Bitcoin Analysis

Bitcoin’s price rallied back above the $40k level before the close of Monday’s daily session and concluded the day +$970.

The BTC/USD 1D chart below shows BTC’s price trading between the 1 fibonacci level [$33,530] and 0.786 [$41,178.06], at the time of writing.

The targets to the upside for BTC bulls are 0.786, 0.618 [$47,181.78], 0.5 [$51,398.68] and 0.382 [$55,615.59].

Conversely, the targets to the downside are the 1 fib level followed by 1.272 [$23,810.15], 1.414 [$18,735.57, and 1.618 [$11,445.34].

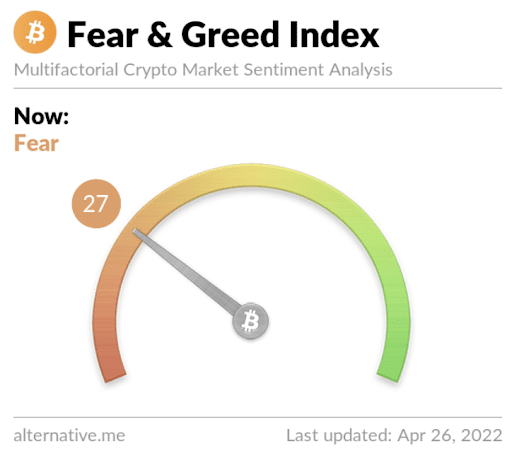

The Fear and Greed Index is 27 Fear and is +4 from Monday’s reading of 23 Extreme Fear.

Bitcoin’s Moving Average: 5-Day [$40,434.02], 20-Day [$42,644.13], 50-Day [$41,670.21], 100-Day [$42,824.04], 200-Day [$46,919.05], Year to Date [$41,476.94].

BTC’s 24 hour price range is $38,398-$40,617 and its 7 day price range is $38,398-$42,736. Bitcoin’s 52 week price range is $29,341-$69,044.

The price of bitcoin on this date last year was $48,981.

The average price of BTC for the last 30 days is $42,830.8.

Bitcoin’s price [+2.46%] closed its daily candle worth $40,456 and in green figures for a second consecutive day on Monday.

Ethereum Analysis

Ether’s price followed bitcoin’s lead higher on Monday by closing higher than 2% up for the day and +$83.86.

The ETH/USD 1D chart below by Elite_Club showcases how close ETH’s price is to breaking an important trend line on the daily timescale. Ether’s price is trading just above the long term trend line between 78.60% [$2,721.88] and 61.80% [$2,906.17], at the time of writing.

Bullish Ether traders are seeking to again crack the 71.00% fib level [$2,805.25] followed by 61.80%, and a full retracement to 0.00% [$3,584.11].

From the perspective of bearish ETH traders, their targets are the 78.60% fib level, and the 100.00% fib level [$2,487.12] to the downside of the chart.

Ether’s Moving Averages: 5-Day [$3,007.07], 20-Day [$3,170.00], 50-Day [$2,955.82], 100-Day [$3,170.01], 200-Day [$3,360.06], Year to Date [$2,979.55].

ETH’s 24 hour price range is $2,809-$3,025 and its 7 day price range is $2,809-$3,167. Ether’s 52 week price range is $1,719-$4,878.

The price of ETH on this date in 2021 was $2,532.

The average price of ETH for the last 30 days is $3,172.

Ether’s price [+2.87%] closed its daily candle on Monday worth $3,005.87 and snapped a streak of five straight daily closes in red digits.

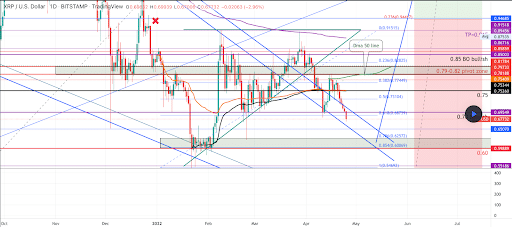

XRP Analysis

XRP’s price was the anomaly on Monday and managed to close in red figures despite the macro’s strong showing. XRP closed Monday’s daily candle -$.005.

The XRP/USD 1D chart below from xtremerider8 shows XRP’s price trading between the 0.618 [$0.687] fib level and 0.5 [$0.731], at the time of writing.

Bullish XRP traders are eyeing the 0.5 fib level, 0.382 [$0.774], and 0.236 [$0.828].

Traders that are short XRP are looking to push XRP’s price below the 0.618 fib level, 0.786 [$0.625], 0.854 [$0.600], and 1 [$0.546].

XRP’s Moving Averages: 5-Day [$0.730], 20-Day [$0.768], 50-Day [$0.773], 100-Day [$0.776], 200-Day [$0.900], Year to Date [$0.755].

XRP’s 24 hour price range is $0.649-$0.703 and its 7 day price range is $0.649-$0.776. XRP’s 52 week price range is $0.51-$3.40.

XRP’S price on this date last year was $1.03.

The average price of XRP over the last 30 days is $0.773.

XRP’s price [-0.76%] closed its daily session on Monday valued at $0.693 and in red figures for a sixth day in a row. XRP’s price is -15.26% for the last 30 days.

The post Bitcoin (40k), Ethereum , XRP ($0.6) Price Analyses appeared first on The Cryptonomist.