By changing the way we display denominations of value in bitcoin, we can make it easier to onboard people who may not understand bitcoin’s divisibility.

As the price of bitcoin will potentially increase over time, we need to adopt a new strategy to promote the relative affordability of bitcoin. In addition, we need to address and remove some legacy barriers which both confuse and intimidate people new to bitcoin. This article proposes some simple, easily executable ideas to address these issues and is intended to stimulate discussion within the existing Bitcoin community.

Although this is primarily aimed at existing bitcoin holders and exchange or wallet developers, if you are new to bitcoin, you may find some of the content of value also. Even without the ideas being adopted, this article covers most of the common areas of confusion and will assist in clarifying some of the issues with the current approach and vocabulary.

It should be noted that we are very early in the bitcoin adoption curve and most people have no clue what bitcoin is, how it works and its benefits. There is still plenty of time to adopt new terminology or promote underused terminology that makes bitcoin more accessible to the majority of the population.

Areas Of Confusion

Even if people have funds available to purchase bitcoin, there are multiple aspects of bitcoin that can confuse or deter the adoption of bitcoin.

Perceived Affordability

The current default of enumerating the pricing of bitcoin per whole coin has a negative impact. At the time of writing, the price of a whole bitcoin is around $40,000. The common and understandable reaction to this, from the average person, is that bitcoin is expensive, unaffordable and it prevents them from acquiring bitcoin. Even worse, it sometimes forces them down the path of looking for more “affordable” cryptocurrencies.

We have reached the point where most people will never be in a position to acquire a whole bitcoin, so a new approach is required to recalibrate people’s perception of bitcoin’s affordability. Primarily, this needs to be done by promoting partial bitcoin purchasing and adopting an alternative, pre-existing default denomination, rather than using the metric of a whole, single bitcoin.

Fractional Complexity

When purchasing or transacting in bitcoin, people are forced to think in terms of unwieldy fractions (e.g., 0.00178652 bitcoin). This fractional complexity makes it difficult to assess the numbers involved accurately and allows for errors to be easily made. In addition, the use of integers with eight decimal places can be extremely intimidating to most people.

Architecture

Although bitcoin is divisible — 100,000,000 satoshis, or sats, per bitcoin — most people are unaware that it’s possible to purchase partial bitcoin.

Familiarity With Fiat Currencies

Bitcoin, while divisible, does not follow the usual convention of existing fiat currencies. Large fractions of bitcoin or large numbers of sats have no similar structures in traditional fiat currencies. This lack of familiarity is off-putting to potential bitcoin holders and makes bitcoin seem entirely alien and different from any currencies they might be used to.

All of these issues can be addressed without any changes to the core bitcoin architecture, but with some relatively minor tweaks to the presentation layer in exchanges and wallets.

There already exists a smaller denomination within bitcoin that usefully mimics some of the principles of traditional fiat currencies. That is the microbitcoin or bit for short which uses the symbol μBTC: 1 bit equals 100 sats

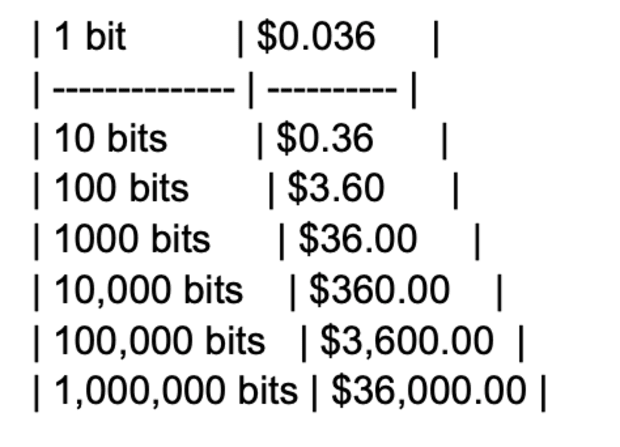

At the current price of $36,000 per BTC, 1 bit is equal to $0.036.

If we now price bitcoin on exchanges as USD/1,000 bits rather than USD/1 BTC, the price becomes a much more affordable $36 per 1,000 bits.

Adopting USD/1,000 bits also gives a lot of scope for the price of bitcoin to rise even further without impacting perceived affordability.

In addition, by using the USD/1,000 bits as a pricing metric, volatility in the price is perceived to be less:

– If bitcoin (BTC) falls from $51,000 BTC to $36,000 BTC this is perceived as a huge drop.

– If bitcoin (USD/1,000 bits) falls from $51 to $36 the impact of the volatility is the same but has less of a perceived impact.

Fractional Complexity

When the average person accesses an exchange, they will see the current whole bitcoin price and be given the option to purchase a fraction of a bitcoin. Usually, this is presented as a single integer with eight decimal places (e.g., based on a BTC price of $36,000, you can purchase 0.01000000 BTC for $360).

If the pricing denomination were bits, you would purchase 10,000 bits for $360, a much simpler human scale.

Prone To Errors

Working with eight decimal places with multiple leading zeros is difficult and prone to error. In some instances, the trailing zeros are omitted (e.g., 0.01 BTC) making the number even harder to process. Besides, who wants to buy 0.01000000 of anything. The number appears meaningless. This becomes even more important when sending bitcoin. Would you feel more confident sending 5,000 bits or 0.00500000 bitcoin — or is that 0.00050000 or 0.00005000, can you even see the difference easily?

Assessing Net Worth In Bitcoin

Ask anyone with less than a whole bitcoin how much they have, and they will usually reply with the USD (or local currency) equivalent (e.g., I have about $5,000 worth of bitcoin). This figure, of course, will fluctuate with the current price of bitcoin. The chances that they will say, “I have 0.13664418 bitcoin,” is zero. If they are really down the bitcoin rabbit hole, they might say they have “13,664,418 sats.” So, how many more sats do they need to get a whole bitcoin? Just take 13,664,418 from 100,000,000!

If the bit were to become the accepted norm, they would say “136,644 bits.” There are a million bits in a bitcoin, so the calculation 1,000,000 – 136,644 is so much easier! It’s 863,356, by the way.

If we want to move people away from working in USD into working with BTC, we need them to know how much bitcoin they own in an understandable form. Over time, it might well be that people will start to want to buy in bits rather than in USD monetary equivalent: “I want to buy another 10,000 bits next month to bring my total to 100,000 bits.”

A common meme when discussing bitcoin volatility is the “1 BTC = 1 BTC.” The inference is that you should not focus on the current fiat equivalent, but look to the future when everything will be priced in bitcoin. So, a good first step is to start allowing people to conceptualize and remember how much bitcoin they have — 0.13664418 bitcoin or just over 130,000 bits — I know which I find easier to remember.

Architecture

A lower denomination of bitcoin already exists called the satoshi or sat, so why not use that? Each bitcoin is comprised of 100,000,000 sats. Many people have called for the satoshi to be the default denominator for bitcoin, but this may not be the best approach.

Familiarity Or Association

If you’re already in the space, you’ll know that satoshis are in reference to Satoshi Nakamoto, the fabled inventor of Bitcoin. It’s a great homage to the creator, however, the word “bit” has familiarity and has a direct association with bitcoin.

Bitcoin is already a relatively well-known term through the mainstream media, so people are already familiar with the word “Bitcoin.” The bit is a perfect diminutive form of the word bitcoin. It’s a “bit” of a bitcoin — there is nothing to learn to associate — it’s just a “bit” of a bitcoin.

Human Scale

Humans find it difficult to appreciate or conceptualize the scale of large numbers.

With sats, 1 BTC equaling 100,000,000 sats is a vast number to comprehend. In addition, the fiat value of a single sat (for now) is in the order of four decimal places. It’s difficult to calculate and visualize or conceptualize a single sat: 1 sat equals $0.0003672. This also means that small purchases require thousands of sats, something that is unnatural and unfamiliar to most people. For example,

– A $4 coffee equals 10,897 sats: In the fiat world, when did you last buy anything for 10,897 cents or pennies?

– A $4 coffee equals 108.97 bits: That’s 108 bits and 97 sats.

Note that the bit example mimics traditional currency notation with whole units and two decimal places. This is a much more familiar concept for people with no experience of bitcoin.

Familiarity With Fiat Currencies

To improve the ease of usage of bitcoin, we need to follow some of the principles of traditional fiat currencies such as the dollar, the pound and the euro.

This can be done without any changes to the core bitcoin principles or architecture and simply relies on a shift in the default denomination of bitcoin. Doing this also positions bitcoin as a more understandable currency to the average person.

Most traditional fiat currencies are structured in the same way.

The Dollar (USD)

Of course, $1 dollar equals 100 cents.

There are no specific names (other than slang) for multiples of the dollar (i.e., 1 dollar, 10 dollars, 100 dollars, 1000 dollars, 100,000 dollars, 1,000,000 dollars).

The dollar can be written as $1 or as a dollar and cents value, such as $1.57 is 1 dollar and 57 cents.

The Pound (GBP)

Likewise, £1 pound equals 100 pence.

There are no specific names (other than slang) for multiples of the pound (i.e., 1 pound, 10 pounds, 100 pounds, 1000 pounds, 100,000 pounds, 1,000,000 pounds).

The pound can be written as £1 or as a pound and pence value, so £1.57 or 1 pound and 57 pence.

It’s exactly the same for the euro with euros and eurocents.

The Bit (BIT)

Similar to the dollar and pound, 1 bit equals 100 sats.

There does not need to be specific names (other than slang) for multiples of the bit (i.e., 1 bit, 10 bits, 100 bits, 1000 bits, 100,000 bits, 1,000,000 bits).

The currency symbol for the bit will need to be agreed upon. Perhaps a lowercase bitcoin ₿ or a combination of μ₿. Let’s use μ₿ for illustrative purposes.

The bit can be written as μ₿1 or as a bit and sats value as μ₿1.57 or 1 bit and 57 sats.

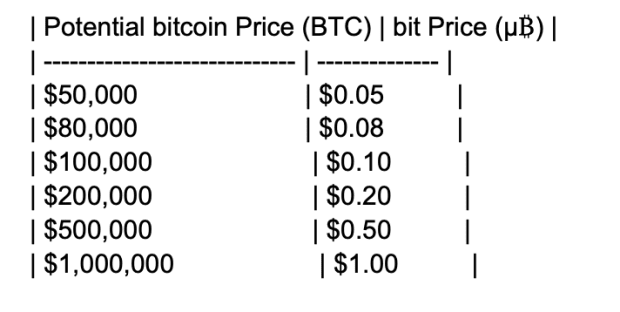

Based on the current bitcoin price of $51,000, the multiples of bits would look like this.

So, μ₿1,000,000 equals 1 BTC.

However, we may not need to denominate in whole bitcoin in the future, just 1 million, 2 million, 3 million bits, etc. Just like we do with the dollar, pound and euro. When have you ever heard a USD millionaire referring to their wealth as 100,000,000 cents?

Future-Proofing

As the price of bitcoin increases, the problem of the perceived affordability of the current denomination of whole bitcoin increases. The bit is well placed to cope with potential bitcoin price increases.

At $1,000,000 per BTC, the bit reaches price parity with the dollar.

Sample Presentations

Exchanges

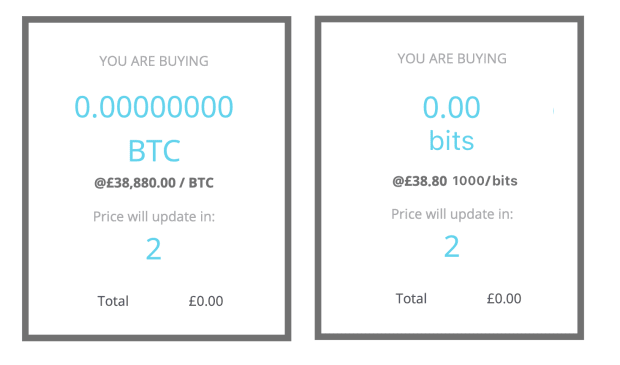

In the rudimentary illustration below, the left panel shows a typical buy screen on an exchange. This shows BTC as a single integer with eight decimal places, along with the price of a single bitcoin. The fractional complexity of the bitcoin amount and the high cost of the whole bitcoin is off-putting and alien to most people.

A mock-up of the same screen is below but displays bits with a price per 1,000 bits. Again, we are able to deal with whole numbers with just two decimal places and the price isn’t anywhere near as scary as a single bitcoin.

Wallets

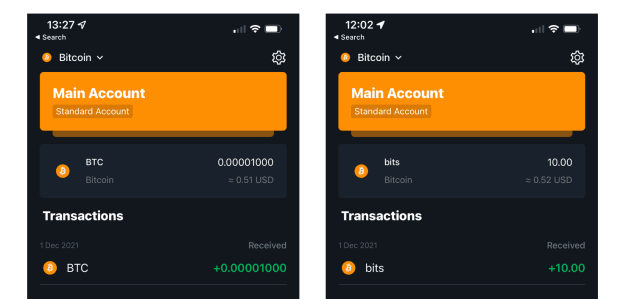

No need for a mock-up as one wallet already has the option to enumerate in bits, that is the Blockstream Green wallet. The screenshot below is in standard BTC. This uses the standard presentation of a single integer with eight decimal places to represent the fraction of a bitcoin.

The same wallet switched to enumerate in bits (on the right), shows a much more user-friendly presentation of bits and two decimal places of sats, just like a familiar, traditional fiat currency. Both display the amount of bitcoin in USD. The bits presentation is much cleaner, more familiar, easier to read and less prone to error.

Implementation And Adoption

There is no change required to the underlying core Bitcoin technology. There are also no changes needed to any core Layer 2 technologies such as Lightning.

The changes that would need to happen:

– Consensus on adopting the bit as a common denominator across exchanges and wallets.

– Consensus on selecting and adopting a standard currency symbol for the bit.

– Changes to the presentation layers of exchanges and wallets to show 1,000 bits as the pricing indicator for bitcoin.

– Changes to exchanges and wallets to transact using the bit as the standard denomination for BTC.

All of these are relatively minor technical changes.

The most important (and most difficult) change that needs to happen is to change the mindset of the existing Bitcoin community. We need to find a consensus to switch to using bits as the preferred domination of bitcoin.

This may be difficult for existing Bitcoin users who are already familiar (and comfortable) with using sats and may think that it’s too late in the process to change.

I cannot stress how early we are in the bitcoin adoption cycle, and change is possible. It just needs consensus and a real understanding of the potential benefits. Making a change now to using bits as the default denomination would make a massive difference in the perception of bitcoin to the general public, as well as smooth the way to bitcoin being adopted and used on a day-to-day basis.

There is no doubt that we need to address how bitcoin can be more relatable and accessible, as well as being less error-prone, intimidating and confusing.

“Stacking sats” is a great slogan but totally meaningless to a no-coiner.

“Buying bits” is something people can relate to.

This is a guest post by Don McAllister. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.