(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

The last major hydrocarbon energy shock occurred because Arab suppliers rug pulled the West. The Gulf States “lived their values” regarding the political situation in Israel at the time. This time the West decided to “live their values” and cancel the world’s largest energy producer. Don’t allow your opinion on the righteousness (or not) of the military action between Russia and Ukraine detract from the fact that this time around the Western energy consumer decided to go on strike.

I am 100% certain that there will be a financial crisis of epic proportions predicated on losses faced by commodity producers and traders who touch every aspect of the globalised financial system. You cannot remove the world’s largest energy producer – and the collateral these commodity resources represent – from the financial system without serious unimagined and unintended consequences.

Look no further than the antics that went down on the LME with respect to its Nickel contract. Jim Bianco laid it out nicely with this tweet. The LME is a dead exchange walking. LME is the canary in the commodity derivatives coal mine.

During the unfolding of this new global financial crisis, if you are serious about what the future holds monetarily for the various global factions, reading Zoltan Pozsar’s missives is non-negotiable. He is a money markets and rates strategist for Credit Suisse and pairs an excellent understanding of the intricate plumbing of global money markets with a clear and concise writing style. I don’t know if he coined the terms “Inside Money” and “Outside Money,” but I rather like how simple yet informative these descriptions of money and collateral are.

Inside Money are monetary instruments that exist as liabilities on another player’s balance sheet. A government bond is a liability of the sovereign, but an asset in the banking system that trades like cash depending on the credit quality of the issuer.

Outside Money are instruments that are not liabilities on another player’s balance sheet. Gold and Bitcoin are perfect examples.

The current PetroDollar / EuroDollar monetary system ended last week with the confiscation of the Russian Central Bank’s fiat currency reserves by the US and EU, and the removal of certain Russian banks from the SWIFT network. In a generation hence, when hopefully this sad episode of human history concludes, historians will point to 26 February 2022 as the date on which this system ended, and a new, currently unknown-to-us system sprouted.

I obviously have predictions on how this will play out, and that is the subject of this essay. Your moralistic opinions of the rightness or wrongness of different flags’ actions during this war should not distract you from the colossal implications to your personal finances.

As always, my task is to synthesise a wide range of macro economic thinkers who are better informed than I am, place their thoughts into my own vernacular, and relate them back to the crypto capital markets. Regardless of the speed at which this war subsides, the monetary rules of engagement will not go back to the post-1971 Petro / Eurodollar system. A new neutral reserve asset, which I believe will be gold, will be used to facilitate global trade in energy and foodstuffs. From a philosophical standpoint, central banks and sovereigns appreciate the value of gold, but not that of Bitcoin. Human civilization is approximately 10,000 years old, and gold has always been valued as a monetary instrument. Bitcoin is less than two decades old. But don’t worry: as gold succeeds so will Bitcoin. And I will explain why.

To kick it off, let’s ponder the prescient words of Zoltan from his 7 March 2022 note, entitled “Bretton Woods III”:

From the Bretton Woods era backed by gold bullion, to Bretton Woods II backed by inside money (Treasuries with un-hedgeable confiscation risks), to Bretton Woods III backed by outside money (gold bullion and other commodities).

After this war is over, “money” will never be the same again…

…and Bitcoin (if it still exists then) will probably benefit from all this.

It All Balances

The global economy is not a magic bean stalk that just produces bountiful yummy consumable goods. It is a balanced system, where some flags produce more than they consume, and other flags consume more than they produce. Both sides must balance, just like in all parts of life and the universe. Everything is relative, and nothing is ever created or destroyed, just transformed.

Every flag usually has its own domestic currency, that thang we call fiat. Depending on the natural endowments of location and other cultural factors, flags import and export different types of products and services on the global market. If everyone traded in their own currencies, it would introduce additional friction and cost. Instead, one flag’s fiat currency becomes the reserve currency, and most trade is conducted in that currency.

It’s a great privilege and ruinous cost to host the world’s reserve currency. The USD is the most used currency for global trade, FACT. Most hydrocarbons are priced in USD, FACT. As a result, the rest of the world uses USD to price any and all traded stuff on the global markets, FACT.

The USD post-1971 is not backed by gold, but by US Treasury bonds. Energy producers up until recently earned more income on the world markets in USD than they spent. Therefore, they saved USD. Up until China claimed the crown, the US consumed the most energy of any nation. Therefore, it made sense that the largest consumer (and largest economy) paid for its energy imports in its own fiat currency. There were other non-monetary inducements as well, such as access to advanced weaponry, that wedded oil producers to the dollar.

But from where does the demand for US treasuries emanate? If you have a bunch of dollars, and by “a bunch,” I mean billions and trillions of dollars, there are very few markets liquid enough to handle your flows. As Beyonce said: “I don’t think you’re ready for this jelly.” And the jelly of most domestic capital markets is woefully inadequate for commodity exporters to save their excess income. And more importantly, most countries are not willing to bear the cost of being the reserve currency issuer.

The US treasury market is the largest and deepest market globally. Therefore, excess global dollar savings flow in. If you want to be the global reserve currency, you must allow foreigners to invest as much as they like into your capital markets. In economics lingo, your capital account must be open.

This is great for a government in some circumstances. America essentially prints as much USD as it wishes … at zero cost, because it correctly assumes there will be a large foreign contingent of savers who MUST purchase this debt. While it’s great to get something for nothing, the cost is that your economy becomes financialised.

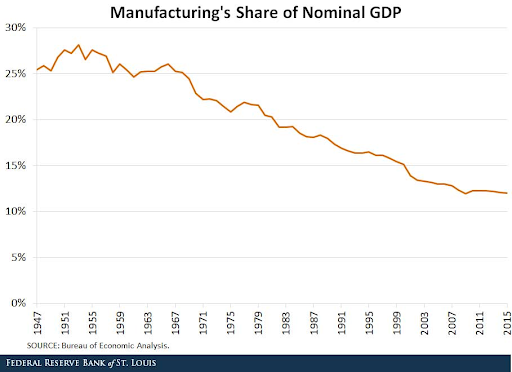

America became the world’s factory after WWII. It then became a country of financial services not factories. And the charts above shows the slow decline into irrelevance of manufacturing in America. The manufacturing share of nominal GDP has more than halved since America went off the gold standard in 1971.

America became the world’s factory after WWII. It then became a country of financial services not factories. And the charts above shows the slow decline into irrelevance of manufacturing in America. The manufacturing share of nominal GDP has more than halved since America went off the gold standard in 1971.

America exports finance, not goods, to the world on a macro scale. If your secret sauce is open, deep, and liquid capital markets, then you will prioritise the interests of financial services over manufacturing. Ask any former employee of a rust belt manufacturer whose factory was offshored to China because of Ricardian Equivalence. That’s a euphemism for, “in China they work for less. Therefore, to boost corporate profits, we shipped your job abroad.” Free trade, 4 da people!

There is a reason why America is full of business schools. The business of America is corporate financial optimisation at the expense of making real things. That benefits a very select group of individuals at the expense of the majority of the population. But it must happen in order for America to keep its side of the bargain vis-a-vis being the country that hosts the global reserve currency.

That is a brief explanation on why American capital markets accumulate trillions of sovereign savings in the form of USD. Readers should also ask why countries that produce things and earn dollars don’t invest those dollars back into their own countries?

Funny thang there, the biggest “savers” are saving at the expense of their domestic wage earners. There are various ways in which countries reduce their general wage level. There is no free lunch. Those “savings” are essentially the difference between the wage level of a deficit country like America, and a surplus country like China. If China wanted to, it could exchange their trillions of dollars for Renminbi. That would push up the price of Renminbi, and hurt exporters. But it would make consumer products (imports) cheaper for workers.

This is mercantilism 101. China is not the first country to pursue such a strategy, Germany, Japan, South Korea, Taiwan, etc. all do the same thing – just on a much smaller scale. Speaking of my favourite volatility hedge fund manager, a large part of his business model is taking the other side of fixed income derivatives trades emanating from pension funds from export powerhouse countries. These countries refuse to let wages grow at an equal or greater rate than productivity gains, therefore they must re-invest a larger and larger amount of, usually dollars, into lower and lower yielding bonds. Therefore, as they reach for yield, they sell volatility extremely cheaply to investment banks for an income pickup, who recycle that volatility back to certain volatility hedge funds to satisfy their internal risk limits.

As you can see, very simplistically, large imbalances that are left to be financed or invested in the global capital markets usually come at the expense of the domestic middle-income worker. Put aside your “moralistic” connotations of saving vs. spending. Perversely large deficits or surpluses always come at the expense of some sector of society.

|

Country |

Current Account Surplus (USD, 2020) |

|

China |

$273,980,396,750 |

|

Germany |

$269,077,454,630 |

|

Japan |

$148,932,280,610 |

|

Korea |

$75,275,700,000 |

|

Italy |

$71,983,874,880 |

|

Netherlands |

$63,655,067,200 |

|

Singapore |

$59,785,684,520 |

|

Australia |

$36,212,053,240 |

|

Russian Federation |

$36,004,300,000 |

|

Kuwait |

$33,833,135,580 |

|

Total |

$1,068,739,947,410 |

This data is from the World Bank.

As you can see the largest ten countries in total must invest approximately $1 trillion of savings each year.

On the other side are the countries that buy commodities and finished goods from these export powerhouses.

|

Country |

Current Account Deficit (USD, 2020) |

|

United States |

$616,087,000,000 |

|

United Kingdom |

$73,658,364,680 |

|

France |

$49,060,184,400 |

|

Turkey |

$35,536,000,000 |

|

Canada |

$29,215,726,800 |

|

Brazil |

$24,491,770,540 |

|

Saudi Arabia |

$21,565,341,700 |

|

Algeria |

$18,221,431,880 |

|

Nigeria |

$16,975,923,420 |

|

Egypt |

$14,235,956,910 |

|

Total |

$899,047,700,330 |

As you can see, the largest ten countries in total must finance approximately $900 billion worth of purchases each year. The US is by far and away the biggest deficit country, which is only possible because it is both the largest economy globally and issues the global reserve currency. If the US had to finance its deficit like ordinary flags, then the US 10-year treasury would certainly not yield only a meagre 2%.

Remember these tables – we will come back to them later.

Analog vs. Digital

Money can be split into two things. The unit of account, and the network on which this token moves. The network is more important than the unit. Let’s examine.

Prior to computers and the internet, all forms of money used a physical network. That is, if I want to “send” you a dollar, e.g., an ounce of gold, a cowrie shell, etc., I can walk over and hand it to you. If you live far away, I can ride a horse, sail in a ship, drive in a car, etc. But the movement is physical.

Most importantly, when all else fails, I can always walk. Therefore, as long as I have enough calories to put one foot in front of the other, I can always move some monetary token across the network.

This physical analog network is censorship resistant, anonymous, but very slow and limiting in a globalised economy. The mainframe computer, and most recently the internet, allowed society to digitise the network. We created digital forms of the most common units of accounts, paper money and gold, and began “sending” value electronically over centralised permissioned digital networks, like Society for Worldwide Interbank Financial Telecommunication (aka SWIFT).

The SWIFT network is a communications layer that allows messages about credit and debits of fiat currencies to be sent between financial intermediaries. It is collectively owned by many nations but effectively controlled by the US and EU.

Money stopped being a “thing” that we hold and observe, and it morphed into electronic data.

That is still the way the majority of money moves between participants on the network. These digital networks are operated by commercial banks, which are regulated by governments. You might think you have a net worth of $100, but if the bank or government for whatever reason decides you can no longer access the digital network, your net worth becomes $0.

Fiat money at a sovereign level is purely digital as well. No one sends pallets of physical banknotes to pay for their imports. Physical gold still rides on the cart and buggy network. That is why governments expend energy to store their gold “savings” locally. And if governments are very trusting of each other, smaller nations will store their gold savings in large financial centres. It gets a bit tricky when nations ask for their gold back. Put dat Juvenile back on “Slow motion for ya.”

All base fiat money derivatives like government bonds and shares of companies also ride on centralised, permissioned digital networks. These are the regulated domestic exchanges where such assets are traded. If you hold these assets, you merely rent them from the network, and the network can decide to remove you unilaterally at any time.

If you are a country that “saves” in the global reserve currency and any associated assets, you do not own your savings. You are allowed to own things at the mercy of the flag that operates the network. You trust that the ruling flag will not expropriate your “savings” and therefore you believe your net worth as a country is greater than zero in the nominal terms of the global reserve currency.

As long as savers believe that the ruling flag will respect the property rights of foreigners, global trade occurs quite frictionlessly. However, if the ruling flag decides to block access to the network to any participants, it begs the question: should you “save” in assets that ride on this centralised, permissioned digital monetary network?

Remember this, you own nothing, you merely “rent” your net worth both as an individual or sovereign from the entity that operates the centralised, permissioned fiat digital monetary network.

Twelve Trillion

As you can tell, this article focuses on finances of the sovereign, the flag, the nation state… There are much fewer entities to analyse, and their decisions are more predictable given the large notionals and impact they will have on various asset prices.

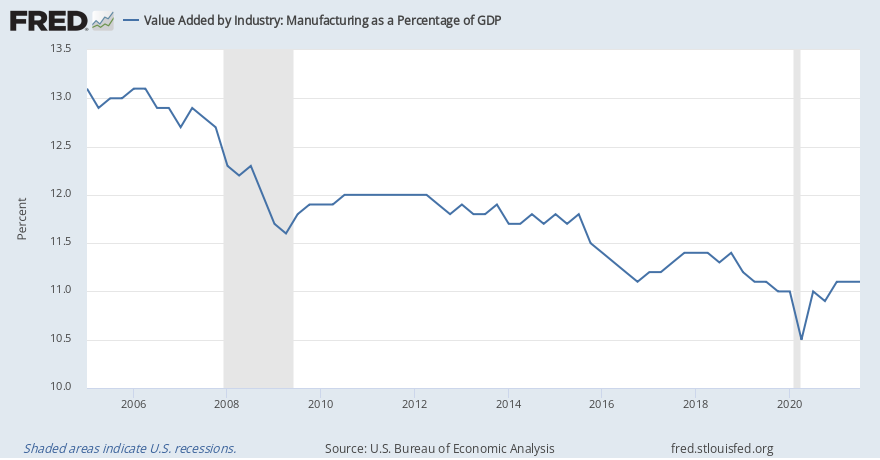

Thank you Luke Gromen from FFTT for this chart.

Excluding gold, approximately $12 trillion worth of “savings” are held by flags in a small set of fiat currencies. The USD commands the elephant’s share of this amount.

As I explained in the previous section, these “assets” ride on multiple centralised, permissioned, digital networks. If you save in dollars, America controls the network. If you save in Euros, the EU controls the network. If you save in renminbi, China controls the network. Capisce?

A majority of sovereign savings is denominated in currencies of the US, EU, or their allies. I will refer to them as the “West”. For lack of a better term, everyone else is often referred to as part of the “Global South” (read Noam Chomsky to get a better understanding of the linguistics behind these terms and how they influence our behaviour). The Global South’s largest champion is China, though on a per capita basis China is a poor country. China, due to its importance in the global economy, conducts more and more trade in its own fiat currency, the Renminbi or CNY.

Because everyone trades with China, many central banks hold some of their reserves in CNY. Therefore, it is effectively the only developing country fiat currency that is held in large quantities by other central banks.

On 26 February 2022, the West decided to confiscate the reserves of a sovereign nation held in a variety of G10 currencies. The Russian Central Bank lost access to $630 billion worth of reserves. In addition, various large, systemically important Russian commercial banks were removed from the SWIFT network. And then, of their own accord, many private businesses decided to cease trading in any capacity with Russia or Russia-domiciled businesses. JP Morgan and Goldman Sachs are recent examples of American banks that “cancelled” Russia.

Russia is the largest country by landmass, exporting the most raw energy globally (mostly in the form of hydrocarbons – oil and natural gas – and it is one of the largest producers of foodstuffs). The West includes the wealthiest countries globally, who consume energy and food, and purchase it with their own fiat currencies. This arrangement is fini. Never before has it been possible, due to the digital nature of fiat currency payments, to shun a country like this.

Money is a medium of energy storage, and the most-used monetary instruments now lack the largest energy producer globally as a user. Why should any central bank “save” in any Western fiat currency, when their savings can be expropriated arbitrarily and unilaterally by the operators of the digital fiat monetary networks?

This incongruity is so obvious that even the Western establishment financial news puppets completely understand what occurred and predict as I do that rational countries with a capital account surplus must now save in another currency.

- If Russian Currency Reserves Aren’t Really Money, the World Is in for a Shock (Wall Street Journal)

- Russia’s Money is Gone (Bloomberg)

- Can Foreign-Currency Reserves be Sanctions Proofed? (The Economist)

The next step in the progression is to estimate the magnitude of flows and the mechanisms by which central banks MUST shift reserves out of fiat currencies where their domestic government does not operate the value transfer network.

Position Size

As many readers know, I began my career as an equities trader in emerging markets. One of the lessons you learn quickly is that it is always a big door in, and a small door out. Therefore, you must size your position with your exit in mind. While the liquidity is great entering a trade and you might be lulled into a false belief that you can size it up, when it comes time to exit, the bid might be absent. Unfortunately in those circumstances, what on paper was a profitable trade becomes an unmitigated disaster, as there is no way to exit the position without incurring substantial losses.

To illustrate the dilemma facing sovereigns that accumulate reserves in large size, let’s examine China and its international currency flows in more detail.

China is the world’s low-cost factory. Since 2001 when the US allowed China entry into the World Trade Organisation, China’s export growth has mushroomed. Even with its voracious appetite for industrial commodities and energy, China still net-net accumulates reserves internationally. As is required, China must reinvest these fiat savings into assets such as US Treasury bonds. And China is one of the largest holders of US government debt. This $3 to $4 trillion in savings is now a sitting duck for confiscation by the West at any moment.

China is the world’s low-cost factory. Since 2001 when the US allowed China entry into the World Trade Organisation, China’s export growth has mushroomed. Even with its voracious appetite for industrial commodities and energy, China still net-net accumulates reserves internationally. As is required, China must reinvest these fiat savings into assets such as US Treasury bonds. And China is one of the largest holders of US government debt. This $3 to $4 trillion in savings is now a sitting duck for confiscation by the West at any moment.

While Beijing surely appreciated the risk of accumulating reserves in Western fiat currencies, it also had to assume that damaging its claims on assets would not be in the interest of the Western world. But who would have thought the current situation with Russia would unfold in the current fashion? It’s a “jump the shark” moment, and China is on notice that their “savings” are not safe.

Don’t make the problem worse. When you inherit a poopy position as a trader that you can’t immediately ameliorate, just simply don’t get deeper into the hole. In the context of China and other surplus countries, that means do not let your fiat currency position grow as you earn income internationally.

Instead, what China will do is accept a fiat currency for their goods and immediately exchange it for a harder asset. Given gold is the hard money choice for humanity, China and others like it will begin to provide a sizable bid in the physical gold market. China will purchase gold in the spot markets and take delivery in the paper derivatives markets of gold bullion in exchange for Western fiat currencies.

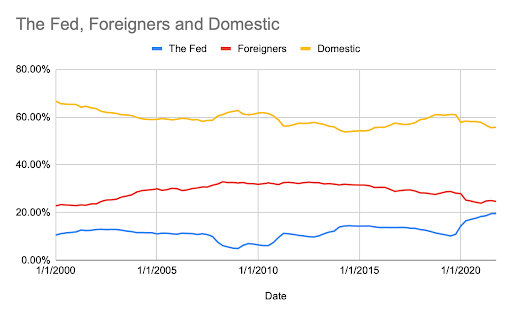

Source: FRED

Source: FRED

Since the start of 2009, the end of the 2008 GFC, the following changes occurred in who owned the gargantuan amount of debt issued by the US Treasury.

Domestic entities held 10% LESS.

Foreign entities held 23% LESS.

The Federal Reserve banks held 207% MORE.

The Fed by far and away is the marginal buyer of debt that both Americans and foreigners don’t wish to purchase. If foreigners don’t feel safe holding their accumulated savings in US Treasuries, the Fed chairperson is going to be Driving Miss Daisy a whole lot more miles.

Let’s forget the $12 trillion stock of existing “savings.” On an annual basis, the net surplus globally is $967 billion (I will provide calculations in the next section). The amount of trade that happens in Western fiat currencies will immediately be exchanged for gold, or maybe bartered for storable foodstuffs (think wheat and other grains) or storable industrial commodities (think oil, copper, nickel, etc.).

In essence, the largest surplus countries’ fiat currencies will implicitly grow their gold or commodity backing. Over time, these countries like China will have the “hardest” fiat currencies due to the asset composition of their reserves. Deficit countries globally, but particularly in the West, will have the weakest currencies as gold and commodities flow from West to East.

The price of gold will phase shift multiples higher than it is today. Trade happens at the margin, and faced with an indiscriminate buyer (all countries that earn fiat money internationally), it will inexorably march higher. This is a medium to long-term play (over the next decade); in the short-term, expect slow, creeping appreciation coupled with bouts of extreme downside volatility.

It is in no one’s interest for the gold price to quickly ratchet higher. If you are a sovereign who runs a current account deficit and wishes to continue to finance yourself at a low rate, a high gold price dissuades investors from parking money into your negatively real yielding government bonds. If you are a sovereign who runs an account surplus, you wish to purchase gold at the cheapest price because you want to dump your fiat at the highest price possible vs. gold.

Regarding the stock of existing Western fiat currency reserves, I don’t know if any large “owner” of these reserves will be able to materially exit their position without collapsing the Western global debt and financial markets. Rather, I would take the softer approach and allow my debt to mature as it would otherwise do, and invest the principal into gold or storable commodities.

Flows

|

Country |

Current Account Surplus (USD, 2020) |

|

China |

$273,980,396,750 |

|

Germany |

$269,077,454,630 |

|

Japan |

$148,932,280,610 |

|

Korea |

$75,275,700,000 |

|

Italy |

$71,983,874,880 |

|

Netherlands |

$63,655,067,200 |

|

Singapore |

$59,785,684,520 |

|

Australia |

$36,212,053,240 |

|

Russian Federation |

$36,004,300,000 |

|

Kuwait |

$33,833,135,580 |

|

Total |

$1,068,739,947,410 |

As I explained, surplus countries now have a safety issue with regards to their international fiat currency savings.

The below table is from the IMF and details the breakdown of reserves by fiat currency.

|

Fiat Currency |

Weight in Reserves |

|

USD |

59.02% |

|

EUR |

21.24% |

|

JPY |

6.03% |

|

GBP |

4.69% |

|

CNY |

2.25% |

|

CAD |

2.07% |

|

AUD |

1.82% |

|

CHF |

0.17% |

|

OTHER |

2.70% |

Using these weights as a proxy, let’s assume that countries with an annual surplus earn in these currency weights as well. That allows us to remove any net goods or services that are paid for in the domestic fiat currency they fully control. Doing this maths reduces the amount of annual savings that must find a home to $967 billion, which is only a 10% reduction of the problem.

As I argue in this essay, flags that wish to stop accumulating confiscatable fiat currency balances will purchase gold or storable commodities.

|

# of Troy oz per metric tonne |

32150.7 |

||

|

2021 Annual Gold Production (Metric tonnes) |

3560.66 |

||

|

Gold Price |

$2,000.00 |

||

|

% in Gold |

Oz |

Metric Tonnes |

Multiple of Annual Production |

|

100% |

483,486,975 |

15038.14769 |

4.22x |

|

75% |

362,615,231 |

11278.61077 |

3.17x |

|

50% |

241,743,487 |

7519.073845 |

2.11x |

|

25% |

120,871,744 |

3759.536923 |

1.06x |

|

10% |

48,348,697 |

1503.814769 |

.42x |

The above table estimates the impact of surplus nations ceasing to save in fiat currencies they don’t control into gold. Does this mean that if 100% of annual surpluses were saved in gold, the price would ONLY go up 4x? Absolutely not, there are many other players globally who consume the gold that comes out of the ground. We have just added another indiscriminate buyer to the physical market.

Please note, this is a PER YEAR analysis of flows. That should send your noggin’ spinnin’. The global economy doesn’t stop on January 1st 2023, it keeps on chuggin’. And gold keeps on pumping.

This also assumes that large gold producing nations will allow their mined gold to be exported so that other flags can lessen their exposure to fiat wampum. In a new era where globalised supply chains are onshored and nations restrict exports of key commodities so that they are self-sufficient at home first, it is foolish to assume that all gold produced is fair game for all flags in a global free-ish market setting.

Flags that astutely stop accumulating reserves in foreign fiat currencies will compete to buy gold out of mines via taking delivery in the paper futures markets. This competition will push the marginal last price well north of $10,000, and we could see stupendous prices for gold that seems unfathomable. Be on the lookout for more dysfunction in gold futures markets as entities actually start taking physical delivery. We may finally find out if all that gold is actually there. The LME is just the preamble, the financial system will be littered with commodities exchange zombies that couldn’t make good on their promises to participants.

A gold price of >$10,000 will psychologically shock the global asset markets. As global asset allocators now think chiefly about inflation and real yields, any and all hard monetary assets believed to protect portfolios from this pestilence will get bid to astronomical levels. And that is the mental shift that breaks the correlation of Bitcoin with traditional risk-on / off assets, such as US equities and nominal interest rates.

The above is a graph of the 10-day correlation between Bitcoin and the Nasdaq 100 index (perfectly correlated assets have a correlation of +1, perfectly negative correlated assets have a correlation of -1). As you can see, Bitcoin is currently tied at the hip with big tech risk assets. If we believe nominal rates will go higher and cause an equities bear market and an economic recession, Bitcoin will follow big tech into the latrine. The only way to break this correlation is a narrative shift on what makes Bitcoin valuable. A rip roaring bull market in gold in the face of rising nominal rates and global stagflation will break this relationship.

As gold marches its way above $10,000, Bitcoin will march its way to $1,000,000. The bear market in fiat currencies will trigger the largest wealth transfer the world has ever seen.

Diminishing Demand

The West put themselves into quite a pickle.

Energy will cost more, food will cost more, and increased military spending will further crowd out the civvy economy. Citizens will protest the high and rising cost of living to their elected representatives. Politicians will resort to their easy button, villinaising producers, implementing energy subsidies for consumers, and in the worst case, using price controls. The summation of these popular quick fixes for inflation will be increased government spending. Someone must lend to the government at a rate it can afford …

Previously, when surplus countries believed in the sanctity of their reserves, America could count on foreigners (read: capital account surplus countries) to fund these deficits through debt purchases. America both issues the reserve currency and runs the largest current account deficit, therefore it’s the only flag that matters in this analysis.

But now surplus countries will save in terms of gold and storable commodities. And even those who consider themselves allies of the West are not immune to confiscation if they do not directly control the fiat monetary transfer network in which they accumulate reserves.

With foreign buyers on strike, governments must allow rates to rise to a level that entices domestic demand for bonds. But higher rates crowd out capital for private businesses. That leads to a recession, because all available capital flows to high yielding government risk-free bonds.

That’s no bueno.

Therefore, the central bank will be called upon once more to explicitly or implicitly finance the government through bond purchases funded by “money printer go brrr.” The interest expense of the government is kept in check on a nominal basis, private enterprise does not face higher nominal borrowing costs, and economic activity measured by GDP can continue to grow on a nominal basis.

The number one job of a politician is to get re-elected. People vote with their wallets. Government debt interest rates will rise in order to pay for increased outlays, but that will cause a recession. Most politicians will not be able to keep their seat if that happens. This is especially true because their opponent will tell the people they have the solution, more government spending but paid for with central bank money printing. Currently they call this “Modern Monetary Theory,” although it used to be called money printing. Same sauce, different packaging.

As I laid out in “Annihilation,” even if central banks raise rates slightly on a nominal basis, in real terms interest rates are still deeply negative. They will remain this way for a very, very, very long time because the structural setup of Western economies points directly to a long period of high and persistent inflation.

Finance This …

At $616 billion per year, the US current account deficit will become increasingly more expensive to finance. The US government spent 168% more than tax receipts in 2021. In 2021 the US had to sell ~$2.8 trillion worth of bonds just to pay for that year’s deficit. Don’t forget that every year debt that matures must be rolled or pay for in full, which also adds to the US Treasury’s gross issuance amount each year.

If we assume foreign flags refuse to increase their exposure to USD fiat, and domestic entities do not increase or decrease their purchase, then who will fill the gap?

Y’all know the answer to this.

It’s time for the Fed to cross the monetary rubicon again and indirectly finance their domestic government. Once crossed, this is a sure road to ruin and hyperinflation. Any classically trained economist knows that this is a big no no. But the Fed, or any central bank for that matter, doesn’t call the shots and always bends to the desires of the domestic politicians in charge.

But isn’t the Fed supposed to stop purchases of government bonds? Yes, that was the plan until the largest energy producer was cancelled. Unless the USG wants to increase their interest expense dramatically, the Fed must purchase the balance of bonds that cannot attract buyers.

There are various entities that could surreptitiously increase their balance sheets to purchase negatively real yielding US bonds so that on the surface the Fed is not seen to be increasing their balance sheet. I am not a money markets expert, but I do expect strategists like Zoltan to expose such machinations as they transpire. The maths dictate that interest rates remain negative so that the USG can de-lever its balance sheet. As I wrote in my piece FARB<L>AST OFF <GO>, to pay for the costs of WWII, the Fed merged with the Treasury and engineered deeply negative real interest rates for almost a decade.

Regardless of whether the US gets pulled into the conflict, the USG can use this conflagration as an argument on why such financial and fiscal coordination is required. The bill must be paid, and the citizen always pays it explicitly (via higher taxes), or implicitly (via financial repression). I hope these large numbers clearly illustrate the problem and the solution.

Again, as I argued in my last essay “Annihilation,” all that is occurring right now is a theatrical performance about raising nominal rates. Do not get distracted, it’s all about real rates. And they mathematically must remain deeply negative for many years.

Gold vs. Bitcoin

Gold: “If you don’t hold it, you don’t own it.”

Bitcoin: “Not your keys, not your coins.”

For outside money to truly be outside, it must be in your physical possession. Even legal guarantees that you will receive your assets upon request are not enough if you can’t physically walk into the vault, or plug in the USB stick to access your savings whenever YOU desire. There should be no institution, person, or process stopping you from accessing your funds immediately. Any other arrangement renders your outside money, inside. And as I hope you understand after reading this essay, the value of inside money has drastically declined in the past few weeks.

Now back to regular programming.

The reason why a central bank buys gold instead of Bitcoin is solely due to historical precedent. I am not a maximalist. Both are hard money, one is analog (gold) one is digital (Bitcoin). If a central bank begins saving exclusively in gold, and global trade imbalances are settled in gold terms, I am fully confident that over time some central banks may tire of shipping gold around the world to pay for things. They would rather conduct a small but rising amount of trade in a digital currency, which would naturally be Bitcoin.

I will argue in a subsequent essay that the Global South, who lack the ability and access to trade and store gold efficiently, will gravitate towards Bitcoin. El Salvador opened the door to this possibility, and many are watching how Bitcoinification of their reserves helps or hurts their economy.

Gold is great, but it is a PITA to store on an individual level. If you fully accept that direct possession of physical gold is required to ensure you actually own what you think you own, then gold becomes quite cumbersome. Most readers don’t have a vault in a freeport in which to store their yellow pet rocks. Instead, you would like a more transportable hard store of wealth.

Whether you have 1 Satoshi or 1,000 Bitcoin to store, all that is required is a string of characters that comprise your public and private key. That weighs essentially nothing, and can be accessed anywhere there is internet. This is the value proposition from a storage and transfer perspective of Bitcoin over gold.

Again, I am fully confident that on a personal level if you believe you should spend fiat and save gold, the mental leap towards spending fiat and saving Bitcoin is minuscule.

One, Two, Buckle My Shoe

For a single Bitcoin, my unit is in the millions.

For an ounce of gold, my unit is in the thousands.

That is the magnitude of fiat denominated price that will occur in the coming years as global trade is settled via neutral hard monetary instruments and not the debt-backed fiat currencies of the West.

One retort is why can’t China step up and attempt to offer the Renminbi (CNY) as the global reserve currency. Many analysts do not understand that China just wishes to trade with its trading partners, who are mostly in Eurasia, with CNY. It does not wish to open its capital accounts and give strong property rights to foreigners. Therefore, Beijing does not wish to supplant America as the reserved currency issuer. To the extent that trading partners are not willing to settle trade in CNY, there is gold. And the Shanghai gold futures exchange is one of the most liquid globally. China is perfectly set up both philosophically and practically to trade and save in gold terms.

On a medium-term basis, it is time to back up the John Deere excavator and scoop up as much gold and Bitcoin as you can afford. This is it, the start of a monetary regime change. Nothing lasts forever, and the days of Petro / Eurodollar supremacy are over. The phase shift will be chaotic, it will be volatile, it will morph, but it will 100% be MASSIVELY inflationary in fiat currency terms.

There is no government, ever, that resisted the temptation to print money in order to pay its bills and placate its citizens. The government will never voluntarily go bankrupt. This is axiomatic. I challenge you to contradict me with evidence.

Therefore, if your time horizon is in the years, it’s time. If you mess with the bull, you get the horns. Remember: it’s not gold or Bitcoin that is increasing in price, it’s a decrease in value of the fiat currency in which they are priced.

If you want to be a savvy trader, then I still believe the direct gut shots to the global economy because of this war will cause a correlation 1 moment, in which all assets will get dumped while we figure out who is going to hold the bag of losses emanating from commodity derivatives trades gone bad. Spoiler alert, it’s always the ordinary citizen that suffers, because money printing to nominally ensure repayment is always the solution. This causes inflation. And then we nationalise the bad actors as punishment for the bailout. Nationalisation can be implicit or explicit.

However, before the losses are assigned, and the central banks get religious again about aggressive money printing, financial asset prices get the stick. Be prepared to suffer extreme drawdowns as the rules of the global financial system are re-written. If you aren’t willing to babysit your Bitcoin, then close your eyes, press that buy button, and concentrate on the safety of your family from a physical and monetary perspective. Awakening a few years after the fog of war dissipates will present a situation where hard money instruments rule all of global trade.

Don’t let anyone paint you as a stark raving Cassandra for taking drastic action to protect your standard of living by saving using different types of monetary hard assets. You cannot cancel the largest energy producer from a monetary system without massive repercussions. If even the bougiest, most establishment, sycophantic media outlets come to the same conclusions as this essay, then it’s only those who refuse to open their eyes and ears who will be left in the dust of history believing nothing is afoot.

The post Energy Cancelled appeared first on BitMEX Blog.