A coming liquidity crisis in legacy markets could have negative impact on bitcoin price.

The below is from a recent edition of the Deep Dive, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

Today, we saw yet another acceleration in the United States Consumer Price Index for the month of February with data coming in line with consensus expectations at 7.91%. Previously, we expected inflation to potentially peak in Q1 while remaining elevated for the rest of the year but that scenario is looking less and less likely as the surge in commodities and energy prices are now taking over.

Even if it has little material impact on bringing prices down, the Federal Reserve and other central banks are in a position where they are now forced to try and aggressively tighten monetary policy to maintain any integrity or illusion of their price stability goals.

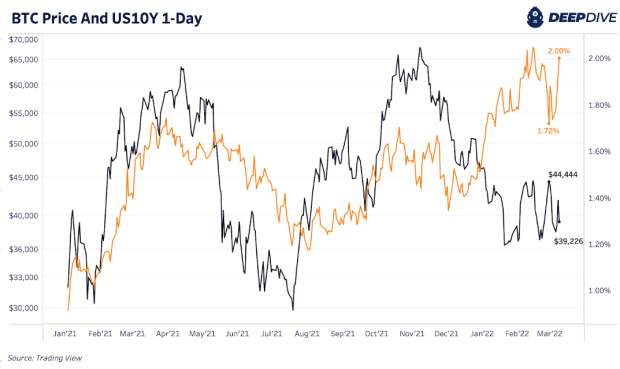

Since December, a rise in the 10-year yields with credit getting more expensive has coincided with a fall in bitcoin’s price.

So what does this all mean for the big picture?

Credit markets are beginning to realize that inflation is here to stay, in a big way, as is the trend of rising yields since Q4 2021. As credit instruments sell off, interest rates in a historically over-indebted economic system rise, leading to a lower net present value for financial assets, and higher interest burdens on consumer, corporate and sovereign balance sheets.

Our base case for the short/intermediate term is increasingly tight financial conditions and an unwind in leverage (in legacy markets, as bitcoin derivatives have already de-risked substantially).

In our view, this regime ends with a liquidity crisis in legacy markets, which likely has a net negative impact on the bitcoin price, followed by a pivot in central bank policy back towards quantitative easing and ultimately yield curve control.

Short/medium term liquidity risks aside, the end game is unchanged. The case for a non-sovereign absolutely scarce digital monetary asset has never been stronger.