divergence between the price action and the All Exchange Reserves trend.

Unlike the market crash in May, the monthly net position change shows a significant volume of BTC being taken off the market the recent drop from $69K to $42K. The Conclusion is that the supply shock is evident but the supply/demand puzzle would be completed when the new capital flows into the market by new investors.