An NFT derivative is an NFT project created utilizing creative assets and the intellectual property of an already existing project.

NFT derivative projects tend to bring about mixed reviews from NFT enthusiasts. Some call them cash grabs and opportunistic rip-offs, others call them unique appreciations or homages of other popular projects.

The following NFT derivative projects guide explores both sides of the coin– we’ll explore the difference between official derivative projects and unofficial derivative projects.

What is a Derivative Project? Know How to Spot an Official Derivative

During bull markets, new investors and consumers enter the market, and these new market participants see popular fast-moving NFT projects and develop FOMO (fear of missing out). Granted, everyone in crypto feels a bit of FOMO sometimes, but new entrants aren’t as experienced in knowing how to direct it.

In markets where the price of an asset or security rises continuously, the entrants start to act with a bit more urgency, often throwing caution to the wind in search of the next big astronomical gain.

Most derivative projects are unofficial copycat versions of existing projects, and unless you see a formal notice of partnership issued by the original project, you can assume the derivative is unofficial.

Derivatives tend to contain elements of existing projects and are highly imitative, without many new creative elements being introduced.

Unofficial Derivative for Good

There are multiple reasons why a creator may decide to create a derivative project.

Sometimes, they can be fun and allow community members to explore their creativity. Inspired community members will attempt to share their excitement and appreciation for the overarching community in a new context.

This is apparent in projects like Jenkins The Valet. Jenkins is considered unique for a few reasons. Despite being an unofficial derivative project within the Bored Ape Yacht Club community, it’s still considered a fairly successful project in the NFT community because it has a unique value proposition.

The project’s founders, Tally Labs, have demonstrated an ability to execute and a vision beyond just “selling out”. Tally Labs is currently represented by CAA, one of the biggest talent agencies in Hollywood.

Unofficial NFT Derivative for Bad

Alternatively, some creators create NFT derivative projects solely with profiteering undertones.

To satiate the demand of new entrants, opportunists create predatory projects designed to look like a cheap entry into “the next big NFT project”.

For example, let’s take a look at the many derivatives of the famed project Doodles.

A Direct Unofficial Derivative: Here is an unofficial Doodles derivative called “Lil Baby Doodles X”.

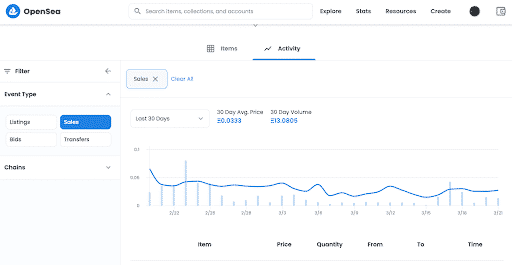

Unofficial projects tend to exhibit pump and dump characteristics– social media hype, large buy-ins upon minting and launch, followed by a sudden and precipitous fall. These manipulative schemes attempt to boost the price of the NFT through fake recommendations on Twitter, Telegram, and Discord.

As Doodles gained traction, so did unofficial derivatives like Lil Baby Doodles X. With a price tag of just over 0.1 ETH, influencers could hype up the derivative as a way to jump on the Doodles rocket ship without the hefty price tag.

Lil Baby Doodles X went crumbling downward soon after it officially launched.

Many NFT derivative projects tend to be cash grabs created without the intention of building a long-term community or retaining value. Some schemes can make millions of dollars upon launch– hence the incentive to launch derivatives and the proliferation of NFT derivative scams.

Also known as rugpulls, projects with short-term cash grab perspectives are soon abandoned by their anonymous or pseudonymous founders. who take off with thousands or millions of dollars worth of tokens.

The primary goal of these projects is to sell as much as possible, while the founders gradually dump dozens or hundreds of the NFTs they own. It’s basically market manipulation– these projects will hype the community and roadmap but have little to no intention of executing past mint day.

Unfortunately, most buyers find out they’ve been duped after it’s too late.

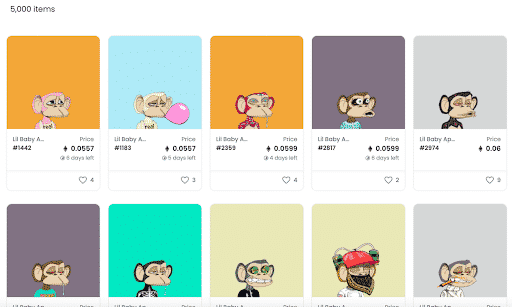

However, there are a few metrics to keep an eye to assess a project’s long-term viability:

- A growing floor price over time.

- The number of individual wallets holding the NFTs

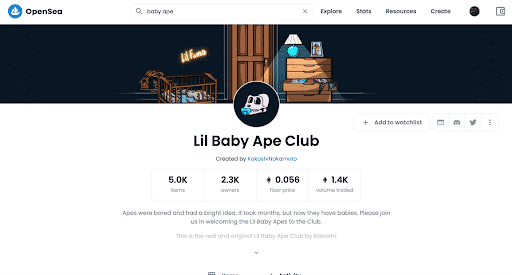

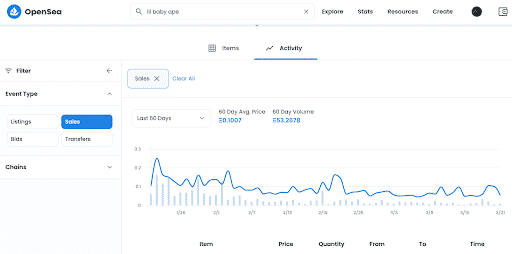

Lil Baby Ape Club is another example of one of these spin-offs. The Bored Ape Yacht Club is known to be one of the most popular NFT projects in the space; some feel like they missed the train, some feel they can’t afford it, others are looking for the next big thing.

The problem is when you’re looking for the next big thing, you can fall into a trap; check out this Bored Ape Yacht Club derivative project “Lil Baby Ape Club”.

The NFTs look like baby versions of the Bored Ape Yacht Club. Cute, right? Well, if you bought one when they came out, you most likely lost money. The price has been on an overall decline ever since it launched. Not so cute.

One must be aware of whether a project is officially launched by the founding company and team; in this case, Yuga Labs are the creators of the Bored Ape Yacht Club brand, and they had nothing to do with the Lil Baby Ape Club.

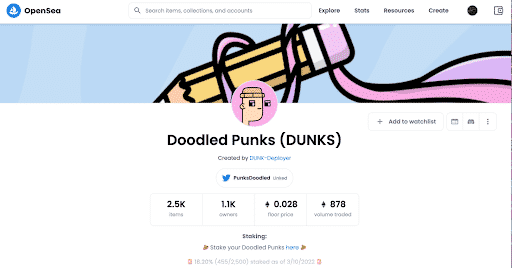

Unofficial Derivative Collaborations: Doodled Punks

“Doodled Punks” combines the art style of Doodles with a profile dynamic from Cryptopunks.

However, the price tags and value are drastically different from their inspirations.

Official Derivative Projects

Not all derivative projects are cash grabs. There is a difference between an unofficial derivative project, an affiliated derivative, and a subsequent drop by a project’s founding team.

Noodles, for example, is the first Doodle derivative project approved by the Doodlebank, which is a community-led DAO for the Doodle project.

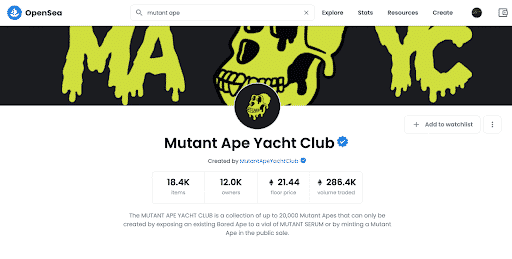

For example, “Mutant Ape Yacht Club” is an official project released by The Bored Ape Yacht Club. It’s issued by the original project founders, and its value tends to trail the Bored Ape Yacht Club’s value.

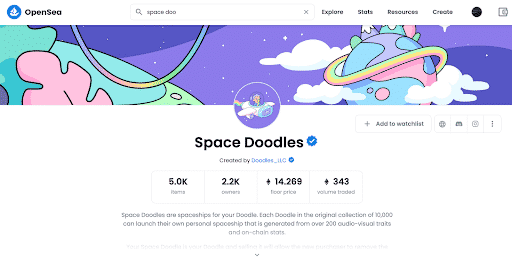

As another example, Space Doodles is a derivative project created by the Doodles founding team. This official derivative project is relatively unique in that in order to get a Space Doodle, you need to swap your Doodle in a smart contract in order to redeem it. The price of Space Doodles has tracked relatively closely with the price of Doodles as a result. As a project, Doodle’ is aspirational for many NFT community members.

While unofficial derivatives have dubious value, official derivatives created by the original founding team have a chance of holding or even appreciating value.

Just like one can’t go on Etsy, buy a fake Balenciaga shirt and expect to sell it on StockX to make money, the same applies here. Authenticity is key.

Don’t get stuck with the bag.

Final Thoughts: To Derivative or Not to Derivative

The general sentiment in the NFT space is to avoid derivative projects, in most but not all cases.

Derivatives spring up in bull markets, but historically, don’t play out well. If you do decide to buy an unofficial derivative, you’re rolling the dice on an already extremely speculative asset.

The next big NFT projects will likely be from founders that anticipate delivering on a roadmap ad building an authentic community, not from projects that copy other projects’ intellectual property.

If a project does copy and seems to be doing well, the other shoe will most likely drop at some point.

The standout NFT projects pushing the NFT ecosystem forward tend to add a unique element to the space, and each wave of innovation adds to the excitement of the space.

The post NFT Derivative Projects Guide: Official vs. Unofficial Derivatives appeared first on CoinCentral.