Gold-pegged tokens (also known as gold-backed cryptocurrency) are digital assets that are either backed by physical gold or are algorithmically derived from the price of gold. In function, the tokens are either pegged to the price of fiat currency such as the U.S. dollar or to the actual commodity price of gold.

The current price of gold to which tokens are pegged varies by provider, but most typically use the same ratio. Gold-backed tokens typically represent a physical collection of gold that must be owned by the stablecoin issuer; the amount of tokens a provider can issue is limited to how much it physically owns.

Since gold-pegged tokens leverage the flexibility and advantages of cryptocurrency and the stability of gold’s price, they provide:

- More stable value storage than the more volatile assets like Bitcoin and Ethereum.

- The ability to “hold” gold without needing to physically have possession of the asset.

- A way to buy gold without needing a minimum investment

Each of the many gold-pegged tokens on the market aims to offer unique advantages over the other, such as faster transactions, gold bullion options, and no fees. Tether Gold, for example, has a market cap of $469 million and allows for multiple redemption options.

$100,000 worth of gold weighs about 3.59 pounds– a dense little brick of value storage. This might not seem like much to the average gym-inclined reader, but that’s just where the value of gold-pegged tokens starts:

- If you wanted to sell $20,000 of this gold brick, how would you go about it?

- If you had to move houses or countries, would you lose sleep over transporting it safely?

- If you’re storing this brick in your home, how confident are you in your security?

Now, gold-pegged tokens aren’t the knight in shining armor ready to fix every single one of gold’s problems, but they do offer some competitive technological advantages. For example,

- If you wanted to sell $20,000 of your $100,000 of gold-pegged tokens, you could likely do so in minutes on a cryptocurrency exchange (provided the exchange has liquidity for your token) at that tokens’ market value. You could add more gold-pegged tokens to your stockpile just as easily.

- If you had to relocate, you’d only have to protect your hardware wallet and recovery phrases. If you keep your tokens online somewhere, you won’t even need to worry about protecting a physical object.

However, the security of your gold-pegged tokens is still paramount– rather than fearing a physical break-in, you’d have to take preventative measures to protect from a digital one.

The following guide explores the history of gold-pegged tokens, their advantages, disadvantages, and how you can invest.

History of Gold-Pegged Tokens

Although considered a new type of currency, the idea of ‘digital gold’ spans back to the founding of the internet.

In 1995, E-Gold was the first digital currency that was backed by gold. The currency was held by millions of people around the globe, until it was shut down by the US Government due to licensing complications.

Several alternatives have since been made, but were unsuccessful due to the lack of supporting technology. Now, with the help of blockchain technology as a secure accounting method, the concept of gold-backed digital currencies is palpable.

Companies can use the blockchain to issue tokens that represent physical gold. For example, 1 gram of gold is equal to one token. This gram of gold is physically held by the custodian in a secure location and can be traded with other coin holders.

If investors don’t want to trade, most providers also allow investors to exchange their tokens for physical gold if they wish to store it themselves.

Advantages of Gold-Pegged Tokens

Gold-pegged tokens have several advantages over both traditional gold and their cryptocurrency alternatives.

Less Volatile than Most Crypto

The biggest advantage of gold-pegged tokens is they’re significantly less volatile than most cryptocurrency investments.

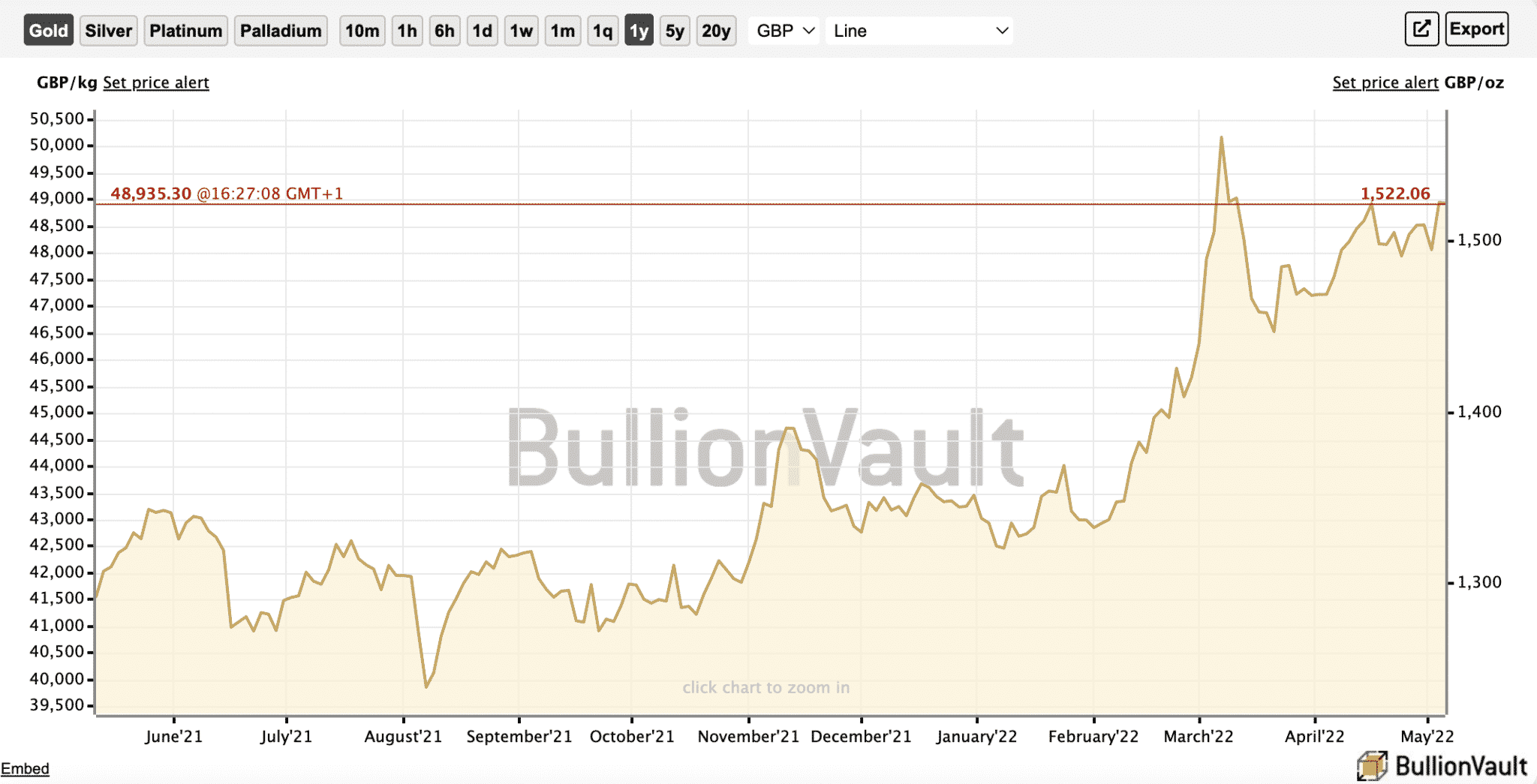

In 2021, Bitcoin’s value ranged from $69,045.00 to $29,795.55.

In the same year, gold’s price ranged from $1,954.40 to $1,678.00.

This decrease in volatility allows investors to add stability to their cryptocurrency portfolio, or at least diversify away from the wild swings cryptocurrency tends to have.

In traditional investing, gold is often used as a hedge during periods of uncertainty and extreme market conditions. By applying this to a somewhat unpredictable cryptocurrency market, investors can add greater stability to their portfolios.

Removes Storage Complications

Gold-pegged tokens allow physical gold to be traded with ease.

In the past, owning gold was problematic; It could be held through bullions (gold bars) which could then be stored by third-party institutions or by the owner in their house.

Holding gold in your home can be risky, and fees can quickly add up when paying a third party.

Gold-pegged tokens overcome both of these issues. Once a token is purchased very few providers charge storage fees. This allows investors to protect their gold and save money in the process.

To make a profit, several providers will charge transaction fees, whilst others issue loans to institutions and make investments.

Easily Transferable

Another issue commonly associated with gold is its transportability. If an investor held a large quantity of gold, selling or transferring it was problematic. It would often involve additional fees, and would require the gold to be moved from one vault to another.

With gold-pegged tokens, investors can simply transfer their contract over and the deal is complete.

No Minimum Investment Limit

Historically, an investor would need to spend a certain amount to buy gold. Due to fractionalized tokens, there is no minimum limit on how much someone can invest.

This removes the barriers to entry and allows small investors to include gold in their portfolios.

Less Human Intervention

The trading of gold-pegged tokens is often ruled by smart contracts; by their default programming, interaction with other human parties is minimized.

Instead of having to organize the transportation of gold from one investor to the next, an investor can transfer their gold via a smart contract.

Disadvantages of Gold-Pegged Tokens

Despite their advantages, there are also a few downsides to gold-pegged tokens.

Lower Potential ROI

In a market that’s known for its high-risk high-reward excitement, the returns of gold-pegged tokens can be somewhat underwhelming.

In a sense, gold is a better store of value than altcoins, but it built its reputation on stability not potential upside.

Reliance On Centralized Service Providers

Despite being a cryptocurrency, gold-pegged tokens are still reliant on centralized service providers. These providers manage the physical gold and often require investors to pass KYC (know-your-customer).

This will require an investor’s personal information, which may be seen as a downside for anonymous crypto investors.

Wallets Can Be Hacked

Although less risky in terms of market fluctuations, holders are still required to protect their hardware wallets. With most gold-pegged tokens being ERC-20 tokens, they can be stored in digital wallets such as MetaMask, and hardware wallets such as the Ledger Nano X.

These wallets can be hacked and in the process, gold-pegged tokens can be stolen.

How To Buy Gold-Pegged Tokens

To buy gold-pegged tokens, you’ll first need to use a fiat onramp that allows you to transfer fiat currency into cryptocurrency, whether that be Bitcoin (BTC) or Ethereum (ETH), or even straight to the gold-pegged token.

Gemini and Kraken, for example, are two popular centralized U.S. exchanges that allow people to buy a popular gold-pegged token PAXG directly with USD.

Other tokens have access in different exchanges– we recommend checking out our list of the top gold-pegged tokens to find the easiest location to exchange.

Final Thoughts: Are Gold-Pegged Tokens Worth It?

Gold-pegged tokens are an incredible application of blockchain technology– tokenizing a heavy and valuable metal opens the gold marketplace to a much wider variety of potential investors.

As the cryptocurrency market continues to grow, the demand for gold-pegged tokens will likely follow. It’s important to understand the benefits each token provider offers before making a purchase.

Do they align with your requirements? As with any investment, do your due diligence.

Who backs your token?

Where are the facilities where your gold will be stored?

Where can you sell your token?

Where will you store your token?

Gold-pegged tokens are a good way to get exposure to this commodity. However, gold-pegged tokens still have technological risks to protect against.

Hackers, for example, can pry open a poorly secured exchange account or wallet and just as easily siphon hundreds of thousands or millions of dollars of value.

Owning a token is the easy part– keeping it safe will require an adept understanding of how to keep your crypto safe.

The post What Are Gold-Pegged Tokens? How to Invest in Gold Via Crypto appeared first on CoinCentral.