If you would like to view the full recording of the live Crowdfest event, you can find it on our YouTube channel. You can also read the full Quarterly Report by Jerry Sun here.

Participants:

- Jerry Sun – Messari research analyst

- Federico Landini – Uniswap Grants Program

- Boris Stanic – Uniswap Grants Program

- Yj – Uniswap Grants Program

Jerry Sun (0:07): We’re at the top of the hour here, so let’s get started. I think a round of introductions would be welcome. I’m sure many in the Uniswap community know who you guys are, either through discord or the grants program, but I think for anyone on the call who doesn’t, I’m sure that would be helpful. Happy to pass it to you guys first, and then I can go after you guys. Any of you guys want to get us started?

Boris Stanic (0:34): I’ll go first. So when we do interviews for the grants program, one of us usually introduces all of us, since we basically all do the same thing but maybe we switch it up for this time. So, my name is Boris, I’m part of the Uniswap Grants Program (UGP) and Uniswap community. For the past almost a year now, its my workaversary or DAOversary soon. What I do is review the grant applications, I host the Uniswap community calls every two weeks, and then we make sure that the grants that we support actually turn out successful – so connecting them with the right people, funding them, trying to break the barriers in front of them, basically. That’s us and myself together, so yea!

Jerry Sun (1:42): Nice to have you, Boris!

Federico Landini (1:46): I will go, then Yj. Hi everybody, my name is Fede and I’m also part of the Uniswap Grants Program. I was a grantee, I started as a grantee, so I applied to the Uniswap Grants Program to develop a simulator to simulate Uniswap V3 strategies. I got funds and I got involved in the community, and three months ago I joined the team with Yj, Ken and Boris, and we review all together other applications and we follow up grants and help people to develop tools that help the Uniswap community.

Yj (2:24): I’m Yj and I’m also one of the reviewers for the Uniswap Grants Program. I first started getting involved with Uniswap staff and helping out with more difficult user tech support on Discord. I also help kind of keep an eye on some other channels, like the international community on the Discord server, for example a Chinese channel, Japanese channel, Indonesian channel. And then about six months ago now, I started helping Boris and Ken, and later on Fede as well, with reviews on grants. Then most recently, Fede and I started the Uniswap grants Community Analytics Program, which we are running right now with data analytics bounties for various topics to encourage the open sharing of crypto and Uniswap analytics for the community, so that’s me.

Jerry Sun (3:19): Awesome, welcome everyone! My name is Jerry, I’m a research analyst on the Messari team, I’m based out of San Francisco here, and I wrote the Q1 quarterly report that we’ll be spending some time talking about today. I also wrote the Q4 quarterly report, so I’m fairly familiar with the contents of both reports, and happy to talk about some of the quarter-over-quarter changes that we saw. I think we can get started and dive into the report here. This is where I want to try to share my screen and we’ll see if I’m able to make this work here.

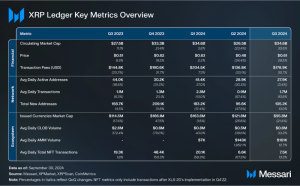

Jerry Sun (4:41): So we got the report pulled up, this is the State of Uniswap Q1 2022. I just want to pull this up because one of the things I want to add as a quick disclaimer before we start is that traditionally in our reports, we host them on our website, messari.io, and for the quarterly reports we decided to go and covert all of them to PDF as well. We think that, just in general, PDFs are an easy way for distribution and we want to make sure that everyone in the community has an opportunity to go and read the report, to go and distribute and send to their friends for example. Ethan’s got it pulled up there, and if you guys want to pull it up or check it out, it’s available on the website and I think we have it linked in the chat bar to the right, at the very top. So diving into the report here, I’ve actually got a presentation that I’ve wanted to pull up. We can start with talking a little bit about the macro, so the key metric summary is the table that we’ll want to talk about here. To give a quick overview from a high level of Uniswap and how it performed in Q1, I would say that Q1 was a very different quarter relative to Q4. There we a lot of catalysts for Q4, you think about the rise of NFTs at the beginning of Q4, bitcoin and ether hit all-time highs during that quarter, and all of that activity clearly benefits Uniswap because it encourages a lot of people to go to the DEX to make trades, it encourages trading activity. Q1, in contrast, was a little bit more of a pullback, what I would consider a reversion back to the mean, and so we did see some quarter-over-quarter decreases in total volume, in liquidity, in trading fees, things like that. One important caveat to note, though, is that this is all priced in USD equivalent denominations, so obviously even if the price of bitcoin, ether, and all these crypto tokens is decreasing, that’s going to affect some of the metrics here as well. For you guys on this panel, personally, when you think about Uniswap and the health of the protocol, what are important metrics that you guys look at? What are the best ways to think about how to analyze Uniswap?

Federico Landini (8:33): I personally do believe to have a look at the relative performance of Uniswap compared to the other DEXs, so as you say in the last quarter Q1 that the market was quite, not as exciting let’s say as it was in Q4, but if you check the dominance or the performance of Uniswap compared to other AMMs and other DEXs, Uniswap was quite consistently the top DEX also in Q1. I think that’s a good sign of strength and health of the protocol.

Boris Stanic (9:13): Maybe I’ll share my thoughts, so trading volumes and numbers don’t really interest that much because it all has to do with how much crypto in general is getting traction and interest among people. As long as I see that projects are launching on top of Uniswap — for example as soon as they launch a token, there’s a Uniswap pool which has a lot of activity and there are also liquidity mining incentives, and they’re using Uniswap for what it was built for — that’s exactly what Uniswap as a protocol needs. It’s being used, and now the volumes at which it’s being used just has to do with the whole cryptocurrency scene and market in general, and you can’t affect it that much as a DEX or as a protocol.

Yj (10:18): Yeah, I feel the same way in the sense that one of the things I raised when looking at the reports is that if you talk about volume reducing, we normally use the USD equivalent, so if crypto as a whole drops from one quarter to the next then you expect USD equivalent volume to just drop. So, fair dimension comparing against other DEXs and other protocols is key. The other thing to consider would be comparing against centralized exchanges because it’s all part of price fighting, and Uniswap’s mechanism relies on arbitrage to do the price finding, so when we compare against Coinbase and others, what does that show? Then also another very important thing for V3 especially is, of course, the capital efficiency, concentrated liquidity from the perspective of both liquidity providers in terms of earning fees and also swappers in terms of getting the best execution price, including any fee they’re night need to pay on other protocols or centralized exchanges. Does Uniswap give the best value? I think those are the type of comparative metrics that I personally am most interested in.

Jerry Sun (11:36): Right, I think those great points that you make and Yj just to supplement what you’re saying, there’s not a lot Uniswap can do as an individual protocol relative to the broader crypto economy, your metrics are just going to fluctuate just depending on how crypto does in general for the quarter. Just to back that up with some numbers, and Yj pointed this out earlier, that crypto as an entire ecosystem went from $3T in Q4 to $2T at the end of Q1. So that is almost a 50% decrease in terms of how the size of the economy shrank, but when you look at some of these metrics, I think Uniswap actually showed its resiliency because volume only decreased 20%. So what does that mean? It means that if you convert the USD equivalent, Uniswap probably did just as well or maybe even slightly better in Q1 than it did in the previous quarter. There’s probably a continued growth of users, of trades, and I think those are all positive signs. I don’t know if you guys all saw this, but on Twitter, Coinbase announced a bunch of new tokens that they want to list and it’s a lot of stuff that people don’t necessarily know. Some of them people do and a decent number of them people did not know, and that’s something I’ve been thinking about because it seems like they’re trying to compete with Uniswap because it’s so easy to go and list a token on Uniswap. Once you have an airdrop or whatever it’s immediately on there, whereas with Coinbase it’s just so much harder to do that, but they’re trying to list as many tokens as they can. That’s gonna be an advantage that Uniswap will probably have over centralized exchanges. I think you guys made great points and the way you guys think about Uniswap is something I definitely agree with, a very holistic picture.

We can jump now to the next slide, and I want to talk about the growth of Polygon. This is a graph we’ve included in the report, but on the left side of this chart here, you got to see some of the scaling solutions start to take place in terms of liquidity. It’s still very dominated by Ethereum, which is the dark and light blue shading, which represents V2 and V3, but one of the biggest winners of Q1 was Polygon. Their growth was very organic, there weren’t any liquidity mining incentives that went live in Q1, they I believe are live now for the first week of April. When Polygon says they’re going to institute liquidity mining, my question for you guys is does Uniswap or do people in the community have any sort of interaction with the Polygon team? How do people hold them to it to make sure that gets implemented?

Boris Stanic (15:42): Maybe I’ll answer this one since I was the most involved. I tweeted out a small thread about 100 days after the proposal passed and there wasn’t too much news about the liquidity mining incentives, but I wasn’t paying enough attention so that’s a mistake on my part. There was actually a developer from Polygon who was updating people but I didn’t follow him so I didn’t see this. Polygon main accounts are just too busy always updating us on the things that are actually launching, so they don’t update people on things they’re working on because they’re constantly launching something. To your question, we do not have a say in how liquidity mining incentives will look on Polygon, it’s completely organized by the Polygon team. As to how we will hold them accountable to make sure these promises are fulfilled, the Polygon team is a highly respectful one and even though it’s not common in crypto, we trusted that they will. There wasn’t a trustless process, so they said there would be up to $15M in liquidity mining incentives and we said, “Yea sure! That sounds good.” If some time passed and if they didn’t do anything, we wouldn’t be able to do anything as well, but I know the other internet research group that’s being supported by the Uniswap Grants Program is actually researching how we can make this trustless. If someone claims that they will do something if a proposal passes, what kind of mechanics can we implement so this becomes a trustless process and it gets executed automatically? Hopefully I didn’t miss any of your questions.

Jerry Sun (18:06): No, I think that’s great. In the governance proposal for Polygon, and the way you phrased it as well, you know it’s phrased as “we’re going to give up to $15M of liquidity mining incentives and up to $5M to support the ecosystem around V3 on Polygon.” I saw recently through the live liquidity mining that right now they’ve set aside $3M through a third-party, and what I’m curious about is if that’s what traditionally occurs when they say we’re gonna give “up to 15” but then they set aside $3M? Also, is it common to use a third-party, I think they used Iracus Finance, to go and set that up? Are those things you traditionally see?

Boris Stanic (19:07): I think this was the first time in history, at least of Uniswap, that somebody promised something and then liquidity mining incentives happened. I don’t think there’s a usual case for it or am I missing something? Do you have any other examples of this kind of deal happening?

Federico Landini (19:41): I don’t think it’s happened in the Uniswap ecosystem, and as Boris was saying, it’s probably an area of improvement where governance has to figure out how to make sure these agreements are followed up on. I think it’s an area that’s interesting, but in this case it was the first time so maybe it was not perfect but in the end it came through.

Jerry Sun (20:23): Right, and to summarize here, Polygon has had organic growth even without the liquidity mining. They’ve been the fastest rising in terms of growth relative to time out of the non-Ethereum scaling solutions for V3, so they’ve done a tremendous job.

Federico Landrini (20:47): As we said at the beginning, we are running a Uniswap analytics program, and one of the bounties that we published was exactly about the growth of Uniswap on Polygon. We got some really great dashboards from the community that show how fast Uniswap was able to affirm itself on Polygon, and in less than a month it became the biggest DEX on Polygon without liquidity mining incentives. I think this is a very interesting data point that our analyst in the community pointed out.

Jerry Sun (21:27): Right, and the Polygon community is just, in general, very big too, so I think there’s a lot of market capture opportunity for Uniswap.

Yj (21:39): Yeah, that’s what I was going to say. I think part of this is dependent on how much ERC-20s have already been bridged over from Mainnet to Polygon prior to the Uniswap V3 launch, following the successful governance proposal. The different scaling solutions all went online onto Mainnet at different times, and then on each of them, they are different major and maybe chain-exclusive projects that launch on them. Some of them, like Polygon, I haven’t really looked into the data yet and maybe this is one analysis that would be interesting to look at, but they might have already had a lot of projects and tokens being bridged over or launched natively or exclusively for Polygon. So when Uniswap is there, there’s a lot more tokens available for liquidity and swapping. That’s maybe a gut feeling on my end, since I haven’t looked at the data. Then in terms of the liquidity mining promise, it’s going to be very difficult as a community and grants program to encourage more trustless tooling and processes to make everything smoother and better. But if you think about it, when the Polygon governance proposal was put out, there was never any cross-chain governance process or tooling at all, so it had to be a trust-based thing. When they, “we will launch on Polygon,” at the time, Uniswap Labs had to work with them to launch it and put in the rails to make sure everything works. Since then, things have been happening and UGP actually funded GFX Labs to start researching cross-chain governance for Uniswap, and that resulted in a successful test case activation of one of the basis point pools on Polygon, just a few days ago. Hoping that as a grants program, we can encourage more and more of this type of research and tooling development to make things move towards full trustlessness.

Boris Stanic (24:05): Can I just share one thing when it comes to L2 solutions that I think might be important?

Jerry Sun (24:13): Yeah, absolutely.

Boris Stanic (24:15): So we have a graph here of liquidity and I don’t think that liquidity and volume, in terms of numbers, is as important as a number of unique addresses that interacted on the certain L2 solution. Big whales and big traders will always prefer the security of a main chain and liquidity of a main chain over trusting some L2 solution because the safest chain is the Ethereum chain. But what happens on the main chain is that smaller traders get priced out by gas and here is where L2 solutions come into play and they make it so that you can still do trustless swaps in a fully decentralized way, well not fully but as far as it currently goes. It just opens the door for smaller traders to enter the scene and invest in the tokens and swap tokens that they like, so that’s what’s one point that I want to share.

Jerry Sun (25:32): Right, I think that’s a great point. I guess Boris, to add on to what you’re saying, one reason why, in my opinion, Polygon has really taken off is that it’s just seen as a side chain. It’s very easy to bridge between Polygon and Ethereum, but you go to something like Optimism, optimistic L2 rollups, and it’s a little bit more difficult to move money back and forth, in terms of waiting periods and things like that. So I assume that when zk-rollups become live or you can launch smart contracts on zk-rollups, the governance community at Uniswap are probably gonna go and try to set that up as well, and we’ll probably see some good organic growth from there too because again, like you said, there’s cheaper costs but you don’t have to worry about some of the the difficulties with using the optimistic rollups in that sense.

Boris Stanic (26:34): Yeah, definitely. The L2 scene is still developing and people put a lot of hope into zk-rollups to make it even better, but we’ll have to wait and see. Ethereum as a chain is also progressing and will be able to sustain more transactions per second and the combination of these two things might make it so that we don’t ever see $300 fees on Uniswap ever again. It will be something that we will tell kids about, you know, so the whole scene is just making it so that it can sustain higher throughput in a sustainable way, so not jeopardizing decentralization and security too much. That will enable lower fees, which will enable more people to actually use Uniswap as a dapp on those chains.

Jerry Sun (27:52): Right, right. Yj you mentioned something that I thought was pretty interesting, which is the cross-chain governance proposal that’s going on right now with Polygon. I talk about it in the report, but extremely successful, and I think a very good example of governance coming together and coming up with something that is really beneficial to everyone; to LPs, to people who want to make swaps on Uniswap. I think since its creation it’s generated like $2.5M to $3M of fees for LPs, so that’s a big win for everyone. I guess I’m kind of curious to hear your thought on this, because in terms of cross-chain governance, this is the first example of cross-chain governance, but in the future how do you envision cross-chain governance to play out? Do you think, “right now it’s live on Ethereum and then gets implemented on Polygon,” do you think that will continue to be the case? Do you guys think it might be the other way around, where maybe you test something on Polygon if there’s a little less activity you see if it works, and then you try it on Ethereum? Assuming cross-chain governance works, what are your takes on that?

Yj (29:15): I think it’s hard to say. It’s still developing, it’s so new. And just in governance in general, even voting mechanisms, are being changed all the time by different projects and people are still experimenting on it. The thing with Uniswap governance and the Uniswap protocol as a whole is the immutable nature of it. So as it stands now, that has been deployed without further governance proposals that get passed and executed. There is no simple way of doing more complex cross-chain stuff, so the Polygon one has to necessarily go from Mainnet onto Polygon because the $UNI token where voting power lies is on Mainnet Unisawap, right. And actually, in the previous community call that Boris hosted, we also quickly discussed this in terms of governance, the fact that $UNI token actually loses its voting power if it’s bridged to other side chains or L2s, if you put it in LP, if you put it on lending protocol. We actually have a current live data bounty program asking the community to contribute to this, and to look into the extent of loss of $UNI voting power when you utilize it for other things. But going back to your original question, you were saying whether I personally see experimentation being done on L2s or chains before moving back, I mean as it stands that cannot happen, but that’s not to say that it will not happen. I’m personally quite excited to see what people come up with to experiment on this, and actually Uniswap Grants Program is looking for people to submit applications to research and maybe prototype or test or experiment with all these. I think it will be pretty exciting to see, and of course with Uniswap continuing to get deployed on other chains, stuff like cross-chain processing mechanism will become more and more important, so I’m personally quite looking forward to seeing the new stuff that can come up from there.

Jerry Sun (31:31): Right, definitely. Well, you know, you bring up the grants program, and you guys are exploring a lot of different ways to do some studies on how you can do governance with the $UNI token on other chains, and just other initiatives in general for the grants program. I want to talk about the grants program a little bit here, this is obviously your bread and butter, seeing all these proposals. The first question I have is a fun one for myself which is, when I go and DM the Uniswap Grants Program Twitter handle, which one of you guys is responding to me?

Boris Stanic (32:15): None of us, I think. We have a shadow writer.

Jerry Sun (32:24): Well whoever that person is, I just wanted to say how very friendly and very helpful, so thank you. Thank that person, whoever it is.

Boris Stanic (32:35): I mean, I think you can deduce who it is. It’s nobody in this chat.

Jerry Sun (32:41): Right, of course. Well tell us a little about the grants program, how are decisions made in the grants program? In terms of deciding what projects or proposals get funded, is it a group decision? Do you guys each look at proposals individually? What is the structure of that?

Yj (33:11): Boris you undertake this one?

Boris Stanic (33:14): Okay I’ll do it since I think I’ve spent the longest period of time as part of the grants program. Essentially, it is a group decision and a key question that we always ask ourselves when we look at the applications is: does this fall into the grand program scope? So the program was established by the governance to fund public goods and promote the protocol in the ecosystem, but promoting doesn’t really mean marketing, at least that’s what we believe. So when you look at the public goods, one key question that we ask ourselves and look for in the application is: will this happen if we don’t intervene? So let’s say somebody is making a for-profit project, and then a small part of that for-profit project touches Uniswap, and they would like us to fund development of the project for that part which touches Uniswap. The answer to the question, “will it happen if we don’t fund it?” is yes because they’re building a whole project also and this key part will also be part of it. But on the other side, we have different SDKs, libraries, and things that wouldn’t really exist or, even better, wouldn’t exist in a humane way, because somebody would spend hours and hours developing it and making it great for the others to use and wouldn’t get any kind of compensation for it. That’s when we step in with our connections, so grantees have questions and we make sure that they get answers, and we also support them financially so that they don’t work on these things for free. We have a small process, we do weekly sprints where we have two ongoing sprints at the same time, so we do interviews and then we do you know discussions and internal reviews. These are two separate sprints where, if the previous week was interviews, the current week is discussions, and we try to find more information if we need it. Then for the interviews, we just do the interviews and take notes so we can discuss it and do more research the next week. I think since Fede and Yj joined we’ve had the just right amount of reviewers and people to not have an expanding backlog like we had before, so I think we’re pretty up to date right now. But it’s always a discussion and our working group trusts each other, so maybe if I personally don’t see value in some proposal but Fede or Yj think that it’s really good for the ecosystem, I will trust their call. Of course we are not perfect, we make mistakes and we try to correct those as well through some of the other grants that we do, such as Gitcoin, where we actually let the community decide how funds will be distributed. Hopefully that answers your question.

Jerry Sun (37:45): Right, definitely. This is not the most direct comparison, I know there’s some differences, but I think the grants program almost like you guys are investors and you’re making investments not for for-profit businesses per se, and you’re not looking for a direct financial return, but rather to grow the ecosystem to benefit the Uniswap protocol and the crypto community as a whole. So when investors give money to a project, typically they also get updates maybe once a month or once a quarter, as they want to know how their investment is doing, what have you guys done with this funding, and things like that. I know there’s not always follow-ups in terms of governance, but with the grants program, if I want to come to you with a project for $25,000 and then you guys approve it, what goes after the approval process? Do you have check-ins with the proposer?

Boris Stanic (38:57): Somebody else should answer this, but yes, so maybe Yj they or Fede since you know the process.

Federico Landrini (39:03): Yes, we have continuous checks, monthly or bi-monthly depending on the project, to check the the status and to try to help the grantee as much as possible with our connection to the Uniswap Labs team or to other resources from other projects. As I shared at the beginning, I was a grantee myself so I went through this process and this is what made me more and more involved in the community, and at the end, ended up part of the grants program team itself. It’s also an opportunity for the grantees to be involved more, to participate in hackathons, in presentations, really it’s not only that they need to work on their project but it’s being part of the community and helping each other to be successful in the end.

Yj (39:53): Yeah, I think the distinction between VC investors and the grants program is an important one, in the sense that when we accept a grant application, we will ask for a sensible timeline and what the plan is. Then we put in sensible milestones for those check-ins and they don’t have to be super straight in terms of deadlines or timing, but if we don’t hear something back from a grantee, the main worry is that they are facing blockers that they cannot surpass. We are here to encourage people to work together in open-source ways and create public goods for the Uniswap ecosystem. So the worry is not so much about people running away with $5,000 or something, it’s more about if there is something blocking you from achieving the aims of the grant that you applied for. So the check-in plays a role in that sense, to see how we can help, because as Fede said, they might need some input from the Labs team, they might need input from from other people within crypto, so we try to make those connections for them in order to maximize the return from grants. And, you know, Uniswap Grants Program was given a mandate to do so by community governance, so that’s a bit of a difference.

Jerry Sun (41:26): Right, that makes sense. From you all’s perspective, what are some of the biggest challenges that you guys face when you go through proposals, when you accept proposals, and just managing the grants program? I’ve heard from people who are part of grants programs, and they always say it’s a very time consuming job, it’s a very extensive role. And you know, Fede, from what you’re saying it sounds like you guys have check-ins, and if you guys have check-ins with I don’t know how many grants you guys approve every week, I assume it’s you know one or two or several maybe a week, that’s a decent number of check-ins that you kind of continuously have to do every month or every two months. I’m just kind of curious, from your perspective, what are some of the blockers on your end if you guys have any?

Federico Landrini (42:28): Personally, I think the broadness of the space and the knowledge that you have to have to to judge some of the projects is the most difficult part for us, because as you know, crypto is a very very technical space, and we move from development to tokeneconomics to governance to analytics, so there is a very broad surface that we try to cover as much as possible, and when we cannot do it, we try to to get help in the community to get the knowledge that is required to understand the proposal.

Jerry Sun (43:22): Gotcha. Do you guys have any sort of funding minimum or maximum for any of the proposals? I know that these are kind of arbitrary, these waves, they don’t really correlate to any specific period of time, you just kind of batch them together. However, wave six is noticeably higher in terms of the funding than in previous waves, and a big part of that is due to the other internet funding. I think that was very significant, but just in terms of how much you’re able to give, are there any sort of restrictions on your end?

Boris Stanic (44:07): There are no restrictions really, well other internet grant was really big, but it’s actually delegated funding, so they will use those funds to fund more grants and research and different people, so it’s not just a team where five or six of them get the whole million dollars. It will actually be sort of like a subDAO or committee, but they do great things in the research, so that’s why we decided to support them. When we talk about minimums and maximums, there are no such things, but you’re right, wave eight already exists but it wasn’t announced so it’s just an arbitrary amount of applications that we you know cut and then you say, “okay this is a wave.” Also some things that you’ll probably see in the wave eight that we started doing recently are smaller grants, and we’re open to having a smaller part especially when it comes to different events in different parts of the world and different communities. So for spoilers, in the wave eight you will see a lot of smaller grants that are targeting different events and communities across the world, and we think that that’s a great way of just spreading the word of Uniswap and also helping these communities grow because, let’s say $5,000 to some community event that is not in the most expensive part of the world will encourage more people than you would otherwise get. You will have a greater impact than spending $20,000 or $30,000 on a San Francisco event, so we are more open to sponsoring these smaller grants recently. Maybe something to add Yj?

Yj (46:41): Yeah, I was going to say that in terms of the amounts, at the end of the day, the grants program is somewhat a reactive process, so we do not prescribe or dictate how grant applications should be. It’s somewhat reactive and organic in the sense that it might just happen that during wave six, for whatever reason, a lot of people happen to prepare their grants application and submit their model at the same time, and then the ones that were deemed fundable just all added up right. Then, what Boris was saying about the spoiler alert for wave eight, we don’t know why, but wave eight actually had quite a few more event sponsorship-type grant applications that came in of different sizes, and we made the decision to fund them because we see value in them. So that’s why some funds, some waves, given that arbitrary like drawing of timing, can be big or small or can be anything really. But one one thing to note would be that we avoid funding things that are just purely an idea with no work done yet, like if someone comes in and say, “I have this grand idea but I haven’t done anything about it, I need money to do it,” we try to avoid doing that normally. Our thinking, and I think we’re in alignment, is that grants funding should be mostly for things that people already put some thought and effort into, already pursued, and have some minimal progress to show. So that also influences our decision-making process.

Jerry Sun (48:24): Right, you guys want to see a minimum viable product, I guess.

Boris Stanic (48:30): It’s not really that we demand, it’s just the necessity because we are a small grant program in terms of people who are part of it, and we don’t have enough manpower to get the whole project off the ground because that’s the hardest part, getting it off the ground. We are here more to help you get from the current stage of your project to the next stage of your project, but getting the whole thing off the ground is currently too much for us. Maybe sometime in the future if we grow in numbers and manpower, we will be able to support such ideas, but right now it’s more about getting the projects to the next level.

Jerry Sun (49:24): Right, right. Some of the things that you said in your earlier answer, Boris, about funding events in some smaller places, I think that’s a really great idea. You’re really stretching the value of the funding in a lot of ways, and I assume some will be similar to Art Basel and we have it on the screen here as one of the things that you guys funded previously or funded last year but, uh I think that funding went to setting up a booth right to onboard people into crypto. Is that a similar goal that you guys are hoping to achieve with these funds for the smaller events?

Boris Stanic (50:10): For the smaller events, when we think about it, it’s not as much about Uniswap as it is about onboarding people to the cryptocurrency space and blockchain space in general. So we want to support people getting into the community of blockchain in general, and then eventually they will stumble upon Uniswap almost for sure, which is great for us. So yeah, we want to support these communities to grow and eventually they will reach Uniswap as well. And yeah, a similar case with Art Basel, we thought that there will be a lot of people there that have interest in cryptocurrencies, but maybe didn’t have anybody you know to onboard them to the space, so we thought it’d be a great idea for us as a grant program to support that.

Jerry Sun (51:26): Right, gotcha. That makes a ton of sense. I’m really excited to kind of see the grants that get released in wave eight. You gave a little spoiler here, but curious to see what things got funded. If we move to the governance section, I know we got a couple minutes here at the very end, and I know there are some questions that we’ll get to from the community, but if we go to the next page in this deck, the last page in this deck, I’ve got a list of some major governance updates from this past quarter. It’s a little bit small here, but one of the things I really want to talk about and get your personal opinions on is the fee switch. This fee switch is something that everyone talks about, it’s very famous in the crypto community, and I think for this particular proposal, it got rejected because it sounds like people wanted to go and set up a research group to understand how to best set up the fee switch or how to best turn on the fee switch. In your personal opinions, when do you think the fee switch should be turned on, if ever, and how should it be done if that time does come?

Boris Stanic (52:55): Yj maybe you take this one, I know you have a lot of opinions about the research.

Yj (53:02): Sorry I was just typing answers in the chat. I think the fact that no consensus has been forthcoming kind of just says it all. We have people asking about and proposing it and and talking about it, but it never really got enough traction as far as I can see, so in terms of the incentive, if you have fee switch then the community treasury will get the fee, so it gets fed back to the community treasury which is also controlled by $UNI token holders with delegated voting rights. So if overall, the dedicated voting power collectively feels that fee switching is a good thing, then I would imagine you go ahead and at least progress a bit further. My personal opinion right now is that nothing is happening yet, maybe there’s no real need for it yet, but it can happen anytime, so we should continue conversations and have debates about this. If possible, we should get some data-backed opinions or commentary on it to see what to do next, so that’s what I think.

Jerry Sun (54:45): But do you think the fee switch will ever happen? Because, in theory, there is a potential future where you have this fee switch and it just never gets turned on, because the way the current system is, LPs get a lot of fees and it works for them and then Uniswap as a protocol provides a service, they don’t necessarily earn protocol revenue that goes to the community. I don’t know if you guys think it will ever happen or not?

Federico Landrini (55:19): It’s a good question and I don’t think there is an answer. It’s very difficult to forecast what will happen. For me personally, the important part is the health of the protocol and the growth of the protocol, and then I think that when the community is ready and we know what we want to do, we can find a solution. The important thing is to have a LP protocol, and then once we decide to switch or another governance decision that improves the tokeneconomics of you of the $UNI token, it could work. So for me, the key thing at the moment is to really focus on the health of the protocol, as you showed your report.

Jerry Sun (56:04): Right, right. I think that makes a lot of sense. We have a couple of questions from the community here, so I think we could spend the last couple of minutes answering those. The first question I notice is, “please tell us quarterly volume of centralized exchanges like Binance and Coinbase, so we can compare how they are doing with Uniswap.” To my knowledge, I think Coinbase processed about $525B worth of trades in the quarter and I think the previous quarter was around like $330B or so. For them, it was an increase, but compared to Uniswap, if you look at the quarters, I think Uniswap processed about $180B. So the values you’re looking at are $180B and $525B. Uniswap is processing about a third of the transaction volume of Coinbase, but Coinbase is seen as a traditional fiat on-ramp for a lot of people. Institutions are also heavily active on a lot of centralized exchanges, so it’s not a direct apples-to-apples kind of comparison in that sense, but I think to say that Uniswap is processing a third of the transaction volume of a company like Coinbase is no small feat, in my personal opinion. Another question I’ve got is, “the purpose of Uniswap grants is to encourage development of projects built on top of the Uniswap protocol or something else?”

Boris Stanic (58:00): It’s to grow the Uniswap protocol and its ecosystem, so we encourage development on top of Uniswap. We believe if we make it streamlined, easier, better documentation, more resources supporting more programming languages and make that whole process more enjoyable, that is how we encourage development on top of Uniswap. Finding strategic partnerships and things like that is out of scope for the grants program, so we are here so that once you decide to build on top of Uniswap, you have the best time of your life. But making you and giving you a reason to do so, that’s more for that particular team or a person to decide on.

Jerry Sun (59:02): Right, got it. This last question we have from the community is: these governance proposals seem fixated on extending Uniswap to other fledging protocols. This is worrisome. Who is focusing on making the core product better and easier to use? This comes from John. I can answer this one as well. We’re talking about the uniswap grants program, and that’s separate from Uniswap Labs. Uniswap Labs is doing a lot of the development of the protocol they’ve got the engineers who are working on the protocol. The grants program is a portion of the funding from the treasury and their mandate is to essentially, like Boris was saying, build the Uniswap ecosystem and spread awareness on the crypto economy as a whole, so completely separate. I’m sure the people at Uniswap are definitely working on improving the product, and I think we are at time here so we can just about wrap up. John’s question is actually very related to my final question which is: you guys are a little bit closer to what’s going on with Uniswap than many of us on the call, so I wanted to just quickly ask if you have any alpha or any insights into what Uniswap V4 might look like. I think we’re all kind of curious.

Yj (1:00:35): I don’t have anything. I actually don’t. I have no idea and that’s why we were saying the other day, remember that the grants program is completely separate from Uniswap Labs, so I don’t know, maybe Boris has some alpha.

Boris Stanic (1:00:53): To be honest, the first time I heard about V4 was yesterday when they were discussing some applications and somebody said, “this will help in researching the V4,” and so that’s as much as I know about the V4. Did somebody say there will be a V4?

Jerry Sun (1:01:17): I assume there will be, that’s kind of my assumption.

Boris Stanic (1:01:21): Okay, this is just my personal opinion of what Uniswap V4 might be. So Uniswap V4, in my opinion, will be a Uniswap that combines all the different deployments. You’ll have a single interface, you’ll select which token you want to swap to which token, and it will execute on some chain where you will get optimal fees, slippage, price and execution time. You won’t even know where it executed, but the tokens that you wanted will end up in your wallet and that will actually be the V4. We, as a governance, deploying Uniswap V3 on all these different chains, scaling solutions side chains whatever, is the path to V4, but as I said, this is just my opinion of what V4 might be.

Jerry Sun (1:02:29): All right. Fede, Yj, do you guys want to make any predictions?

Federico Landrini (1:02:33): No, no predictions. I like the vision of Boris, but it’s just a wish at the moment. We really don’t have any kind of insight on a roadmap or anything like that.

Jerry Sun (1:02:47): Got it. Alrighty, well we are kind of past the hour here. I appreciate you guys all hopping on, this is a really enjoyable experience and I enjoyed getting to chat about the health of the protocol, what you guys are doing on the grants program, and some of these roadmap and governance updates that are currently ongoing. Thanks everyone for tuning in, the audience and to the three of you guys, and wish you guys a good rest of the day.