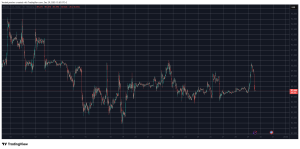

Turkey has seen a surge in cryptocurrency trading, with trades shooting past a million trades per day. The increased trading activity comes as the local currency, the Lira, falls to record lows, with citizens turning to crypto in an attempt to save their dwindling savings.

The drop in the Lira began when the central bank chief was abruptly removed earlier in the year.

Crossing The One Million Threshold

With the Lira having lost nearly 40% of its value since September, citizens have been actively looking at options so that they can avoid the crippling effects of inflation. So far, Turkey has crossed the one million trades per day threshold twice, with the first time being back in March when the abrupt replacement of the chief of the country’s central bank triggered a significant slump in the Lira’s valuation.

While the number of trades had fallen back significantly in recent months, the latest wave of volatility and uncertainty has reignited interest in crypto trading in the country.

Crypto A Viable Option

Citizens of Turkey are now increasingly converting the Lira into Gold or USD, with the local currency having lost 90% of its value since 2008. However, cryptocurrencies have also become a viable option, especially since Ankara has made the conversion into Gold and USD more difficult. Bitcoin and Tether are the most popular trades against the Lira, a position that they have held for the past three years. At present, Turkey accounts for 16% of the world’s crypto users.

The increased trading activity has also attracted the attention of Turkish authorities, with the country’s deputy prime minister revealing that the government will be drafting regulations for the emerging asset class.

Potential Rescue Package

Turkey’s president has announced a rescue plan, hoping to encourage citizens to put money back into the foundering currency, but this measure has only led to a marginal strengthening of the currency, with the Lira still having lost half its value against the Dollar.

The government stated that it would guarantee returns on any Lira deposits, similar to returns on foreign currencies, with citizens required to deposit Lira in fixed accounts with a minimum interest rate. While the government has still not clarified how it would pay for the incentives to depositors, economists have suggested that the central bank would continue to print more money.

Runaway Inflation And Lira In Freefall

The Lira has continued to fall after Turkish president Recep Tayyip Erdogan rejected pleas and warnings from businesses about the recent interest cut rates while affirming that there was no going back from the approach Turkey had adopted. The Lira has slumped to a record low of 17.5 against the Dollar, having lost 50% of its value since Erdogan ordered the central bank to lower borrowing costs.

With inflation figures crossing 16% and a currency in crisis, citizens of Turkey are ditching the Lira and turning to Bitcoin as a way to hedge against inflation and prevent their savings from devaluing further. The Lira had plummeted after the sacking of the central bank governor Naci Agbal.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.