Download the PDF version of this report by clicking here.

Key Insights

- Solana experienced continued growth in network usage, developer activity, network infrastructure, and overall ecosystem during the quarter.

- Solana also experienced network performance challenges and declines in financial performance.

- After an exploit of the Wormhole bridge in February, there were further instances of degraded network performance throughout the quarter.

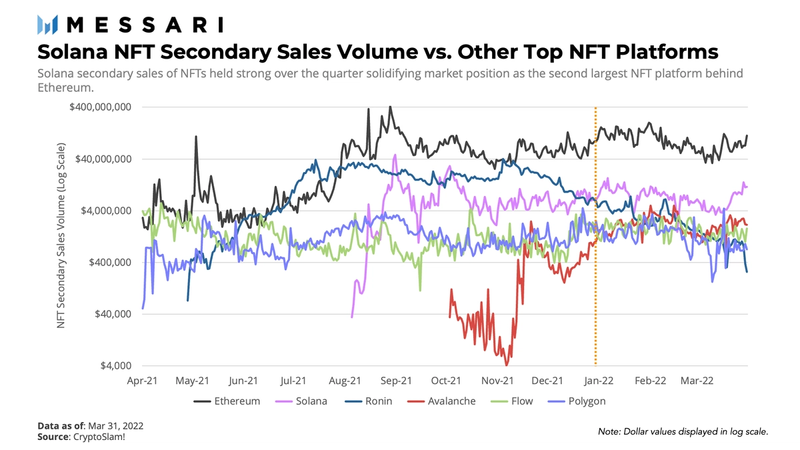

- By the end of the quarter, Solana became the second-largest protocol by secondary NFT sales volume, trailing only behind Ethereum.

- Solana’s growth strategies centered around improvements in user access and UX, seeking out strategic investment and partnerships, and expanding into several emerging sectors.

- Significant technological advancements in core platform optimization and the Neon EVM layer are on the horizon.

The Narrative

Several Layer-1 networks reported high growth rates in 2021, including Solana. With the rollout of bridge infrastructures like Wormhole and Allbridge billions of dollars migrated into the Solana ecosystem. Self custody solutions like the Phantom Wallet enabled millions of users to self-custody their assets further adding to growth. Other growth drivers included high profile partnerships (i.e. FTX, Circle) and incentive programs focused on DeFi, GameFi, and Web3. As users and developers entered the ecosystem, Solana recorded all-time-highs in daily users, transactions, revenue, minted NFTs, total value locked (TVL), and market capitalization. Still, it was unclear how the network would fare in 2022 after experiencing network performance issues during the latter half of 2021.

Ultimately, Q1 2022 consisted of continued growth in some respects but challenges and declines in others. Despite volatility across some metrics, stabilization of network usage, financial performance, and network infrastructure occured by the end of the quarter. Several developments accounted for the Q1 results, including new NFTs and growing NFT markets that reached billion-dollar sales volume; the diversification of TVL across DeFi applications; improvements in UX such as the Phantom mobile wallet; and the launch of new applications across several sectors other than DeFi.

Solana’s success in the second half of 2021 brought on growing pains that carried over into Q1. In February, the ecosystem experienced an exploit of the Wormhole bridge that resulted in the loss of 120,000 ETH (subsequently replenished) and further instances of degraded network performance throughout the quarter.

The Solana team prioritized the development of mitigation strategies to prevent future issues. They also continued to execute on growth strategies to ensure continued adoption heading into Q2.

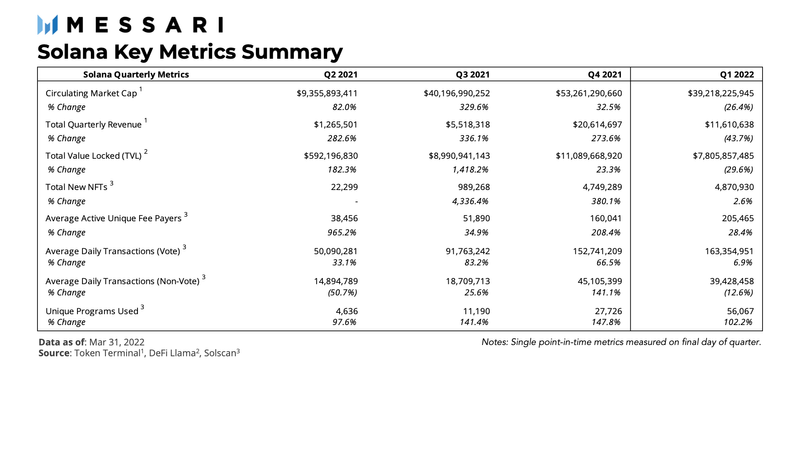

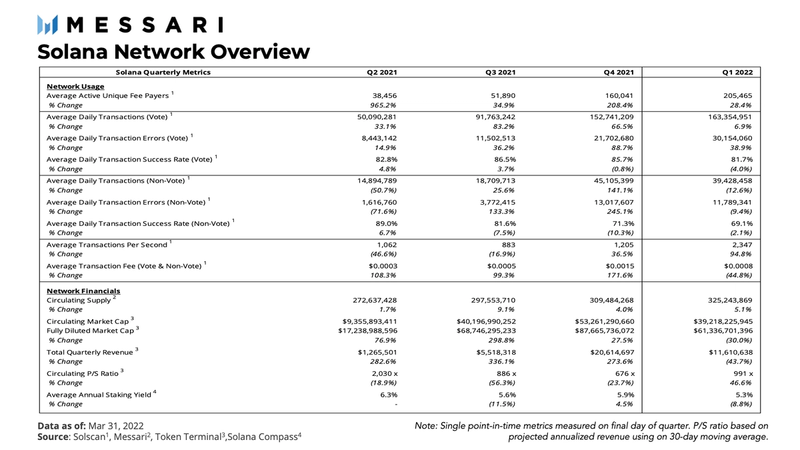

Network Overview

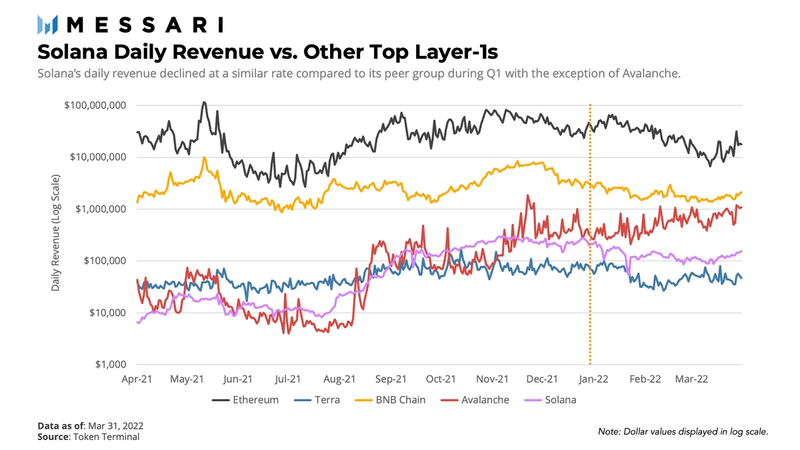

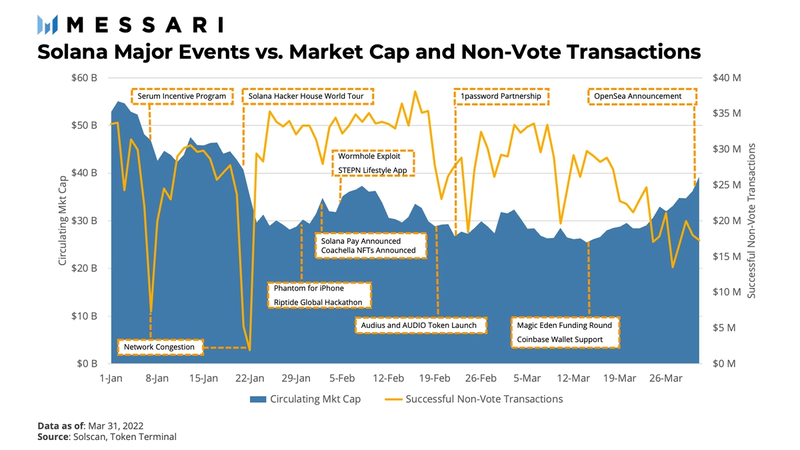

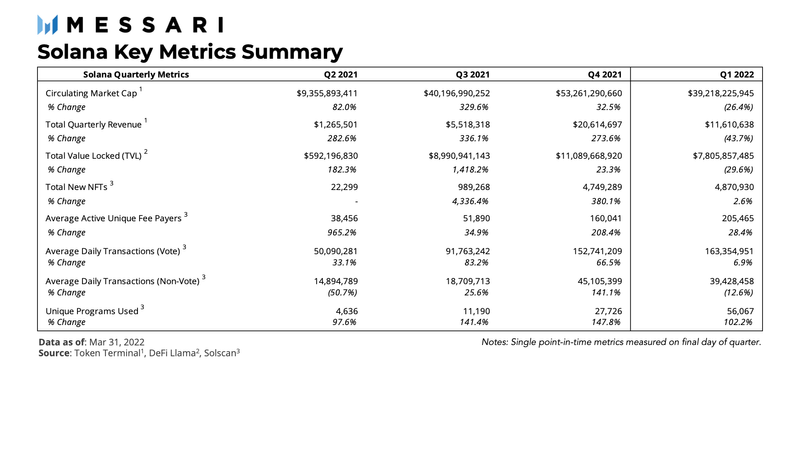

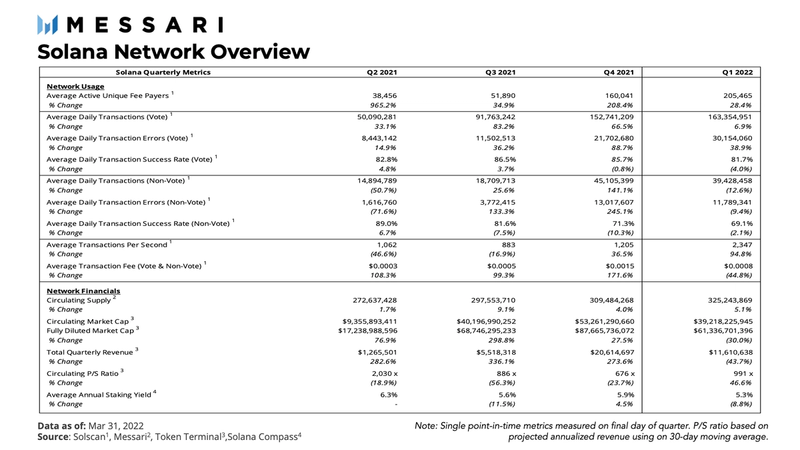

Solana experienced mixed trends across network and financial metrics compared to the prior quarter. While market cap and revenue declined by 30% and 43.5%, respectively, the network experienced continued uptrends in usage, quantified by average active unique fee payers (+28.4%), average transactions per second (+94.8%), and total average daily transactions (+4.2%). Intuitively, the decline in revenue generation (measured by user expenditure on transactions) mirrored the decline in average transaction fees (-44.8%). Degraded network performance also put significant downward pressure on revenue, as daily revenue saw sharp declines during network congestion.

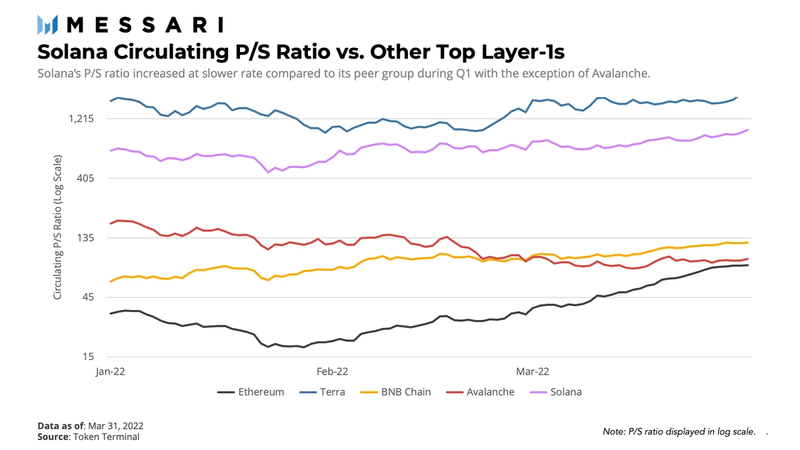

Because revenue declined faster than market cap, the price-to-sales (P/S) ratio trended upward, moving from 676x to 991x. Unlike last quarter, network usage continued to grow while financial performance declined.

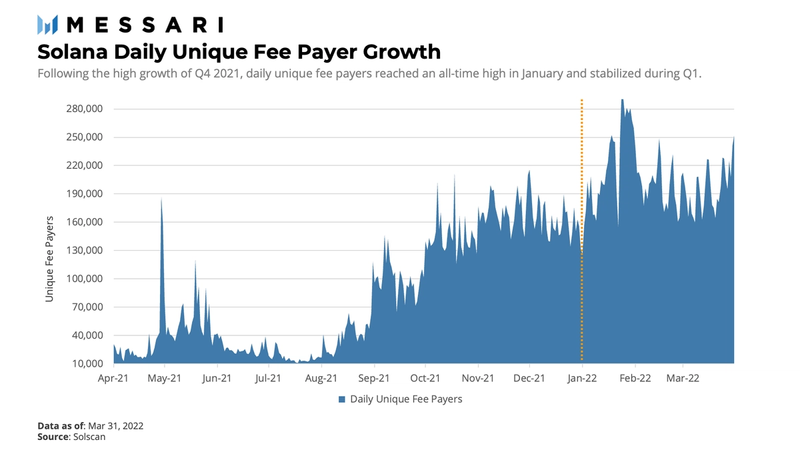

The “daily unique fee payers” metric consists of the number of unique accounts that pay for at least one transaction per day. Network usage continued upward as unique fee payers reached an all-time-high of 280,000 in January. For perspective, Solana had more unique fee payers during January than in all of Q3 2021, when the network also experienced triple-digit percentage growth in market cap and revenue. The network averaged around 160,000 unique fee payers during Q4 and stabilized at about 205,000 during Q1. The growth in unique fee payers is consistent with the growth in NFTs and NFT sales, application launches, and growth in transactions.

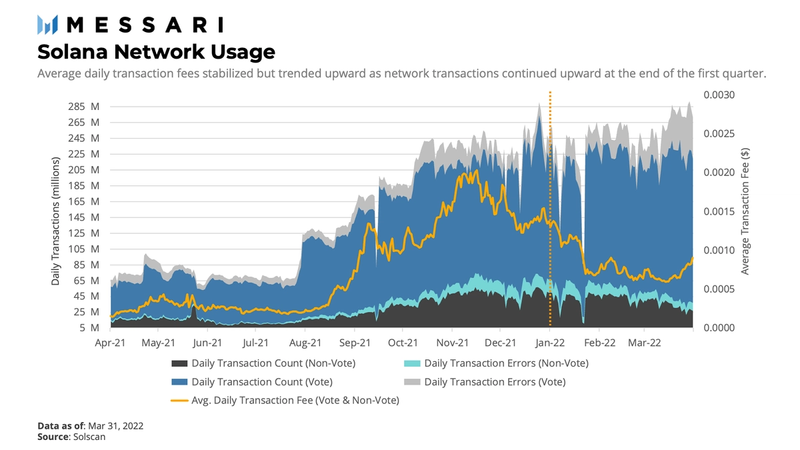

Transactions on Solana can be divided into two categories: 1) consensus and 2) token transfers and smart contract logic. Solana’s PoS consensus process is unlike other smart contract platforms because its votes for consensus are registered as on-chain events. Non-vote transactions are analogous to EVM transaction counts and represent the actual economic activity on the network.

Like Q4, total transaction activity on the network followed a similar pattern to daily unique fee payer growth. It only deviated due to the anomalies related to degraded network performance seen in the early and middle part of January. Solana’s average daily voting transactions rose from ~152 million last quarter to ~163 million in Q1. However, average daily non-vote transactions declined from ~45 million last quarter to ~39 million.

If the number of validators on the network increased (which it did over Q1), then the number of vote transactions would go up, even if non-vote transactions remained constant. As highlighted later in this report, the Solana DeFi ecosystem contracted during the quarter, likely contributing to the decline in non-vote transactions. On the aggregate, however, total daily transactions continued their upward trend as validator count expanded.

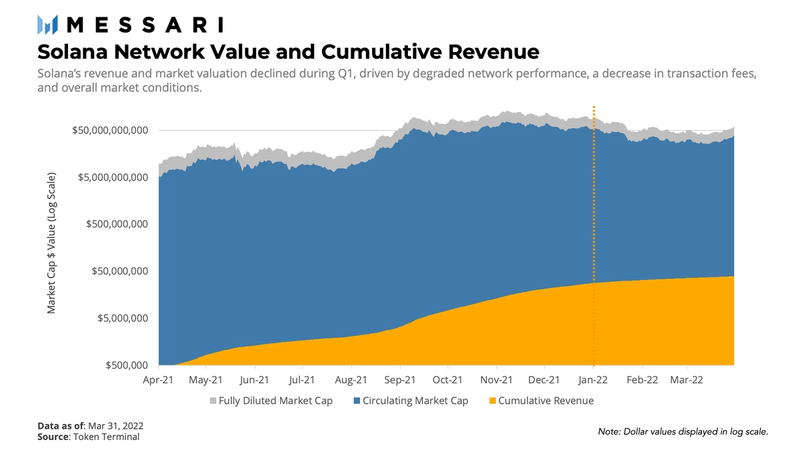

As daily unique signers and total transactions grew, cumulative revenue decelerated after declines in daily revenue. Cumulative revenue became a more significant fraction of the network’s fully diluted market value (FDV), despite quarterly revenue decreasing by 43.5%. For perspective, cumulative revenue as a percentage of FDV is 15 times what it was last year, signaling that fundamentals like network usage and revenue are moving more in line with market value.

Although fundamental metrics are becoming a greater portion of market value, the question is just how statistically significant the spread between fundamentals and market value is. With that in mind, as fundamental value (as opposed to speculative value) becomes a more substantial part of market value, a strong correlation between fundamental usage and market value may exist.

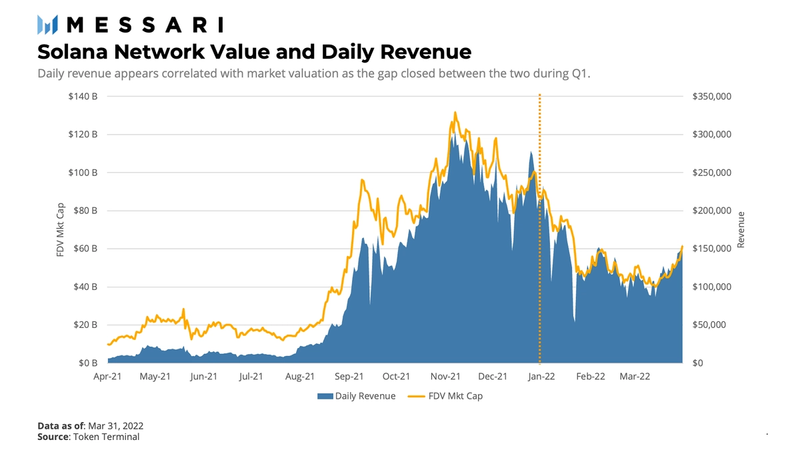

Most notably, the volatility and trend of daily revenue are generally accompanied by movements in FDV. The same relationship exists between circulating market cap and price. Additionally, the spread between daily revenue and FDV tightened during Q1, with occasional spikes and declines in revenue accompanied by spikes and declines in FDV. Again, this correlation could indicate that the network moved closer to its fundamental value than speculative value.

If the relationship holds, then fundamentals may have a significant relationship with market value, otherwise also interpreted as network value. Therefore, an area of concern related to this relationship is network reliability. As seen in 2021 and throughout Q1, degraded network performance decreases network usage and therefore reduces the network’s continued flow of revenue. If Solana were to continue to experience degraded performance that lasts for any material amount of time, it would appear that a resulting drag on fundamental usage may catalyze volatility and drag on network value.

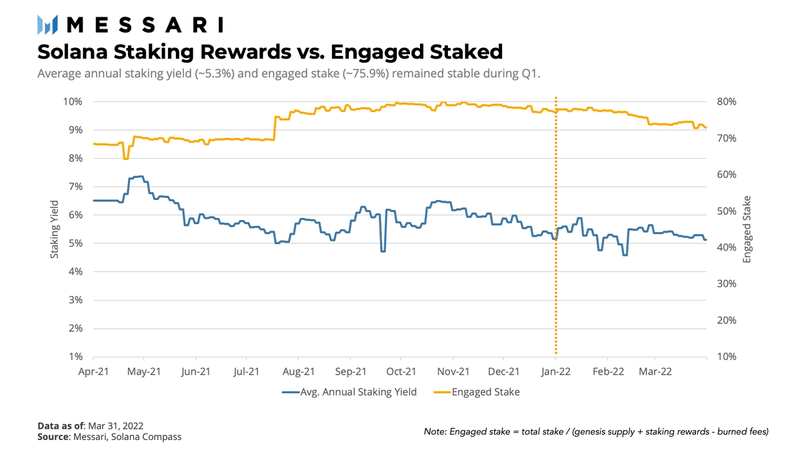

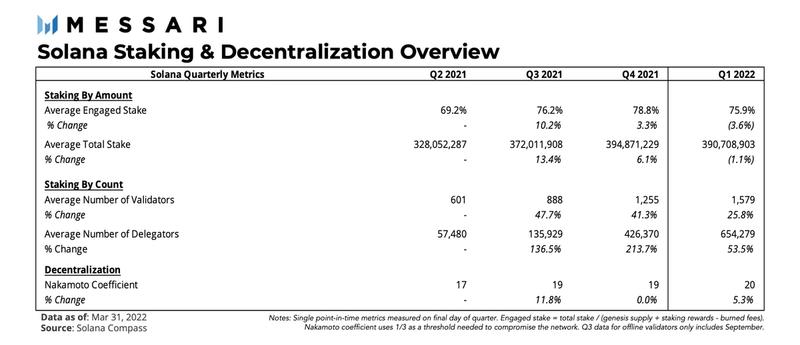

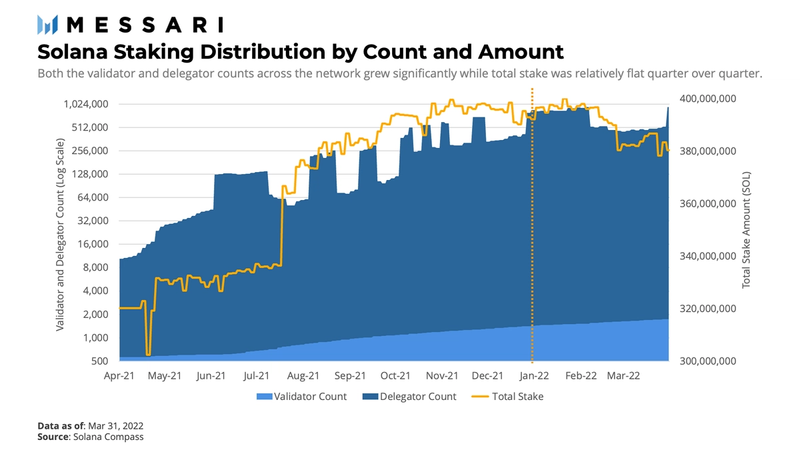

Since April 2021, engaged stake and staking yields have been stable, with an average annualized yield of ~6%. If the engaged stake were to experience volatility, so too would yield, but the engaged stake on Solana has been strong and stable at ~75% over the last year. The stability of engaged stake mitigates network value volatility to some extent and is favorable for the distribution of stake and decentralization as more validators and delegators come online.

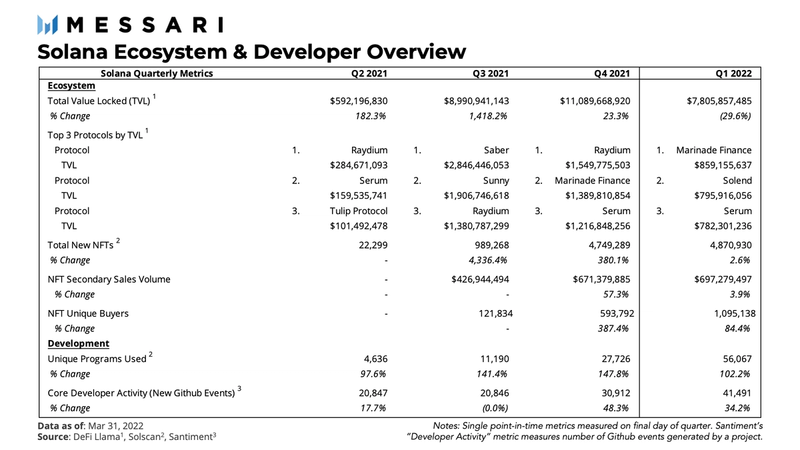

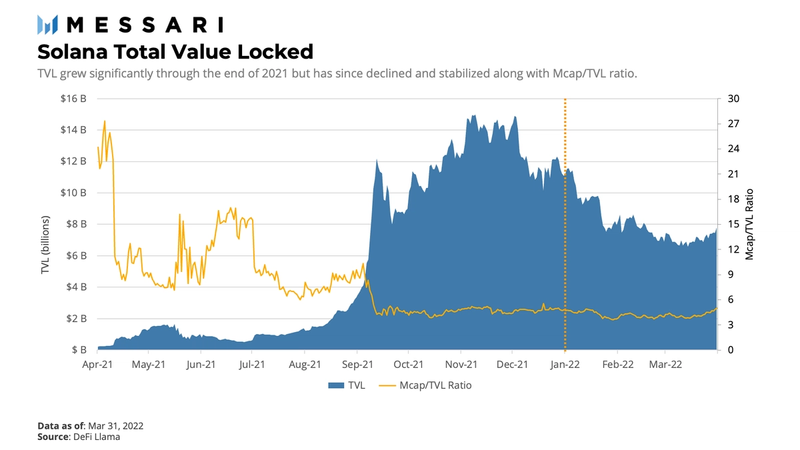

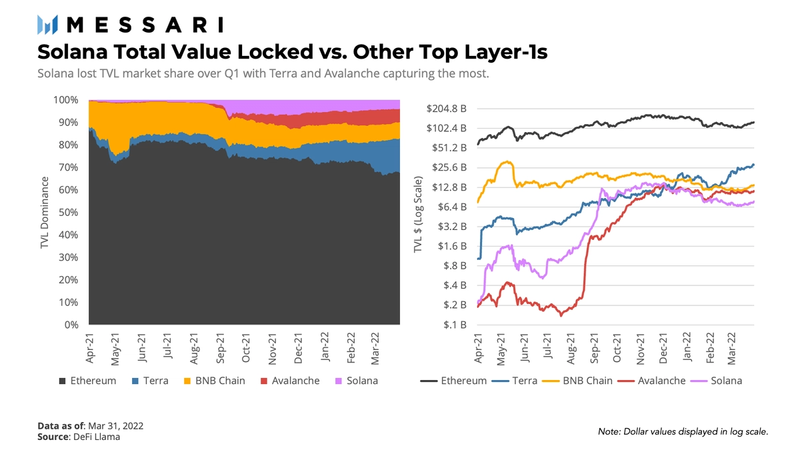

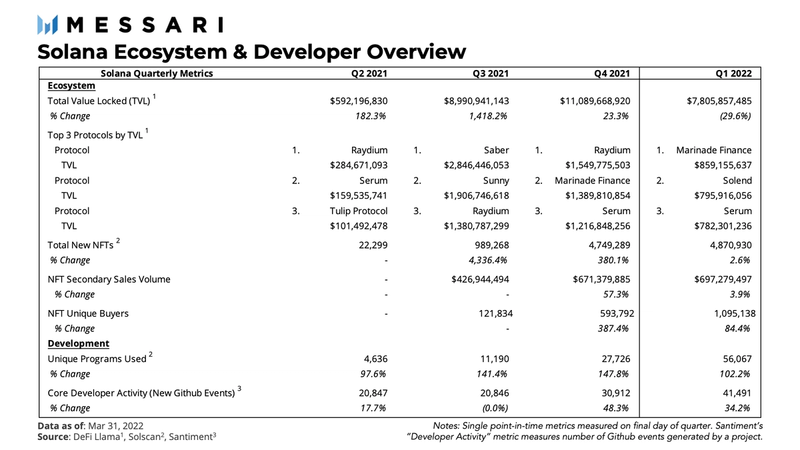

Heading into 2022, Solana DeFi experienced declines in TVL (-29.6%), much like many other Layer-1s but at a rate about twice the rate of the top chains by TVL. With that in mind, mitigation strategies were put in place to mitigate the contraction of its DeFi economy. One such strategy came from Serum, the central limit order book that underpins much of DeFi on Solana. Serum announced a $100 million fundraising in January to expand its operations.

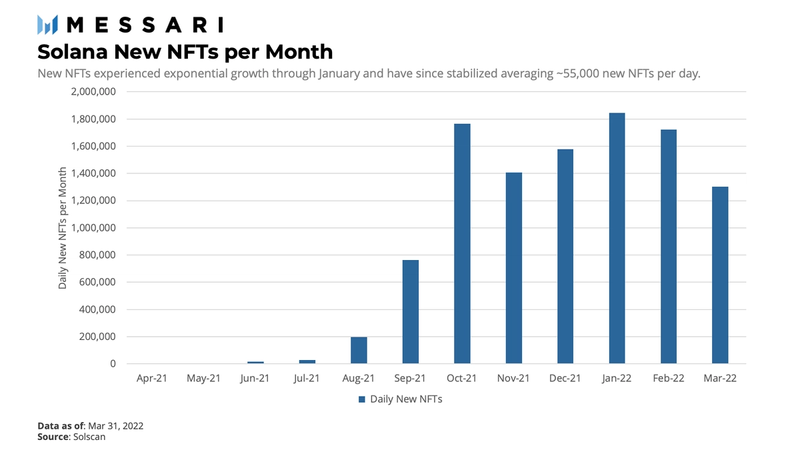

Unlike DeFi sector, the Solana NFT market continued its accelerated growth after an exponential Q4. This growth was fueled by the number of new projects, secondary sales volume, and unique NFT buyers. In aggregate, Solana NFT total sales volume crossed $1 billion in the middle of January.

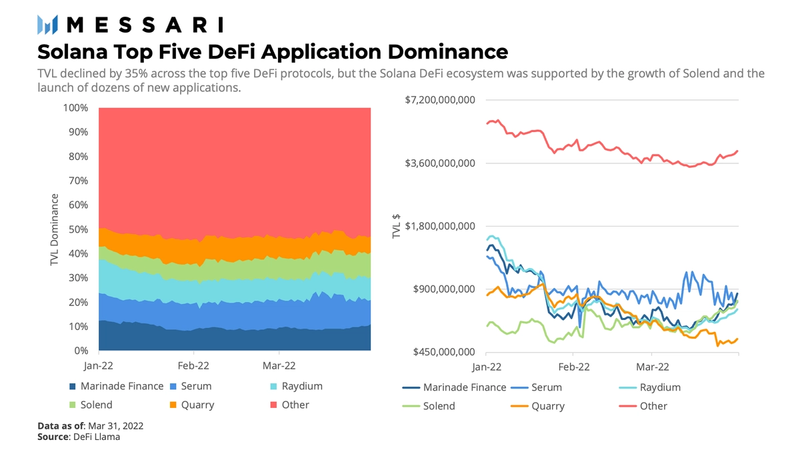

TVL might have declined more drastically if not for the horizontal expansion of the DeFi sector. Solana’s total DeFi ecosystem decline was less intense than the top DeFi protocols Marinade Finance (38%), Serum (39%), and Raydium (53%). Their collective TVL declined by 44% — more than 15% greater than Solana’s entire TVL decline. This suggests that the development of smaller protocols in the DeFi ecosystem offset the market forces negatively impacting the other protocols’ TVL. Nonetheless, TVL appears to have stabilized at ~$7 billion heading into Q2.

The launch of the Serum DeFi incentive program and the growth of emerging DeFi protocols stabilized the sector by the end of the quarter. Solend TVL grew by 33%, moving it up to second place. Meanwhile, the fastest-growing DeFi protocol that worked its way into the top 10 was Lido, growing by 82% over the quarter.

The other notable trend across Q1 was the steady long tail of DeFi protocols on Solana with at least $1 million TVL. Entering Q1, 30 protocols had amassed $1 million TVL, up from just 17 from the prior quarter. Exiting Q1, 35 protocols maintained the $1 million TVL mark. Despite the down quarter, the diversification of TVL remains healthy, with the “other” category making up 50%. In addition, the number of applications with recorded TVL grew from 40 to 60, representing a 50% increase in its DeFi foundation.

Following a breakout Q4 2021, Solana NFT activity retained its strength amidst the network’s decline in DeFi activity. Daily new NFTs maintained a quarterly level of almost 5 million new NFTs and grew by 2.6% over the quarter. For perspective, newly minted NFTs reached 85% of the amount minted during 2021. Further traction could be seen in total sales volume crossing $1 billion by mid-January and Metaplex minting 2,000 NFTs per hour by February. By the end of the quarter, Solana became the second-largest protocol by secondary NFT sales volume, trailing only behind Ethereum.

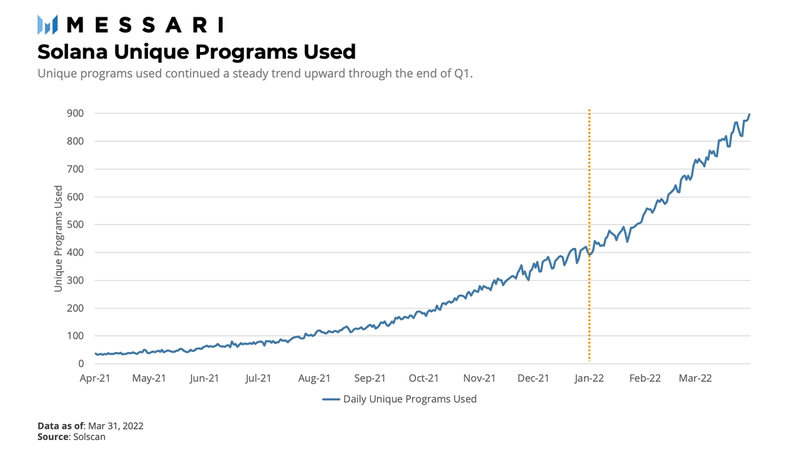

Another indicator of ecosystem development is the number of unique programs used in a given time period. The unique program metric represents applications with at least one successful instruction per day, based on a single program address. The number of unique programs used has grown steadily each month as more applications launch and grow their user base.

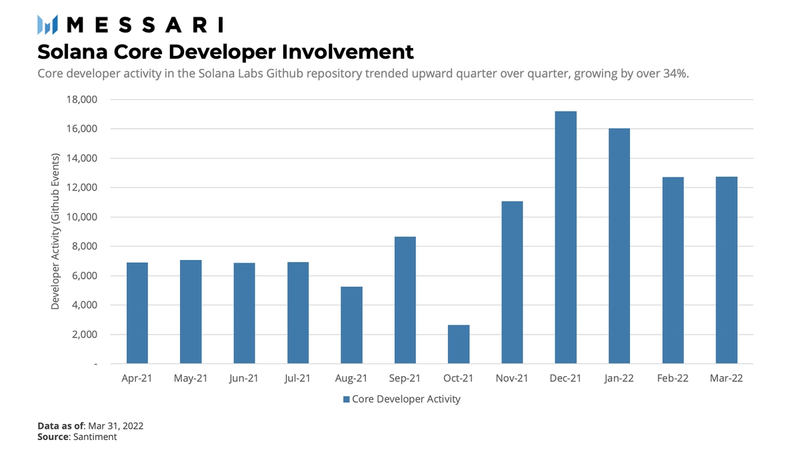

Events in Solana Lab’s Github repository continued to grow (34.2%) quarter over quarter. Though in a monthly downtrend, the quarterly number of events indicates that the network’s core is collectively stronger than in prior quarters.

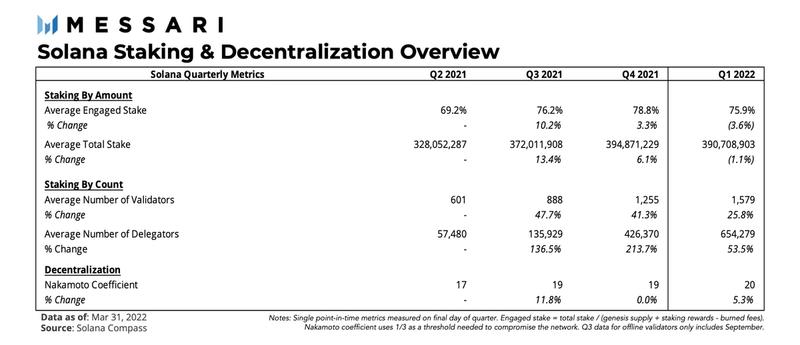

Staking and Decentralization Overview

The security of PoS networks like Solana requires users to lock up the network’s native tokens and participate in validation duties. The distributed network of validators and active participants ensures that the network functions as intended.

As mentioned earlier in this report, the average engaged stake on Solana has held strong at ~75% over the last year. This stability mitigates network value volatility to some extent. The stability has also allowed network infrastructure to expand with increases in the number of validators and delegators (i.e., active stakers). Growth in infrastructure paired with a relatively flat total stake amount suggests the greater distribution of stake and therefore decentralization.

Staking amounts during Q1 were relatively uneventful, with average stake changes in single-digit percentage points quarter over quarter. Such predictability and lack of volatility in the total stake amount are generally good for network health.

While the average staking amount was relatively flat, there was a material increase in the average number of validators and delegators. The average validator count grew from 1,255 to 1,579, representing a 25.8% increase in network security participants.

The average number of delegators grew significantly from 426,370 to 654,279, representing a 53.5% increase. When it comes to Solana, delegators are referred to as active stakers, measured by the number of accounts that received staking awards. Because the majority of wallets only have one stake account, delegator count is a rough indication of the number of individuals staking.

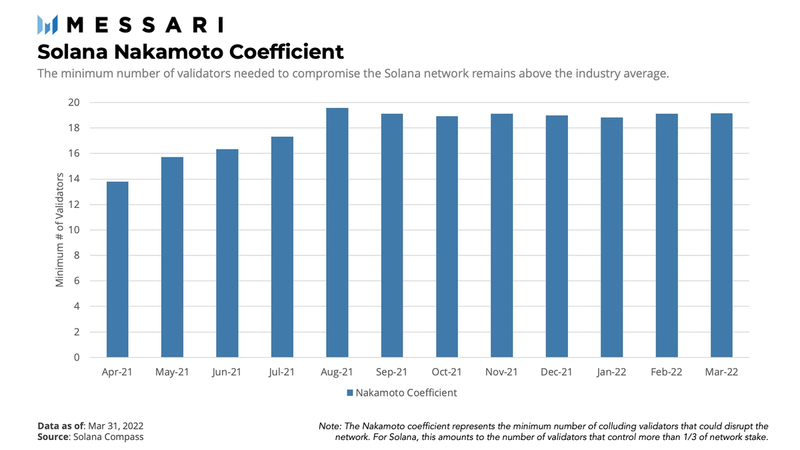

The Nakamoto coefficient is a metric first introduced by Balaji Srinivasan to quantify the decentralization of blockchain networks. The coefficient represents the minimum number of colluding actors necessary to disrupt the network. For Solana, the Nakamoto coefficient equals the number of validators that control one third of the network’s stake.

Solana’s Nakamoto coefficient hovered in the low teens to begin 2021 but improved to 19 by the end of the year. With the growth in validator count and stability in total amount staked, the coefficient has improved further and remained stable at 20, putting Solana above a peer group average of 10 when compared to other Layer-1 networks.

Competitive Analysis

Currently, the Layer-1 space is a competitive race between new and legacy protocols to be the fastest, cheapest, and most secure network.. Each competitor has focused on maximizing these activities while making a range of trade-offs regarding centralization. The ideal blockchain would be fast, secure, widely used, and adequately decentralized.

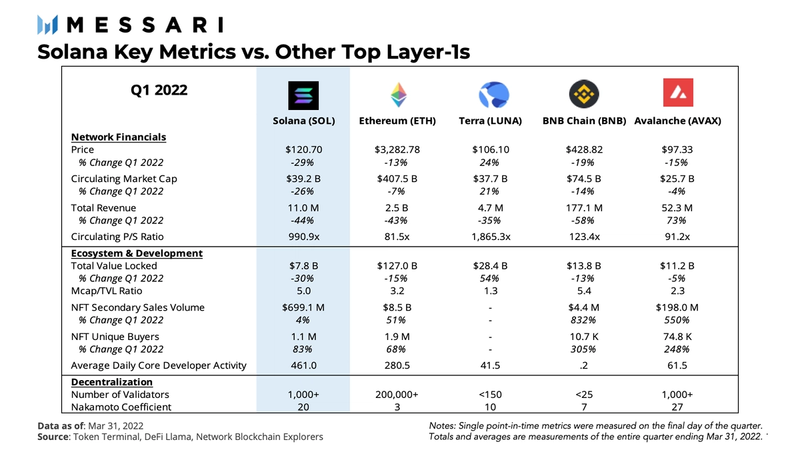

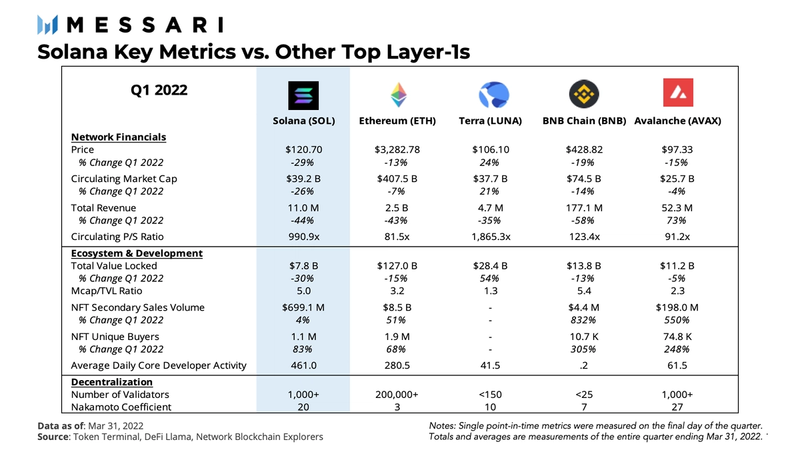

Technical advancements, core developer activity (Solana is leading its peer group), and ecosystem growth strategies may separate one L1 from another in terms of network usage and financial performance. Here, we evaluate Solana’s progress versus the top five Layer-1s by TVL (including Solana). The methodology used to derive this peer group is simply by grouping the top five chains with the largest TVL, seeing as today, DeFi is the sector driving the majority of each network’s economic activity.

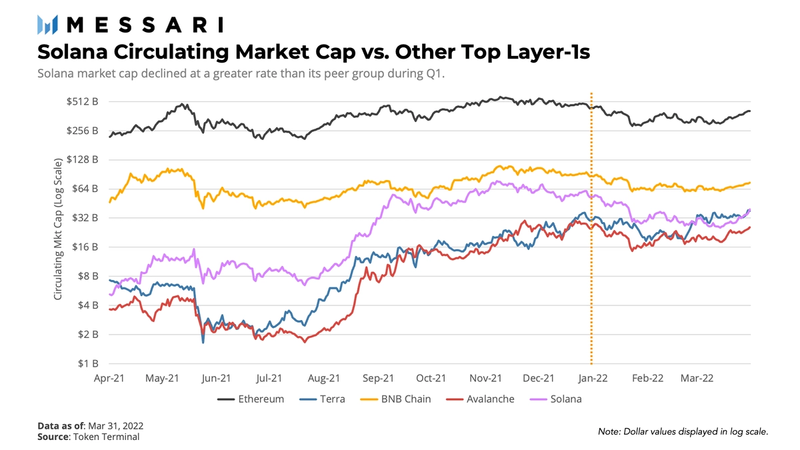

Solana experienced the greatest decline in market cap compared to the peer group. Much of the market value decline occurred during times of degraded network performance. Following its network performance issues, network value stabilized and began to trend upward, allowing Solana to return to a market cap position ahead of Terra by the end of the quarter.

Similarly, Solana’s daily revenue trended downward and experienced volatility in January. The peer group also experienced declines, with the exception of Avalanche.

Solana’s P/S ratio increased over the quarter, as did all other chains except for Avalanche. Because Solana experienced a greater market value (i.e., price) decline and a similar decline in revenue (i.e., sales), the increase in P/S was not as significant as Ethereum and BNB Chain. From a relative valuation perspective, Solana is now more in line with Terra with a P/S of 990x versus Terra’s 1,865x. The rest of the peer group ranges between 80x and 125x.

Q1 was a flat to down quarter for the crypto market, with aggregate TVL decreasing from $240 billion to $230 billion. Solana’s TVL declined at the fastest rate among the top Layer-1s. A significant portion of Solana’s decline benefited Terra and Avalanche, separating further from Solana in terms of TVL. Solana began to reverse course and trend upward at the end of the quarter. The Solana Mcap/TVL ratio also ended among the highest at 5x, trailing only behind BNB Chain’s 5.4x.

Solana continued its path to establishing a strong position relative to a peer group of the top L1s by secondary NFT sales volume. While Avalanche played catch-up, Solana further separated from longer-term NFT platforms Ronin, Flow, and Polygon.

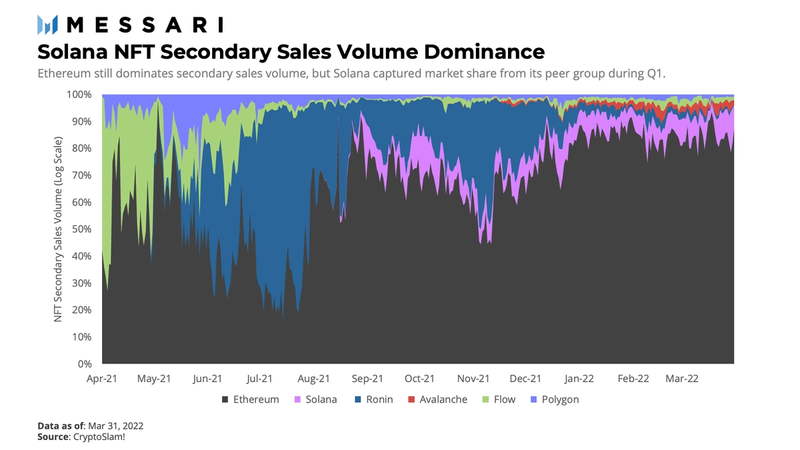

Though Ethereum still dominates roughly 85% of the secondary NFT market, Solana’s position as the second-largest by sales volume is a bright spot when evaluating Q1.

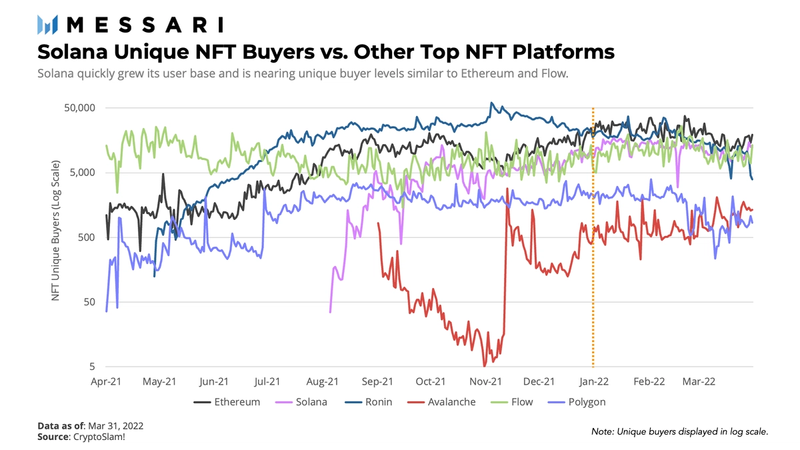

Similarly, Solana continued its path to attracting unique buyers and establishing a strong position nearing levels similar to Ethereum and Flow.

Key Events, Catalysts, and Strategies for Ecosystem Growth

While some quantifiable data suggest a slow down in some areas of the Solana economy, significant qualitative efforts through growth strategies, product launches, and improvements in user access and experience (UX) pushed the network forward. Several qualitative aspects may provide further insight into why the Solana network and ecosystem experienced what they did over the quarter and why they may be well-positioned for continued adoption heading into Q2.

January 2022

In January, there were advances in user access and experience. Moonpay, a money services application for buying and selling crypto, announced its support for USDC, the most popular stablecoin on Solana. Further, a new version of the Unity-Solana wallet was rolled out, which featured password encryption and NFT loading optimization. Shortly after this development, WalletConnect, an emerging protocol for connecting wallets and applications, announced support for Solana. Major UX advancements wrapped up with the most widely-used wallet on Solana, the Phantom Wallet, releasing support for mobile compatibility. Coinbase announced support for Solana SPL tokens on that same day, signaling accelerated access to the Solana ecosystem through Coinbase.

In addition to advancements in UX, several growth strategies and partnerships enabled the expansion of application launches across different sectors. Heading into 2022, Solana Ventures’ $150 million fund to boost GamFi was underway. Similarly, Serum announced plans to raise $100 million to expand operations. At the same time, Visa announced the onboarding of its first Solana-based project Zebtec, a payroll protocol, to its Fintech Fast Track program. Lastly, G2 Esports, a popular esports platform, announced its collaboration with Metaplex to offer NFTs for various uses across the platform.

By the end of January, additional strategies for growth were put in place with the Solana Hacker House World Tour and the Riptide Global Hackathon. The World Tour was a series of six-week-long hacker houses around the globe aimed at all levels of development on Solana. Paired with Hacker Houses and sponsors like Visa and Google, Riptide organized a hackathon with $5 million in prizes to be paid out to successful development efforts across multiple tracks such as Web3 and gaming.

In addition, a number of new applications were launched. The GameFi sector ushered in launches of applications like Wasder, Trash Pandas, and MechaFightClub, while Web3 brought launches of messaging application 4thTech and social platform Rally.io. Rally.io is a leading Ethereum-based platform for creators to launch their social tokens. It plans to use Solana to launch projects that tap into the RLY Network. Lastly, the Solana network also made strides in the stablecoin space with the launch of UXD Protocol (UXD), an algorithmic stablecoin, and Hubble Protocol (USDH), a censorship-resistant stablecoin.

Ultimately, it was an eventful January, filled with advances in UX and a series of growth strategies.

February 2022

February followed suit with additional advancements in UX, growth strategies, and product launches. Most notably, the launch of Solana Pay, a protocol for merchant payments, was announced on February 1. Within days, Solana Pay received 325+ inbound leads from across the globe and witnessed over 70 forks on GitHub. In addition to Solana Pay, UX also advanced with the announcement of the 1Password partnership with Phantom Wallet to create a simpler, more secure way to manage assets on the Solana blockchain.

While over 1,100 builders worldwide registered for the Riptide Hackathon to compete for prizes & seed funding, the NFT marketplace was back on the scene in February. Music and arts festival Coachella introduced the Coachella Collectibles NFTs intended for lifetime festival passes and digital collectibles redeemable for physical items. Further, Project Galaxy, a collaborative credential infrastructure for Web3, announced a $1 million prize pool for an NFT treasure hunt campaign across 27 different protocols on Solana.

As was the case in January, several anticipated project launches took place across various sectors including NFTs, GameFi, and Web3. Burnt Finance announced its launch and is the

first protocol on Solana to enable users to buy, sell, trade, and mint NFTs on a decentralized protocol. The protocol intends to release a number of DeFi functionalities that will allow NFTs to be used for liquidity, fractionalization, and GameFi. STEPN, a move-to-earn app officially went live on the Apple iOS store in February. Shortly after, Audius, a decentralized music platform, announced its anticipated launch of the AUDIO token and rewards for taking in-app actions such as completing profiles, uploading, inviting friends, and listening streaks.

Through February, advances in UX continued, more access to the ecosystem was enabled, and growth strategies continued to usher in use cases that went beyond DeFi.

March 2022

Down the final stretch of Q1, the Solana growth strategy brought more improvements in UX and significant moves to expand the NFT marketplace and additional product launches across sectors.

On March 1, FTX and Bonfida teamed up and announced that users could directly withdraw from FTX using their .sol domain name. This advancement removes the barrier of unreadable wallet addresses through the Solana Name Service (SNS), powered by Bonfida. By the end of the first week of March, further advancements on Solana Pay were announced with the rollout of mtnPay, an iOS Point-of-Sale app, and its progression to the Merchant Beta phase. By the middle of March, Coinbase Wallet added support for Solana project tokens, which was announced not long after Coinbase announced support for SPL tokens at the end of January. This likely indicates that Coinbase is moving towards more Solana token listings. By the end of March, the hardware wallet Ledger announced support for Solana on Ledger Live.

Before the quarter could end, Magic Eden, the largest NFT marketplace based on Solana, announced it had raised $27 million in a Series A funding round. Paradigm led the round, with Sequoia Capital, Solana Ventures, Greylock Partners, Electric Capital, and others participating.

Another major indicator of the continued growth of the Solana NFT market came from OpenSea, which announced support would be coming for Solana NFTs in April. OpenSea is the largest NFT marketplace in the industry, hosting markets primarily for Ethereum-based NFTs. Lastly, Serum and Burnt Finance were back in the headlines when Serum introduced the Serum NFT Ecosystem — a series of Solana-based NFT collections that will be launched and minted using the Burnt Finance Ignition Launchpad. Collectively, it would seem that greater access and greater liquidity for Solana NFTs are on the way.

While significant moves towards expanding the NFT sector are notable, product launches across multiple sectors continued. Solana finished out the quarter with the launch of Dialect, a dynamic, composable notification and wallet-to-wallet chat application, and Angelic, a multiplayer strategy role-playing game. Lastly, Krafton, the game maker of PUBG, a battle royale series with more than a billion downloads, announced that they will develop games on the Solana blockchain. Here again, we see continued expansion into sectors that go beyond DeFi.

Ecosystem Challenges

Although the second half of 2021 was pivotal for the Solana network, it came with growing pains that carried into Q1. Network performance issues occurred on December 13, January 7, and January 21. In each instance, throughput deteriorated and resulted in a material decrease in TPS and an increase in failed transactions. As mentioned earlier, these events had a negative impact on network fundamentals that appeared to have negatively impacted network value.

Nonetheless, Solana co-founder Anatoly Yakovenko subsequently shared details about the network congestion issues observed on the network. Gulfstream, Solana’s alternative to the mempool for pending transactions, currently allows bots to propose an arbitrary number of transactions, forcing block producers to check all transactions before making a block. This can lead to users submitting transactions that aren’t included in blocks because producers cannot process all transactions before finalizing blocks. Ultimately, as a result of bots proposing an overwhelming number of transactions, block production suffered, and the network experienced degraded performance.

A network congestion mitigation strategy was also subsequently outlined. The Mainnet Beta v1.10.x series will include QUIC, a feature that will allow block producers to instruct bots to propose only a small number of transactions at a time. A block producer would be able to parse through all transactions and select the valid ones. QUIC is not intended to solve the network congestion issues alone. Fee and prioritization changes are currently in development to allow users to jump ahead of the transaction queue as transactions propagate through the network. To that end, both QUIC and a fee prioritization mechanism should mitigate the bot spamming of the network.

In addition to degraded network performance, the ecosystem experienced an exploit of the widely used cross-chain bridge Wormhole. On February 2, the Wormhole team stated via Twitter that the network was exploited for 120,000 wETH. An incident report was released indicating that an attacker exploited a signature verification vulnerability in the Wormhole network to mint 120,000 Wormhole-wrapped Ether on Solana. These tokens were not backed by Ether deposits on the Ethereum side of the Portal bridge. The attacker then bridged 93,750 of the tokens to Ethereum, withdrawing the unwrapped Ether from the contract. By February 3, the vulnerability was patched, and the bridge was brought back online. Further, Jump Crypto replenished the ETH contract, and the wETH/ETH backing was restored.

The Road Ahead

Currently, Solana does not maintain an updated public-facing roadmap. However, it is expected that the Solana ecosystem will continue efforts to drive growth through its growth strategies and incentives.

The core platform upgrades are expected to continue. Solana launched its mainnet beta in March 2020. Since the beta release, the development team has been working on optimizing the network. Though still in beta, Solana has 100% functionality, even if there are pending developments. Such developments and mitigation strategies outlined by Yakovenko show what separates the network from being in beta versus a full release. With that in mind, some concerns about network performance will likely be addressed once Solana is fully released with further plans for continued risk mitigation, such as QUIC and the fee prioritization mechanisms. No date has been assigned to the full mainnet release.

Another major development involves Neon, a Solana project building a smart contract layer that utilizes the Ethereum Virtual Machine (EVM). According to Neon, its implementation of the EVM will be able to process 4,500 TPS. This could be a significant catalyst for growth as we saw other EVM Layer-1s acquire developers, users, and considerable market share during 2021. Solana’s Neon EVM is expected to launch by the end of June.

Closing Summary

In some respects, Q1 2022 was a positive quarter for Solana, but it also presented some challenges. As the quarter came to a close, network usage, financial performance, and network infrastructure stabilized. Several factors contributed to the Q1 results, including the continued growth of new NFTs and NFT markets, diversification of TVL, improvements in UX, and new applications across several sectors outside of DeFi.

Even though the network recorded new highs across several aspects, the ecosystem experienced an exploit of the Wormhole bridge in February and further instances of degraded network performance throughout the quarter. The core platform upgrades are expected to continue as mitigation strategies have been outlined. Once Solana is fully released, these network performance concerns should be addressed to a great extent.

Ultimately, despite intermittent network congestion, the ecosystem continued to execute on growth strategies and showed signs of further adoption heading into Q2. The Solana ecosystem will likely proceed with its efforts to drive growth. With developments ranging from Solana Pay and OpenSea to the Neon EVM, expansion into various sectors and a fully Ethereum-compatible environment appear to be on the horizon for Solana.

Appendix

This report was commissioned by Solana, a member of Protocol Services. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. Paid membership in Protocol Services does not influence editorial decisions or content. Author(s) may hold cryptocurrencies named in this report.

Crypto projects can commission independent research through Protocol Services. For more details or to join the program, contact ps@messari.io.

This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. The past performance of any asset is not indicative of future results. Please see our terms of use for more information.