Bitcoin price

Monday’s daily candle was another battle that went to bullish BTC market participants as BTC’s price closed the day +$1,442 and above short term resistance at the $43k level.

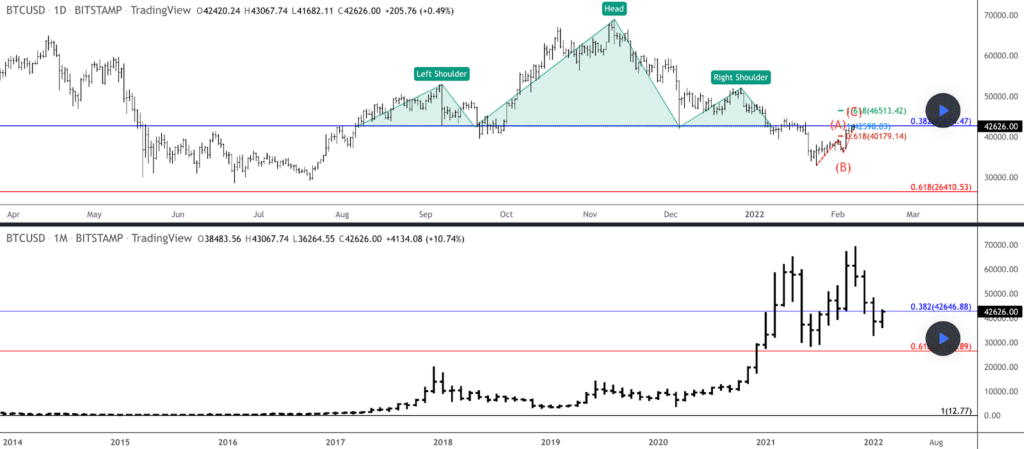

The BTC/USD 1D chart below from Kongkiat shows the most critical support levels and resistances in the interim for BTC market participants.

Traders can see bitcoin’s price has formed a head and shoulders pattern that has the potential upside in the mid-term of the $52k level. That level could be a major tug-of-war between bullish and bearish market participants.

In the interim, bullish traders are seeking to crack the $46,513 level as further confirmation of their momentum. Conversely, bearish traders are seeking a trip back down to retest the 0.618 fib level [$40,179.14].

Bitcoin’s Moving Averages: 20-Day [$39,772.24], 50-Day [$45,111.98], 100-Day [$50,990.83], 200-Day [$46,091.71], Year to Date [$40,695.47].

The Fear and Greed Index for Tuesday is 48 Neutral and -3 from yesterday’s reading of 45 Fear.

BTC’s 24 hour price range is $41,787-$ 44,476 and its 7 day price range is $36,438-$44,425. Bitcoin’s 52 week price range is $40,161-$69,044.

The price of bitcoin on this date last year was $46,307.

The average price of BTC for the last 30 days is $40,161.

Bitcoin’s price [+3.4%] closed its daily candle worth $43,865 and in green figures for twelve of the last sixteen days.

Ethereum Analysis

Ether’s price also finished its daily session with further positive momentum on Monday and closed +$83.28.

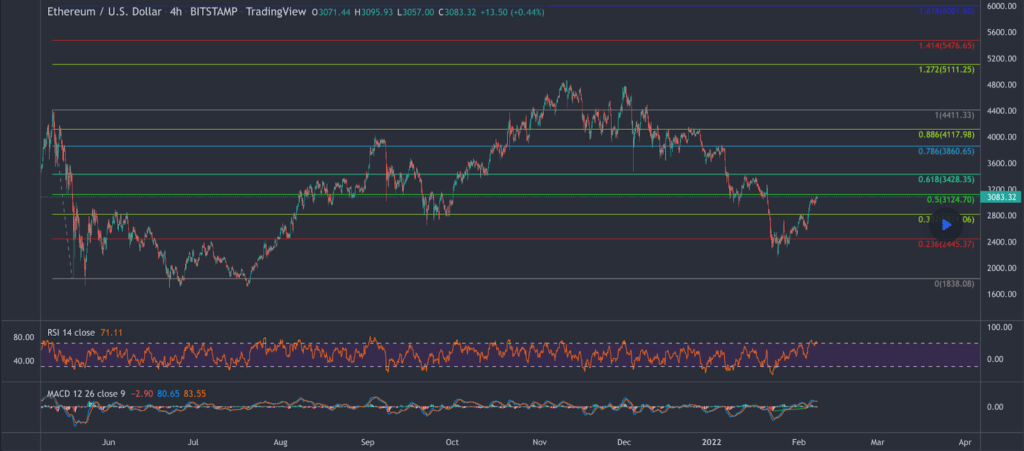

The second chart we’re examining today is the ETH/USD 4HR chart below from CLTullmann. Bullish traders have sent Ether’s price back above critical levels at the 0.382 fib [$2,821.06] and the 0.5 fib [$3,124.7]. The next target for bullish traders is the .0618 [$3,428.35] and above that is a secondary target of 0.786 [$3,860.65].

Bearish ETH traders are conversely looking to shift momentum back to their favor and again send back below the $3k level and the 0.382 fib with a target of 0.236 [$2,445.37] eventually. If that level is broken, bearish Ether market participants will likely have the opportunity to send ETH’s price back below the $2k level for the first time since July 21, 2021.

Ether’s Moving Averages: 20-Day [$2,868.09], 50-Day [$3,522.66], 100-Day [$3,725.81], 200-Day [$3,256.65], Year to Date [$3,007.44].

ETH’s 24 hour price range is $3,008-$3,190 and its 7 day price range is $2,590-$3,178. Ether’s 52 week price range is $1,351-$4,878.

The price of ETH on this date in 2021 was $1,751.

The average price of ETH for the last 30 days is $3,269.59.

Ether’s price [+2.72%] closed its daily candle on Monday worth $3,139.68.

Solana Analysis

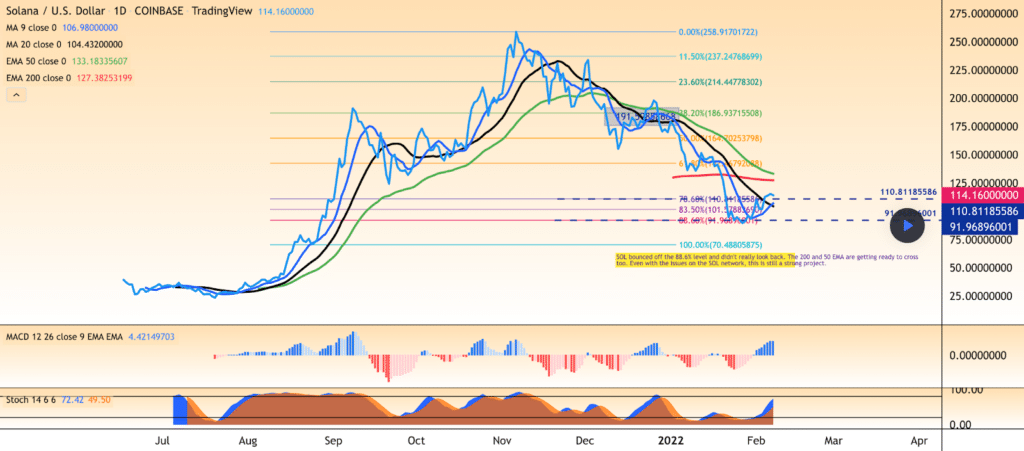

The SOL/USD 1D chart below from stikytrading shows bullish Solana market participants again trying to solidify the 0.786 fib level [$110.81] as support after becoming resistance earlier this year. If bullish traders can hold the 78.60% as support their next target overhead is the 61.80% fib level [$142.75].

Bearish traders are looking to again send SOL’s price below the $110 level and attempt to create a lower low not seen since late in 2021 below the 88.60% and the $91 level.

Solana’s Moving Averages: 20-Day [$117.37], 50-Day [$154.75], 100-Day [$171.13], 200-Day [$114.40], Year to Date [$125.66].

Solana’s 24 hour price range is $113.55-$121.68 and its 7 day price range is $94.96-$121.68. Solana’s 52 week price range is $7.26-$259.96.

Solana’s price on this date last year was $7.91.

The average price of SOL over the last 30 days is $118.34.

Solana’s price [+1.93%] closed its daily session on Monday worth $117.49.

The post Bitcoin, Ethereum, Solana all marked-up in price on Monday appeared first on The Cryptonomist.