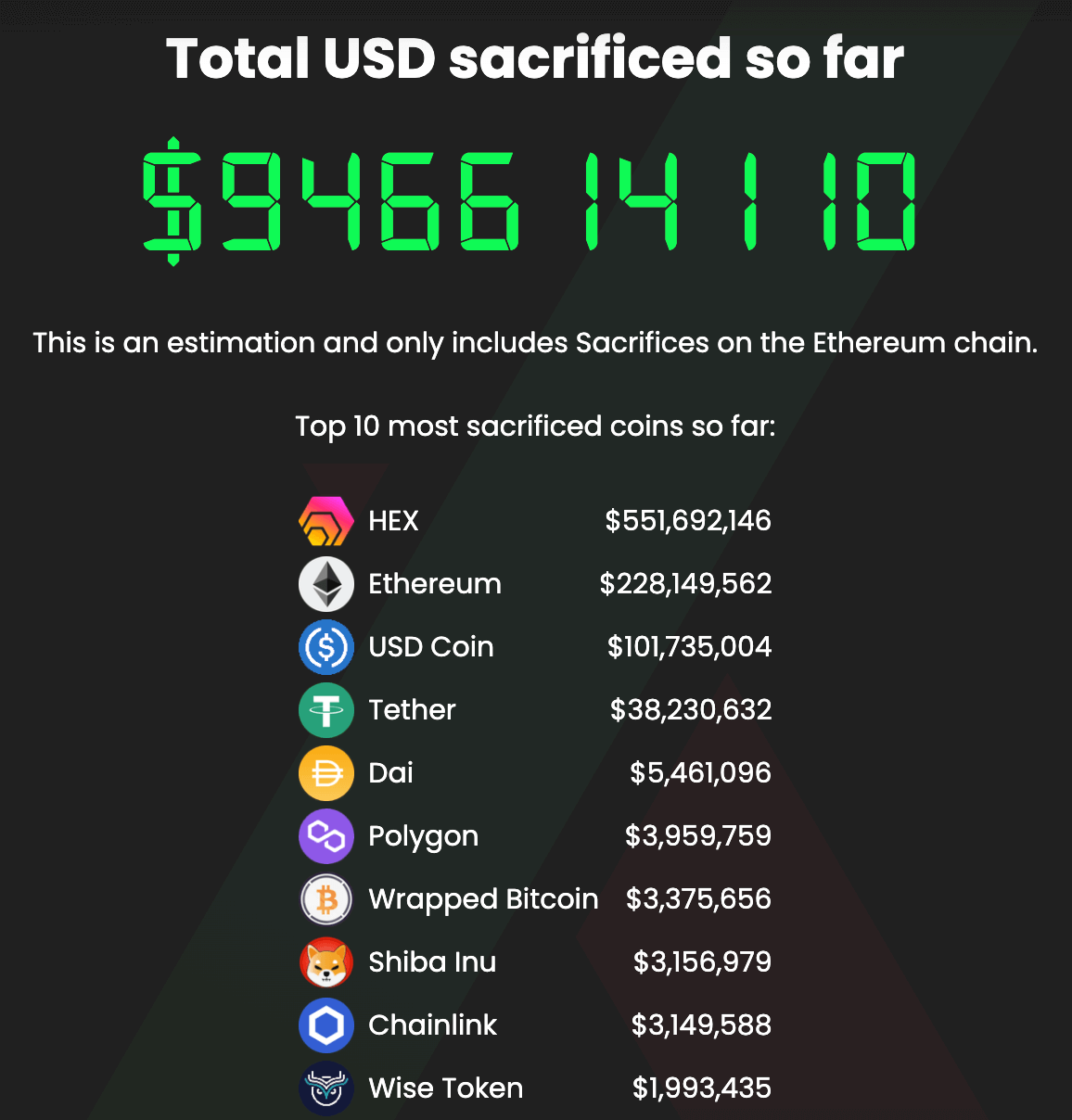

On Jan 10th, the first stage of PulseX’s “sacrifice” ended, bringing total investment into the project to $1 billion and making it one of the largest funding rounds (albeit unofficial) in crypto history.

This comes just 4 months after the half-billion-dollar sacrifice to Pulsechain, a future Ethereum fork on which PulseX is expected to be the main DEX.

A disclaimer on PulseX’s website reads, “By sacrificing your crypto you do NOT buy PLSX. You can give your crypto away, sacrifice it as a political statement.”

Depending on whether you ask detractors or supporters, this clause is either a loophole to avoid being labeled a security by the SEC, or evidence that it’s the next Bitconnect.

Assuming most of the funds sacrificed were de facto investments made with the expectation of profit, nor came from wallets associated with the team to inflate the project, how did a chain led by Richard Heart, founder of controversial cryptocurrency Hex, become one of the largest crowdfunding campaigns in crypto history?

And, why is discussion almost entirely limited to the Hex community?

This article will explain what some believe Pulsechain and PulseX will do. It will also list the reasons some believe the project is a scam.

What Problem Does Pulsechain Solve?

Hundreds of successful DApps have launched on Ethereum but the network’s popularity has made it expensive to use and slow. In 2021, gas fees—the price to validate transactions — occasionally reached hundreds of dollars.

This made developers realize the potential of new Layer 1 chains—like Solana, Binance Smart Chain, and Polygon—that host their own DApps. Some of these chains are not compatible with Ethereum and require bridging solutions to interoperate. Others, like Polygon, are compatible with Ethereum.

For users, the most obvious benefit of using an EVM-compatible chain is that you can swap an ERC-20 token on that DEX, or buy a project token from your chain on an Ethereum DEX like Uniswap.

When building a Layer 1 chain, developers can theoretically copy the entirety of Ethereum’s code, create a radically different protocol, or, as in the case of BSC, make some improvements to it.

In crypto language, a “fork” of a blockchain means an improved version, with developers making changes to the protocol and its rules. When Ethereum makes upgrades, e.g. the London upgrade, they are called forks as well.

According to founder Richard Heart, Pulsechain will be a fork of Ethereum. The extent of the changes is not yet known—no code has been released to the public. However, the main claims are:

- 4x throughput

- Proof of Stake

- Deflationary mechanism

Additionally, all major DApps from Ethereum will also be forked. In other words, the goal is to copy Ethereum and have a built-out ecosystem from the start.

What is PulseX?

As the Ethereum ecosystem will be copied over to Pulsechain, PulseX will be the fork of Uniswap.

It is intended to be the main DEX of the Pulsechain ecosystem. For reference, PancakeSwap is also a fork of Uniswap and achieved this analogous function on Binance Smart Chain.

DEXs like SushiSwap and Uniswap have their own governance tokens—SUSHI and UNI, respectively—which grant voting rights to holders. PLSX will be PulseX’s token, and people who sacrificed get a number of “points” based on the size and timing of their contribution. These points correspond to a quantity of PLSX to be airdropped to their wallets once the exchange launches.

Likewise, PLS—Pulsechain’s native cryptocurrency—will be airdropped to those who sacrificed for that project.

The price of PLSX and PLS will start at $0 and subsequent price targets are anybody’s guess.

Many believe that Pulse will launch in March or April and PulseX towards the end of the year.

Will Pulse Solve Ethereum Congestion?

Richard Heart has said that the goal of Pulsechain is not to compete with Ethereum, but to decrease the burden on the network.

Besides forking Ethereum, the project will also copy the chain’s state. Every wallet will get a match of their ERC-20 tokens on Pulsechain. In other words, it will be a massive airdrop.

For example, if you have 10 eHEX (Ethereum network HEX), you will get an additional 10 pHEX (Pulsechain HEX) on Pulsechain.

However, there is no way to peg the price of the same token on Ethereum and Pulsechain tokens, meaning that the latter may be worthless, or more expensive.

Why Some Believe Pulse is a Scam

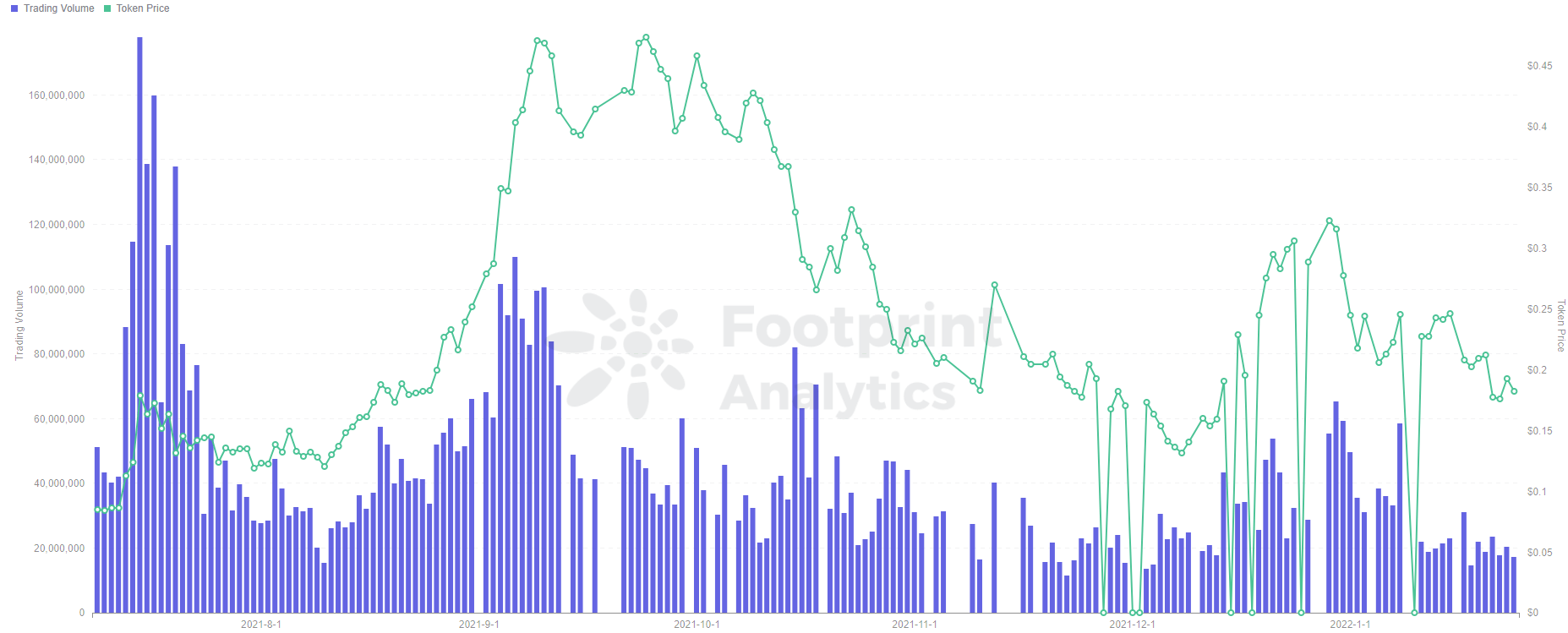

The biggest criticism of Pulse and PulseX is that they are directly connected to Hex, a controversial token that has performed well in terms of price but with questionable fundamentals.

According to Richard Heart, Hex aims to be the blockchain’s native certificate of deposit.

Actual certificates of a deposit exist because financial institutions use such deposits to gain returns throughout the market. They can do this because the currency you deposit, e.g. USD, has salability and value which can be employed, which banks do after leveraging it. In other words, certificates of deposit work because the bank uses the purchaser’s money to create value, namely in the form of loans; the money does not generate value by simply sitting in an account, and the currency’s soundness precedes the fact that it can be deposited to earn interest.

In other words, the locking-in mechanism is a necessary but not sufficient condition for CDs, in the traditional sense, to work.

Currently, the high APY that crypto staking earns comes from the tokens facilitating currency swaps on exchanges—a service with very high demand. As it stands, Hex facilitates no service, does not generate value via loans, nor has widespread adoption as a digital currency.

So where does the 40% annual APY come from? The high returns are maintained entirely by the purchase of new Hex that is not staked, which is the classic Ponzi scheme.

Furthermore, scams and Ponzi schemes in the traditional financial market are often cloaked as certificates of deposit as well. CDs that significantly outperform the market tend to attract the attention of regulators, and so-called digital certificates of deposits, especially those that claim to provide too-good-to-be-true returns should be scrutinized heavily.

The counterargument is that Hex’s smart contract is built to incentivize price stability. The reality is, bitcoin is only as good as its perceived value, and indeed was worth very little until it received widespread adoption as a risky but profitable investment asset. In other words, the desire to get rich pumped bitcoin, and arguments about the soundness of its fundamentals followed.

Eventually, bitcoin might become a widespread currency, but it will have started as a highly speculative asset that was also frequently called a scam.

Hex claims to take the functionality of bitcoin but uses proof-of-stake and adds a staking mechanism that increases returns to those who complete their term, in negative proportion to those who do not. Instead of paying newly minted currency, i.e. the inflation, to miners as with bitcoin, Hex pays the inflation to stakers who provide stability. Ideally, the potential for easy profits will fuel mass adoption, after which an efficient ecosystem can be built upon its fundamentals. Pulsechain and PulseX are supposed to be the initial steps of that ecosystem.

Date & Author: February 8th 2022, James@footprint.network

What is Footprint?

Footprint Analytics is an all-in-one analysis platform to visualize blockchain data and discover insights. It cleans and integrates on-chain data so users of any experience level can quickly start researching tokens, projects and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their own customized charts in minutes. Uncover blockchain data and discover the value trend behind the project.

The post What is PulseX and Why Did People Give It a Billion Dollars? appeared first on CryptoSlate.