The force of the bear market has hit some projects worse than others. But no coin has gone through more pain than LUNA, the governance token behind the Terra ecosystem. The token has fallen so much, so fast that Binance —the world’s largest crypto exchange— is turning its back against it.

On May 12, Binance announced the suspension of perpetual contracts on the LUNA/USDT pair after lowering the authorized leverage to 8x.

This move comes after a series of events that caused the price of LUNA to plummet by more than 99%, inflicting millions of dollars in losses to investors in the crypto community.

As mentioned previously, Binance Futures will conduct an automatic settlement on the $LUNA USDT-Margined Contract and then delist the Futures contract at May 12, 2022 3:30pm UTC.https://t.co/774JF0HcqP

— Binance (@binance) May 12, 2022

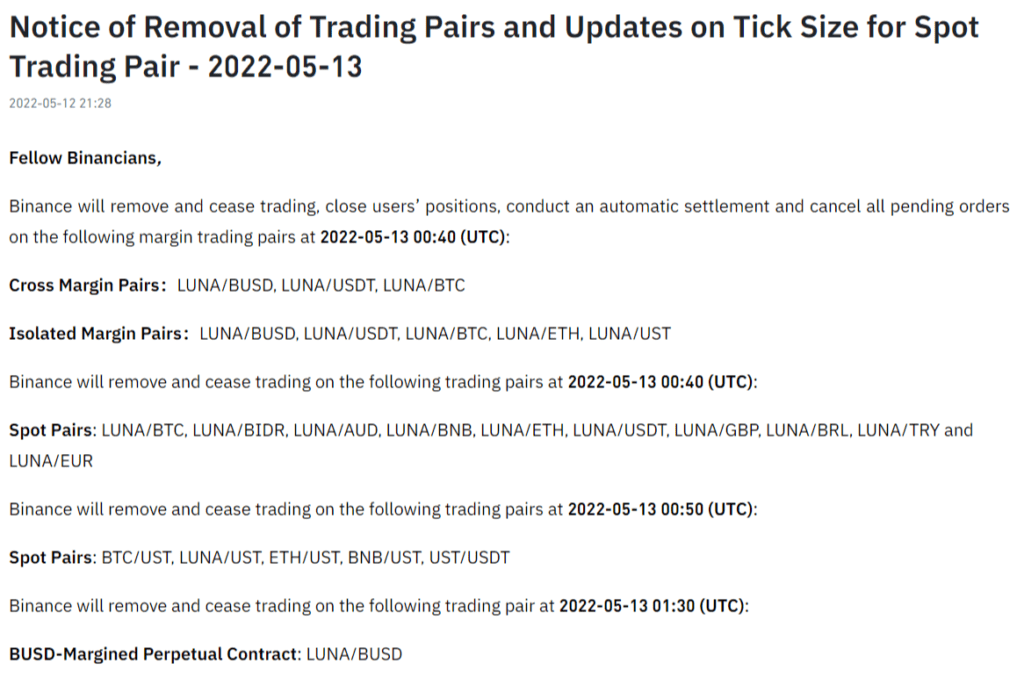

However, that was not enough. LUNA kept falling with no signs of stopping. Just hours after the previous announcement, Binance said it would be removing cross and isolated margin pairs, spot trading pairs BUSD margined perpetual contracts on LUNA, basically saying goodbye to the so hyped cryptocurrency.

This move is not spontaneus. One day before, on May 11, Binance reduced the maximum leverage on LUNA futures to 8X after seeing a massive wave of liquidations due to overleveraged positions. However, anyone trying to save a long leveraged position during that day would have lost it, as the LUNA token is currently trading at less than $0.005.

Yesterday, the CEO of Binance, Changpeng Zhao warned via his official Twitter account that it was necessary to respect the market when trading it since it is a “new market” with new stablecoins, that “When they are hot, they are all the rage. [But] When they drop, it can be a vicious circle”. This message was related to all that was happening with UST.

Many asked me about the markets today. We need to respect the market, with a level of caution too. It goes up and down in cycles. And especially the fact that it doesn’t always make sense. 1/4

— CZ

Binance (@cz_binance) May 11, 2022

LUNA price collapses and drives several people out of business

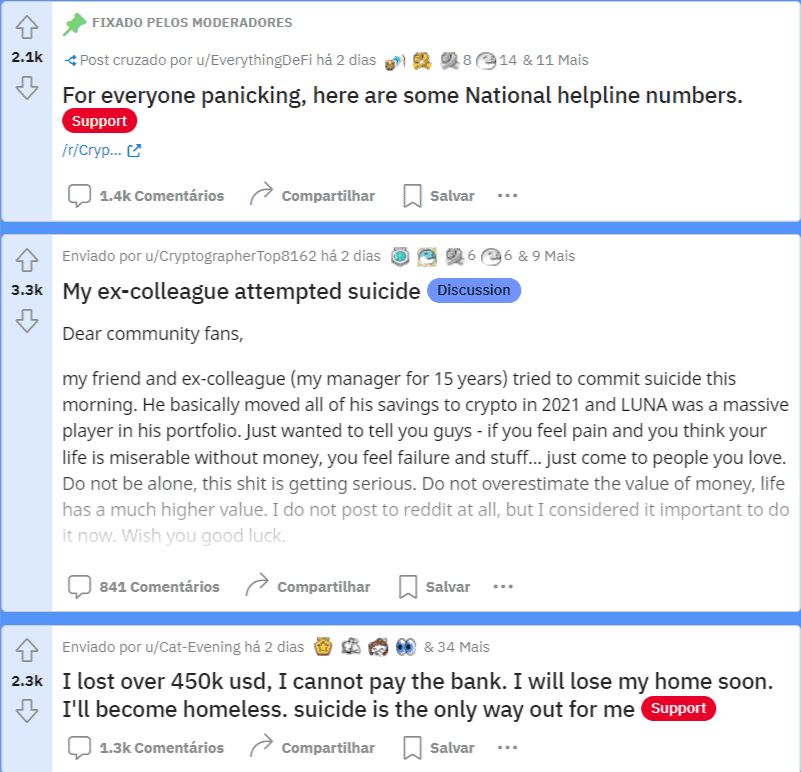

On May 11, the price of LUNA fell from $40 to less than $1. Such was the case that there were even people in the Reddit community who spoke of suicide, while others reported losing their savings and house mortgages due to the crash.

In less than a week, anyone with $100,000 invested in Terra’s project went down to just under $500 in total assets. And this is not counting those who froze their money in the “safe” UST stablecoin. Even though UST was designed to be worth 1$, the token crashed from 1$ to $0.2 —which is catastrophic for any investor, conservative or aggressive.

My 2.8 million dollars is literally worth $1000

HAHAHAHAHAAHAHAHAHAHAHAHAHAHAHHAHAHAHAHAHAHAHAHA. Yeah I’m packing this in

pic.twitter.com/qeiVN5yG2w

— KSICRYPTO (@ksicrypto) May 12, 2022

For now, the team behind Terra (LUNA) announced that they are working on specific measures to bring the project back to life; however, so far, the actions taken seem not to have impacted the broader market sentiment.

Validators are applying a patch to disable further delegations, and they will coordinate to restart the network in a few minutes. https://t.co/4gakxPLpLm

— Terra (UST)

Powered by LUNA

(@terra_money) May 12, 2022

The team behind Terra is now considering all proposals to resuscitate LUNA and UST —even ones that would have been unthinkable before, like altering the token’s algorithm. Today the Terra development team announced that they had stopped the blockchain to “avoid governance attacks after a severe inflation of $LUNA.”

Therefore, although Terra founder Do Kwon said on May 11 that they are working to bring the project back, other exchanges may follow in Binance’s footsteps and end up delisting LUNA/USDT trading until further notice.