SPONSORED POST*

The crypto market has been affected by the geopolitical issues that have arisen lately. With the Ukraine-Russia conflict still raging on, various financial markets are still feeling the heat. Bitcoin has experienced huge volatility recently, surging from $38,500 to $42,500 and then crashing to $38,500 in a very short time. However, not all investors are deterred by the current climate. Inflow volumes also show that investors still believe in the crypto market.

Crypto Funds Register Largest Weekly Inflows Since December

Digital asset investment products registered $127 million worth of cumulative inflows for the week ending March 6, according to CoinShares data. It was the highest weekly inflow since Dec. 12, 2021. The increase was also significantly higher than the $36 million of inflows registered the previous week.

It is a testament to the faith that investors continue to have in bitcoin. Despite the early December crash, investors have repeatedly shown that their money is still on bitcoin, and with last week’s inflows, there is no doubt about this.

Among Geopolitical Tensions Bitcoin Bounced As Crypto Investors Appeared to Agree U.S. Executive Actions

According to the White House, U.S. President Joe Biden signed an executive order on March 9th requiring the government to assess the risks and benefits of creating a central bank digital dollar, as well as other cryptocurrency issues. The executive order is much less intrusive than the market feared, with it mainly directing the federal agencies and other key agencies to evaluate cryptocurrencies’ role on “the future of money”. It is worth noting that it instructs the Commerce Department to research how cryptocurrencies might help support US competition in the global economy. Overall, it seems that the U.S. government is taking an approach to accept and coexist with crypto, instead of stamping it out.

What Can We Expect For BTC?

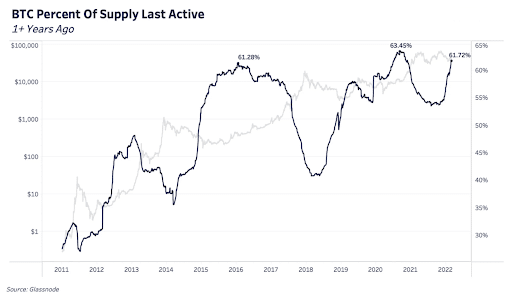

Despite the global macro and geopolitical stage continuing to create uncertainty in the market, long-term BTC holders are sitting tight and not selling their assets. From the BTC Percent of Supply chart on Glassnode, 61.72% of BTC which has been held for more than 1-year have not moved. This percentage of holding has been rising since the beginning of 2022 and has picked up pace as the Russia-Ukraine war breaks out, showing the Hodlers’ strong belief on BTC price appreciation.

To conclude it, it’s still too early to say, though, whether the federal government will fully embrace crypto, but Biden’s signing executive orders on crypto somewhat indicates that he takes crypto as a serious part of the US economy and that it might even have some potential. And hodlers who play for the long haul (buy-and-hold) also support BTC price rising.

How To Profit From Volatility?

Despite good prospects, the Bitcoin market will still remain volatile for some time to come. Using the right investment method can make volatility a powerful tool for profit. BTC futures trading enables traders to long or short BTC, so traders can earn money as long as their predictions are right. While spot traders only earn profits when the price of bitcoin goes up. Furthermore, traders can borrow leverage from exchanges to increase their buying power, thus multiplying their profits.

For example, a trader opens a long position of 100 BTC at the price of $38,000 with Bexplus 100x leverage. Then, the price goes up to $42,000. As a result, he will make a profit of ($42,000 – $38,000) * 100 BTC / $42,000 = 9.5 BTC, while the margin he needs is only 1 BTC.

Bexplus offers 100x leverage in BTC, ETH, DOGE, ADA, and XRP futures contracts. Bexplus is trusted by over 1 million traders worldwide, including the USA, Japan, Korea, and Iran. No KYC, no deposit fee, traders can receive the most attentive services, including 24/7 customer support.

- Demo account with 10 BTC

Bexplus is one of the few exchanges that offer a free demo account, which puts you through its rules and trading widgets. Inside the demo account is 10 BTC for traders to practice and try out strategies as much as they like.

- BTC Wallet: up to 21% Annualized Interest Without Any Risks

Bexplus users can gain profits not only from trading. Join the Bexplus wallet to earn up to 21% annualized interest without taking risks. With up to 21% annualized interests, it is no doubt one of the most profitable rates in the industry.

With Bexplus’ copy trading, you can automatically copy the trades of other excellent traders. It can be a really valuable portfolio for those who are just starting out in trading, or those who don’t want to dedicate a huge amount of time to manage their trades.

The top-ranking Bexplus app integrates all the necessary functions and tools (real-time charts, a variety of indicators, news alerts and etc.) while keeping a minimalist and intuitive interface. With the Bexplus app, you can manage your account anywhere and anytime you want. Furthermore, the 24/7 notification could keep you updated with big price movements, making it easier to secure your positions.

- Deposit Activity to Earn 100% BTC Cashback

Deposit BTC in the Bexplus account and you can earn a 100% BTC bonus, which can also be used to trade futures contracts. Plus, more margins reduce the likelihood of forced liquidation. The more deposit, the more bonus you will get. Up to 10 BTC is available for each deposit. (Bonuses are not withdrawable, the profit obtained with the bonus can be withdrawn.)

Click here to register to get your 100% deposit bonus.

Any other questions, you can join bexplus official discord or telegram, contact admin or 24-hour customer service for help.

Discord: discord.gg/Bexplusofficial

(↑↑↑where you can communicate with experienced traders or other traders and refer to the trading signals of traders who have long-term profitability in futures trading)

Telegram: t.me/Bexplusofficial

*This article has been paid. The Cryptonomist didn’t write the article nor has tested the platform.

The post Geopolitical Tensions Could Not Beat Bitcoin appeared first on The Cryptonomist.