In the same way that the adoption of cryptocurrencies increased worldwide, so did the Ponzi schemes and other frauds related to the crypto ecosystem. OneCoin is one of the most obvious examples; but Europol is focused on closing the case and put its promoters behind bars —no matter how long it takes.

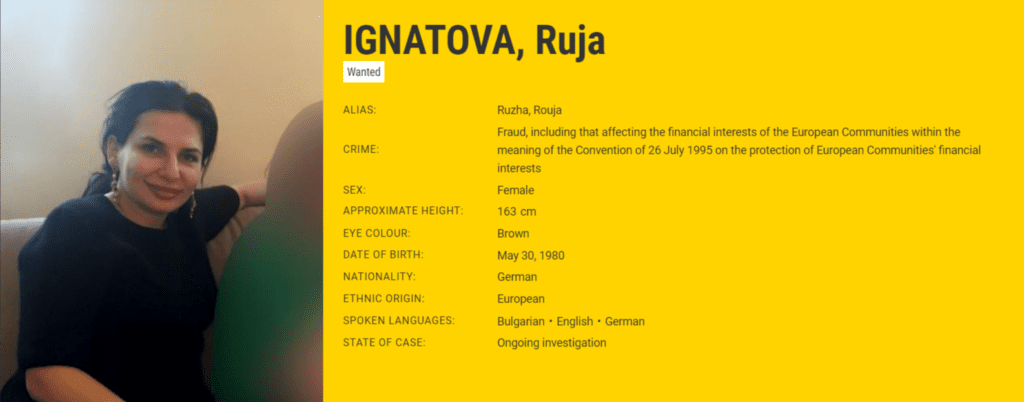

On May 11, Europol added Ruja Ignatova, founder of the OneCoin Ponzi scheme, to its list of Europe’s most wanted fugitives, offering a reward of up to €5,000 to anyone who helps to track her whereabouts.

As per Europol information, Ignatova is wanted for fraud-related crimes that have affected people’s financial interests in the European Union.

Ignatova Raised Over €5 Billion With OneCoin

Ignatova is suspected of driving the Ponzi scheme behind the so-called cryptocurrency “OneCoin,” which raised approximately €5 billion by the end of 2007 from investors in more than 170 countries.

Now fugitive, Ignatova launched the “OneCoin” project in mid-2014, selling it to investors as the future “Bitcoin Killer”; however, as has happened with many Ponzi schemes, like Arbistar or Bitconnect, when Ignatova felt in danger, she escaped, taking billions of dollars with her.

In December 2016, the Italian Antitrust Authority issued an injunction against the company One Network Services Ltd [OneCoin], describing its activities as an “illegal pyramid sales system.” However, it was only in 2017 when the company’s accounts in various parts of the world were frozen.

On The Run With €1 Billion

According to Europol, the whereabouts of Ignatova have been unknown since October 25, 2017. Allegedly, this happened after she knew the US Government was investigating her. She disappeared shortly after that, leaving her brother Konstantin Ignatov (who was arrested in 2019) in charge of the project.

In addition, Europol said that the losses caused by OneCoin around the world amount to several billions of dollars, adding that Ignatova and her companions could potentially be armed and that anyone willing to collaborate with the authorities should be careful.

“The fraud-related loss established so far is in the upper double-digit million range. The loss caused on a global scale probably amounts to several billion USD.”

How Did “OneCoin” Work?

Onecoin worked based on selling educational materials or bundles at 100 to 118,000 euros on cryptocurrency trading. The bundles included “tokens” through which investors could “mine” Onecoins.

However, the mined “coins” were not accepted by any exchange outside the one offered by the company called Xcoinx, which raised alarms in the community and ended up breaking the whole Ponzi scheme they had been running for years.

Xcoinx did not allow the exchange of onecoins to any other currency. Ignatova’s fortune has not been sized or recovered.