Key Insights

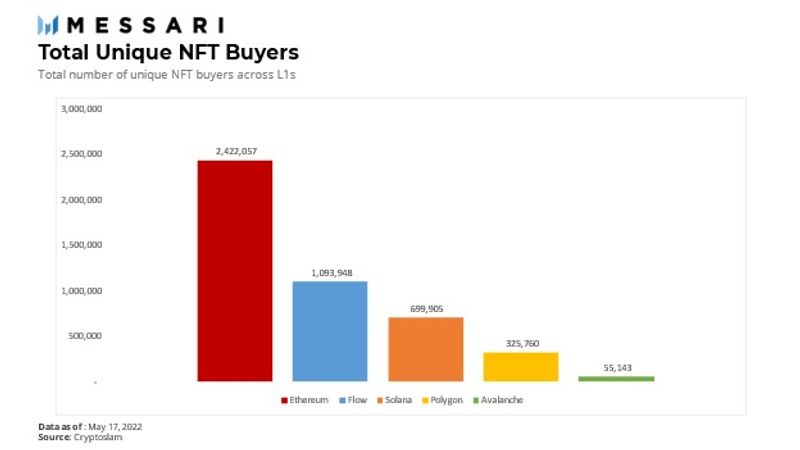

- The Flow blockchain saw early success with NBA Top Shot NFTs, now the network boasts over 3 million active users including delegators and validator nodes.

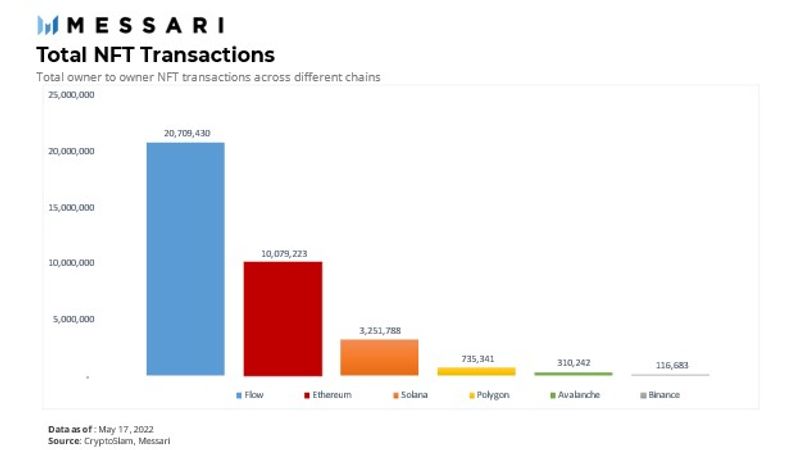

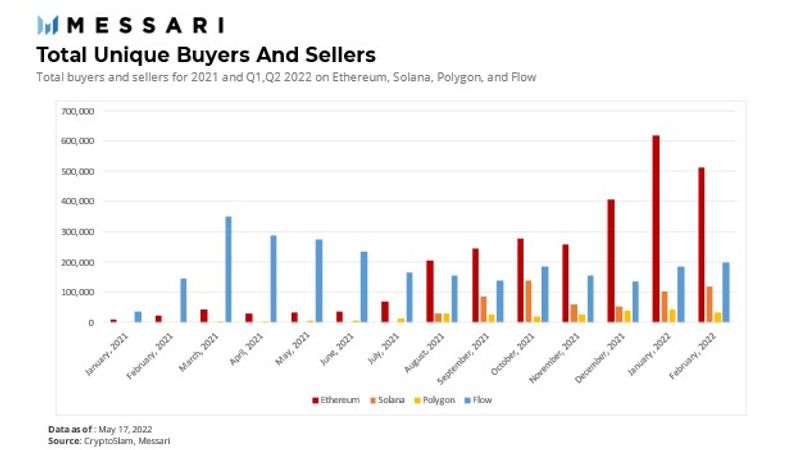

- Flow is currently leading in owner-to-owner NFT transactions, outpacing the likes of Ethereum and Solana.

- Flow recently committed to further support developers and users on its network by announcing the $725 million Flow Ecosystem Fund.

In Q2-Q3 2021, NFTs witnessed significant inflows, estimated to have increased sales volumes by over 8,000%. Since then, retail participants, independent artists, and consumer conglomerates have poured their attention into the NFT market, ushering in what some are calling the Renaissance 2.0. Platforms creating and offering access to the NFT marketplace have accelerated the pace of their technological innovation, becoming the gateway for retail participants to crypto markets and the Web3 environment.

One of the most prominent and well-known platforms providing these services is Flow, a Layer-1 (L1) Proof-of-Stake (PoS) blockchain developed by Dapper Labs. Flow was created to provide an alternative platform for Dapper Labs, independent projects, developers, and artists to create decentralized applications without the complexities of Ethereum’s Layer-2 (L2) network scaling solutions. Instead, the project adopted a unique multi-role architectural network design, which it believes provides a simpler solution to Ethereum’s L2 sharding approach and produces more efficient network speeds and throughput.

Brief History

The Flow blockchain first launched with its Flow Developer Preview in Q4 2019 to allow early smart contract development without the need for access to a full network instance. However, it had secured three initial private sale rounds, raising over $30 million from over 80 venture capital firms, including Coinbase, Samsung, and Union Square Ventures.

During that time, Dapper Labs utilized the Flow Developer preview to develop NBA Top Shot, one of the earliest and most prominent sports NFTs on the market. As a result of NBA Top Shot’s success and the release of the Flow Beta Mainnet V0.1 in Q2 2020, Flow has become a prominent competitor in the L1 protocol ecosystem. Since its beta mainnet launch, the project has partnered with prominent global sports brands such as the UFC and NBA and has deployed over 800 smart contracts with over 4 million unique accounts on its network.

The Flow Blockchain

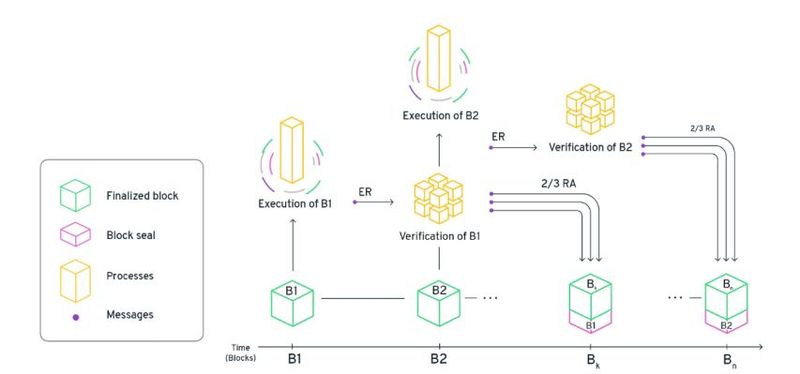

As previously stated, Flow runs on a multi-node architecture network design. To avoid the complexities of sharding on Ethereum, a multi-node network separates the responsibilities assigned to validator nodes across different stages of each transaction. Therefore, each node can specialize its role, allowing for increased efficiency at each validation step and each transaction. Sharding, on the other hand, separates roles across different transactions and does not specialize in validator nodes for each step of a transaction.

Flow’s multi-node approach encourages the specialization of node labor between deterministic and non-deterministic tasks. This design approach follows from the belief that the main issues contributing to congestion on a network are deterministic or “objective” tasks such as computing the result of ordered transactions. Each node is optimized based on its capabilities, which increases the blockchain’s throughput, and the higher throughput helps solve user and developer issues within the network.

The tasks across the Flow blockchain are distributed amongst four separate roles, each one required to stake a certain amount of capital in order to perform its specified tasks:

- Consensus Nodes: determine the presence and order of each transaction.

- Execution Nodes: perform computations related to each transaction.

- Verification Nodes: maintain a portion of the network’s security by ensuring Execution Nodes perform appropriately.

- Collection Nodes: contribute to increasing network connectivity and data availability for projects on the Flow blockchain by collecting transaction data from user agents.

To ensure security within the network, Flow enables a high number of participants to run non-deterministic Consensus and Verification nodes, the network’s authority of security. The remaining two nodes, Execution and Collection, have purely deterministic roles, making them less vulnerable to exploits. Therefore, Execution nodes are meant to be operated by specific dedicated hardware in a professional manner.

Source: Flow Whitepaper

To become a validator on the Flow network, a minimum amount of the native FLOW token must be staked, as follows:

- Consensus Nodes: 500,000 FLOW

- Execution Nodes: 1,250,000 FLOW

- Verification Nodes: 135,000 FLOW

- Collection Nodes: 250,000 FLOW

Flow Blockchain Metrics

During the initial stages of the project, Flow introduced three large-scale token distribution/engagement programs in order to increase community member engagement and scalability of the network:

- Cloudburst Partners: entities chosen by initial FLOW holders to operate one or more validator nodes while distributing their rewards to individuals building on the Flow platform.

- Floodplain Validators: ecosystem participants interested in engaging early with the Flow network to help scale content and resources.

- Decentralized Reputation and Incentive Protocol (DRIP): designed to distribute FLOW to end users of dapps built on the network for staking, delegating, and providing active participation in the ecosystem.

During this time, Flow faced the potential risk of compromising the blockchain’s security and scalability when the majority of tokens were concentrated by centralized entities.Transitioning to a decentralized network was determined by how quickly the token distribution programs allowed for the appropriate security and scalability for developers and users. Since then, Flow has managed to adequately decentralize its network via token distribution and was recently deemed “controlled by the community” with community nodes comprising over 68% of the network’s consensus nodes.

The most recent staking metrics show 305 nodes:

- Execution Nodes: 7

- Consensus Nodes: 115

- Collection Nodes: 106

- Verification Nodes: 77

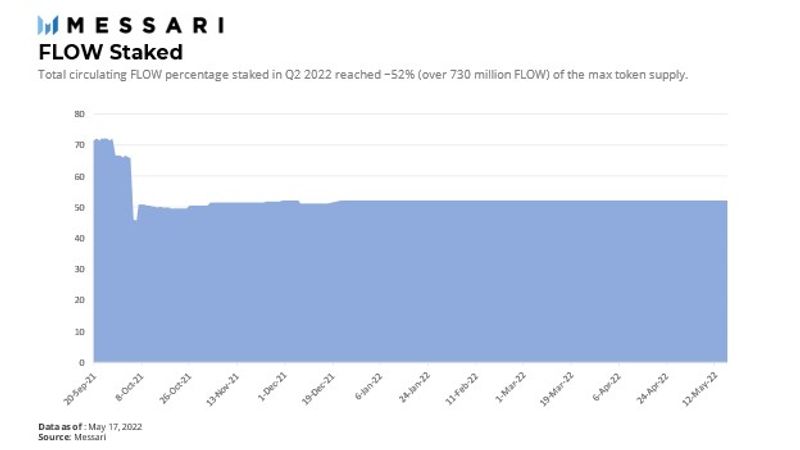

There are also over 31,000 delegators contributing to the Flow network. Delegators are FLOW holders that stake FLOW by designating tokens to node operators. Additionally, over 730 million FLOW (~52% of the total token supply) has been staked, with staking rewards reaching over 100 million FLOW (over 7% of the total token supply).

Technical Features:

Cadence

As with the majority of new L1 protocols, Flow has its own programming language, Cadence, for smart contract development. Cadence offers a higher level of decentralization when it comes to storing data (e.g., digital assets). Unlike Solidity, which stores information on a central ledger, Cadence stores data directly in users’ accounts. Without a centralized data storage function, Cadence can bring more security to Flow’s network architecture. This feature also offers developers and end users a simpler method for creating and transferring digital assets on the Flow blockchain.

SPoCKs

Furthermore, Flow has integrated an innovative cryptographic technique called the Specialized Proofs of Confidential Knowledge (SPoCKs) in order to address the Verifier’s Dilemma. SPoCKs are characterized as cryptographic commitments. They certify that Verification Nodes have properly done their job and have not blindly approved results generated from Execution Nodes without proper verification that the work has been done correctly. SPoCKs also regulate Execution Nodes by ensuring each node has computed each block appropriately.

Flow Client Library (FCL)

A function within almost all L1 protocols is the interaction amongst crypto wallets such as Metamask, decentralized applications, and the network’s blockchain. Traditionally, applications provide access to crypto wallets via browser plugins or by hard-coding browser-based crypto wallet activities without the need for a plugin. These methods, although adopted by many blockchains, pose a barrier of entry to users. They are difficult to scale and require extra work from developers in order to allow wallet-to-application interaction. The FCL allows developers to connect a wallet or application with fewer lines of code. It also allows any application to work with any FCL-compatible wallet and vice versa. For developers, this creates a seamless experience when developing applications on Flow and provides consistency across interactions between applications and wallets.

Flow Token

The Flow platform runs on FLOW, its native token that allows developers and users to interact on the Flow blockchain. Holders can use their FLOW to stake and work towards securing the network and accommodating computation and storage tasks across the platform. FLOW is also used to pay out rewards to stakers as well as gas/transaction fees for activities on the network.

FLOW Distribution

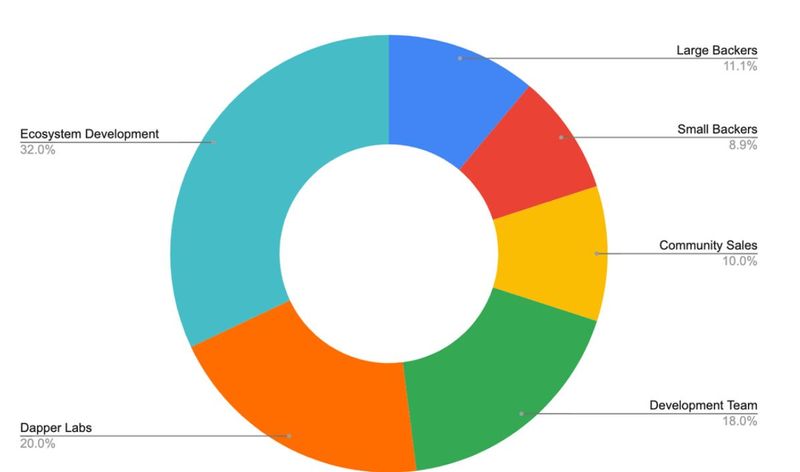

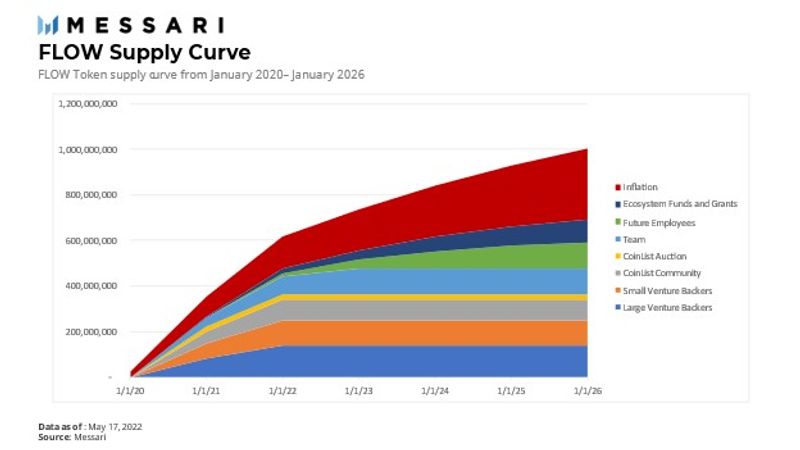

During the initial release of the FLOW token, 1.25 billion FLOW was created and distributed to holders outlined below:

- Dapper Labs: 20%, allocated to its long-term treasury.

- Development Team: 18%, vested over three years with a one-year cliff.

- Ecosystem Development: 29%, subject to lockup during the first year that expires no sooner than the first unlock for early backers and the team.

- Community Sales: 13%, 12-month lockup.

- Large Backers (contributions over $1 million): 11.1%, 24-month lockup with a one-year cliff.

- Small Backers (contributions less than $1 million): 8.9%, 24-month lockup with a one-year cliff.

Source: Flow Website

It should be noted that during the lockup periods above, tokens can only be used for staking purposes or utility in NBA Top Shot as of day one. Lockups and transfer restrictions began at the exact moment for all entities.

Flow does not yet have its own treasury; however, the Flow Foundation will have a role in administering 250 million FLOW which has been reserved for long-term distribution and ecosystem development.

Governance

On-chain governance features for FLOW stakeholders consist of three forms of decision-making processes:

- Ecosystem Decisions: includes issues related to choosing council members and finalizing the allocation of funds set by the foundation.

- Protocol Parameters: matters involving aspects of the network that are set as parameters and don’t require a protocol upgrade.

- Protocol Upgrade: all matters involved during a hard fork of the network requiring large participation and buy-in from all FLOW stakeholders.

These features are slated to be available to users in Q2 2022. Currently, most decisions made on the Flow ecosystem are off-chain wherein proposals are submitted to the Flow GitHub repository, proposals are discussed, and a decision is made based on community consensus for implementing the proposed alteration. Authorization is required to implement the changes after community consensus has been reached for alterations to be appropriately deployed to validator nodes.

Ecosystem Overview

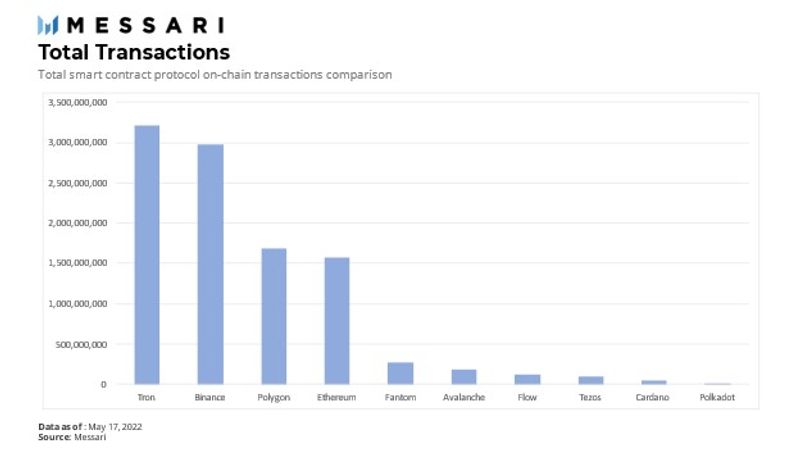

In terms of total transaction volume conducted on the network, Flow is showing impressive standing given how long the network has existed compared to its counterparts.

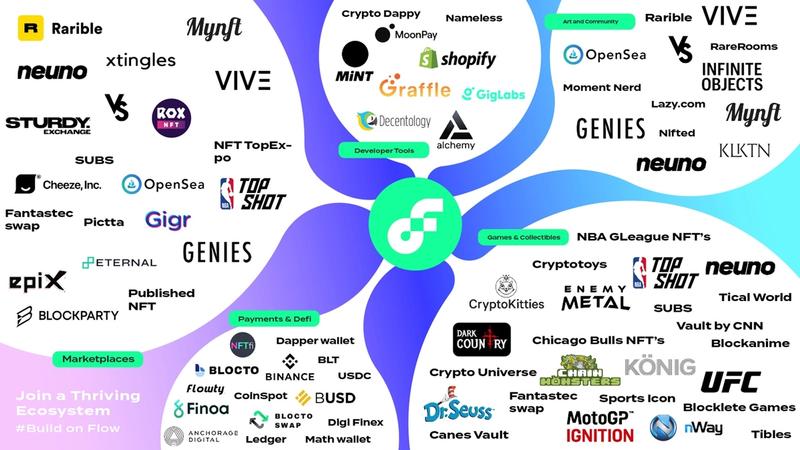

In terms of total transactions and active wallets, Flow currently has over 3 million active users including delegators and validator nodes. Due to the earliness of the protocol, Flow has significant road to cover to reach “legacy” L1 ecosystems such as Ethereum. However, significant progress has been made in accelerating user activity on its network. Regardless, Flow has provided adequate support for on-boarding new users that wish to develop and deploy on the network. With this, the platform aims to attract a larger spectrum of dapps, such as DeFi and Web3-specific projects. With more projects, Flow can close the gap on network traffic and ecosystem participation.

As stated, Flow currently has over 800 smart contracts deployed and is most well known for attracting projects in the NFT ecosystem. There is a stark contrast in the secondary NFT transaction volumes on Flow compared to other L1s (and L2s on Ethereum) providing secondary NFT sales. Flow seems to be leading owner-to-owner NFT transactions. Flow continues to make strides within the NFT space with continuous engagement between native Flow projects and new project releases.

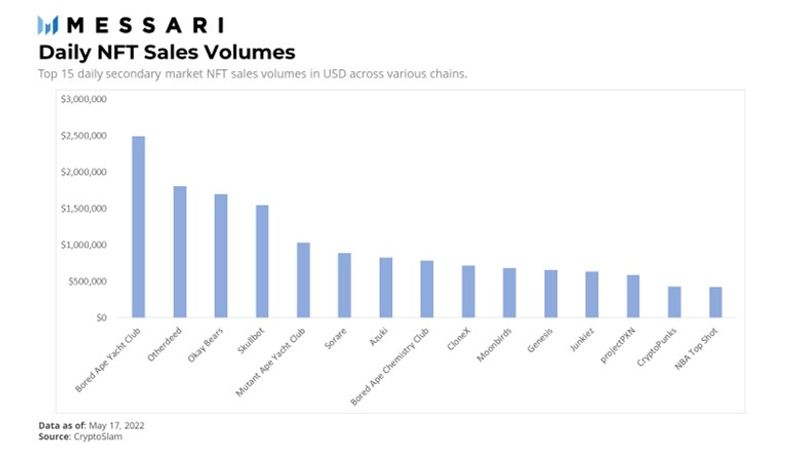

Among the top-ranking NFTs by secondary market sales volume, Flow’s NBA Top Shot remains a strong competitor amongst notable existing and new NFT projects.

Flow also saw a considerable increase in new developers entering the network during the early stages of its testnet launch in Q1 2021. Coupled with high-profile partnerships with companies such as Samsung, Ubisoft, and Warner Music Group, Flow is uniquely positioned to continue the expansion of mainstream adoption not only in the NFT market but for the broad spectrum of crypto projects. Further adoption in DeFi and Web3-based projects on the Flow blockchain can bring more awareness and participation from retail participants and large organizations.

Dapper Labs continues to invest in projects being built on Flow and has partnered with leading private investment companies such as a16z and Animoca Brands. Additionally, the Dapper Labs team offers ease of access to new projects seeking fundraising by leveraging the team’s significant network and VC outreach.

Layer-1 Competition and Risks

Competition

L1 development has been at the forefront of the crypto space, evolving at an accelerated pace and offering diverse technologies to improve blockchain throughput, security, and speed.

Flow’s efforts to compete with established chains cannot go unnoticed, especially when participating in the NFT and Web3 gaming market. Due to Flow’s performance and the quality of partnerships being executed, the network notably outperformed its counterparts in 2021.

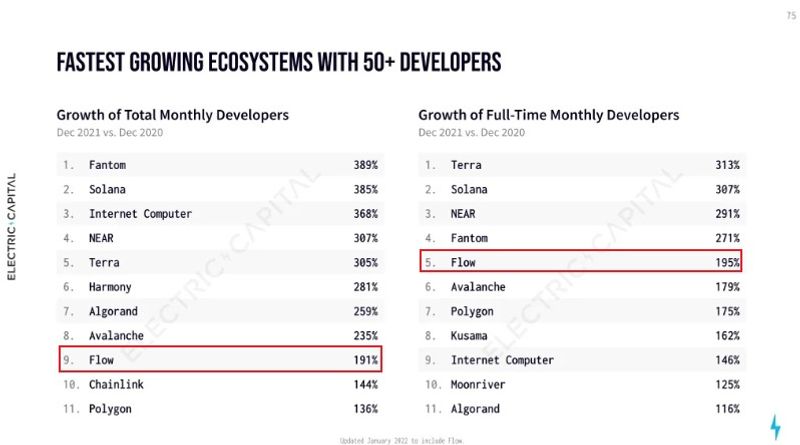

Furthermore, developer activity on Flow has seen significant increase this past year.

Source: Electric Capital

The data above is taken by open-source repositories and code commits from multiple platforms, including GitHub, Gitlab, CoinGecko, and DappRadar, for each protocol. In 2021, Flow was the ninth fastest growing compared to competitors with 50+ developers and fifth fastest growing ecosystem in terms of full-time developers.

Potential Risks

The interactions shown above demonstrate how market participation has been shaped over the past year, especially when it comes to new blockchains offering innovative solutions for users and developers. However, all L1 blockchains face the obstacle of achieving balance amongst scalability, security, and decentralization. Typically, L1 networks that are composed of a single-node type may face difficulties when making tradeoffs amongst scalability, security, and decentralization.

Flow’s multi-node architecture offers additional support when it comes to balancing these key aspects to a L1 protocol. The specialization of nodes allows for each component of the system to prioritize a certain segment of the scalability, security, and decentralization trilemma. Currently, Consensus, Verification, and Collection nodes are more decentralized relative to Execution nodes. Because Execution nodes are deterministic, they don’t require the same level of decentralization. In the same vein, Execution nodes require professional hardware to run, thus favoring scalability over decentralization.

Network performance and availability issues may arise due to Execution node complications. Although the failure of these nodes does not threaten the network’s security, the potential of all eight Execution nodes experiencing problems could halt transaction processing. For example, Flow experienced a network outage after its most recent network upgrade when Execution nodes introduced a new execution identifier. As noted above, Execution nodes are purely deterministic, but the newly implemented identifier was not deterministic which led to blocks not being sealed. The nodes required additional memory to maintain network operations. The Flow blockchain is designed to tradeoff liveness in favor of safety, so the network was halted temporarily to prevent any incorrect block sealing.

The incident response teams, however, responded diligently to the issue and provided clarity on what occurred during the network instability. The team also took steps to solve and mitigate the problem from happening in the future.

The Road Ahead

Flow has not outlined a definitive roadmap; however, the platform follows Dapper Labs’ central vision for the blockchain to be used for high-scale and detailed crypto gaming experiences. Dapper Labs is beginning this process through onboarding additional projects and mainstream consumer brands, while also aiming to migrate existing projects such as CryptoKitties onto Flow.

Source: Dapper Labs

As NFT development on the platform continues, developer activity has also increased. More sectors of the crypto industry are being introduced to Flow, such as IncrementFi, a decentralized money market and liquidity engine aimed to build some of the first DeFi protocols on Flow.

Flow has established itself as a significant platform due to the overwhelming influx of mainstream partnerships, the quality of projects being built, and the blockchain’s performance. According to the project team at Dapper Labs, the Flow testnet network has over 6,000 developers actively building and learning how to deploy smart contracts using Cadence. NFTs and crypto gaming have already demonstrated considerable adoption amongst mainstream investors, and Flow continues to provide services for artists and developers to innovate in the space. Flow recently committed to supporting developers and users on its network by announcing the Flow Ecosystem Fund. The fund raised $725 million to support and accelerate development of applications built on Flow.

Furthermore, as the project diversifies its platform with additional crypto native protocols and Web3 ventures, it should draw additional attention and adoption from developers. Although Flow faces an arduous and competitive landscape before it can become the most efficient and most used L1 blockchain, Flow Flow seems poised to grow into a prominent network challenger.

This report was commissioned by Flow, a member of Protocol Services. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. Paid membership in Protocol Services does not influence editorial decisions or content. Author(s) may hold cryptocurrencies named in this report.

Crypto projects can commission independent research through Protocol Services. For more details or to join the program, contact ps@messari.io.

This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. The past performance of any asset is not indicative of future results. Please see our terms of use for more information.