Key Insights

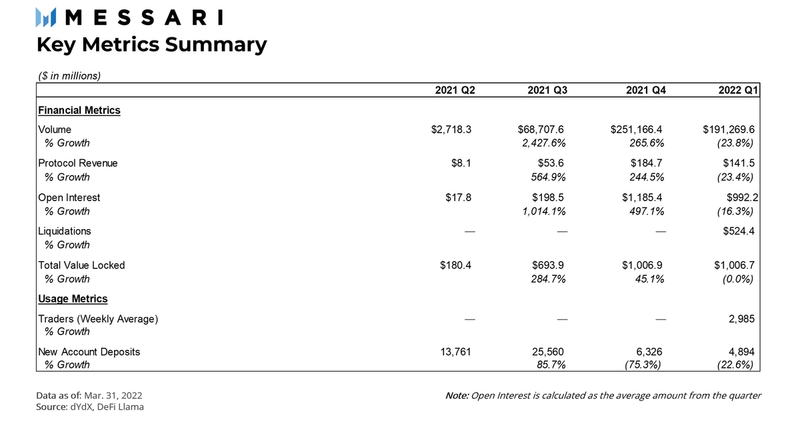

- dYdX trading volume fell 23.8% in Q1 compared to the previous quarter, which coincided with decreases seen in other spot-based DEXs and with a broader decrease in crypto market capitalization as a whole.

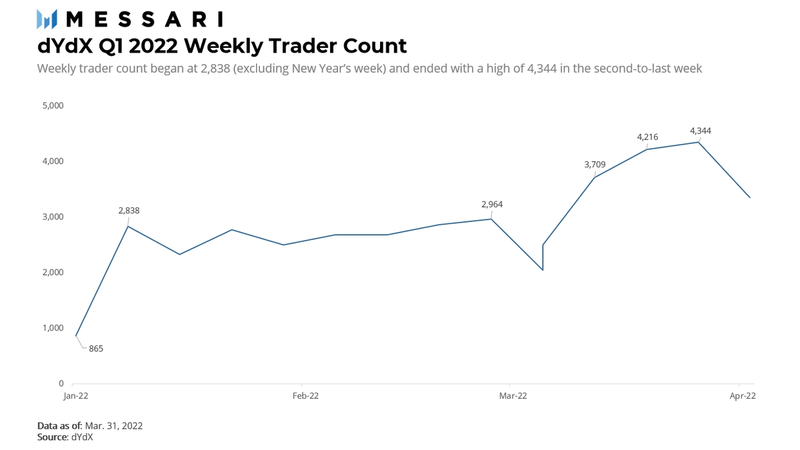

- The number of weekly traders using the protocol has been trending upwards from January to the end of the quarter.

- New account depositors in the quarter fell for the second quarter in a row after peaking in Q3 2020

- dYdX announced new features on the protocol, including beta-testing of a new mobile app, a gamified Trading Leagues platform, unique user profiles, and a corresponding new NFT avatar collection called Hedgies.

- One of the most anticipated objectives for the remainder of the year is the launch of dYdX V4, which will fully decentralize the protocol and prevent any single party from controlling the protocol’s revenue.

Introduction to dYdX

dYdX Protocol operates a derivatives exchange on the Layer-2 StarkEx network. Cleverly named after the mathematical notation, the hybrid-decentralized exchange offers perpetual futures contracts similar to the ones found on Binance, FTX, and other centralized exchanges. The protocol’s ultimate goal is to build a fully decentralized derivatives exchange where no single party, including the team itself, can claim authority over the protocol’s fundamental operations.

dYdX was founded by Antonio Juliano, an ex-Coinbase engineer, who began working on the idea in the summer of 2017. The protocol’s first two products, Expo and Solo, were built for margin trading on Ethereum. After seeing the explosion of perpetuals trading on Bitmex in 2019, dYdX decided to become the first DeFi protocol to trade perpetuals. The launch of perpetuals for major tokens like BTC and ETH quickly grew in popularity among traders seeking to use margin. Ease of use was later further improved with the addition of StarkEx layer-2 rollups in 2021. In hindsight, it is quite clear that dYdX’s shift to perpetuals has paid off — the protocol has retained its status as the leading DeFi derivatives exchange.

During Q4 2021, the dYdX community lowered market maker thresholds and increased staking rewards for the protocol’s native DYDX token (stkDYDX). Additionally, the dYdX Foundation rolled out a mobile app in beta on iOS; started Trading Leagues, an open-ended trading competition; launched public trader profiles; and unveiled Hedgies, an NFT collection.

Macro Overview

At the end of Q1 2022, dYdX operated 33 markets, ranging from layer-1s networks to blue-chip Ethereum DeFi tokens. Just like centralized derivatives exchanges, BTC and ETH comprise the majority of trading volume at 45.8% and 39.6%, respectively. The high trading volume of BTC and ETH, consequently, also makes it the highest source of fee revenue for the protocol.

Fee revenues are earned by the protocol as a percentage of each trade. Just recently, on April 19th, the protocol ended a temporary fee holiday where those fees were reduced by up to 66%. In our analysis, it’s worth noting derivative exchanges operate with more capital efficiency since most trades are leveraged and fees are taken on each trade’s notional size. A protocol like dYdX can stretch their revenue per dollar of collateral metric further than other DeFi business models. For example, comparing Q1 revenue-to-TVL ratios for dYdX and Uniswap shows the former calculating out to $0.14 per dollar and the latter achieving a fraction of that at $0.02 per dollar.

Traders are incentivized to use the protocol through a Trader Rewards program. The mechanism distributes 3,835,616 native DYDX tokens each epoch (which lasts 28 days), to participants who have paid fees or hold positions in active contracts. A special formula is used to determine how those tokens are distributed to qualifying users. The rewards program is scheduled to last five years and is designed to boost trading volume on dYdX.

With that in perspective, dYdX facilitated $191.3 billion of trading volume in Q1 2022. The number was 23.8% lower than the total volume seen in Q4 2021. One big reason was the change of sentiment around crypto markets. In Q4, BTC and ETH both hit all-time-highs, and NFTs saw a resurgence in popularity. As a result, trading activity increased across the ecosystem, and dYdX was no exception. Interest in crypto was bound to revert back to the mean, bringing total dYdX volumes down with it.

Further trading behavior was analyzed in a recent report by Max Holloway and the team at Xenophon Labs. The team concluded that in the current rewards mechanism, traders are incentivized to maximize rewards by making trades at the end of each epoch. Making those trades towards the end provides two things: (1) traders receive their rewards shortly after making their trades, and (2) traders can better quantify the value of expected rewards.

A quick glance at the chart above superficially supports that data. Every four weeks, there is the occasional week of high volume as each epoch ends. However, incentivized activity is common with DeFi protocols, and it’s possible trading levels would be more evenly distributed if the rewards program was removed. Debates within governance have also taken place to determine if the rewards program should be adjusted to measure activity on a daily basis instead of by each epoch. Support was garnered from the community but no action has taken place to change the distribution of rewards.

New depositors, a proxy for new accounts, have decreased significantly since a hot Q3 2021. The metric declined 22.6% in Q1 after declining 75.3% in Q4 2021. A total of 4,894 deposits were made in Q1, bringing the total depositor count over the last year to 50,541. Although the slowdown of new accounts may seem like a challenge, the number of dYdX traders is naturally lower than spot-based DEXs because trading on leverage can be too risky for the average investor.

The weekly trader count had a positive trend throughout the quarter. Even excluding the global minimum for the first week of January (ending January 2), weekly trader counts went from 2,838 to 3,345 with a high of 4,344 traders in the second-to-last week. The most significant weekly decline occurred for the week ending March 6, which was a chaotic week for markets in general following Russia’s invasion of Ukraine.

Open interest is a measure of the number of open contracts held by traders. When traders open a position, the total open interest number increases; when they close out of a contract, the open interest count decreases. The metric is commonly used as an indicator to confirm trends in markets.

Open interest edged upwards this past quarter to end at $1.3 billion. That value includes both long and short positions. Although it is difficult to glean direct information purely from open interest, The rise in open interest this past quarter could be a sign that speculators are re-entering the market after the previous quarter’s slowdown.

Perpetuals Market Spotlight

The first version of dYdX’s perpetuals product started with three markets: Bitcoin, Ethereum, and Chainlink. Over the following two years, dYdX expanded to 33 markets supporting a variety of widely traded tokens, with an emphasis on blue-chip Layer-1s and DeFi protocols. This report focuses on the markets with the highest Q1 volume: BTC-USD, ETH-USD, and AVAX-USD.

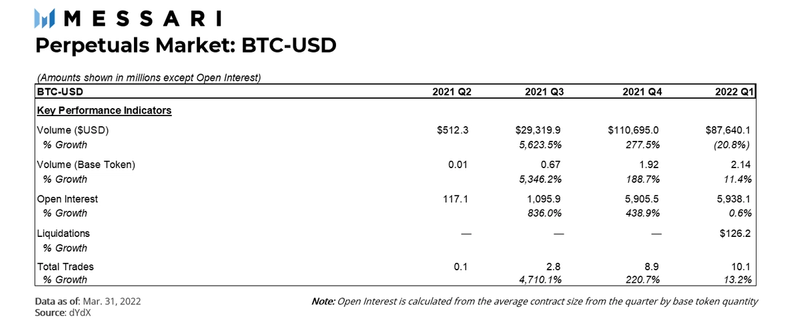

BTC-USD

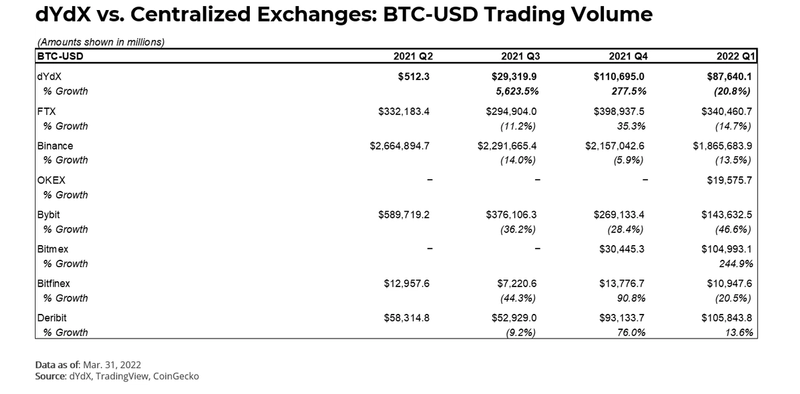

BTC-USD was the first market available through dYdX and is still widely traded. Total volume in Q1 was $87.6 billion, which was 20.8% lower than the previous quarter. The decline in trading volume is in line with the decline in overall trading volume for the protocol. However, in Q1, the trading volume of BTC perpetuals surpassed 2 million BTC tokens for the first time in a single quarter.

After comparing BTC trading activity on the protocol to the same activity on several centralized exchanges (FTX, Binance, Deribit, OKX, Bybit, BitMEX, and Bitfinex), the results showed that dYdX should be considered a serious competitor in the ecosystem. The protocol facilitated $87.6 billion in trades in the BTC perpetuals market, nearly the same amount as that of established exchanges such as Deribit and BitMEX.

Bitcoin open interest hit an all-time high in Q3 2021 amidst a frantic bull market. Many traders opened new contracts to gain margined exposure to the price movement. The count of outstanding tokens rose from just over 1,000 to an all-time high of 8,348 on October 19, 2021. Open interest then decreased in Q4, bottoming out at 4,620 tokens before finishing this past quarter about halfway between the local maximum and minimum at 6,547.

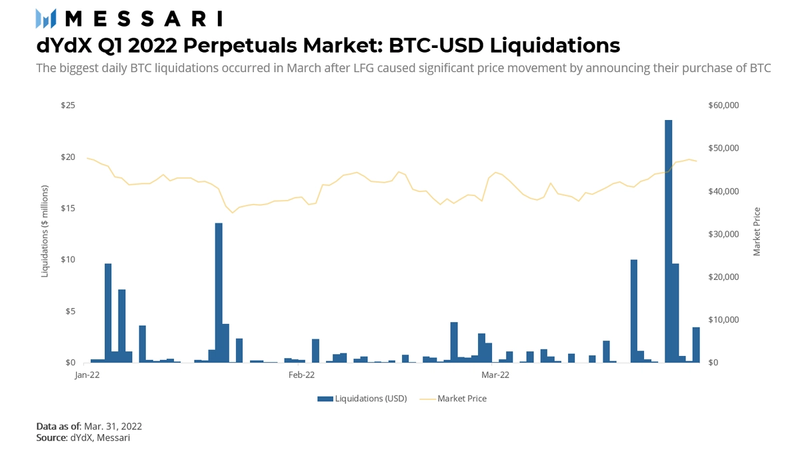

Daily bitcoin liquidations peaked on March 27 at $23.6 million. This particular day was notable as bitcoin returned to its breakeven price on the year and reached as high as $47,000 on the market. The token price increased 4.4% on the day, fueled by the $125 million purchase of BTC by the Luna Foundation Guard. Such a sudden intraday jump likely triggered a large number of liquidations by those who were holding short positions. The following day’s price was also particularly high, ranking as the fourth-highest day of liquidated contracts in the quarter.

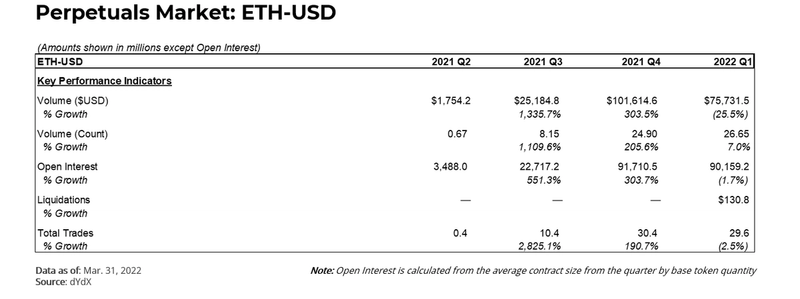

ETH-USD

Cumulative ETH trading volume for the quarter fell to $75.7 billion. The largest trading day occurred on March 14 while the lowest volume day fell on January 30. The daily range for the quarter fell between $255,000 to $2.3 billion, which is a 10x range between the high and the low. This wide range ultimately rests outside of the control of the protocol and more on larger economic events driving high-volume or low-volume trading days.

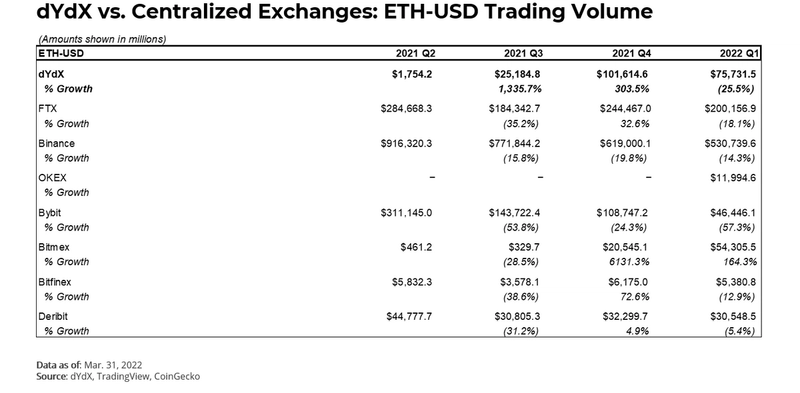

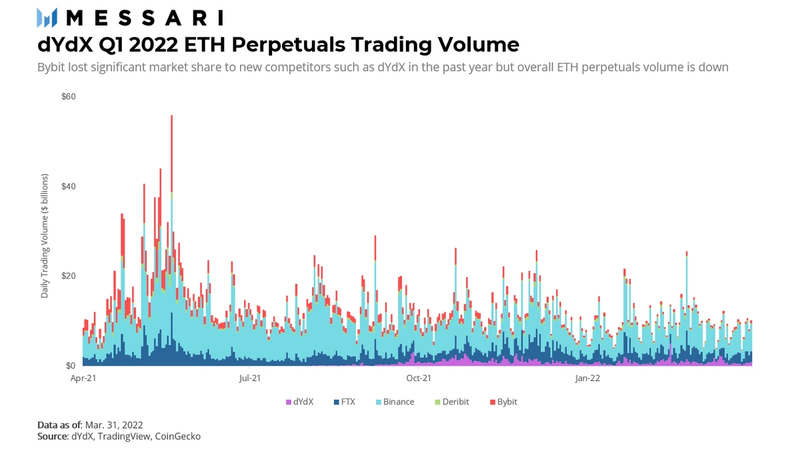

dYdX held a strong market share in comparison to centralized exchanges in the ETH market. Out of the seven other exchanges, dYdX volumes came in third behind Binance and FTX, which remain the undisputed leaders of perpetuals trading. Nonetheless, adoption metrics highlight how valuable the DYDX token airdrop was to usage; dYdX activity as a percentage of centralized exchange volumes soared from a few basis points to single-digits immediately after the airdrop.

ETH’s open interest declined throughout Q4 but is now seeing an upward trajectory heading into Q2 2022. A closer look at the metric shows open interest increasing when ETH fell to $2,500, then decreasing when ETH hit the $3,000 range. It then proceeded to rise again when ETH dipped into the mid-$2000s before flatlining as ETH settled into a range right before the end of the quarter. The overall movement of ETH open interest follows closely with BTC open interest as a strong correlation between the two assets continues to persist.

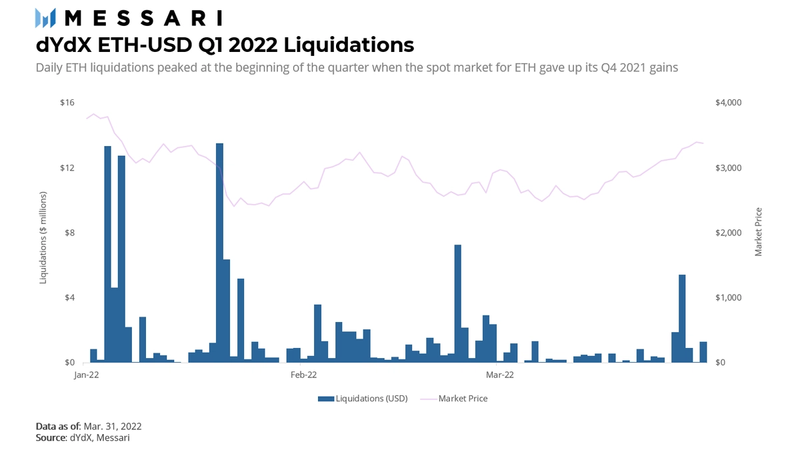

The highest daily liquidations for ETH this quarter all took place in the first few weeks of January. This came at a time when the market was reversing many of the gains earned in Q4 2021. On January 21, the ETH market saw its highest day of liquidations in the quarter. Not surprisingly, the day was brutal in the markets; the price of ETH dropped low/mid-double-digit percentages from the previous day. Notably, $13.5 billion of open contracts were liquidated after those holding the position failed to maintain the margin ratio.

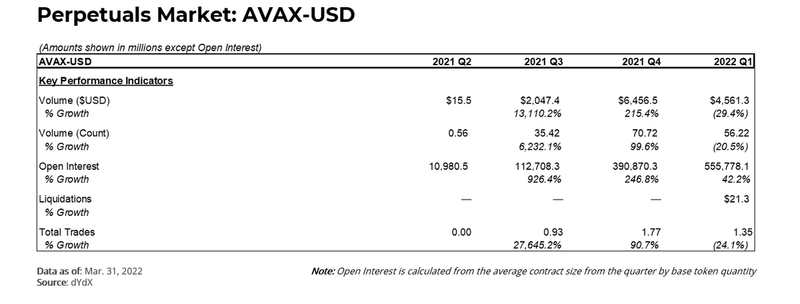

AVAX-USD

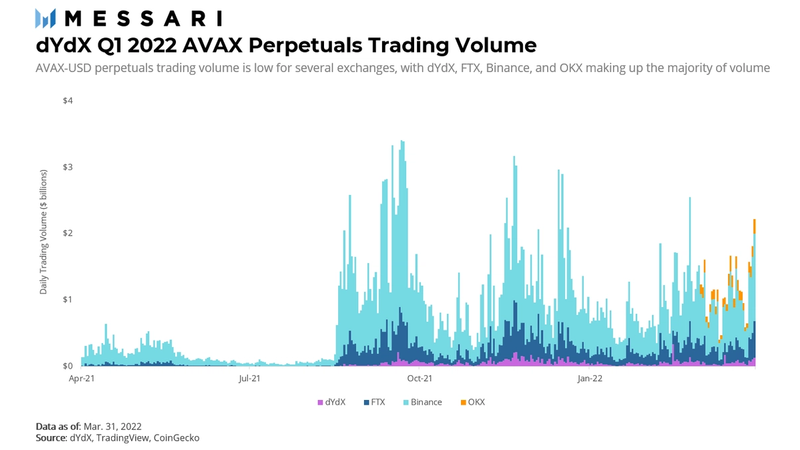

One reason for dYdX’s relative strength in AVAX trading compared to BTC or ETH is its position as a DeFi-native exchange. The protocol facilitated $4.6B worth of AVAX trades in Q1 while centralized competitors such as Bybit, BitMEX, Bitfinex, and Deribit only achieved 10% or less of the same volume. The only exchanges which outpaced dYdX were FTX and Binance at $20.0 billion and $59.0 billion, respectively.

AVAX open interest has been on the rise since August 2021 when the Avalanche network attracted attention as a popular, fast, cheap EVM-enabled network. As a result, in Q1 2022, open interest increased by 31.3%, going from 487,000 to 640,000 outstanding perpetual contracts. All of this occurred behind the backdrop of falling and then flattening AVAX token prices; the combination of falling AVAX prices but increased open interest could be read as a signal for increased investor interest in the blockchain network as a serious bet on the future.

Liquidations within the quarter amounted to $21.3 million. Peak liquidations were dispersed fairly evenly throughout the three months as the token underwent higher volatility relative to ETH and BTC. AVAX began the quarter priced above $110 and fell to a low point below $70 before bouncing back. The day with the most liquidations was January 7.

Trading Leagues, Profiles, and Hedgies

In an effort to continue attracting users, the dYdX announced a few new features to help gamify the trading experience. First, dYdX announced the creation of Trading Leagues in January. The leagues are a first-of-its-kind trading competition designed to boost volume by offering weekly prizes to the highest-performing traders. Prices are given out weekly (which dYdX refers to as a trading season) and vary depending on the specific league tier. Weekly cash prizes can approach $350,000. Users move between leagues according to their weekly performance. Think of the system like the one used for European soccer: the fear of relegation further incentivizes players to do well!

In conjunction with Trading Leagues, users are now able to create personal profiles. Other parties can select an individual profile and view the 30-day historical performance of that trader’s portfolio.

Hedgies were also introduced as NFT avatars for personal profiles. A collection of 4,200 unique NFTs was distributed on Ethereum starting February 1, 2022. Hedgies did not come with a mint cost; the only price to pay was gas fees. Subsequent mints beginning February 8 were given at the end of each trading season to the most profitable traders.

Source: Hedgies

Beyond their status as avatars, Hedgies come with practical utility. Holders of the NFT benefit from reduced fees on the dYdX protocol. Owning Hedgies increases the trader’s fee tier by one category. Since a higher fee tier (associated with a higher balance) decreases one’s trading fees, acquiring a Hedgie effectively increases capital efficiency for traders.

Governance Update

A few major governance proposals were active in the most recent quarter. As dYdX proceeds toward complete decentralization, governance will take on increasing importance in the management of the protocol.

January 7, 2022 – dYdX Grants Program

Reverie, a consultancy for DAOs, proposed to launch and manage a $6.25 million dYdX Grant Program (DGP). After passing the on-chain vote with unanimous support, 752,000 DYDX were moved from the Community Treasury to the Grants Multisignature Wallet (Multisig). As one of the largest community grant programs in DeFi, DGP increases the number of active contributors working on development, marketing, education, and other value accretive activities. The Grants Committee reviews all applications and controls the DGP Multisig.

February 1, 2022 – Liquidity Staking Pool Borrowing Requirements Framework

The Liquidity Staking Pool allows users to stake USDC for DYDX. The staked USDC is an interest-free, uncollateralized loan to pre-approved market makers, only to be used to provide liquidity to dYdX order books. While stakers do earn DYDX, they also incur counterparty risk, namely that a market maker won’t be able to pay back its loan.

To help add new, reliable, and creditworthy liquidity providers to the Liquidity Provider pool, the dYdX Foundation created a set of borrowing requirements. By passing the proposal with near-unanimous support, DYDX tokenholders, who still get the final say on who borrows staked USDC, agreed to use the framework to select borrowers. Under this new framework, prospective borrowers must qualify for Liquidity Provider Rewards in the preceding epoch (by providing more than 0.25% of maker volume), and create a public profile on the dYdX community forum with all the relevant disclosures, and agree to the revolving credit agreement.

February 12, 2022 – Reduce the threshold for receiving liquidity provider rewards to 0.25%

The dYdX Liquidity Provider Rewards program incentivizes market liquidity by giving DYDX to certain liquidity providers. This proposal, passed with almost unanimous support, lowered the minimum maker volume threshold required to start earning these rewards from 1% to 0.25%. This change bolsters liquidity by attracting more active capital from smaller, yet still consequential, market makers.

March 21, 2022 – Implement a Guernsey Purpose Trust for the dYdX Grants Program

Reverie’s proposal to implement a Guernsey purpose trust for the dYdX Grant Program passed with near unanimity. As a result, the committee and Multisig will turn into a Guernsey purpose trust structure: committee members will be trustees; multisig assets will become the purpose trust, and Reverie will be the enforcer. While maintaining the same level of tokenholder control, this new structure simultaneously increases functionality and reduces risk. Some benefits include allowing the conversion of DYDX to USDC (for grants) without tax liabilities, enabling off-chain agreements, and reducing legal liabilities for all parties.

dYdX Grant Program Updates

Since launching DGP at the beginning of the quarter (January 10, 2022), the program has pledged more than $2 million in grants. A few notable grants are listed below:

Approved:

Trading Strategy Bot: Bayswater Capital, a boutique investment bank based in South Africa, will build an open-source trading bot. Any dYdX trader, regardless of location, will be able to use the bot locally through a GitHub repo.

Tooling Page: Chaos Labs, a protocol security platform, will build a comprehensive webpage that includes funding rates (dYdX perpetual premiums), a rewards simulator to estimate trading rewards, and a command-line interface (CLI) trading tool.

In Progress:

Blockcrunch Podcast Sponsorship: Starting this month (April 2022), dYdX will become the primary sponsor of the Blockcrunch podcast for the next six months. Included in the sponsorship are brand shoutouts and commissioned guest episodes with members of the dYdX.

Completed:

Liquidation Alert Tool: A self-hosted tool that alerts users in their email, Discord, Slack, or Telegram when any of their dYdX positions are close to liquidation. The bot was built by Max Holloway.

DAO Organizational Structure Research: Davincifi received a grant to produce a research report examining the history of collective coordination and governance to provide actionable insights to dYdX. The complete report was published on Davincifi’s Substack and can be found here. Key takeaways from the report include investing in non-technical contributors, reducing the number of decision-makers whenever possible, and encouraging more participation from those contributing on the periphery of the ecosystem.

Roadmap

The biggest event on the horizon is the launch of dYdX V4. While V4 development is ongoing, the protocol also launched a new mobile app for on-the-go trading.

dYdX V4

At the beginning of Q1, dYdX Trading Inc. announced its plan to fully decentralize the dYdX protocol by the end of 2022. Right now, dYdX uses the StarkEx L2 as a settlement layer, but dYdX Trading Inc. runs an off-chain order book and matching engine on centralized servers and collects all trading fees. With dYdX V4, the matching engine and order book will be fully decentralized, and dYdX Trading Inc. will not control any part of the protocol or directly collect any trading fees. While dYdX Trading Inc. will continue to develop open-source software and support the protocol’s growth, aspects formerly under its purview such as market creation will be handed over to protocol governance (DYDX tokenholders).

V4 might also move beyond perpetuals and support other trading products (i.e., spot, margin, synthetics, etc.), expand and improve choices around margin and collateral, build rails to support permissionless market creation, and bring improvements to trading and market structure.

Due to potential constraints around throughput, finality, and fairness (frontrunning) this transition will be challenging. However, if executed, the step change in transparent, permissionless, high-performance trading and market creation will be monumental.

dYdX iOS app

In early March, dYdX became one of the first DeFi protocols to launch a native mobile application, albeit in a public beta. Onboarding through the priority waitlist was contingent on holding more than 10 DYDX or one Hedgie and doing greater than $1,000 in trade volume between March 9 and March 23. Additionally, eager beta testers can still join the referral waitlist by participating in social campaigns through Reddit, Twitter, etc. Once the app does publicly launch, all dYdX users will be able to trade and monitor positions on the go like they can with centralized exchanges (e.g., FTX, Binance, etc.) today.

Conclusion

Across the crypto derivatives market, there are two main types of exchanges: centralized exchanges and decentralized exchanges. Centralized exchanges typically have more resources but are hampered by regulations, marred by transparency concerns, and need to be trusted by users. Meanwhile, decentralized exchanges such as dYdX have fewer resources but offer solutions to the problems centralized exchanges face.

For dYdX, the belief that decentralized services will capture more of the market share in light of their advantages is backed by the work the team is doing. With a clear roadmap towards full decentralization and competitive trading volume, the protocol remains a formidable participant leading DeFi’s alternative derivatives exchanges.

This report was commissioned by the dYdX Grants Program, a member of Protocol Services. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. Paid membership in Protocol Services does not influence editorial decisions or content. Author(s) may hold cryptocurrencies named in this report.

Crypto projects can commission independent research through Protocol Services. For more details or to join the program, contact ps@messari.io.

This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. The past performance of any asset is not indicative of future results. Please see our terms of use for more information.

Appendix: