December’s crypto market slowdown became a full downturn in January. DeFi activity shrunk while the prices of BTC and ETH dropped. However, one asset grew faster than ever.

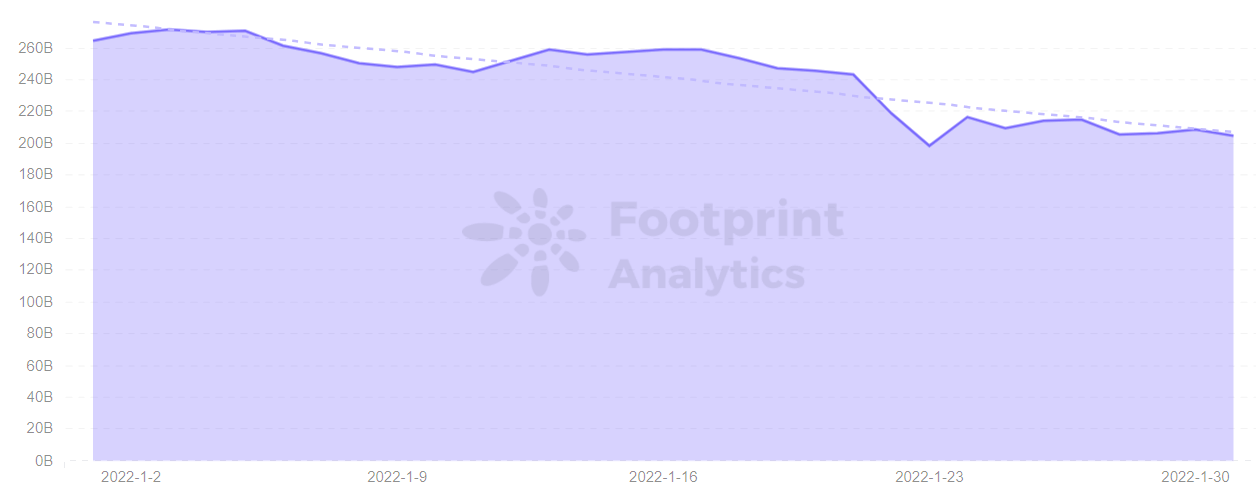

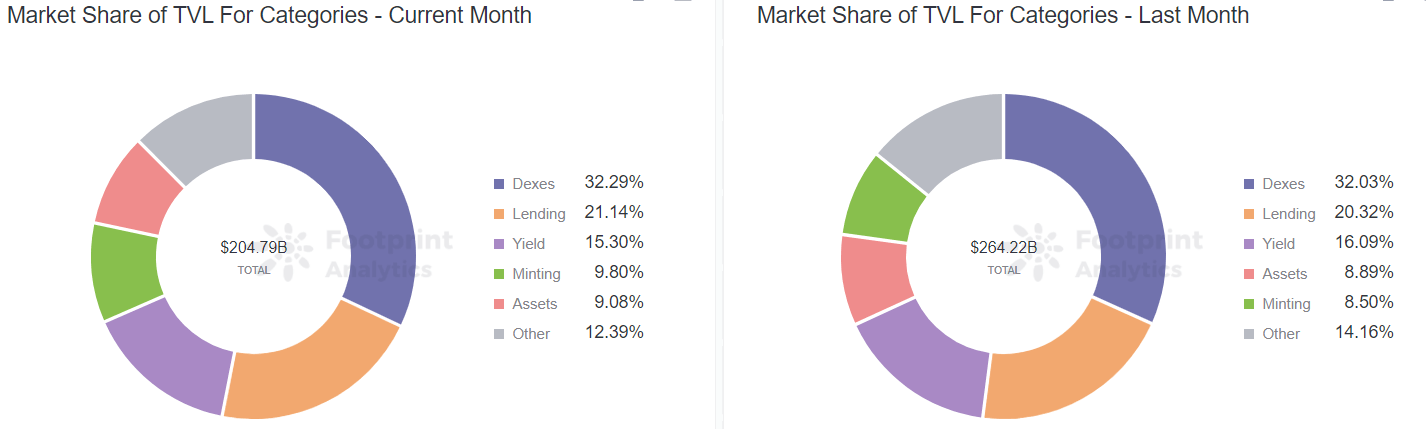

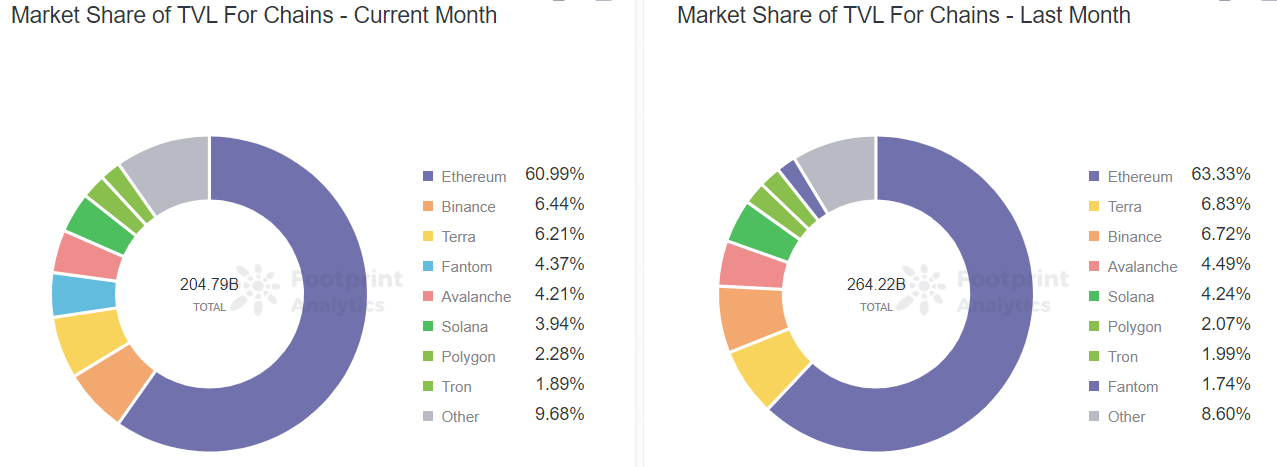

According to Footprint Analytics, DeFi‘s TVL failed to exceed $300 billion, instead dropping to $204.79 billion, a 22% decline MoM. BTC and ETH crashed again, while NFT market volume soared to a new high in January, up 239%.

BTC, ETH Crash Again, Top Protocols Liquidated $425 Million

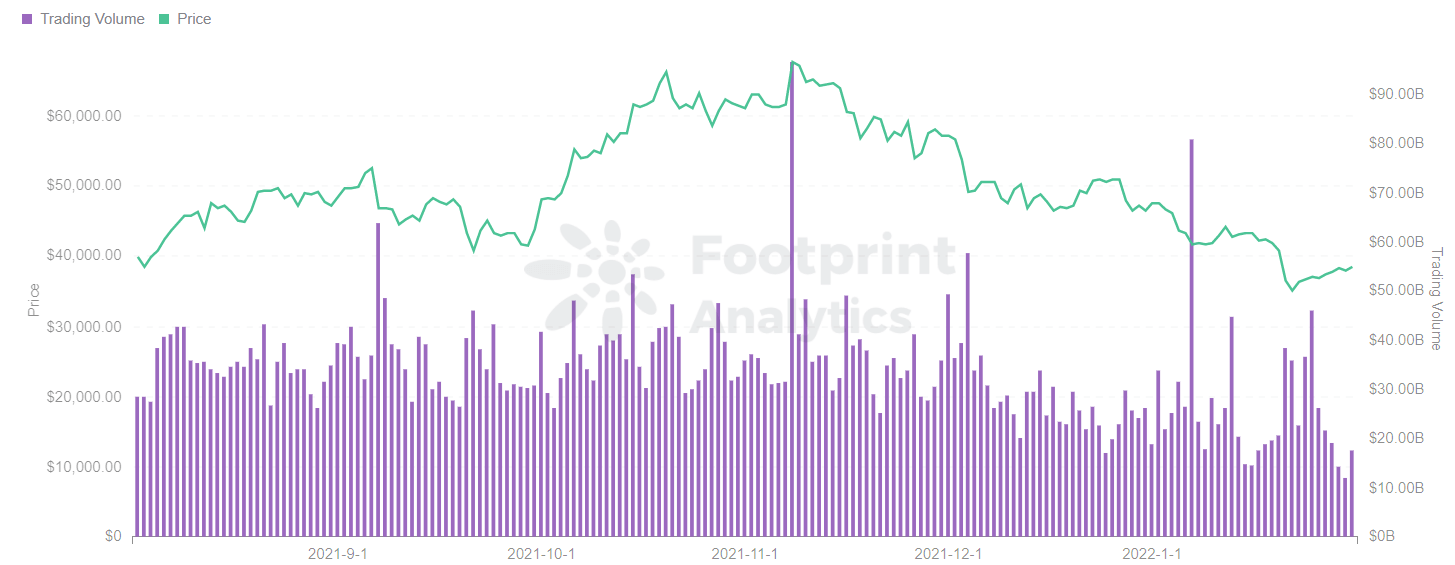

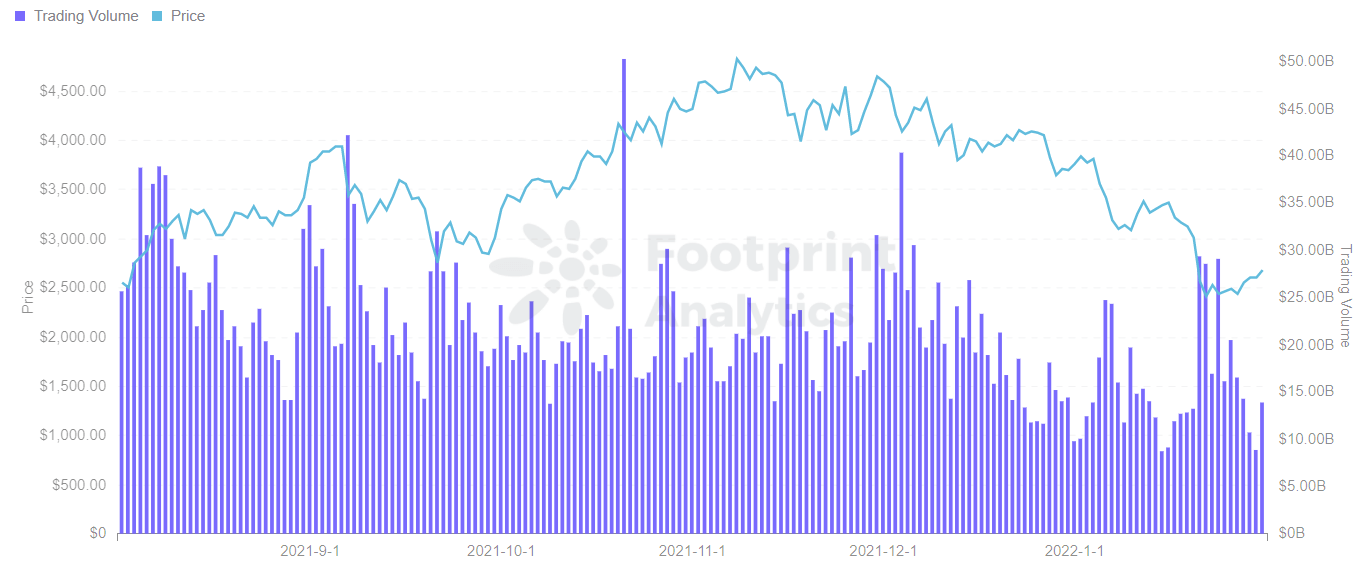

The price of BTC fell 17.3% from $46,472 to $38,430 in January. ETH fell 27.4% from $3,695.6 to $2,684.75, with the highest daily trading volume of the month at $29.31 billion. On the 22nd, BTC and ETH set eclipsed their September 2021 low.

The crash was mainly influenced by policy announcements from various countries. Examples include the Federal Reserve’s tightening of monetary policy, the Bank of Russia’s proposal to ban the use of cryptocurrencies, Pakistan’s ban on cryptocurrency, and other countries’ strict regulation of BTC, from mining and trading to online marketing.

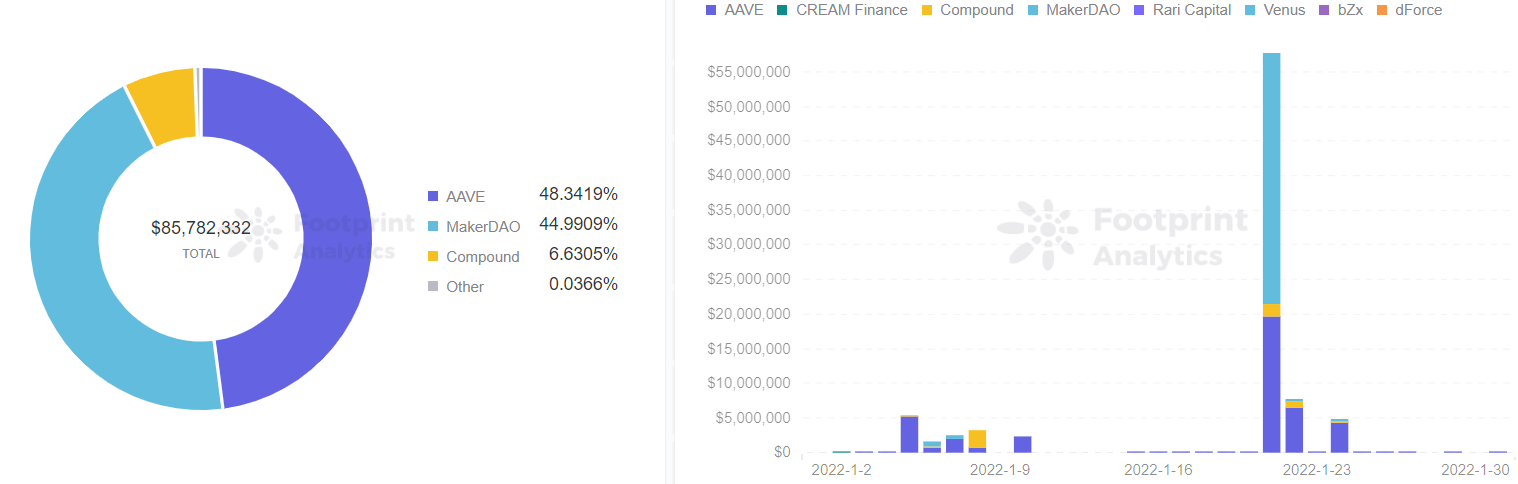

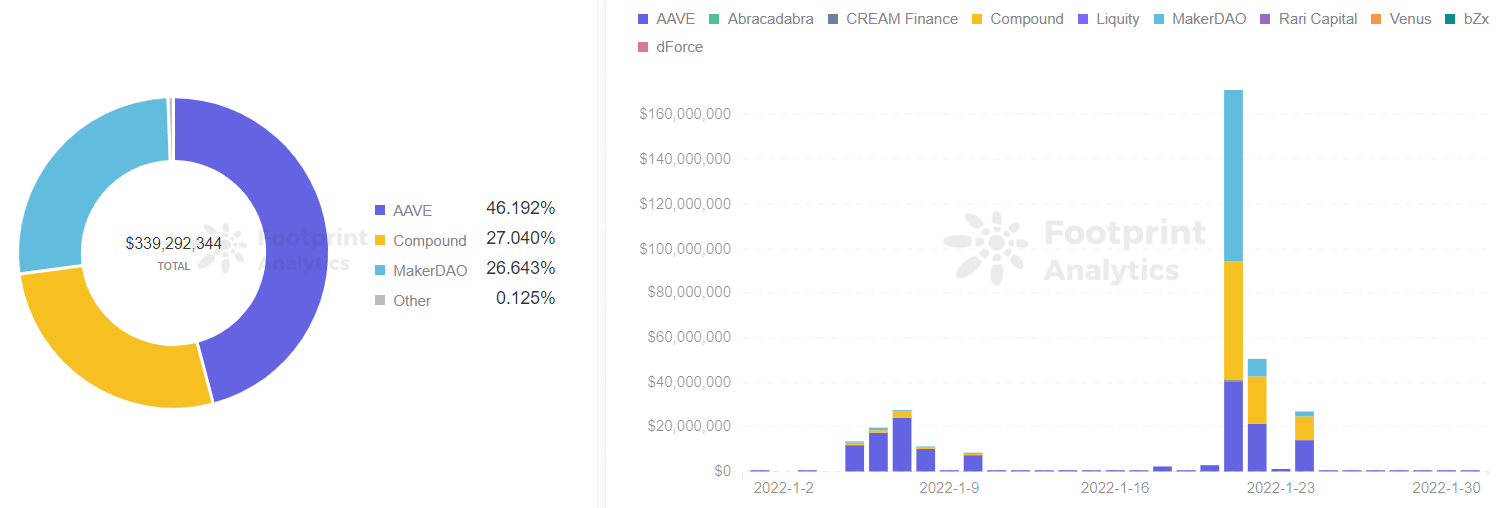

As BTC and ETH prices fell, it drove top lending protocols such as AAVE, Compound, and MakerDAO to trigger massive liquidations around Jan. 7 and 21, with $425 million liquidated.

DeFi TVL decreased 22% MoM

Due to the overall decline in the cryptocurrency market, TVLs fell 22% in January from $264.22 billion to $204.79 billion MoM. Data from Footprint Analytics shows, the TVL of bridge projects increased by 30% , which did not contribute much to the overall DeFi TVL increase due to its small percentage.

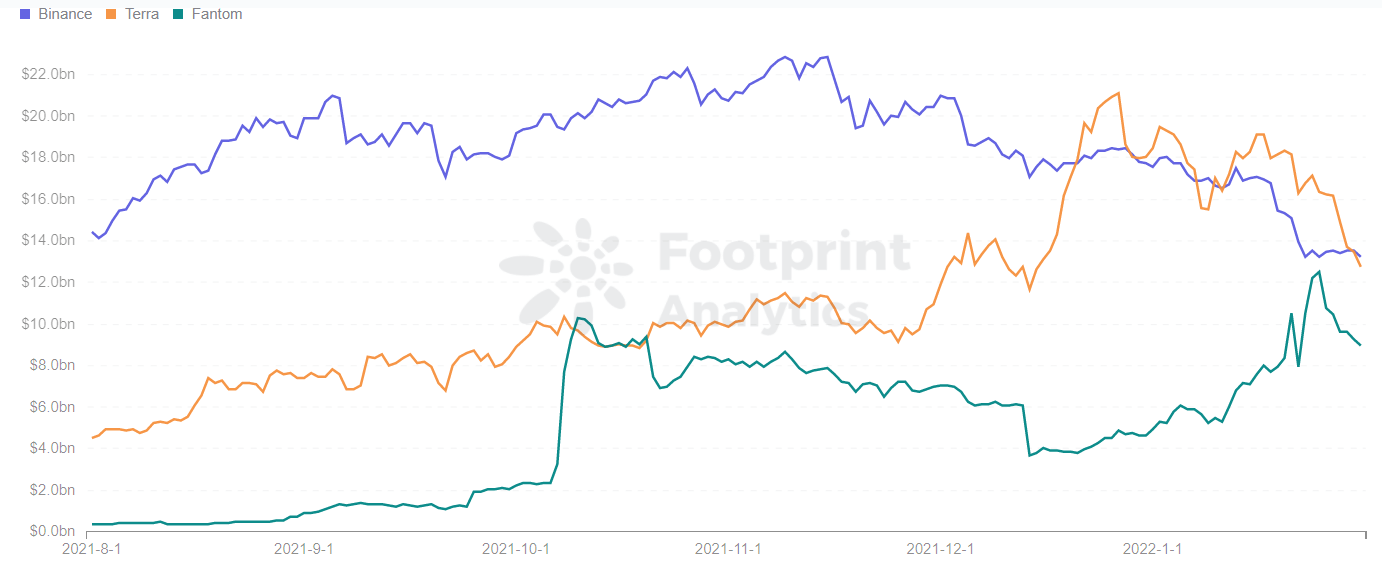

Fantom’s TVL Hits Record High in Blockchain

Blockchains are competitive and each has its own way to capture the market. In January, Terra’s TVL had overtaken BSC several times as the 2nd place. But at the end of the month, BSC overtook it to regain second place.

Fantom’s TVL reached a historical high on Jan. 25, locking in $8.9 billion at a 93% growth rate, jumping past Avalanche ($8.62 billion), Solana ($8.07 billion) and Polygon ($4.67 billion) to the top 4.

Fantom’s TVL hit an all-time high for the following reasons:

- Fantom is a faster (1-2s per transaction) and much less expensive (about $1 for 10 million transactions) alternative to the Ethereum network

- Fantom has a rich ecosystem with yield, dex, and lending projects making up more than 23% of the ecosystem, with Scream and SpookySwap contributing the largest growth in TVL.

- Scream supports depositing and lending of WBTC, WETH, WFTM, DAI, USDC, fUSDT, providing more liquidity.

- SpookySwap offers APY above 100% to attract more users.

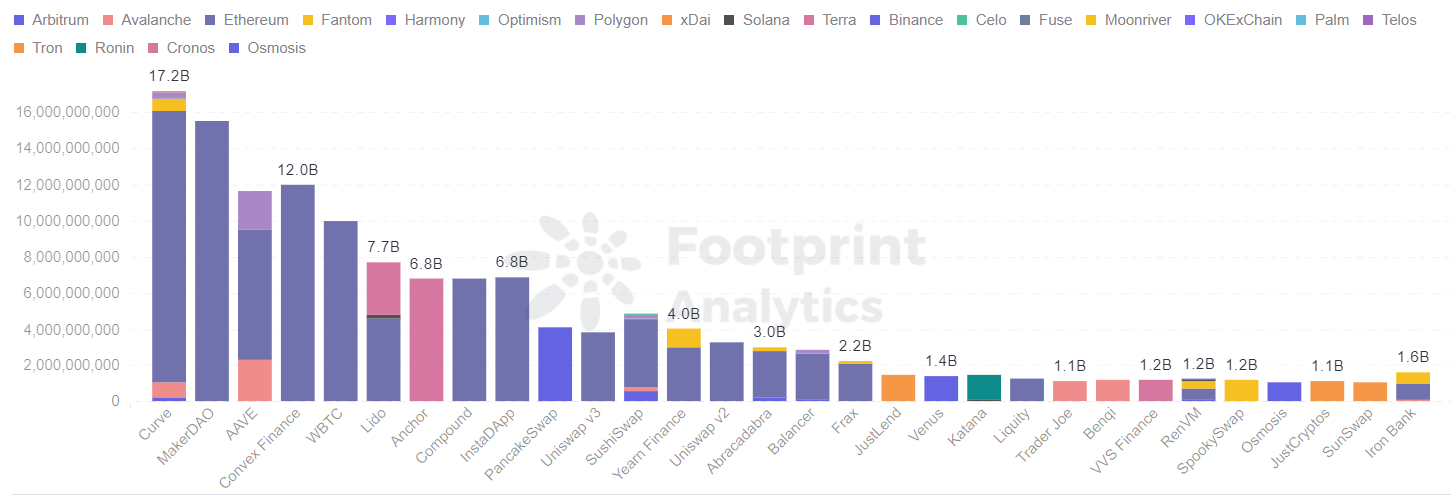

Curve is Still Far Ahead

Curve is the number one DeFi platform by TVL and focuses on trading stablecoins. The drop in BTC price has driven other cryptocurrencies like ETH down, but has had relatively little impact on the prices of stablecoins like USDT and USDC.

The top 5 positions continue to be held by popular projects such as Maker DAO, AAVE and Convex Finance.

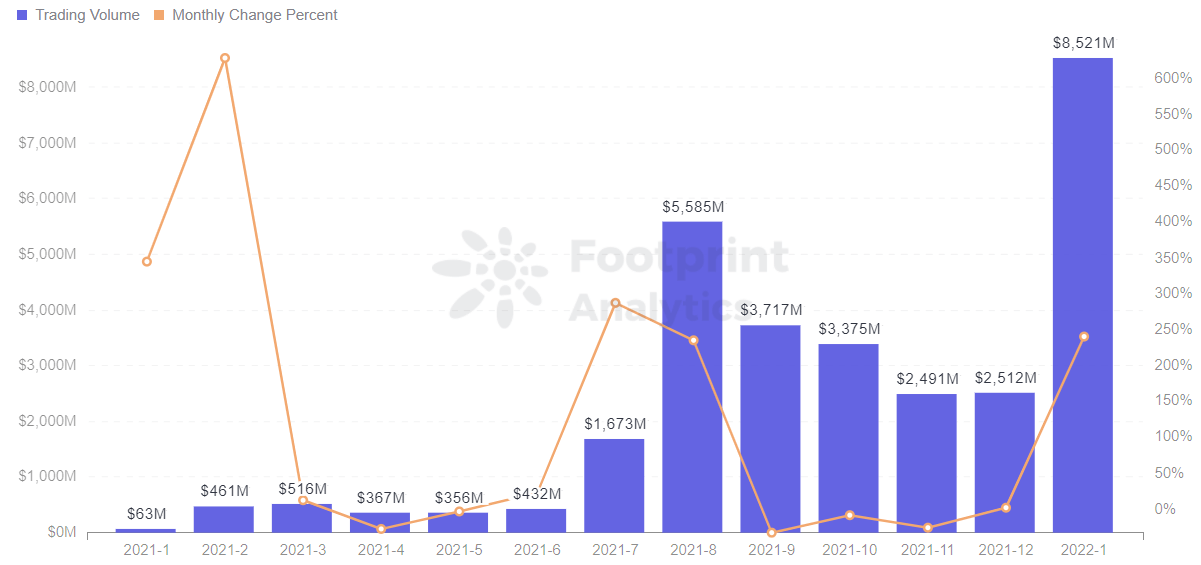

NFT Monthly Volume Hits Record High of $8.52 Billion, Up 239%

With token prices falling due to the regulatory environment, speculative capital flowed into the NFT market for collectibles, games and art. This led to unprecedented activity in the NFT space, with trading volume reaching a new high of $8.52 billion.

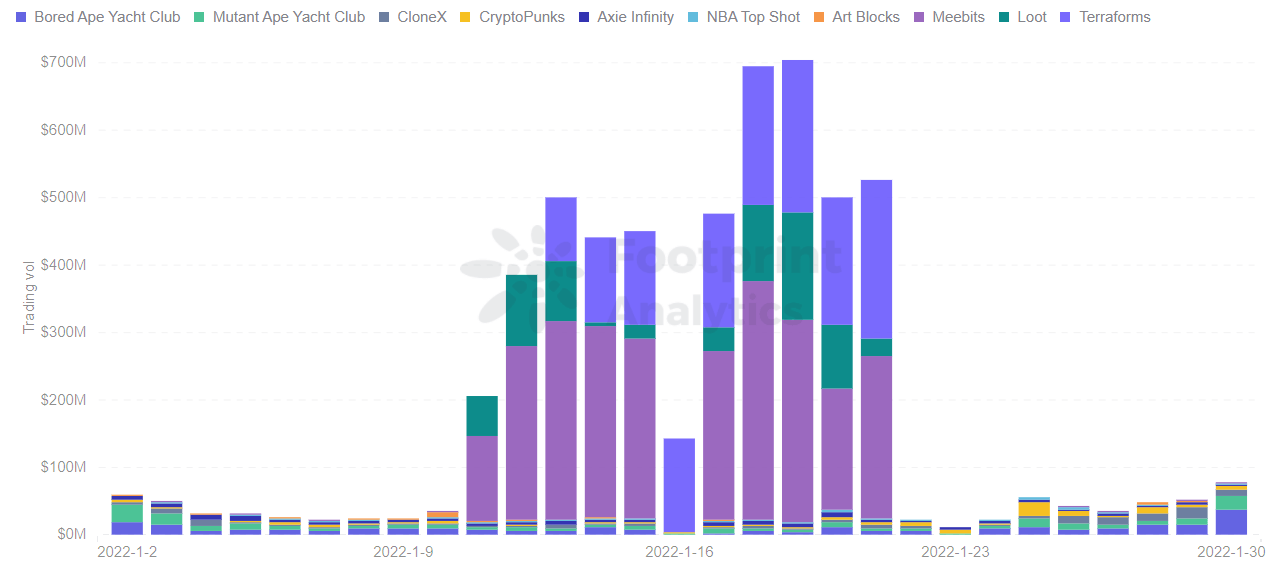

According to Footprint Analytics, Meebits saw a spike in transactions between Jan. 11 and 21, with volume reaching $200 million to $350 million. Meebits is a 3D virtual world game by Larva Labs, the development team of Cryptopunks. The second most traded NFT project was Terraforms, and the third was Loot.

Veteran NFT collections such as Bored Ape Yacht Club, Cryptopunks, Art Blocks, and Axie Infinity had a relatively stable daily trading volume.

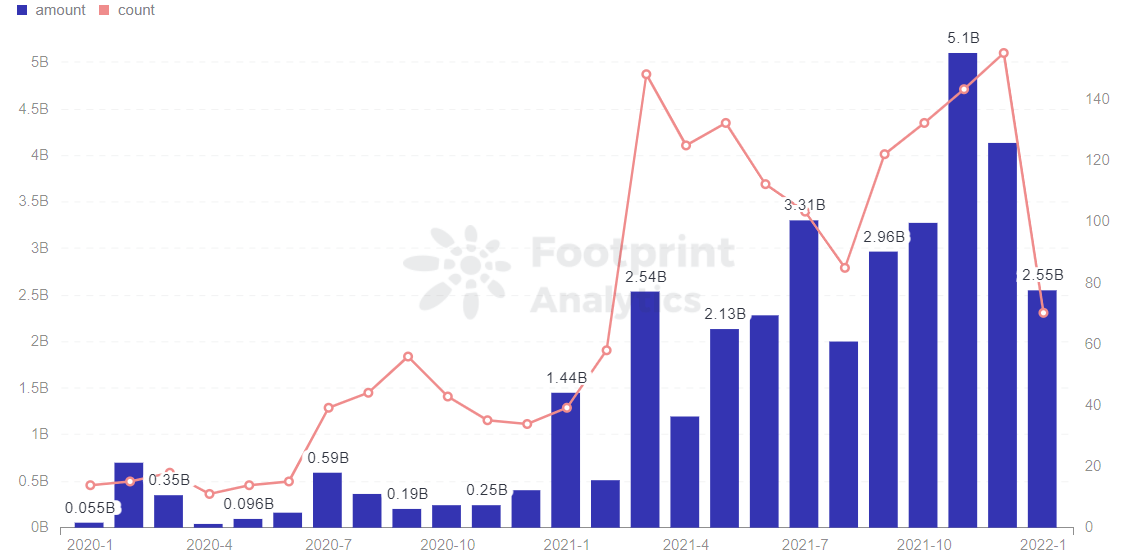

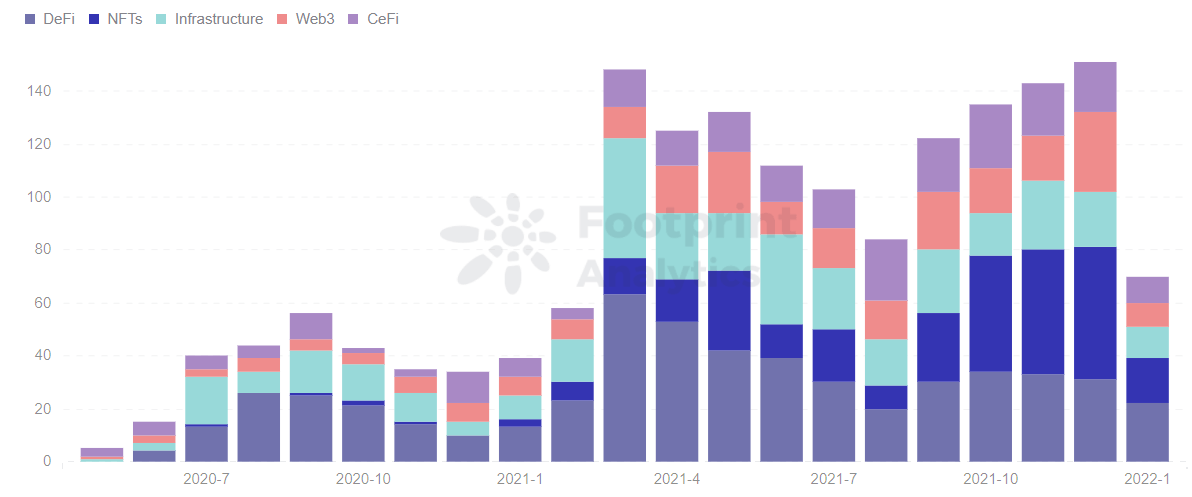

Monthly investment volume down 38% MoM

The number of investments in January was down 55% MoM and the amount invested was down 38%. In terms of investment sectors, the DeFi sector had the lowest decrease compared to December, while the NFT and Web3 sectors had the highest decreases, 66% and 70%.

Summary

Influenced by new policy proposals and regulations, the crypto market entered a downturn in January. Mainstream cryptocurrency prices fell, with BTC and ETH hitting lows. DeFi’s TVL fell 21% MoM, implying a strong correlation with the biggest tokens.

However, the decline in ETH prices has contributed to NFT trading, prompting speculative capital to flow into the NFT markets for collectibles, art and gaming.

January Events Review

Nations

- Pakistan’s FIA freezes 1064 bank accounts used to trade cryptocurrencies

- Israeli Defense Minister confiscates over $800,000 in cryptocurrency to fund military activities

- BTCS becomes the first Nasdaq Listed Company to pay dividends in Bitcoin

- State Bank of Pakistan decides to ban cryptocurrencies

- Pakistan Telecommunications Authority ordered to block more than 1,600 encrypted websites

- White House wants to make crypto rules a national security issue

- Uruguay Installs its first cryptocurrency ATM

- Italy’s Banca Generali Bank to allow BTC purchases early this year

Fundraising

- British Digital Bank Monzo completes a $600M financing with a valuation of $4.5B. Tencent and Others participate in the investment

- Solana horse racing chain game DarleyGo completes seed round financing, Jump Capital leads the investment

- A16z leads additional $25M round for DeFi credit protocol Goldfinch

- British Fintech PrimaryBid close to finalizing $150M funding from softBank

- Fireblocks closes $550M Series E at $8B valuation

- A Subsidiary of the Navier Group is launching a $100M fund for Metaverse creators

- Footprint Analytics raises $1.5M to build accessible Cross-Chain Analytics Tool, led by IOSG

Blockchain

- Polygon (MATIC) schedules Long-Awaited EIP-1559 upgrade for next week

- Nyan Heroes, a Solana-based game project, has partnered with YGG

- The 24-hour transaction volume on the Fantom chain exceeds that of Ethereum

- Tether has recovered $87M in USDT sent to wrong addresses since its launch

DeFi

- Convex Finance’s TVL exceeds $20B

- The total Market Value of cryptocurrencies fell to $1.8T, and BTC once fell below $36,550

- Cross-chain Bridge protocol Multichain joins SkyLaunch alliance

- Bitcoin Nouveau Riche are flocking to Puerto Rico for big tax savings

- Crypto investment agency Pantera’s assets under management reach $5.6B

NFTs

- Samsung to provide ‘NFT Aggregation Platform’ on its smart TV

- YGG has raised $1.4M to help typhoon victims in the Philippines

- Pudgy Penguins NFT project ousts founders as mood turns icy

- One day after launch, OpenSea competitor LooksRare sells over $100M in NFTs

- The total transaction volume of LooksRare in the NFT market exceeds $1B

- January NFT monthly transaction volume hit a new high of $6B

Security

- The Solana Network encounters a short-term failure resulting in performance degradation

- LCX loses $6.8M in a hot wallet compromise over Ethereum blockchain

- Animoca Brands’ Lympo NFT platform hacked for $18.7M

- Raricapital suffered serious price manipulation; Paidun said the stolen funds are now $250,000

- DEX Crosswise was hacked for $879,000

- Decentralized lending protocol Qubit hacked, losing about $80M

Feb. 2022, Vincy@footprint.network — Data Source: Footprint Analytics –January 2022 Report Dashboard

What is Footprint Analytics?

Footprint Analytics is an all-in-one analysis platform to visualize blockchain data and discover insights. It cleans and integrates on-chain data so users of any experience level can quickly start researching tokens, projects and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their own customized charts in minutes. Uncover blockchain data and invest smarter with Footprint.

The post While Bitcoin drops, NFTs soar: Footprint Analytics Monthly Report appeared first on CryptoSlate.