Notable Messari Intel Updates

- Terraform Labs and the Avalanche Foundation have agreed to swap $100 million LUNA and AVAX. Conducted as an OTC deal, the Luna Foundation Guard will add $100 million AVAX to the UST reserve to support the UST/USD peg.

- The Juno network halted at block 2,578,097, which occurred on Apr. 5, 2022, at 11:00 UTC. The Cosmos-based smart contract network chain remained halted for two days before block production resumed.

- Offchain Labs have announced that Arbitrum Nitro is ready, and a full-featured Nitro devnet built on Ethereum’s Goerli testnet has been launched. This is a fully built-out production implementation of Arbitrum Nitro including fraud proofs, the sequencer, the token bridges, and advanced call data compression.

- OpenZeppelin — a crypto cybersecurity technology and services company — has uncovered a vulnerability of Convex Finance protocol that put $15 billion at risk of a rugpull. The bug was fixed, and no funds were lost.

- The team behind the Original Celo Treasury, Ocelot Labs, has shared details about its plans to create an incentivized testnet and canary network built as a rollup on Celestia.

Notable Messari Governor Updates

- The Saddle DAO has submitted a proposal that aims to deploy a wBTC/pBTC pool to Ethereum and Arbitrum. Saddle will launch a three month liquidity incentive campaign on Ethereum. Voting is currently active.

- The Gearbox DAO submitted a proposal that aims to adopt a new revenue model for the Gearbox protocol by monetizing user collateral, utilizing TVL, and lowering the withdrawal fee. Preliminary discussions are currently underway.

- The Perpetual Protocol team has submitted a proposal that seeks to introduce the various changes to Perp V2 tokenomics which include a vote escrow model (vePERP), updates to the Perp protocol reward programs, governance controls for fee distributions, and a new 14-day governance cadence. Preliminary discussions are currently underway.

- The Origin DAO succeeded in passing a proposal that aims to build and deploy a staking framework for OGN tokenholders that allows stakers to stake their OGN. The framework will enable marketplace and royalty fees generated from the Origin Story marketplace to be distributed to OGN stakers.

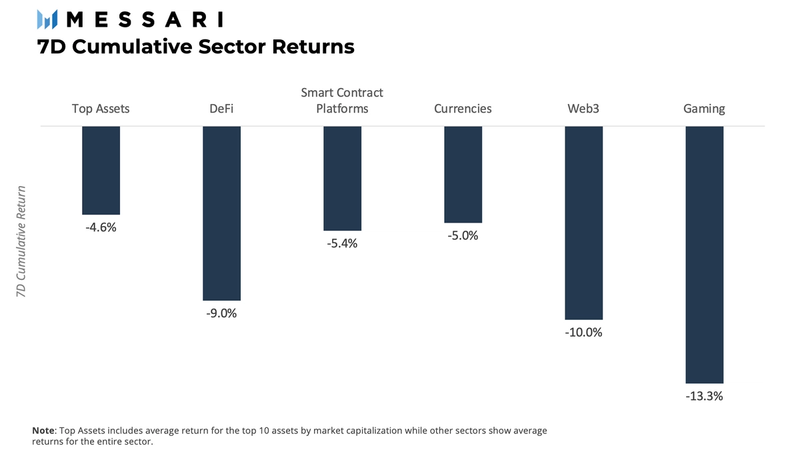

Sector Returns

After three consecutive weeks of positive market sentiment, all sectors are underwater this week. Gaming was the biggest loser as it started showing signs of weakening momentum last week. Last week it was the only sector with a negative return, and this week it took the heaviest losses at -13.28%. Web3 was the other category within sector returns that had a double-digit loss week, shedding 9.99%.

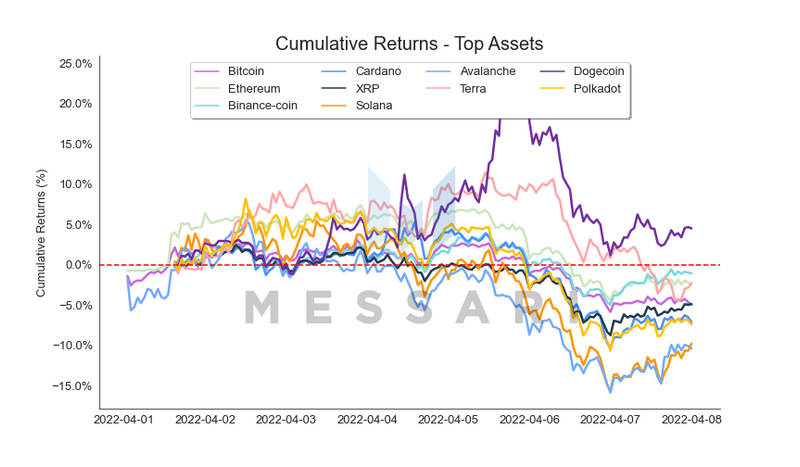

Top Assets

Dogecoin (DOGE) was the only asset within the top 10 assets by market capitalization that ended the week with a positive return. The original dog coin went so far as reaching a 29% gain this week at $0.1796 but then giving most of it back, closing the week with a 4.5% return. Avalanche (AVAX) was the laggard of the group, ending the week with a 10.4% decline.

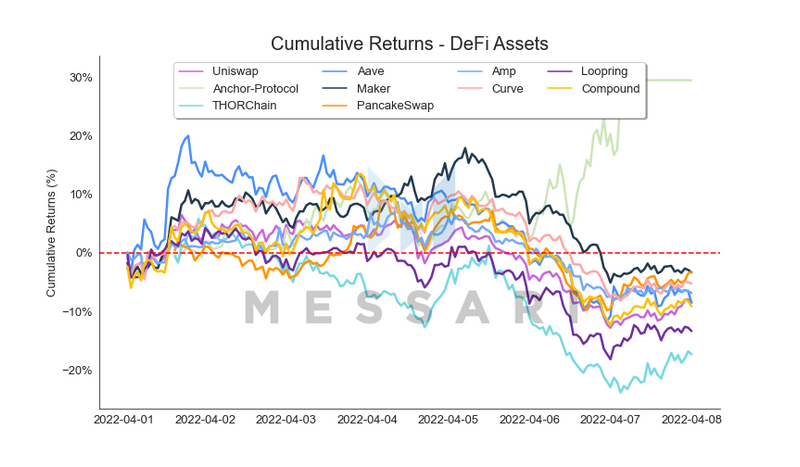

DeFi Assets

It was a very different outcome for the DeFi sector this week compared to last week. Whereas it was the best-performing sector last week, it was among the bottom three this week. Even though the category’s performance was not impressive this week, there was one asset that took the spotlight: Anchor Protocol’s ANC token. The Terra-based lending and borrowing platform saw its token end the week with a 29.5% gain. Impressive considering the rest of the assets in the category finished the week in the red. THORChain (RUNE) was the biggest loser, marking a 17.3% loss for the week.

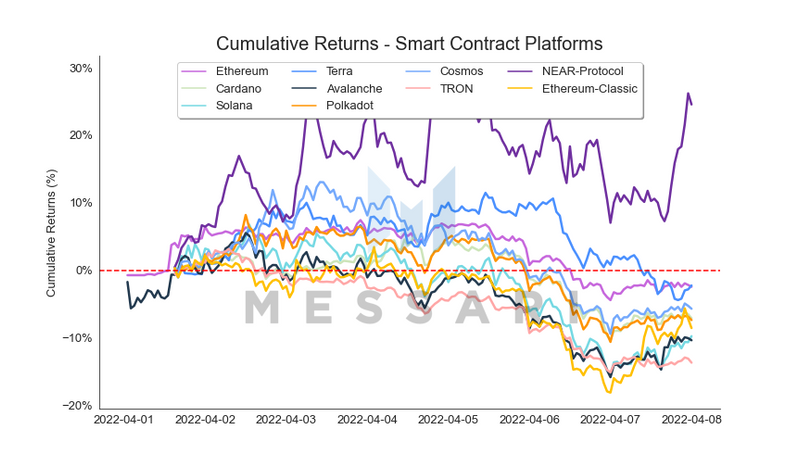

Smart Contract Platforms

NEAR Protocol stole Waves’ (WAVES) thunder this week as the NEAR token closed with a 24.6% gain, eyeing to break all-time-highs. It was the only asset within the top smart contract platforms by market capitalization sector that ended the week with a positive return. The catalysts behind NEAR’s recent rally are news of a $350 million funding round led by Tiger Global and rumors that NEAR will launch its native stablecoin (USN), an algorithmic stablecoin with a similar mechanism to Terra’s UST and staking APY of 20%. TRON performed the worst within the category and took the last spot with a 13.7% loss.

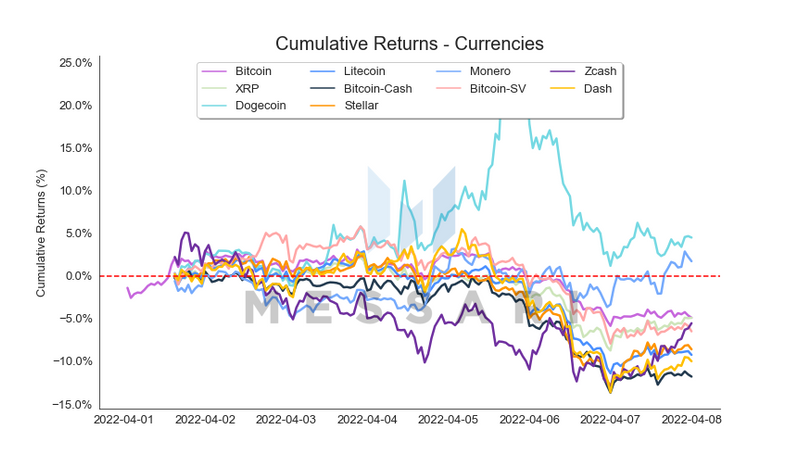

Currencies

Only two currencies made it above water this week with Dogecoin (DOGE) leading the group and Monero (XMR) securing the second position. As mentioned earlier; Dogecoin’s (DOGE) price went as high as 29% at $0.1796 before returning most of the gains. The dog token ended the week with a 4.5% return. The currencies that did not end the week in positive territory traded fairly close to each other throughout the week, closing within a 6.9% range (BTC at -4.9% and BCH at -11.8%).

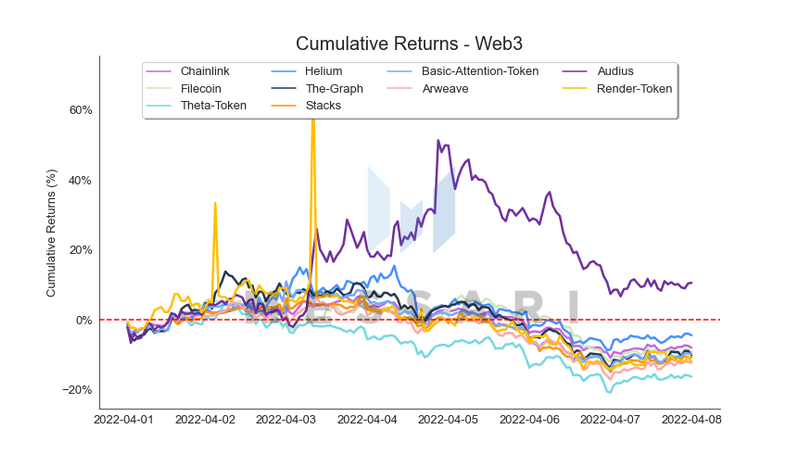

Web3

Audius (AUDIO) was the only winner within the Web3 sector this week with half of the assets in the category reporting double-digit losses. The decentralized music streaming platform has been gaining popularity recently, which has been contributing to its appreciation in price. The token saw its price rise as much as 58.7% before returning most of the gains. It was still enough to secure the number one spot with a 10.6% return. Theta (THETA) secured the endmost position with a 16.3% decline.

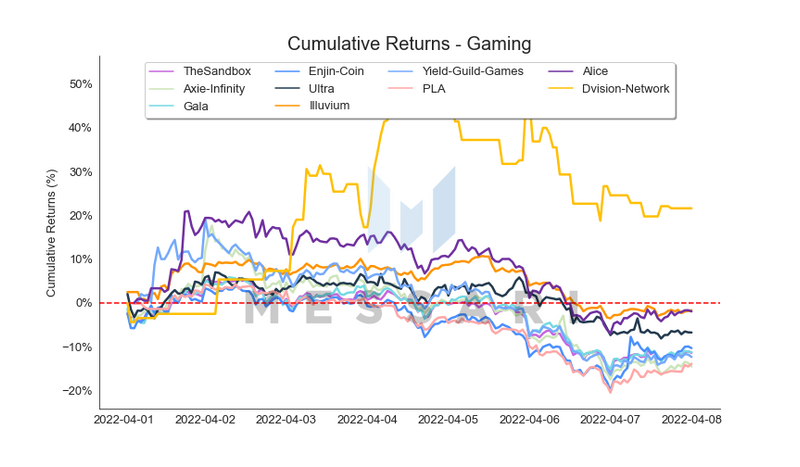

Gaming

Dvision Network was the clear outperformer of the gaming sector this week as the virtual reality content ecosystem’s DVI token price rose as high as 54% at $0.5799 but subsequently returned most gains. The performance was enough to help keep its spot in the first place and finished the week with a 21.6% return. Axie Infinity enters its second week in a row where the AXS token comes in last, following the hack of its cross-chain bridge.