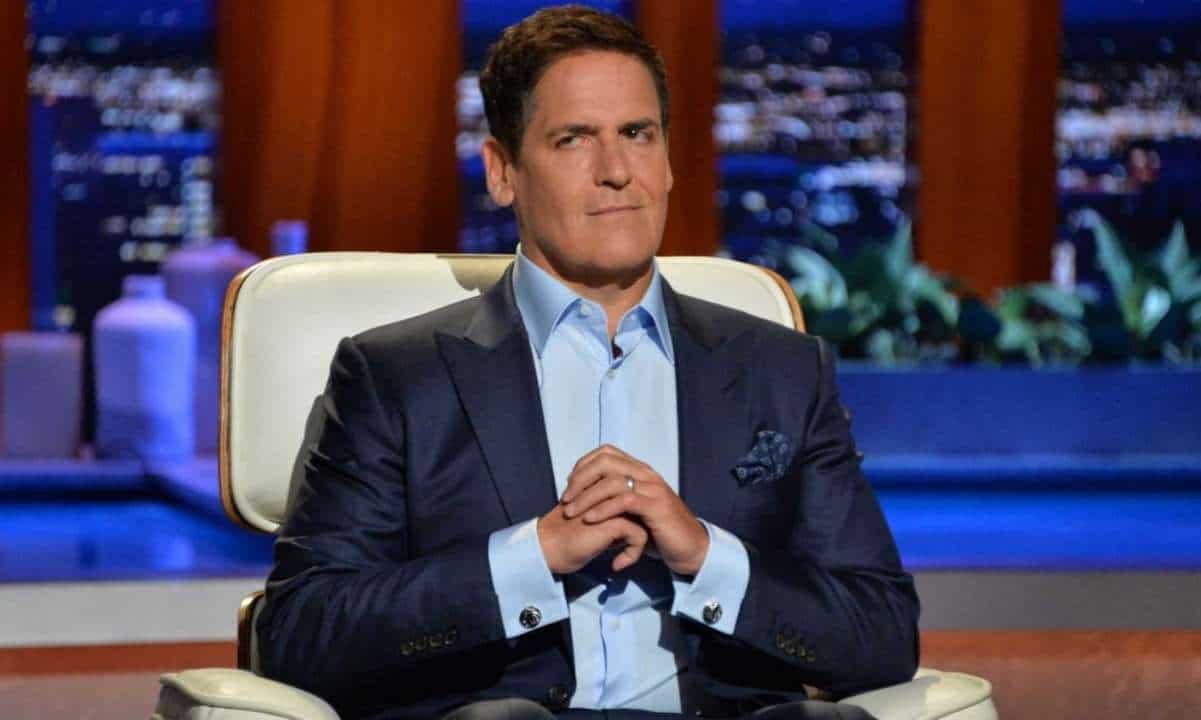

The American billionaire Mark Cuban is excited about Ethereum’s shift from a proof of work model to proof of stake for two key reasons. He believes the so-called Merge will significantly cut the protocol’s energy consumption, and it could turn Ether into a deflationary asset.

‘I’m Very Bullish’

This summer, Ethereum is expected to change its infrastructure from the energy-intensive mining model PoW to PoS, making the blockchain protocol less harmful to the environment. Many investors and participants in the crypto space think the upgrade will be beneficial for Ethereum and will accelerate its dominance.

One such individual is the owner of The Dallas Mavericks – Mark Cuban. He said that after the transition, Ethereum will have a much greener focus, which should increase its adoption among the broader population.

Additionally, Cuban predicted that the transition will “possibly make” Ether deflationary asset. The billionaire explained that the coins’ supply will reduce drastically, while the process of minting new ETH will be slower.

“Following the merge, the amount of ETH issued is projected to drop by 90%, leading to similar fees to reduce Ether’s supply by as much as 5% a year,” the blockchain analytics company – IntoTheBlock – suggested earlier this year.

Cuban said he had not invested in the Beacon Chain but admitted to allocating some of his wealth to ETH and numerous projects built on the Ethereum blockchain.

Cuban Sees Ethereum as a Great Investment Option

Despite being against the asset class in the past, the entrepreneur is currently a keen advocate. He often praises bitcoin’s merits arguing that it is a better financial tool than gold. His NBA team – the Dallas Mavericks – accepts digital assets as a means of payment for tickets and merchandise products as even the popular memecoin Dogecoin is one of them.

However, Cuban seems to have a special viewpoint on Ethereum. In October last year, he advised beginners in the crypto space to select ETH as an investment choice as it has the biggest upside potential:

“As an investment, I think Ethereum has the most upside.”

Prior to that, he gave three reasons why Ethereum will “dwarf” Bitcoin in the future. Those are the higher number of transactions, the diversity of transaction types, and the development efforts in Vitalik Buterin’s crypto brainchild.

Featured Image Courtesy of Fortune