Notable Messari Intel Updates

- The Ethereum Foundation released a report including the foundation’s mission statement, philosophy, and 2021 financial summary. As of March 31, 2022, the Ethereum Foundation holds $1.3 billion in cryptocurrencies and $300 million in non-crypto investments and assets.

- The Evmos team has shared additional details about the mainnet relaunch process. During a Twitter Spaces session, the Evmos team announced that the mainnet relaunch has been scheduled for April 26, 2022. A new client release and genesis file are expected to be shared in the coming days.

- Arweave has integrated Avalanche’s native token AVAX into the Bundlr Network. Users are now able to pay for data uploads to Arweave with the AVAX token, enabling native Arweave storage inside Avalanche applications.

- The Orchid team announced that its decentralized VPN is now live on the Fantom network, allowing users to fund their Orchid accounts with FTM. Orchid is now live on Fantom, Avalanche, Polygon, Binance Smart Chain, Optimism, Ethereum, Gnosis Chain, and Aurora on NEAR.

Notable Messari Governor Updates

- The Illuvium DAO has submitted a proposal that aims to approve the Parameters for Illuvium: Zero Land Sale. The proposal specifies that 100,000 Land NFT plots will go on sale. Voting is currently active.

- The Sushi DAO submitted a proposal that seeks community sentiment towards implementing a clawback on the Sushi DAO’s Vesting Merkle Tree Distributor contract. The Sushiswap Merkle Distributor contract holds SUSHI LP token rewards for early liquidity providers to claim initially through six months with the full tokens vested in October 2021. However, the contract holds 10,936,284 SUSHI (worth ~$36 million at the time of writing) of unclaimed tokens. Preliminary discussions are ongoing.

- The City DAO submitted a proposal that aims to ratify the CityDAO Charter and Operating Agreement. The purpose of the Charter is to provide clarity on CityDAO’s mission and values, rules of cooperation, organizational structure, governance, distributed authority, and rules of coordination. Voting is currently active.

- The Gnosis DAO submitted a proposal that advocates for a hard fork of the Gnosis Chain in response to an attack that took place on March 15, 2022 via the Omnibridge on both the Agave and Hundred Finance protocols. In total, 517 tokens (including WETH, GNO, USDC, and WBTC) are vulnerable to the attack which uses a callback function to execute a call after a transfer has occurred, allowing re-entrancy attacks. Voting is currently active.

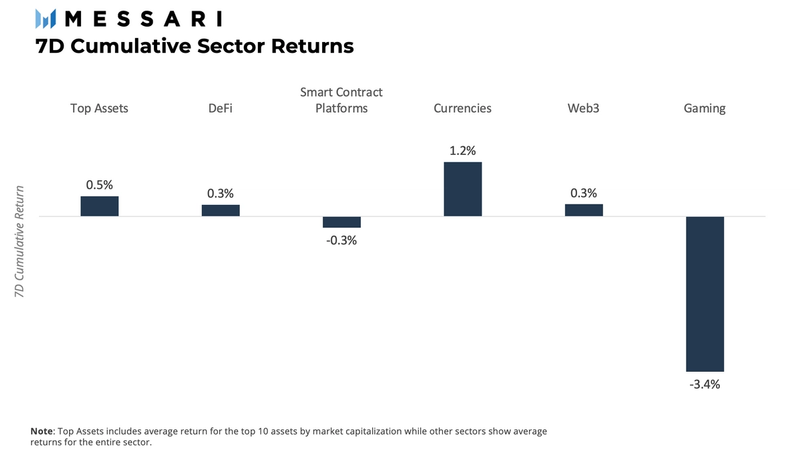

Sector Returns

This week saw some of the least volatile trading within the crypto markets for quite some time. Patterns like this resemble a consolidation phase, which indicates that the markets could be getting ready to make significant moves in the near term. Most top assets on the sectors covered traded within single-digit ranges for the week. However, most sectors had one or two outliers that broke the trend and rallied into the double-digit gains. The currencies sector came out on top this week, gaining 1.20% while gaming fell behind with -3.4%.

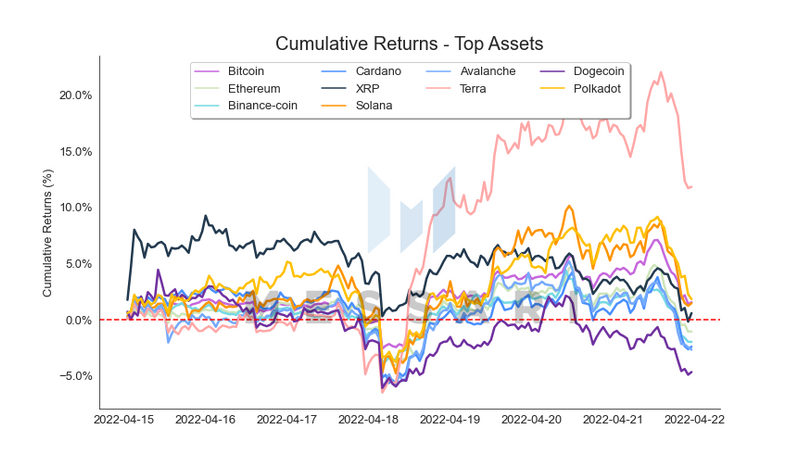

Top Assets

The top assets by market capitalization category showed a mixed set of returns. Half of the assets yielded negative returns, while the other half ended the week on the green. However, Terra (LUNA) stood out as the only asset within the category to finish the week with a double-digit positive return. The Cosmos-based IBC chain’s native asset LUNA rose in price up to 22% before shedding almost half of it, ending the week with an 11.8% gain. Dogecoin (DOGE) took last place among top assets with -4.7% for the week.

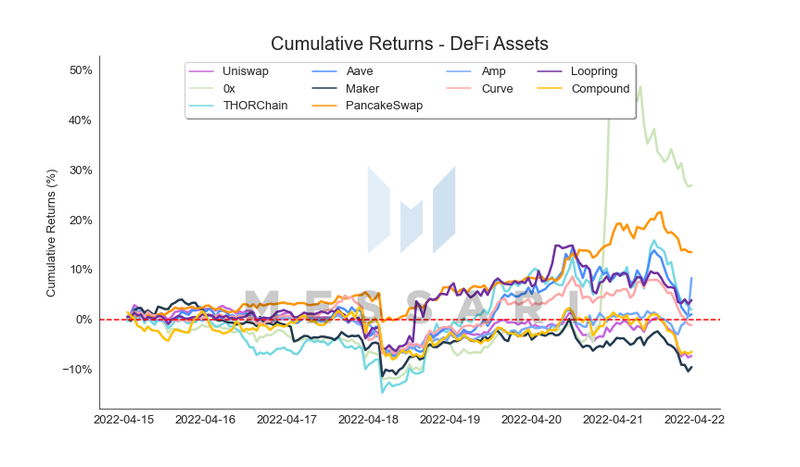

DeFi Assets

DeFi was another sector with mixed returns. Four of the top ten DeFi assets closed the week with single-digit losses while the rest ended in the green. Of the six assets that had positive returns, two of them clearly dominated this week. 0x Protocol stole the spotlight following the announcement that Coinbase will be leveraging the decentralized exchange infrastructure protocol to power their upcoming NFT marketplace. The 0x token’s price spiked to as high as 55% on the week but has been on a continuous downtrend since reaching the weekly top. It finished the week on the top-performing asset covered with a 26.9% gain. Next up was PancakeSwap, ending the week with a 13.5% return.

Smart Contract Platforms

The smart contract platform sector traded with high synchrony for the entire week with the exception of two assets — TRON (TRX) and Terra (LUNA). While the rest of the assets traded within single-digit range, the two assets broke away from the pack in the second half of the week. After over a 30% drop from its all-time-high, LUNA has managed to bounce back, securing an 11.8% return on the week. On the other hand, the unexpected rally of TRON (TRX) happened after Justin Sun announced that TRON will launch its own native algorithmic stablecoin — USDD. According to the news, it will feature a similar mechanism to UST in order to keep its peg and boast a 30% APY. The TRX token spiked 19% following the news and closed the week with an 18.5% gain.

Currencies

Closely resembling how the smart contract platform sector traded, currencies also traded in close synchrony and within a single-digit channel with the exception of two outliers — privacy coins. The two outperforming currencies this week were Monero (XMR) and Zcash (ZEC). Monero (XMR) broke from the pack mid week and propelled itself to a 21.8% gain on the week. Zcash (ZEC) followed suit but to a lesser extent. It ended the week with a 10.5% return.

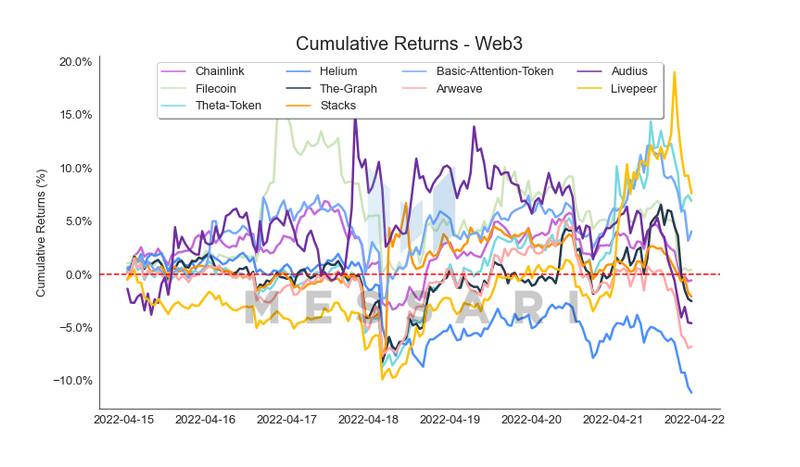

Web3

The Web3 sector had a more volatile week compared to the other sectors. Most tokens traded at their own trend, and returns were quite varied with four of the ten assets finishing the week with positive returns. Among those assets, Livepeer was the one to take the lead for the week. The decentralized video infrastructure protocol’s token saw its price finish the week with a 7.6% return. On the other hand, Helium was the laggard of the group as it posted an 11.1% loss for the week.

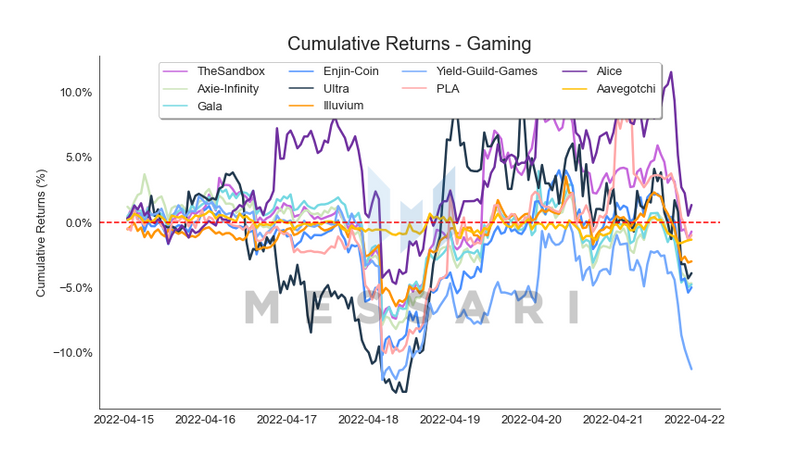

Gaming

The gaming sector took a last second dip as some of the tokens dropped by as much as 10% in a short period of time. The dip was enough to drag most of the top assets within the sector underwater. Alice (ALICE) was the only one to finish the week on green territory by a small margin (1.4%). Yield Guild Games secured the endmost position of the group as it secured an 11.3% decline for the week.