(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

The zenith of the fiduciary is upon us. Never before in the history of human civilisation has a class of individuals been able to reap so much economic benefit for themselves against a backdrop of disastrous performance for the clients they claim to serve. The global class of financial fiduciaries shroud their poor performance in a gilded cloak of incomprehensible financial jargon.

Fiduciaries convinced the world that only they can divine the secrets of finance, both on a personal and corporate level. They accomplished this goal by erecting high temples dedicated to their faith, known colloquially as “business schools.” In these cauldrons of mediocrity, the language of finance is forged with the express purpose to indoctrinate their acolytes into the faith. These acolytes use their superior financial language skills to hoodwink the public into trusting them as money managers.

In order to further enshrine their privilege, the fiduciary class erected asset classifications and preached the sermon of diversification. They preached the sermon of the Sharpe Ratio, the Efficient Frontier, the standard normal gaussian distribution, the 60/40 portfolio, etc. These sermons were disseminated to the lay people through mass financial television and print media. Read “The Misbehavior of Markets: A Fractal View of Financial Turbulence” by Richard L. Hudson and Benoit Mandelbrot for more perspective on the uselessness of “modern” financial theory.

With squiggly lines spewed upon a written canvas, the fiduciary churned out academic paper after paper justifying their methods of asset allocation in a manner only fellow acolytes could comprehend. The sole goal of all these pretences is to syphon money from trusting clients – be they individuals, companies, or governments – in the form of management and performance fees. With these fees, they create a “heads I win, tails you lose,” playing field for themselves – there is no market environment in which the fiduciary loses. And yet, in all environments, the end client underperforms the benchmark equity or bond index.

The cult of the fiduciary continues to play Pan’s flute, emitting a siren song that entrances the world into believing it is respectable. But while I deride the fiduciary, they are useful because their stupidity is obvious and exploitable. They only ask one simple question: “Tell me what an asset IS, and I will tell you how it should or should not fit into your portfolio.”

Let us not look down haughtily at our fellow humans, but use their teachings in the service of Lord Satoshi – and more specifically, his Archangel Vitalik, whom I will focus on in this essay.

Shredding Pow Pow

Meeting a fiduciary or two in the wild is not difficult when you spend two months in a ski town. I actually talk to strangers when I’m skiing, and meet some pretty interesting people.

First Encounter

One blue bird, I met a chap from Michigan who is a financial advisor (FA).

As usual, the group got to talking about each other’s profession. When asked, I evasively said that I traded my own money, and thanks to the internet, could do that on a ski mountain. The FA dude inquired further as to what exactly I traded. I responded, “crypto”.

He shook his head, and then proceeded to remark, “ah…I tell all my clients to avoid crypto”.

I thought to myself, “that’s why you are skiing, and your clients still have a day job.” I chuckled, and headed up for another run.

Second Encounter

As with most ski towns, if you are out past dinner time some combination of drankin’, darts, or billiards is usually on offer. My frat house at university featured a well-kept billiards table. The brothers were very competitive. There were a few other houses that took billiards quite seriously as well, and at parties, we would often play teams of brothers from other houses.

One fond memory I have took place at 4000 Pine St. I had just arrived back on campus after having double knee surgery. As a young lad, I did not appreciate the virtue of stretching, and paid the price. There are certain necessary bodily functions that are quite difficult when you can’t bend your knees.

I could not move my knees so I had knee immobilisers affixed to my legs, and used crutches to hobble around. But that didn’t stop me from playing pool. The house rules at 4000 dictated that in order to win at 8-ball, you had to hit one bank with either the cue ball or the 8-ball for an 8-ball shot to be valid. Even in my physically diminished state, a brother and I ran the table on our competitors, and I hit the winning shot.

The most happening watering hole in this particular ski town is a bar called The Million Dollar Cowboy. After a few warm up games, my university pool skills quickly returned – and I spent a lot of time at the table, meeting a variety of interesting people in the process.

This led to another encounter with a financial advisor in the wild. We chatted about what we each did for a living, and she also remarked that she didn’t like crypto, and didn’t advise any of her clients to buy it.

I told her, “that’s because you don’t have any crypto related products to sell your clients so that you can earn commissions.”

She responded, “that is exactly correct.”

We both proceeded to have a good and deep belly laugh.

Duck or Alligator?

What would a fiduciary do?

Imagine you ask a simple question – “is this animal a duck or an alligator?”

The first question a fiduciary asks is not “let me see a picture,” but rather, “in which classification do I earn a higher commission for my recommendation?” If a duck that quacks and waddles earns a lower commission, then an alligator it shall be.

This long ramble only serves to illustrate the importance of classification on what investments are recommended to individuals, corporations, and governments.

What is Ether?

That is a simple yet profound question.

If you say it’s a commodity, then one type of investor class is interested.

If you say it’s a currency, then another class of investor is interested.

But what if you can convince the world that Ether is simply an infinite duration bond?

The ETH 2.0 merge set to occur later this year will completely morph Ethereum into a Proof of Stake (POS) validated blockchain. The native rewards issued to validators in the form of ETH-based issuance and network fees for staking ETH in validator nodes renders ETH a bond.

If we can convince the fiduciaries that the classification of ETH is a bond rather than a currency, then a whole new set of fiduciary clowns can be mentally primed to allocate into the ecosystem. This fact, paired with ETH 2.0’s ESG-compliant label (another stamp of intellectual ossification), and protocol metrics that are more attractive than the cadre of layer-1 (L1) “ethereum killers” makes ETH supremely undervalued on a relative basis vs. Bitcoin, fiat, and other L1 competitors.

The Math

First, let’s jot down our assumptions.

At some point this year – if the Ethereum Foundation is to be believed – the ETH 2.0 and 1.0 chains will merge. After the merge, Ethereum will achieve consensus via a proof of stake mechanism.

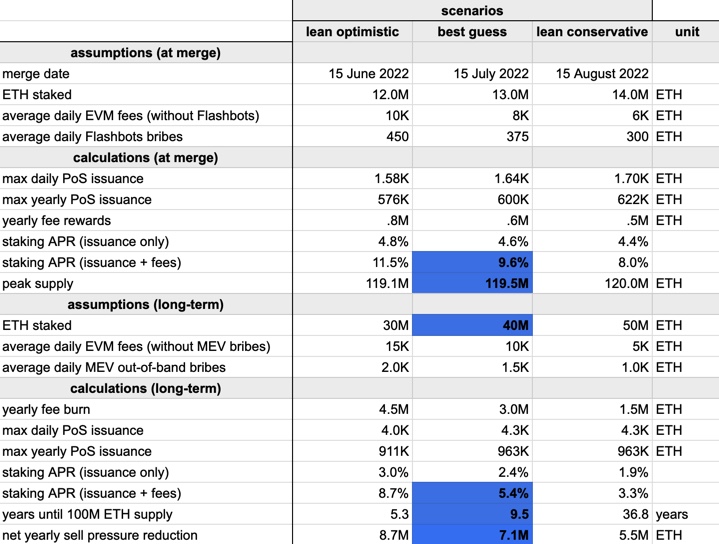

Justin Drake, an ETH researcher, projects that immediately after the merge, stakers could see an APR of around 8-11.5%.

If you are an ETH maxi, you may agree or disagree with these numbers. But I will take them as gospel for now. The point of this essay isn’t to delve into whether the yield is 5% or 10%, but rather to use scenario analysis to value ETH as a bond.

If you are an ETH maxi, you may agree or disagree with these numbers. But I will take them as gospel for now. The point of this essay isn’t to delve into whether the yield is 5% or 10%, but rather to use scenario analysis to value ETH as a bond.

If you want to do this yourself, you must spin up a Virtual Private Server (VPS), and run an Ethereum node with a minimum balance of 32 ETH. You will then (following the launch of 2.0) be eligible to receive issuance plus network fees for every block.

For this analysis, we’ll assume that you are selling an equivalent amount of USD to purchase 32 ETH. This is extremely important – I approach this valuation from the perspective of someone who invests fiat first. Therefore, as with any carry trade, the cost of USD funds is extremely important.

For this analysis to have maximum impact, we must convince larger allocators of capital that indeed, ETH is a bond. Once ETH resides in the bond bucket, they know which page of the book contains the instructions on what to do. No mental effort is required. “Boss, I’m just following the rules, lah!”

As fiduciaries, these pools of capital can borrow closer to the US Treasury curve. That is why I will use the 5-, 10-, 20-, and 30-year yields as my discount rates. I used the estimations of ETH rewards from the table above, and that is where the 8%, 9.60%, and 11.50% yields come from, respectively. I used the yields on these bonds tradable sometime on the 28 March 2022.

Steps:

- Borrow USD for a term, and then purchase ETH at the current exchange rate.

- Stake the 32 ETH, and earn rewards in ETH terms.

- After a certain number of years, sell the 32 ETH and accumulated rewards for USD.

- Repay the USD loan.

The following table is the ETH bond’s present value in ETH terms.

|

Term in Years |

Yield to Maturity |

8% |

9.60% |

11.50% |

|

30 |

2.58% |

67.86 ETH |

78.46 ETH |

91.04 ETH |

|

20 |

2.74% |

57.66 ETH |

65.46 ETH |

74.73 ETH |

|

10 |

2.47% |

47.50 ETH |

51.99 ETH |

57.32 ETH |

|

5 |

2.55% |

40.10 ETH |

42.47 ETH |

45.29 ETH |

Remember, we started with 32 ETH. This is the value of the bond in ETH terms, which includes the initial 32 ETH principle. Market convention is to quote the bond as a percentage of par which would be 32 ETH. But to highlight the quantum, I used the nominal ETH amount. I also did not reinvest ETH earnings by staking them as well. If we used a continuous compounding of ETH earnings as they are received, the bond would be even more valuable. It is obviously possible and financially prudent to continuously compound, but for the simplicity of the maths I did not.

The below table reflects the ETH/USD breakeven price. This is the price at which, when the loan is due, the trade is breakeven from a USD perspective. I assume that all ETH cash flows are converted into USD at a constant ETH/USD price such that I can compute the price at which this trade becomes uneconomical.

|

Term in Years |

Yield to Maturity |

8% |

9.60% |

11.50% |

|

30 |

2.58% |

$1,565 |

$1,354 |

$1,167 |

|

20 |

2.74% |

$1,843 |

$1,623 |

$1,422 |

|

10 |

2.47% |

$2,237 |

$2,044 |

$1,854 |

|

5 |

2.55% |

$2,649 |

$2,501 |

$2,346 |

Below is another version of the same table, this time expressed as a percentage change from the current ETH/USD spot price of $3,320.

|

Term in Years |

Yield to Maturity |

8% |

9.60% |

11.50% |

|

30 |

2.58% |

-52.85% |

-59.22% |

-64.85% |

|

20 |

2.74% |

-44.50% |

-51.12% |

-57.18% |

|

10 |

2.47% |

-32.63% |

-38.45% |

-44.17% |

|

5 |

2.55% |

-20.20% |

-24.66% |

-29.35% |

Local Currency Bonds

Local currency bonds are those where the issuer’s domestic currency and the currency borrowed are the same. If you are a USD-based investor, these bonds carry currency risk. Some investors prefer these bonds, as they usually have high yields. However, the effective yield usually diminishes if the investor hedges their currency risk.

Typically, emerging markets non-deliverable forward (NDF) points are positive. This is because of interest rate parity. But, take a look at the below example of the Malaysian Ringgit NDF.

Spot USD/MYR is 4.2148, while the 1-year NDF is 4.24 / 4.26 – meaning it is trading at a premium to the spot rate. If I purchased MYR local currency bonds and needed to sell MYR vs. buy USD in the future, I would trade on the right-hand side (RHS) and effectively PAY forward points. That means it costs me money to hedge my position.

Some investors are happy to take the currency risk, others are not. As a good fiduciary, you are ambivalent and will just offer two different products. One that is hedged, and one that is not. And in both cases, you charge a phat fee.

In the case of a 5-year ETH local currency bond, if we assume an 11.50% yearly yield, the ETH/USD price would have to decline 29.35% before the investor lost money in USD terms after 5 years.

But if the investors would like to hedge currency exposure, they would need to – at a minimum – hedge the expected total cash flows by trading a forward. Right now, there is scant liquidity out past 3 months for ETH/USD listed futures. I contacted a reputable broker on 28 March 2022 and asked what their mid-price would be in terms of premium or discount for a 1-year ETH/USD forward.

If I am long on an ETH bond, and I get a quote for an ETH/USD forward, I trade on the left-hand side (LHS) to Sell ETH vs. Buy USD. The broker quoted me a mid-market premium of +6.90%. That means to hedge my local currency ETH bond, I actually RECEIVE income. I sell the ETH/USD forward at a premium to spot. This is a positive carry trade.

There are very few trades in which you get a higher yield investing foreign currency bonds, and the act of hedging back into your home currency actually earns you money.

As a final piece to this analysis, I valued a perpetual bond using the validator income received from staking ETH.

|

Long-Term Yield |

8% |

9.60% |

11.50% |

|

2% |

128.00 ETH |

153.60 ETH |

184.00 ETH |

|

5% |

51.20 ETH |

61.44 ETH |

73.60 ETH |

|

10% |

25.60 ETH |

30.72 ETH |

36.80 ETH |

|

15% |

17.07 ETH |

20.48 ETH |

24.53 ETH |

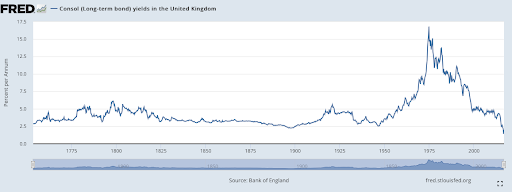

At the outset, I argued that ETH is akin to a perpetual bond. That is a bond with no maturity date. Until it was retired in late 2016, the UK Consol has one of the longest continuous price histories of any government bond ever issued.

UK nominal long-term yields were basically 5% or lower for most of the few hundred year history of this debt instrument. Therefore, let’s assume that the long-term yields from now going forward are 5%, and that the ETH rewards are at the low end of our forecast at 8%. We arrive at a terminal present value of an ETH cash flow stream of 51.20 ETH. The required input for this ETH cash flow stream is 32 ETH.

If we use this to determine the bond implied value of ETH, we arrive at the below chart. The values are simply the multiplication of [Spot * Present Value of ETH Rewards].

|

Long-Term Yield |

8% |

9.60% |

11.50% |

|

2% |

$424,960 |

$509,952 |

$610,880 |

|

5% |

$169,984 |

$203,981 |

$244,352 |

|

10% |

$84,992 |

$101,990 |

$122,176 |

|

15% |

$56,661 |

$67,994 |

$81,451 |

This should not be taken as a price prediction, but rather as a guide to a new way of thinking. If you believe that ETH can or should be valued as a bond, then as an investor – given your long-term interest rate and ETH reward assumptions – you should be willing to buy ETH at today’s prices, as long as it trades at a discount to its perpetual bond derived price.

It’s all about the journey, not the destination, but the destination is definitely Alpha Centauri!

We will return to this perpetual ETH bond table when we discuss ETH bond derivatives a bit later on.

Leverage Please

To avail oneself of the ETH bond requires one to lockup capital indefinitely. That is because currently, you may not unstake ETH once staked on the beacon chain. Post-merge, when POS validation commences, the ETH yield will rise, but stakers are still stuck.

There are various validation pools that allow traders to easily contribute ETH and begin earning a yield. In an attempt to offer liquidity to those locked up, these pools have issued their own tokens which, at a high level, are backed 1:1 with staked ETH.

If you stake 1 ETH into the Lido pool, for example, you are credited with 1 stETH, which trades at a market-determined price. The three largest pools are Lido, Binance, and Rocketpool.

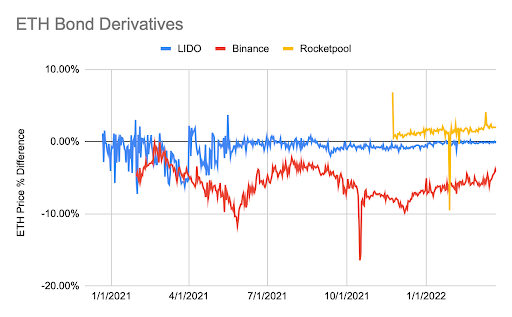

This graph charts the daily percentage premium or discount a particular pool token trades vs. ETH.

Pool Token Price Premium = Rug Risk + Implied ETH Reward + Liquidity Preference

Let’s example the three pillars.

Rug Risk – This is the risk that there is some exploit in the validator code. If, for whatever reason, this smart contract is bricked, stakers’ funds could be rendered inaccessible.

Implied ETH Reward – These pool tokens receive ETH rewards. Therefore the market will discount the future rewards to be received by token holders back to the present.

Liquidity Preference – This is the quantification of the desire of stakers who want liquidity TODAY. The higher the preference, the higher the discount a pool token should trade to ETH. On the other hand, if a pool restricts the amount of ETH deposits it can take, the liquidity preference might actually increase the price of the pool token as is the case with Rocketpool.

My reserve analyst dug into the details of what each of the Lido, Binance, and Rocketpool tokens represent in an attempt to understand why they trade at different premiums to ETH.

Lido – This pool has the largest market share (~85%) and trades very much in line with the price of ETH. When you stake ETH, you are credited stETH in a 1:1 ratio. ETH staking rewards accrue to stETH minus a fee Lido takes for offering the service. This token can be used as collateral in other DeFi apps without impacting accrual of ETH rewards.

Binance – This is the next largest pool in terms of market share and trades at a discount to ETH. When you stake ETH, you are credited with bETH in a 1:1 ratio. ETH staking rewards accrue to bETH minus a fee Binance takes for offering the service. This token can be used as collateral in other DeFi apps but you DO NOT accrue ETH rewards while bETH is staked outside of your Binance wallet. My analyst believes that this is one big reason why bETH trades at a significant discount to ETH. It is not as good of a collateral instrument in the DeFi ecosystem as stETH or rETH.

Rocketpool – This pool has the smallest market share of the three. It consistently trades at a premium to ETH. When you stake ETH, you are credited with rETH in a 1:1 ratio. ETH staking rewards accrue to rETH minus a fee Rocketpool takes for offering the service. Rocketpool is decentralised unlike the other two pools analysed and is severely constrained in the amount of ETH deposits it can accept. More deposits can only be accepted once more pool operators come online. This token can be used as collateral in other DeFi apps without impacting accrual of ETH rewards.

The stETH token is the best approximation of the present value of the ETH bond. I presented a theoretical hypothesis on the present value, and stETH gives the market’s view.

The fact that stETH trades basically in line with ETH is puzzling.

Liquidity Preference – stETH is a $9.8 billion market cap coin, according to Coingecko. It trades $100 million per day, which is approx. 1% of its marketcap. Ether’s daily trading volume vs. its market cap ratio is approx. 3%. If holders of stETH really cared about liquidity on their inaccessible Lido-staked ETH balances, stETH trading volumes relative to its market cap would be much higher. Therefore, it would seemt hat the liquidity preference of investors is close to nil. And as more DeFi platforms accept stETH as collateral, the demand to liquidate stETH into ETH diminishes.

Implied ETH Reward – If we believe the annualised ETH rewards post-merge is 8%, then the implied reward is 8% multiplied by the time until staked ETH is freed. We do not know how long this is. If the market believes that it will take another 6 months post-merge to free staked ETH balances, then the premium should be 4%.

Rug Risk – It is almost impossible to estimate what this risk actually is. We can only back it out by making assumptions on the other three variables. However, surely if you staked ETH on Lido and didn’t believe in the integrity of the tech, you would dump your stETH back into unlocked ETH at these levels in SIZE. But given that stETH trades at the same value as ETH, and has a low average daily trading volume, the market must believe in Lido’s tech.

My conclusion is that stETH either assumes that the full ETH 2.0 process will be completed extremely quickly post-merge, or it is supremely undervalued when viewed against the bond maths of ETH rewards post-merge. If, after reading this essay, the market participants agree with me that ETH post-merge is a bond, then stETH should slowly trade at a larger and larger premium to ETH.

Collateral Usage

Now that these pool tokens exist, they should be used as collateral in the DeFi ecosystem to essentially unlock stuck collateral. AAVE, a decentralised lending protocol, allows traders to post stETH as collateral. Currently, the LTV is 70% on stETH supplied as collateral. MakerDAO also lets you create DAI, its USD-pegged stablecoin, using wrapped stETH (WSTETH) as collateral. Currently the collateralisation ratio for WSTETH is 160%.

This is HUGE. The bedrock of global fiat credit markets is the ability to create a debt asset – which is just a loan to some entity – and then take that debt asset and use it as collateral to borrow even more money. That is how the flywheel of leverage juices the global economy.

While there are obvious benefits to this activity, it does introduce systemic credit risk into the system. If protocols allow more and more leverage with pool tokens as the base collateral, and there is a rug pull event that renders the pool tokens essentially worthless, then all the value built on top would also be impacted. As these tokens become more widely accepted, we must watch out for this risk. The good thing about DeFi is that all of the activity is fully transparent because it is on-chain. Therefore, we can build extremely accurate monitoring systems to gauge the immediate DeFi system credit risk attributable to pool tokens.

The ways in which these pool tokens can be used is almost limitless with regards to interest rate and credit derivatives. However, before I get too excited, let’s observe how the market develops. I will have a lot to say in the future about promising projects that begin to utilise this new pool of collateral to do innovative things and bring life to the ETH fixed-income markets in a decentralised fashion.

What Would Michael Saylor Do?

Saylor is a gangsta because he uses Microstrategy’s ability to tap institutional corporate bond markets as a funding vehicle to acquire Bitcoin. That’s an “ok” strategy, but Bitcoin is pure money and intrinsically yields nothing. Ether is the commodity that powers the world’s largest decentralised computer. Ether will, post-merge, feature an intrinsic yield.

What Saylor – or any other high yield issuer – should do is issue debt and purchase ETH. This is a positive carry trade.

The above chart is the Bloomberg US Corporate High Yield Average OAS. To learn more about OAS, click here. What this shows is that the average US corporate junk bond issuer currently pays 3.41%.

Using the model above, let’s assume that you are the CEO of a bricks and mortar company that wants to meme your way into a high stock price. Never mind what your business is supposed to do, you are a finance optimising broseph.

Inputs:

3.41% cost of capital

5-year maturity

8% ETH rewards

$3,320 ETH/USD price

Outputs:

The present value of this bond is 41.28 ETH.

The breakeven ETH/USD price is $2,573, or a decline of 22.48% from these levels.

Assuming no price movement in the ETH/USD exchange rate, the return in USD terms is 29%.

Would a swashbuckling CEO actually hedge currency exposure? Absolutely not! Remember, public company CEO’s are the best paid fiduciaries – they get to blow shareholder money without consequence. If you get to the plate, swing the bat! Even if you miss, you still get PAID.

For any CEO of a boring STONK, announcing a debt raise coupled with a large purchase of ETH bonds creates twice the value. Firstly, because your stock is now a “DeFi”, “web3.0”, “metaverse”, etc. company, which will excite the hoard of reddit meme stonk traders. Secondly, the trade has positive carry; therefore, put this on in $1 billion size and depending on the accounting treatment, the $290 million of income can be recognised immediately or over time. You just can’t lose!

ESG …

If you believe ESG investing accomplishes anything more than handing more easy money to fiduciaries, then what are you?

While the movement is well-meaning, those in the business of selling investment products have spotted ESG suckers a mile away. It’s one thing to actually do diligence on individual companies, visit facilities, speak with management, and arrive at a conclusion on whether said company actually walks the walk. But most investors’ goal is to virtue signal in the absence of doing the hard work to actually change things for the better.

While the ESG investing movement might be led by a bunch of lazy muppets, Kermit the frog and his crew can push weight in their quest for inner peace. Fiduciaries in the business of index investing have created various vehicles to make it as easy as 1-2-3, do-re-mi, to become “ESG compliant”. This is a massive wall of money that can push prices of anointed assets to new heights.

There is a significant amount of money managers that would like to allocate to “crypto” – by which they mean Bitcoin and or Ether – but the Proof-of-Work consensus mechanism is considered energy wasteful. Crypto is therefore against their ESG mandate.

POS is considered “green” and ESG compliant. I guess they forgot that all those validators are computers, and that computers consume electricity. Last time I checked, fossil fuels and nuclear energy produce the majority of electricity consumed globally. But physics is just semantics – we are now ESG warriors and Newton’s apple is rotten.

But who cares, we are here to make money.

Sentiment will all change when ETH becomes an ESG-friendly, POS blockchain, which ESG funds can then invest in. This opens up ETH to hundreds of billions of USD worth of fiduciaries who due to ETH’s classification, can now safely invest (as in the safety of their job, not their investors’ capital).

Obviously, ETH is not the first smart contract blockchain to utilise POS as a consensus mechanism. Most major L1 chains are POS. However, as traders, we care about change at the margin. At the margin, new funds can now invest in ETH that couldn’t before. That is massively boolish!

Ethereum Killers

“Ethereum is slow and expensive therefore we shall build a competitor that is fast and cheap.” This is the mantra of every project that has come forward to challenge Ethereum for the L1 smart contract crown. The details on how these ragtag groups of would-be Ethereum killers intend to accomplish these goals are irrelevant. Investors have gotten caught up in the hopium and elevated a group of smart contract layer-1 Ethereum killers to massive valuations.

These upstarts command hundreds of billions of dollars of crypto market cap. And in 2021, their prices surged. Now that ETH is on the cusp of the merge and shift to POS, which may or may not bring performance enhancements, will ETH outperform on a relative basis vs. these other L1 coins?

Check ‘des L1 charts.

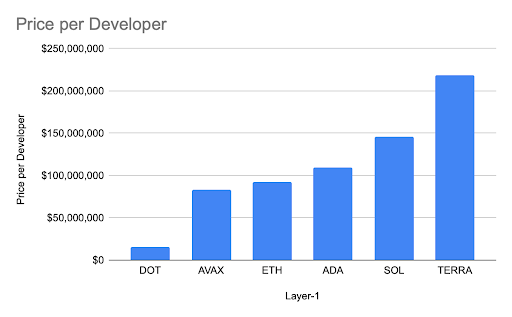

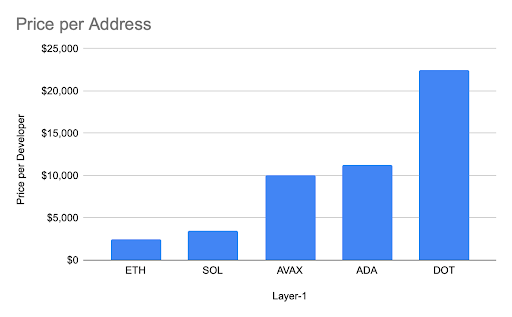

This Price / Developer Ratio chart reflects the market cap of a selection of L1s divided by the number of active developers.

Electric Capital published a very important and insightful research piece which estimated the number of active developers on each of the major chains. A public blockchain is built to be used. If there are only a few developers creating new projects on a given chain, that chain will never become valuable.

Most Ethereum killers trade on much higher multiples because they hope to attract talent to develop on their chain. Hope might get you a Nobel Peace Prize, but at some point, investors are going to ask “where’s the beef?”

According to this report, Ethereum has appx. 4,000 developers, which is 3x larger than the chain with the second largest cohort of devs, Polkadot, which has the second largest cohort of devs.

This Price / Address Ratio chart reflects the market cap of a selection of top L1 protocols divided by the number of addresses.

The number of addresses on a given chain is another crude but useful metric that can be used to evaluate the health of a public blockchain. Ethereum sports 16x more addresses than second-place Solana, but is still cheaper on a Price / Address basis.

This is another great metric to measure hype. The chains that exist only to take market share from ETH trade at much higher multiples. Again, “where is the Miyazaki wagyu?”

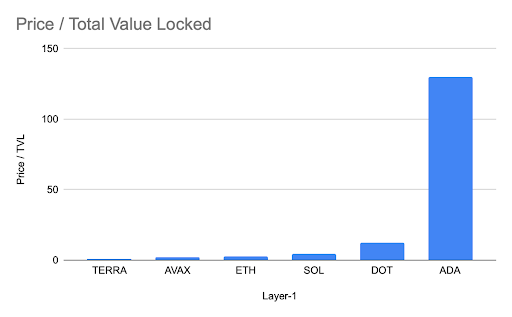

Price / TLV is the market cap divided by the total value locked inside of dApps on a protocol.

This ratio is the easiest way to identify the degree to which DeFi apps are gaining traction. ETH is the third cheapest behind TERRA and AVAX. I am not even sure ADA should be included, if there ever was a coin that traded purely on hopium it is Cardano.

When viewed against these fundamental ratios, ETH is perhaps the least expensive L1. Ethereum’s success bred a coterie of competitors who trade on a hopeful future rather than concrete performance. There is nothing wrong with that, but when ETH is about to feel the love of bond and ESG investors, can these other coins keep pace?

If you are a capital allocator who either already holds some of these coins, or has to choose which smart contract layer-1 coin to invest in, wouldn’t you want to buy the cheapest one? While Ether’s market cap is orders of magnitude larger than its competing chains, it is still cheap on a network funderrrmental valuation basis.

As the year progresses and the merge comes and goes, I expect ETH to significantly outperform any L1 chain that constructed a narrative that it is “faster and cheaper” than Ethereum. That narrative worked from 2020 to the end of 2021, but now Ether supports extremely positive price fundamentals from a flow of and return on capital basis.

Please do not mistake this sentiment to mean I believe that these copypasta chains cannot retest their November 2021 all-time highs. This is purely a relative argument. ETH can go to $10,000 – a roughly 3x return, and Solana to $200 – a roughly 2x return. Would you be happy owning Solana? Surely yes – but you are leaving valuable shekels on the table. Capital flows to where it is treated best.

Praise be to Vitalik

There are three ways to think about how to allocate into ETH, vs. fiat, vs. Bitcoin, vs. other L1’s.

Fiat Allocation

This is a chart of the 10-day rolling correlation between ETH and the Nasdaq100. At 84%, they are basically joined at the hip. ETH (and Bitcoin) are risk assets just like big tech US equities. No bueno!

As the Fed continues on its path to raise nominal rates and the 2s / 10s curve inverts – pointing to a future US recession – equities are going to get crushed. And by crushed, I mean down 30% to 50%, until something breaks in the credit markets and the Fed turns back on the money printer.

If I believe this with every fibre of my being, then I must also believe ETH can trade down in USD terms by 30% to 50%. Until either the broad risk asset market crashes, or ETH’s short-term correlation begins to fall vs. the Nasdaq100 or S&P 500, I will not sell fiat and buy ETH.

The macro is not there, regardless of what I believe about the strong fundamentals of ETH.

Bitcoin vs. Ether

My crypto portfolio at the beginning of 2022 was 50% Bitcoin and 50% Ether. I have conviction in the cheapness of ETH relative to the rest of the crypto firmament. Therefore, my target allocation is 25% Bitcoin and 75% Ether.

Bitcoin becoming the biggest baddest rockstar again will require a change of narrative. Similar to Ether, Bitcoin is viewed as just another risk asset, but it’s a great risk asset because it trades 24/7 and is the only free market left globally.

Bitcoin must again be viewed as a store of value and an inflation hedge, as it is the hardest form of money ever created. Ether is not money – it is a commodity that powers the world’s largest decentralised computer. As I explained in “Yes I Read the Whitepaper”, the Ethereum community clearly decided that ETH is a commodity used to power this computer, not a pure monetary instrument.

Bitcoin does not have an implicit yield in BTC terms at the protocol level. Post-merge, ETH will. Therefore, Bitcoin is money, and ETH is a commodity-linked bond.

As global real rates are deeply negative, I want to own an asset that has a positive yield in its own currency – and at the moment, that is ETH. Bitcoin yields nothing. Therefore, from a pure interest rate differential perspective, I should own more ETH than Bitcoin. This will change when the price of ETH sufficiently rises to incorporate future ETH cash flows, due to the new rewards and validation system.

And finally, the ESG muppets will be able to “safely” invest in ETH after the merge, but not Bitcoin. Game Blouses!

Ether vs. the Competition

I hope the graphs posted earlier clearly demonstrate that ETH trades cheaply based on network fundamentals, while its competitors trade on a brighter future. Again, competing L1’s may realise their dreams of dethroning ETH, but they are hardly there yet.

With ETH’s forthcoming implicit yield, and the ability for ESG investors to allocate to ETH, it will be very hard for investors to continue hoping. Better they trade something which they can justify as “cheap” on a network fundamental level.

A final note about the bridges to nowhere. The Wormhole and Ronin (Axie Infinity) bridges lost users’ funds to the tune of almost $1 billion worth of ETH, other cryptos, and stablecoins. At its core these bridges are the ecosystems’ attempt to import all the amazing dApps built natively on ETH onto the Ethereum-killers’ faster and cheaper blockchains. If traders tire of worrying whether their bridge will be the next to implode, they may just migrate their TVL and business back to ETH, which at the margin is negative for any competing L1. Trust St. Vitalik, rather than dipping your foot in the river Styx and flirting with the wrath of Hades.

5 Ducking Digits

I penned a piece years ago where I predicted ETH would become a 2-digit coin in USD terms. That came to pass for a short while.

I then backed up the truck into ETH when I saw a chart that showed the total value of dApps built on Ethereum was greater than the market value of ETH itself. That was a screaming buy signal.

I have ridden the current ups and downs, and am very happy with the relative size of my ETH allocation within my crypto portfolio. The rest of 2022 is going to be the year of the ERC-20 angels led by his highness Vitalik.

When the dust settles at year-end, I believe ETH will be trading north of $10,000.

The post Five Ducking Digits appeared first on BitMEX Blog.