Bitcoin Analysis

Bitcoin’s price again finished Tuesday’s daily candle lower than it began the day and concluded its daily session -$615.

The BTC/USD 4HR chart below from MMBTtrader shows BTC’s price continuing to range between $46k-$52k and trying to cling to support at $46k. Bitcoin’s 200 MA at $48,144 is now overhead resistance for bulls and they’ll need to flip that level back to support soon or a trip back to the $42k level may be imminent.

The last support before another possible sell-off for BTC’s price is the $40k support zone shown on the chart. Below that level the chartist posits that the BTC market will be extremely bearish over the short-term.

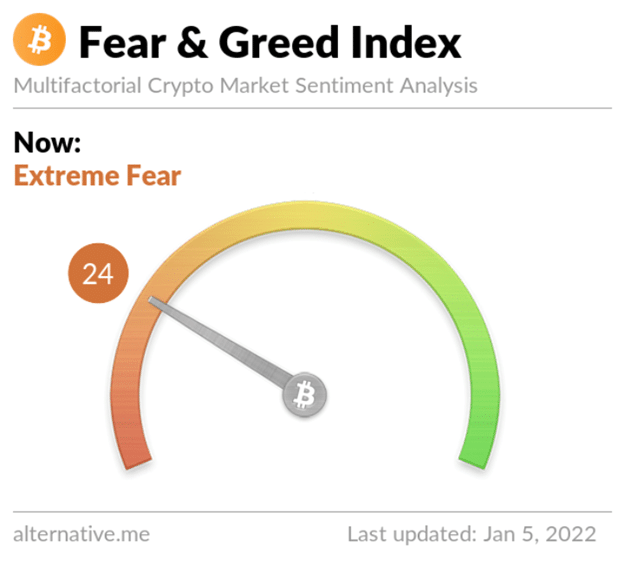

The Fear and Greed Index is 24 Extreme Fear and +1 from yesterday’s reading of 23 Extreme Fear.

Bitcoin’s Moving Averages: 20-Day [$48,254.31], 50-Day [$55,039], 100-Day [$52,735.96], 200-Day [$48,144.97], Year to Date [$46,422.55].

BTC’s 24 hour price range is $45,725-$47,575 and its 7 day price range is $45,725-$48,634. Bitcoin’s 52 week price range is $28,991-$69,044.

The price of bitcoin on this date last year was $34,082.21.

The average price of BTC for the last 30 days is $48,407.3.

Bitcoin [-1.32%] closed its daily candle worth $45,830 and in red figures for the third straight day.

Ethereum Analysis

Ether’s price finished better than BTC’s price on Tuesday and wrapped up its daily candle +$26.35.

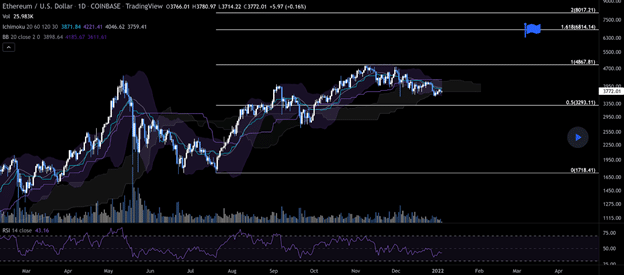

Today we’re looking at the ETH/USD 1D chart below from drosshopper that shows Ether’s price currently trending towards the 0.5 fib level [$3,293.11]. Ether bears are hoping to push ETH’s price below that support level and eventually back down to a full retracement at 0 [$1,718.41].

Conversely, bullish ETH traders are hoping they can rally before or at the 0.5 fib level and again go up and test 1 [$4,867.81]. Of course before Ether bulls can test the $4,8k level again they need to breach the $4k level to the upside – a level that’s been a major inflection point for Ether market participants over the last few months.

Ethereum’s Moving Averages: 20-Day [$3,947.38], 50-Day [$4,223.94], 100-Day [$3,833.64], 200-Day [$3,185.00], Year to Date [$3,790.02].

ETH’s 24 hour price range is $3,723-$3,895 and its 7 day price range is $3,622-$3,895. Ether’s 52 week price range is $984.99-$4,878.26.

The price of ETH on this date in 2020 was $1,103.36.

The average price of ETH for the last 30 days is $3,965.99.

Ether [+0.7%] closed its daily candle on Tuesday worth $3,790.83.

Chainlink Analysis

Chainlink’s price is +32.48% for the last 30 days [at the time of writing] and LINK’s price has started 2022 with a major boost from Chainlink’s ‘The Future of Chainlink’ presentation that was published on January 1st.

The 89 minute presentation outlined three major announcements for 2022 and alluded to how reliant the DeFi sector is now on Chainlink networks with over $75 billion secured by Chainlink.

LINK’s price had already begun to turn bullish again prior to the recent announcements. Moreover, LINK appeared like it had potentially bottomed out against bitcoin but the recent presentation and news look to be further catalysts for the continuation of LINK’s price to the upside by LINK bulls.

The LINK/BTC 1D chart below from BitcoinGalaxy shows LINK breaking out of a descending triangle against bitcoin after spending the majority of the last 6 months giving up ground to BTC’s price.

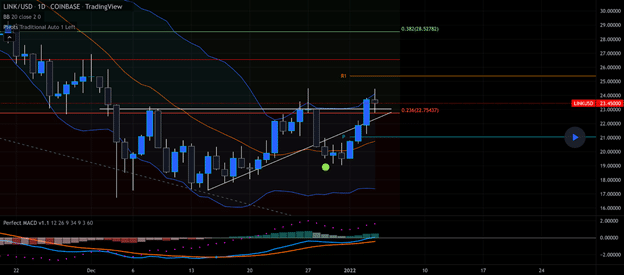

Another chart for traders to consider is the LINK/USD 1D chart from JacobR905. This chart also shows LINK breaking out of a structure to the upside, on this chart it’s LINK’s price breaking a bullish triangle pattern to the upside quite easily.

In the coming days traders will be watching to see if bears can send LINK’s price back down to test the top of its former structure once more or whether bulls can send LINK’s price straight to the 0.382 fib level [$28.52] and test further upside.

Chainlink’s Moving Averages: 20-Day [$20.47], 50-Day [$25.40], 100-Day [$26.15], 200-Day [$27.10], Year to Date [$23.68].

Chainlink’s 24 hour price range is $22.94-$24.45 and its 7 day price range is $19.13-$24.45. LINK’s 52 week price range is $12.82-$52.7.

Chainlink’s price on this date last year was $14.58.

The average price for LINK over the last 30 days is $20.43.

Chainlink [-1.18%] closed its daily candle on Tuesday valued at $23.45 and marginally snapped a streak of three straight closes in green figures.

LINK’s price began to markup on the new day and began Wednesday’s session [+8.76%] for it’s first two hour candle.

The post Bitcoin($45k), Ethereum ($3.8k), Chainlink Price Analyses appeared first on The Cryptonomist.