Since the sharp drop in the crypto markets three days ago, Ethereum was able to recover about 14% from its lowest level at $1,800. However, the daily candlesticks structure remains weak.

Technical Analysis

Technical Analysis By Grizzly

The Daily Chart

On the daily timeframe, $1700 is considered a long-term support level for ETH, which has prevented further price drops in May, June, and July 2021.

Although this level has not been broken down yet, the ETH price did not repeat the immediate bounce back, like the last three occasions in 2021. To understand the reason behind this weak reaction to this multi-year static support, it should be reminded that the macro-economic conditions are different from last year, which is affecting risk assets – both global and crypto markets.

As it seems now and given the current price action, there are two possible scenarios:

Scenario A: Bulls push the price above the horizontal resistance at $2450, and ETH forms a local bottom in the range of $2500 – $3000. Then, most technical analysts are confident that the downtrend is over.

Scenario B: Price can retest the horizontal support at $1700. In that case, there is a high probability of this critical support level breaking down, because the more attempts a support or resistance level gets, the weaker it becomes.

Key Support Levels: $1700 & $1500

Key Resistance Levels: $2200 & $2450

Moving Averages:

MA20: $2545

MA50: $2925

MA100: $2878

MA200: $3347

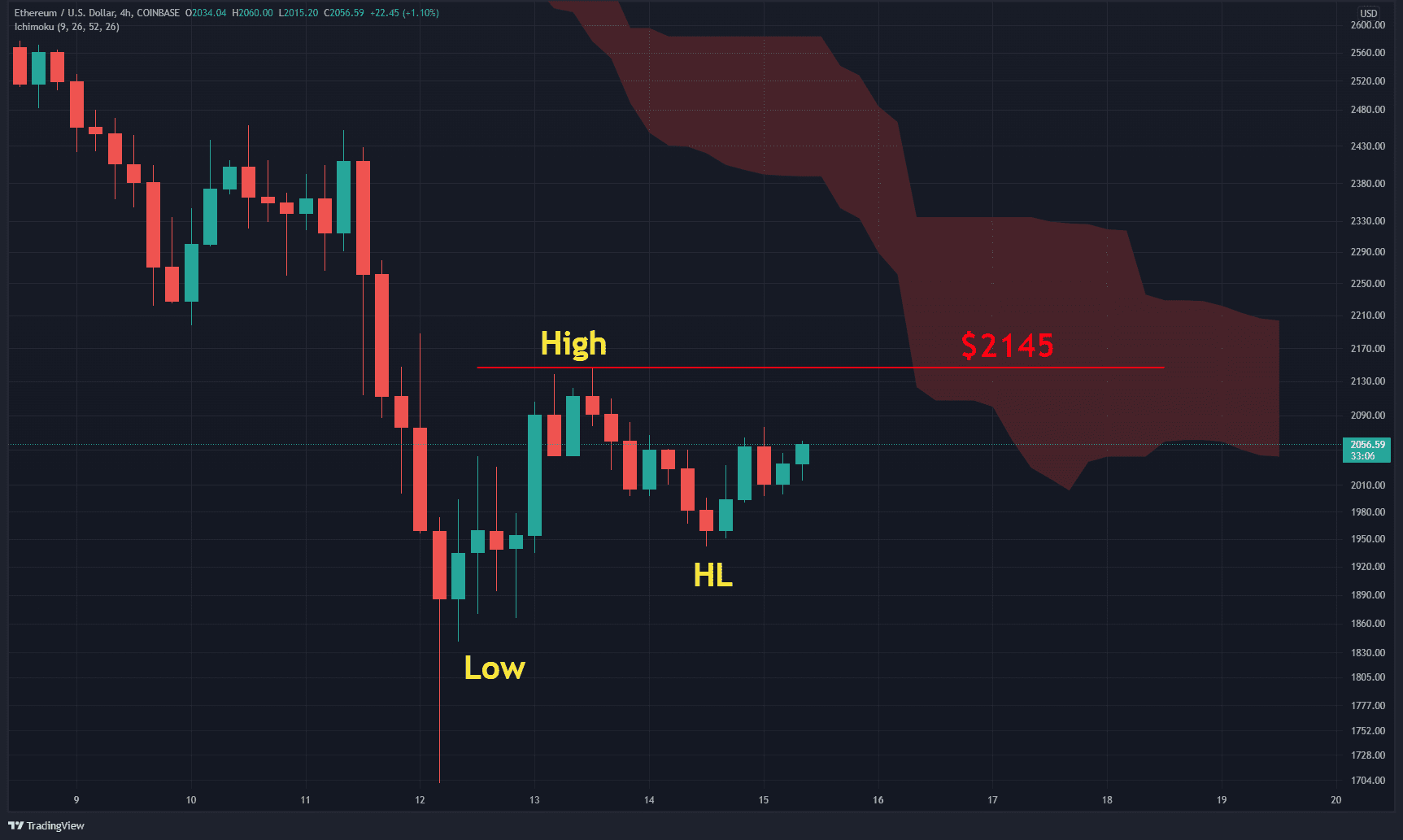

The 4-Hour Chart

ETH is forming a bullish structure on the 4-hour time frame, including higher highs and higher lows. At present, the main barrier is the static resistance at $2145.

ETH must break above this level and form a higher high in order to maintain the bullish structure. The intersection of this level with the thick Ichimoku can also create a serious challenge for bulls.

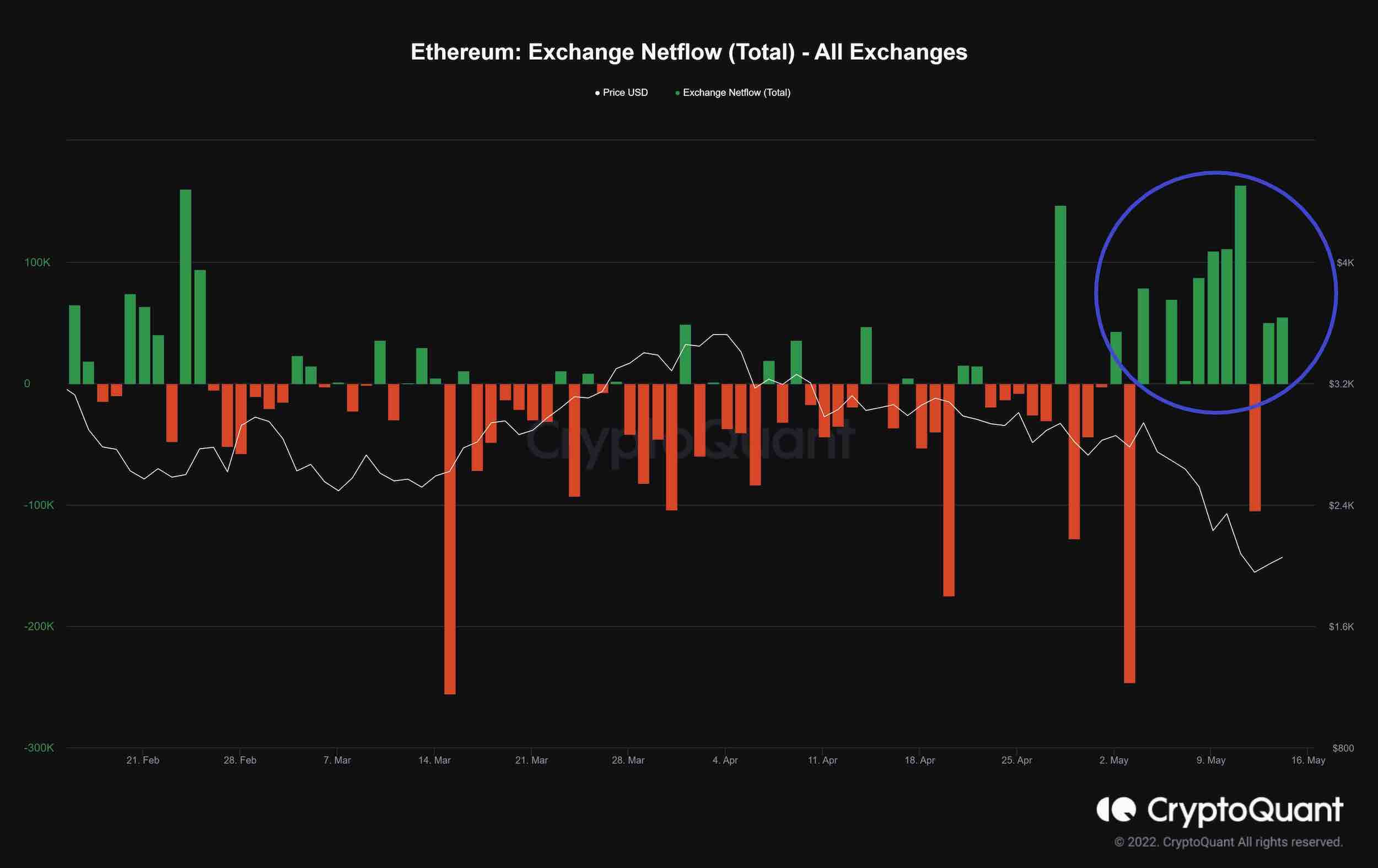

On-chain Analysis: Exchange Netflow (Total)

Definition: The difference between coins flowing in and out of exchanges (Inflow – Outflow = Netflow). A positive value indicates reserves are increasing.

Due to the sharp drop, many investors have transferred their coins into exchanges. Typically, this behavior is accompanied by substantial selling pressure in the market.

As long as the histogram bars do not turn red, speculators tend to be more cautious. For the market to start moving up, we should see market players withdraw their coins from the exchange, something that will cause a ‘supply shock.’