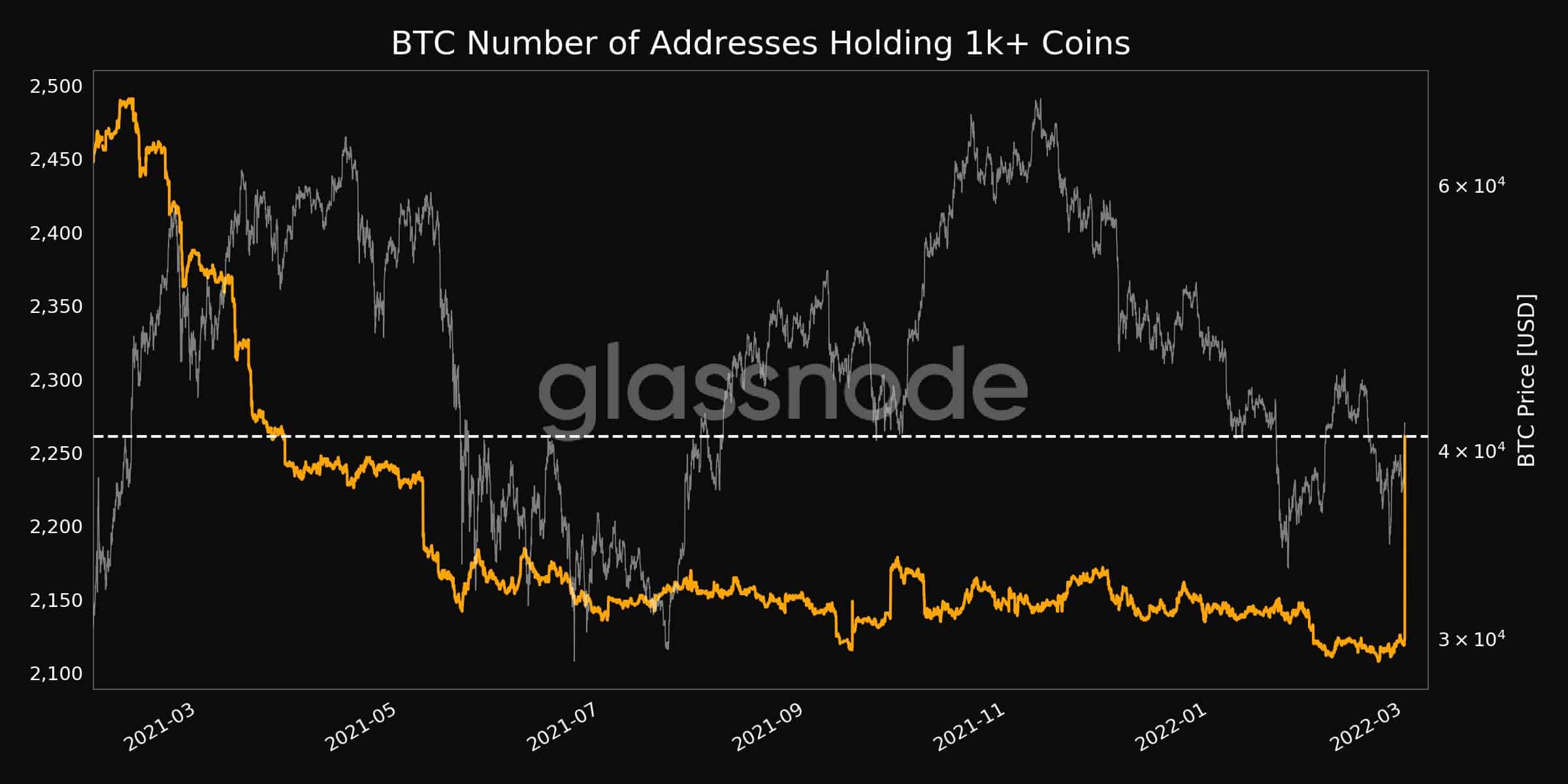

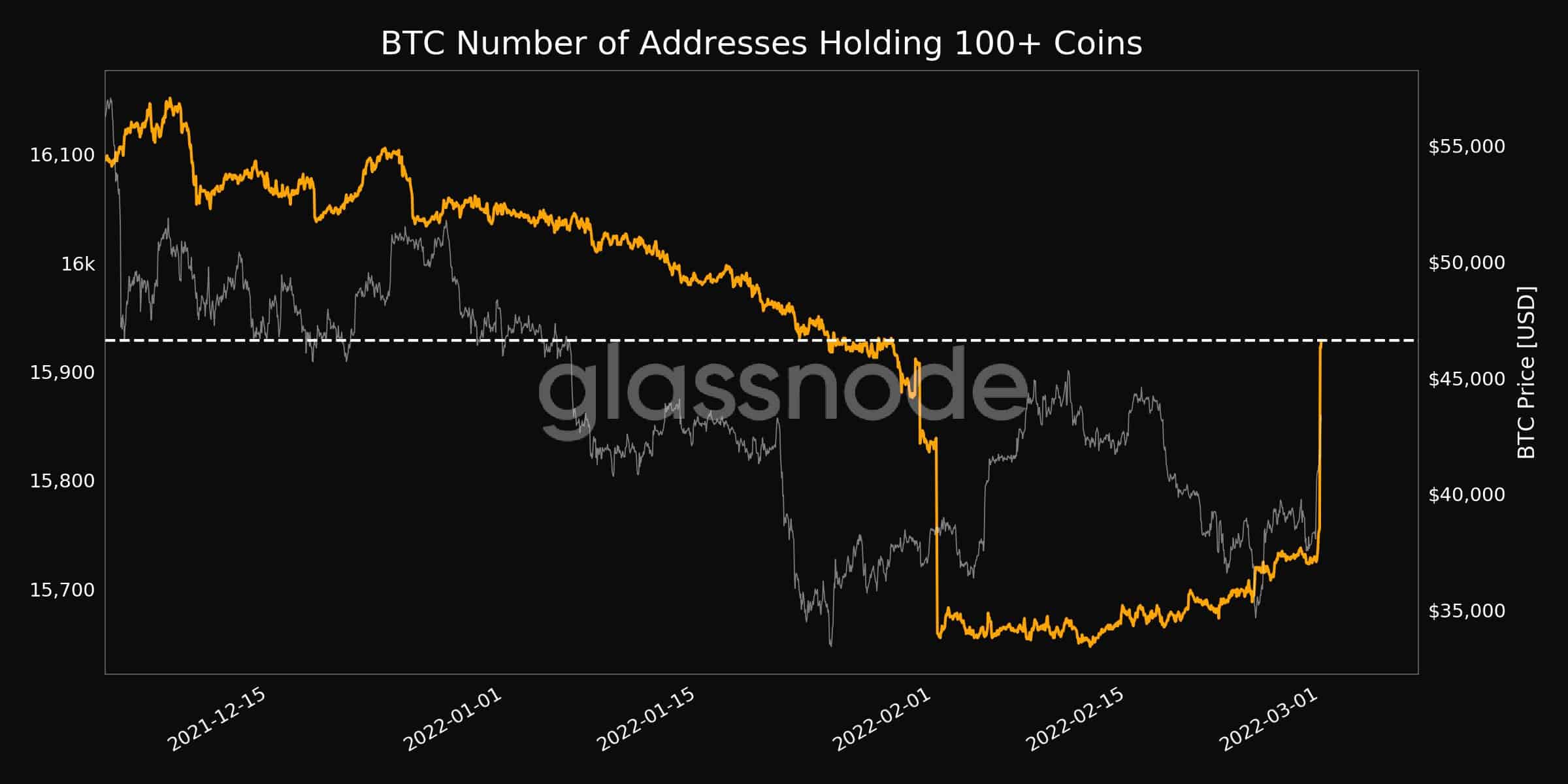

Large bitcoin investors, more specifically such holding at least 100 and 1,000 coins in a single wallet, have started accumulating once again in massive portions.

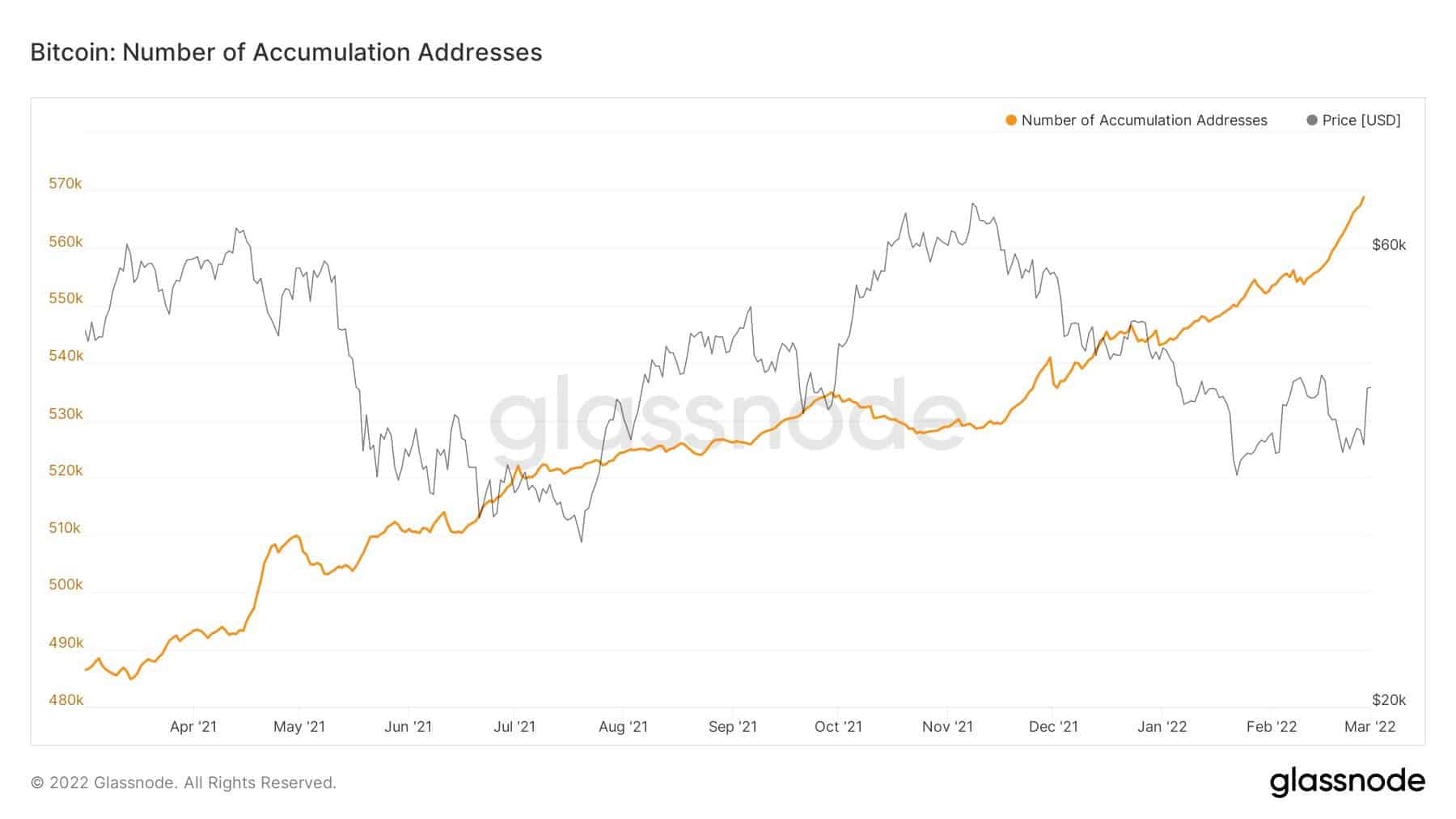

At the same time, the so-called accumulation wallets – meaning those who were active lately but have not spent any BTC – charted a new all-time high.

Bitcoin Whales on Buying Spree

It’s safe to conclude that there’s a lot of uncertainty in today’s financial world. While humanity was about to reduce the impact of the COVID-19 pandemic as a health hazard and had changed its focus to fighting the growing inflation, Russia’s leader decided to launch a “special military operation” against Ukraine.

Somewhat expectedly, Europe’s first war since WW2 caused substantial price disruptions in the crypto markets. Initially, bitcoin plummeted hard before it bounced off and even charted new gains surging towards $45,000.

The latest price increase came following the steep sanctions that the West imposed on Russia because of its aggression, most of which are related to its economy, causing the ruble to crumble.

At the same time, Glassnode data showed that the number of BTC addresses containing over 100 and more than 1,000 coins skyrocketed in a short period of time.

Keeping in mind the financial sanctions against Russia and that crypto exchanges refused to ban the accounts of Russian-based customers, many speculated that some of these increases of large bitcoin wallets could come from the world’s largest country by landmass or at least be related to the events.

Accumulation Wallets Also on the Rise

Further data from the blockchain analytics company informed that accumulation addresses have picked up speed lately and have reached a new all-time high. According to Glassnode, such wallets had at least two incoming transactions, have never spent any of their BTC, and were active in the past seven years.

It’s worth noting, though, that the firm has excluded known addresses belonging to cryptocurrency exchanges or mining entities.