Jerome Powell and Christine Lagarde don’t agree on every point during their IMF “debate.” We analyze how globalization affects Europe and the U.S. differently.

Listen To The Episode Here:

In this episode of the “Fed Watch” podcast, Christian Keroles and I discuss our thoughts on the IMF debate that took place on April 21, 2022, between Federal Reserve (Fed) Chair Jerome Powell; European Central Bank (ECB) President Christine Lagarde; International Monetary Fund (IMF) Managing Director Kristalina Georgieva; Indonesian Finance Minister Sri Mulyani Indrawati; and Barbados Prime Minister Mia Mottley.

Fed Watch is a podcast for people interested in central bank current events and how Bitcoin will integrate or replace aspects of the legacy financial system. To understand how bitcoin will become global money, we must first understand what’s happening now.

Takeaways

First, I must preface my write-up by saying that this was not a debate at all. These financial bureaucrats were simply using this forum to get their message across to the people of the world. They all basically agreed on the major points, those being: inflation is high and we can blame Russia for much of the problem due to supply shocks.

The major theme from Lagarde and Powell was, to get the consumer price index (CPI) back into their acceptable range of 2%, they must rein in demand in their respective economies, since the driving force of the rise is due to a supply shock.

The medium is the message as the saying goes. Although this event is meant to portray a united front for the global financial system, we pick out several very important places where Powell and Lagarde disagree once you dig a little deeper.

ECB And Fed On Inflation

Lagarde breaks down the components of the high CPI rate of change in the eurozone by saying energy increased by 44% year-over-year and constitutes 11% of the index, and another significant portion is due to food prices — core CPI (CPI excluding energy, food and alcohol) increased by only 2.9%. I know that most people in the Bitcoin space don’t accept the importance of Core CPI and think it is a scam to hide actual inflation. But in this case, Lagarde has a point. Most of Europe’s price increases are due to a self-imposed supply shock.

Powell talks about the U.S. CPI differently. He acknowledges the supply shock aspect, but his main view of the supply side of things is that the U.S. economy is red hot and its labor market very tight. He mentions the labor market multiple times, claiming supply cannot keep up with rising demand, as opposed to Europe where supply is being cut relative to demand.

Keroles and I react to these two viewpoints of the central bank chiefs.

The Sunset Of Globalization

We emphasize another very important exchange from the IMF roundtable when the moderator asks about the decline in globalization. Powell says that it is quite possible that we see a reversal in globalization, while Lagarde “pleads Europe’s case” for a mere revisiting of the terms of trade.

I think this exposes a fundamental difference between these two economies and in the podcast we take time to detail this in more depth. Suffice it to say in this write-up, the U.S. is more self-sufficient and ultimately less concerned about the fate of globalization than Europe. Europe is beholden to the global economy for customers and for energy inputs.

Bitcoin’s Answer To Lagarde and Powell

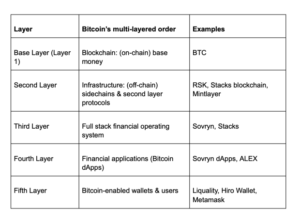

Being a Bitcoin show, Keroles and I take a lot of time discussing just how bitcoin fixes these problems of the financial system that Powell and Lagarde speak about.

Instead of relying on central planners (who admit to following the market anyway), a Bitcoin system will take much of the complexity out of the process. We will not have the false impression that the expert class knows best and people will be unencumbered by a narrative of inadequacy and inefficiency.

That does it for this week. Thanks to the readers and listeners. If you enjoy this content please subscribe, review on iTunes and share!

This is a guest post by Ansel Lindner. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.