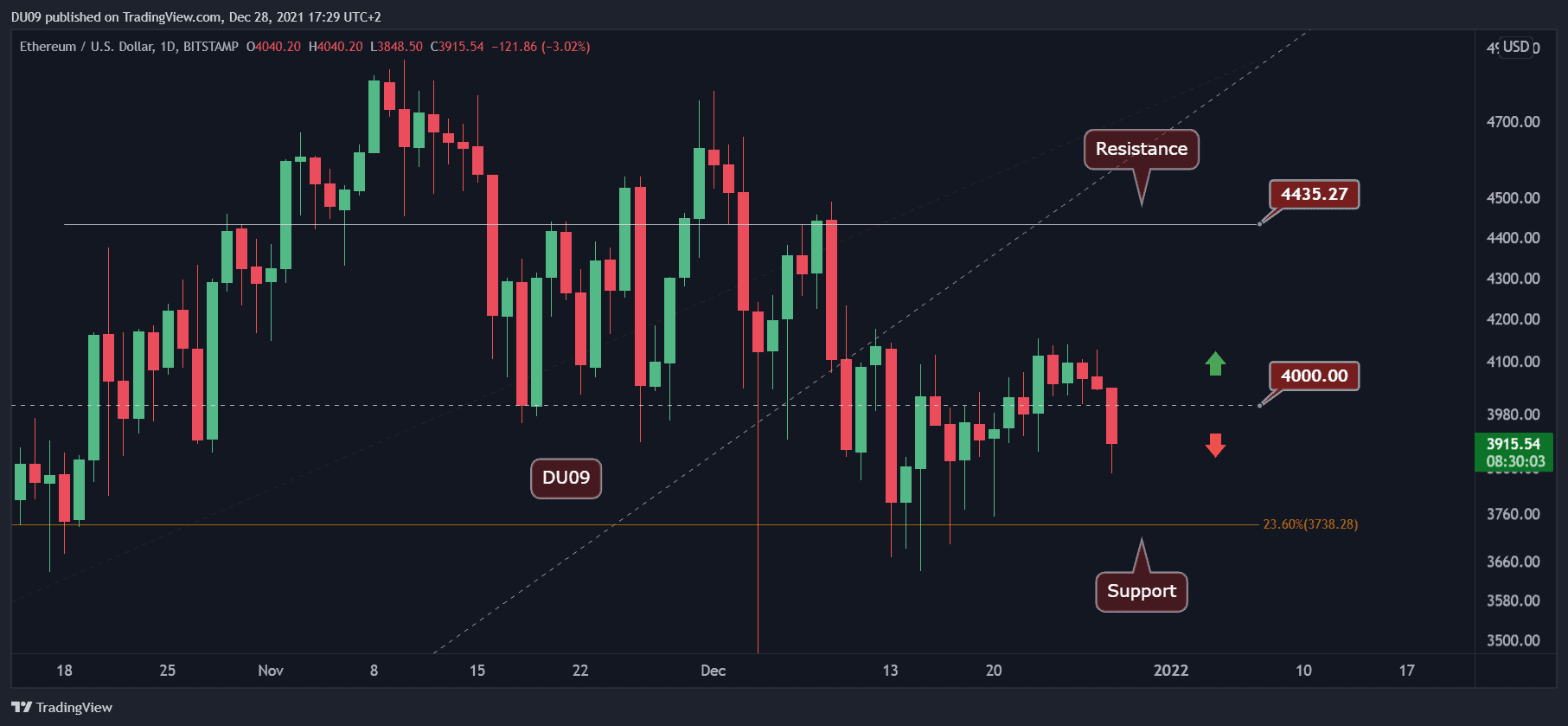

ETH has lost the $4,000 key level once again. In the following analysis, we will try to understand what it means for the second-largest crypto over the next short term.

Key Support levels: $3,738

Key Resistance levels: $4,000, $4,435, $4,868 (ATH)

After a few days maintaining the crucial level above $4,000, ETH’s price dropped below this key price area, which has turned back into solid resistance. The momentum was simply not there to sustain a price above it. As mentioned before, the recent price move was followed by a low amount of trading volume.

The current support lies at $3,738 and will likely be retested if bulls don’t step up soon.

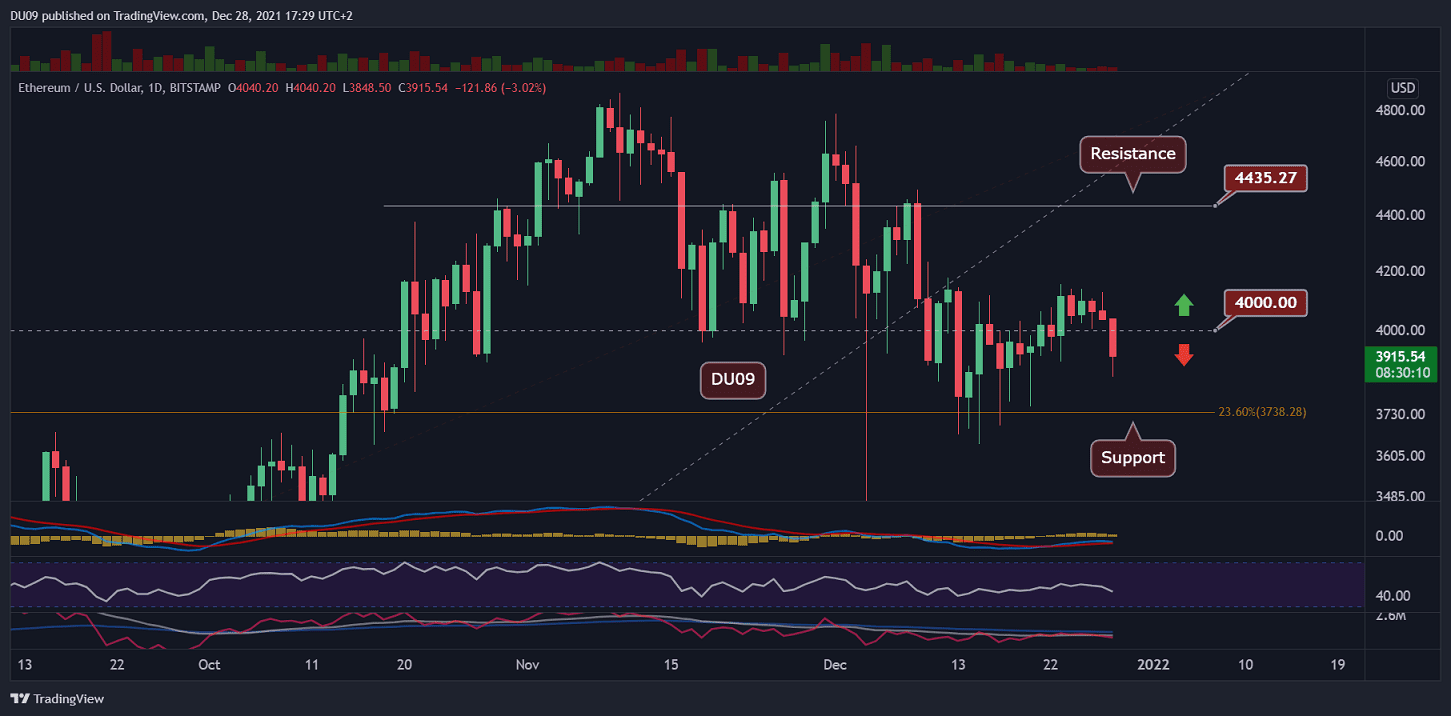

Technical Indicators

Trading Volume: As said before, the volume was extremely low at the start of this week and bears took advantage today. Price slipped on renewed volume, which is bearish.

RSI: The daily RSI is declining as well, and it is under 50 points, indicating that bears are in control of the price action.

MACD: The daily MACD remains bullish and is losing momentum. The histogram and moving averages may soon flip to the bearish side if the current downtrend continues.

Bias

The bias for ETH is bearish right now due to the current price action.

Short-Term Price Prediction for ETH

ETH failed to hold above $4,000. This is a major red flag and may encourage sellers to push ETH lower to the current support at $3,738. It is unlikely that ETH can recover anytime soon; therefore the best hope is for the price to hold above the key support as bulls gather their forces.