The Bored Ape Yacht Club (BAYC) is an exclusive membership project open to any and all owners of the Bored Ape Yacht Club NFT, underpinned by the ApeCoin (APE) token.

BAYC is considered one of the most forward-pushing NFT projects on the market, and might be one of the highest returns on investment ever recorded for early holders.

Released in April 2021, each NFT from the collection of 10,000 BAYC NFTs had a mint price of 0.08 Ethereum. By December 2021, each BAYC NFT had an average floor price of around 60 Ethereum. After the ApeCoin (APE) airdrop, the floor price was over 100 ETH.

The Bored Ape Yacht Club home page.

The creators also released a few derivative sets available to be claimed for free by BAYC holders including the Bored Ape Kennel Club and Mutant Ape Yacht Club. These derivatives rewarded BAYC holders while creating addiionalmarkets for people wishing to join the BAYC fold with a not-as-valuable variation; this was a very effective way for Yuga Labs to scale the project and raise capital for future growth.

The BAYC turned a couple of hundred dollar investment into hundreds of thousands of dollars within the span of months.

The following Bored Ape Yacht Club guide explores the BAYC universe, its role in the evolving NFT landscape, and ApeCoin.

Laying the Foundation: Cryptopunks

Cryptopunks is a historic project created by Larva Labs that launched in June 2017; it issued 10,000 profile picture NFTs, and all were free for anyone to claim.

Why Profile Pictures?

The NFT profile picture movement is fueled by undertones of association and affiliation– think of it like holding a similar model of car in a classic car club. Higher-ticket profile pictures tend to demonstrate status, and since ownership of NFTs is verifiable, it holds its weight.

Cryptopunks set a trend in the NFT ecosystem: release 10,000 NFT profile pictures and an online community forms.

Cryptopunks have historically been an aspirational asset for the average NFT buyer. The Bored Ape Yacht Club and other projects iterated the Cryptopunk model by granting intellectual property rights to buyers, which Cryptopunks did not.

In other words, BAYC holders have full IP rights to do what they want with their NFTs, posing a stark difference from the Cryptopunk model– creators Larva Labs had the full legal right to go after Cryptopunk holders had they infringed on the larger brand’s copyright.

On March 17, 2022, Yuga Labs (BAYC creators) purchased the CryptoPunks holding company Larva Labs (including the Cryptopunks IP); the first thing that Yuga Labs did after they obtained the IP was drop all infringement claims against Cryptopunks holders.

Yuga Labs is credited with a moral coup in the NFT community, signaling a shift to a less litigious and more open and inclusive NFT ecosystem.

Enter The Apeverse

Yuga Labs is building out a dominant NFT ecosystem.

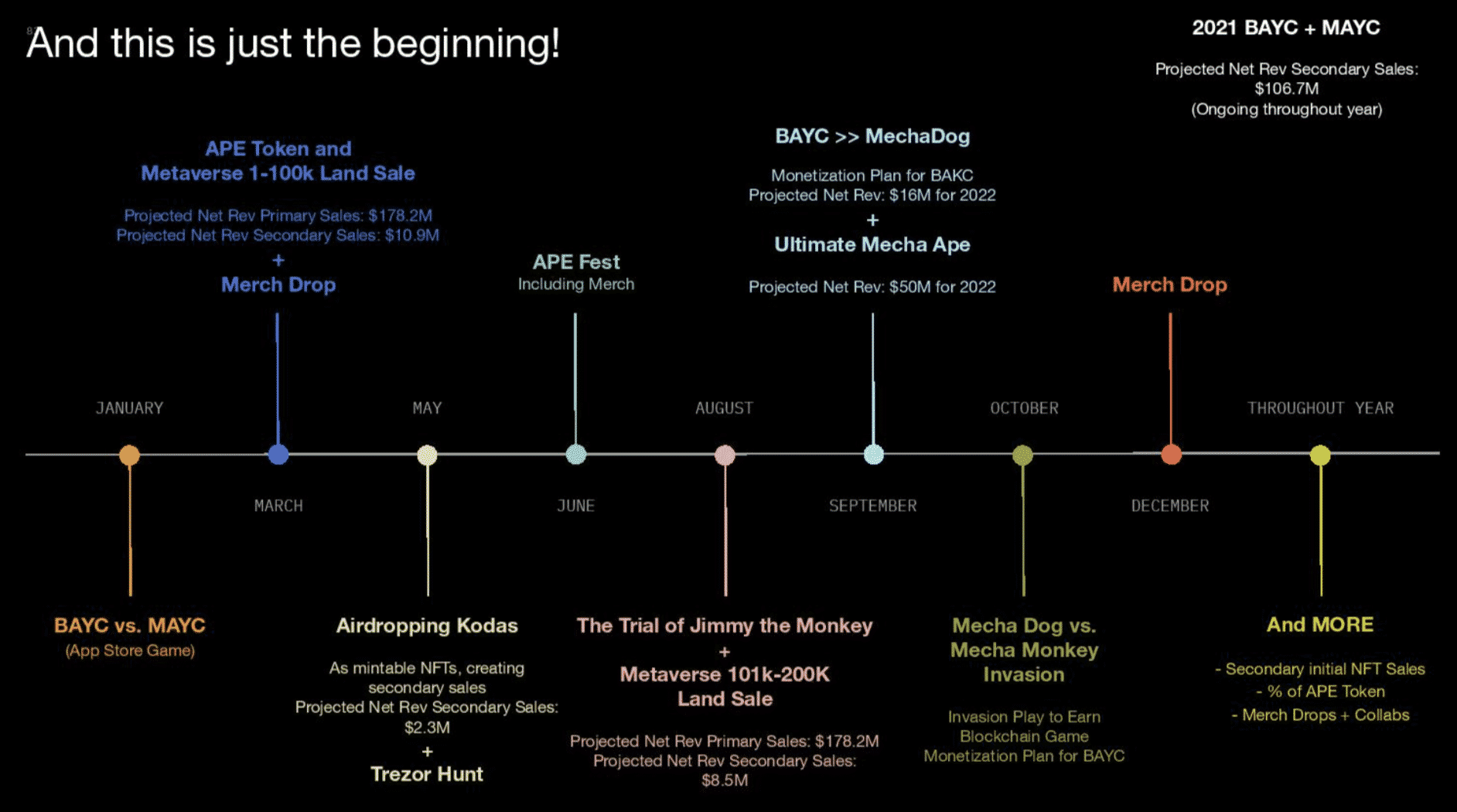

A leaked pitch deck shed a glimpse into the minds of the creators.

Yuga Labs pitch deck

While pitching BAYC to a leading venture capital firm Andreesen Horowitz ( a16z) the Yuga Labs team revealed that it is building a metaverse, video games, launching additional NFTs, and going to be selling metaverse land.

Yuga Labs intends to build the strongest NFT brand we have ever seen, and it’s an evolving case study on Web 2.0 versus Web 3.0.

Web 2.0 companies look to extract value out of their users in exchange for a product, service, or experience, passing along the financial value to stakeholders (traditionally these stakeholders are venture capitalists, angel investors, or private equity funds.)

Web 3.0 companies aim to keep the value circling around their ecosystem of users– in Web 3, the direct stakeholders are the token holders.

Historically,early-stage investing in the United States has been an opportunity reserved for accredited investors.

Blockchain technologies make the accredited investing criteria difficult to enforce– a web of crypto wallets, DAOs, and other crypto investment vehicles can purchase any token or digital asset they please.

By sourcing investment from traditional VC funds like a16z, Yuga Labs will start to face pressure to work in a Web 2.0 model while most likely attempting to present it in a Web 3.0 way to their users.

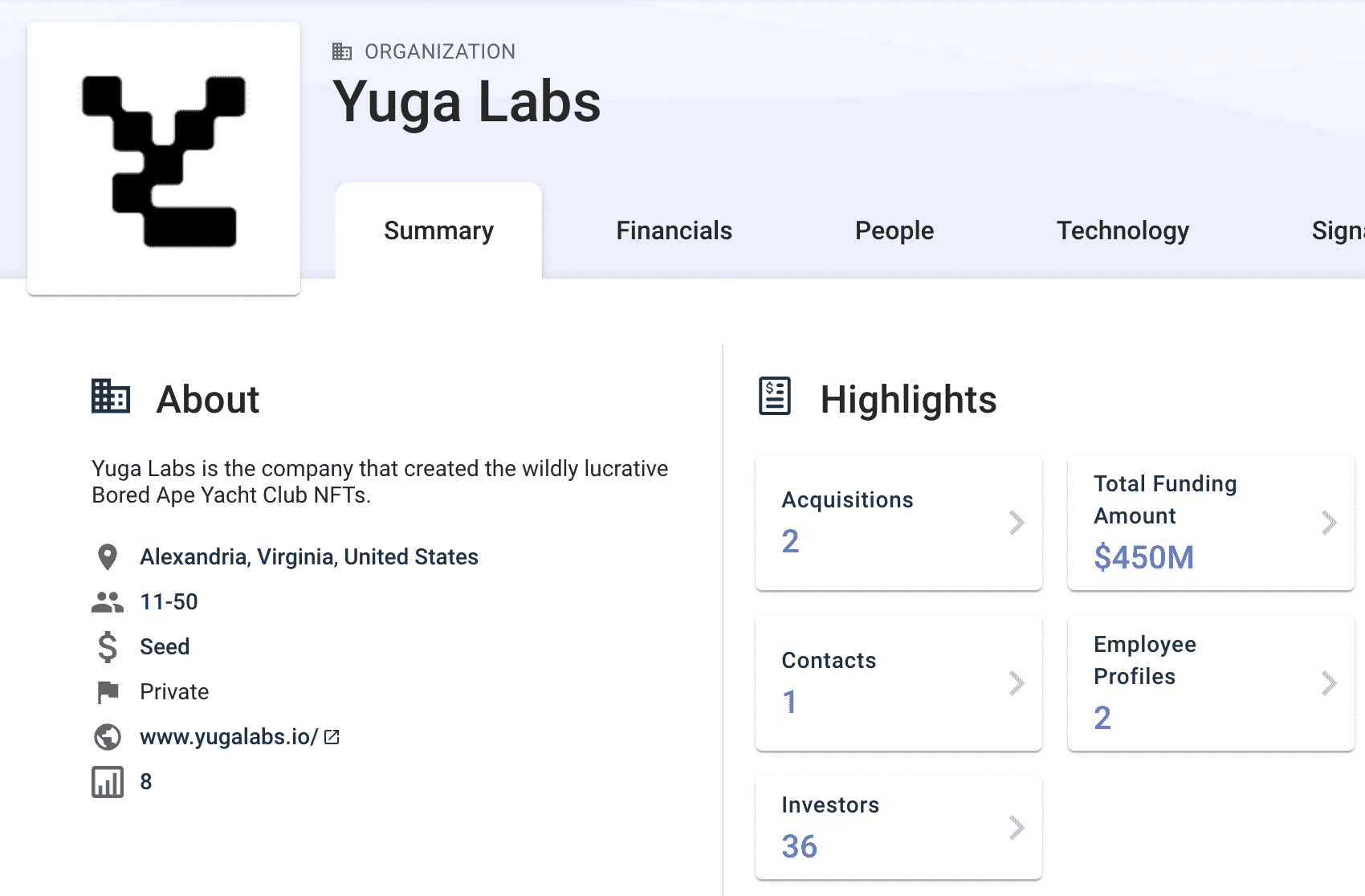

In March 2022, Yuga Labs closed a $450 million round led by a16z, valuing the company at $4 billion.

Yuga Labs on Crunchbase

What is ApeCoin? A Guide on the Bored Ape Yacht Club Token

ApeCoin is an ERC-20 governance and utility token created primarily for the APE ecosystem to empower a decentralized web3 community. As the open-source protocol layer of the ecosystem, ApeCoin underpins several key use cases:

- Governance: ApeCoin allows holders to participate in ApeCoin DAO.

- Unification of Spend: As the ecosystem’s utility token, all participants can share the use of the open currency without centralized intermediaries.

- Access: the token gives access to exclusive gains and services that are exclusive to tokenholders only.

- Incentivization: Third-party developers are incentivized to participate in the APE ecosystem since APE is built into services and games.

It’s not a stretch to liken, not pejoratively, ApeCoin as the Bored Ape Yacht Club’s “Chuck E Cheese” token. Holders can buy merch, play games (to earn more ApeCoin), and spend it in other ways.

Yuga Labs also set up an ecosystem fund; ApeCoin functions as a DAO token, enabling ApeCoin holders to vote on ecosystem happenings and fund allocations. Holders can also write proposals for what they would like to see happen, to be voted on by the community.

Yuga Labs gifted ApeCoin DAO a one-of-one NFT of a blue Bored Ape Yacht Club logo, which conveys with it all rights and privileges to the logo’s intellectual property to the DAO. The ApeCoin DAO will vote and decide how the IP is used.

There is an appointed Board to facilitate DAO decisions. The current ApeCoin DAO board members include:

- Reddit Co-founder Alexis Ohanian

- Head of Ventures & Gaming at FTX Amy Wu

- Principal at Sound Ventures, Maaria Bajwa

- Co-founder & Chairman of Animoca Brands, Yat Siu

- President & General Counsel at Horizen Labs, Dean Steinbeck

Token holders can vote board members out every six months.

The ApeCoin Airdrop

Many millionaires and multi-millionaires were created via the ApeCoin airdrop.

Each Bored Ape Yacht Club NFT holder was airdropped an ApeCoin allocation on March 17, 2022; Bored Ape and Mutant Ape NFT holders received 15% of the total token allocation.

Soon after, popular exchanges Coinbase, FTX, and Binance listed the token available for trading.

If you held a qualifying NFT and were airdropped ApeCoin and subsequently sold it at $13.69 on airdrop day:

- One Bored Ape Yacht Club NFT: 10,094 APE, or about $138,237.17 at the time.

- One Mutant Ape Yacht Club NFT: 2,042 APE, $28,021.28 at the time.

- One Kennel Club NFT: 856 APE tokens, $11,718.64 at the time.

If you had multiple Bored Apes and Mutants you got a multiplier against the amount of allocation.

The remaining tokens will be allocated to project launch contributors, Yuga Labs and its founders, as well as a donation to the Jane Goodall Legacy Foundation.

Final Thoughts: What is the Bored Ape Yacht Club Future?

The Bored Ape Yacht Club ecosystem will be incredibly interesting to follow, as multiple precedents are being set:

How will a venture-funded Web 3.0 company as large as Yuga Labs deliver value to both tranches of token and investor stakeholders

How will ApeCoin underpin the entire ecosystem– will it hold its value?

How will the value creation of the massive BAYC machine spread throughout other realms of crypto?

The post Bored Ape Yacht Club Guide: BAYC, ApeCoin, and the Apeverse appeared first on CoinCentral.