Notable Messari Intel Updates

- Do Kwon has submitted a revised proposal for relaunching the Terra network as a smart contract blockchain without the UST algorithmic stablecoin component. If enacted, the legacy Terra chain would be renamed Terra Classic (LUNC) as the new blockchain would continue to be referred to as Terra (LUNA). It is expected that the new Terra chain will incentivize security with 7% annual token inflation.

- Lens Protocol is now live on mainnet. Users who signed the Lens open letter before May 5 will be able to claim a Lens handle.

- Polygon Nightfall, a privacy-focused Ethereum rollup, has launched on mainnet. Nightfall will be a mainnet beta version at launch as the protocol is still unaudited. The number of validators and wallet amounts will be limited while the project remains in beta. The team plans to lift the restrictions on the network and fully launch the protocol in Q3 or Q4 of 2022.

- The Flow team announced a $725 million Ecosystem Fund, which will focus on providing support for gaming, infrastructure, decentralized finance, and content across the Flow ecosystem. Participants include a16z, AppWorks, Cadenza Ventures, Coatue, Coinfund, Digital Currency Group (DCG), Dispersion Capital, Fabric Ventures, Greenfield One, HashKey, L1 Digital, Mirana Ventures, OP Crypto, SkyVision Capital, Spartan Group, Union Square Ventures, and Dapper Ventures.

- A hard fork on the Harmony network has been scheduled for epoch 999, corresponding to a block height of 26,345,516. The activation block will arrive on May 27, 2022, at approximately 09:41 UTC.

Notable Messari Governor Updates

- We have released our newest version of Messari Governor! This update to our governance aggregator includes a directory of 800+ DAOs as well as 350+ DAO tools. As a result, Messari Governor is the largest database of DAOs and tools available anywhere. Read the article here.

- The Frax DAO has submitted a proposal that aims to approve a $3 million investment in the Pitch strategic round. The investment would be purchased using 50% FXS and 50% FRAX at a $0.50/PITCH rate and subject to a 6-month lock and 2-year vest. Frax previously approved a pitchFXS/FRAX gauge in FIP 59. Preliminary discussions are ongoing.

- Redacted Cartel has submitted a proposal that aims to set up a seven-member DAO Reserves Committee to safeguard and oversee the use of funds from the DAO Reserves (which was approved Redacted Tokenomics V2). The Committee will be responsible for rebalancing the DAO reserve assets, approving budgets and expenses, and approving asset management strategies such as DAO treasury swaps, treasury raises, de-risking strategies, etc. The Committee will not have control of the Redacted Treasury or DAO Reserves via multisig. Preliminary discussions are ongoing.

- The Stake DAO submitted a proposal that aims to whitelist the Stake DAO multisig to interact with the veSDT contract. Stake DAO can therefore protect against hypothetical governance attacks and represent the DAO’s interest on Stake DAO gauge votes and Curve and Frax pools. Preliminary discussions are ongoing.

- The Perpetual Protocol DAO submitted a proposal that seeks to determine a preferred option for sunsetting the Perpetual Protocol v1. The decision follows an incident of price deviation and subsequent bad debt resulting from market volatility and liquidation of a large position in the CREAM market. The liquidation event triggered the flow of the exchange’s entire insurance fund towards settling trades. Hence, the Perp protocol team decided to shut down the protocol to prevent further loss of funds. Voting is currently active.

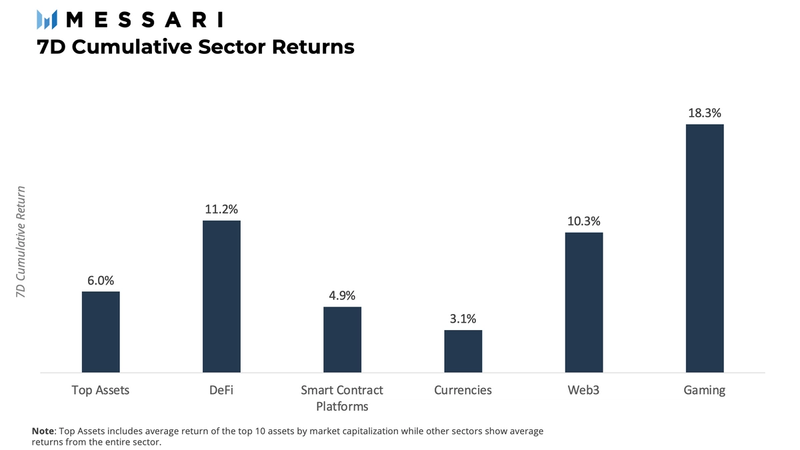

Sector Returns

The cryptocurrencies market had a much-needed breather after a brutal decline last week. All sectors covered were in the green this week with three of them ending with double-digit returns. The gaming sector led the pack with a return of 18.30%. A significant relief following its 40% freefall previous week. Up next was DeFi with a weekly return of 11.21%, another sector recovering from a harsh decline from the previous week (-34.71%). The currencies sector remained the most stable within the group, ending the week 3.14% above the previous.

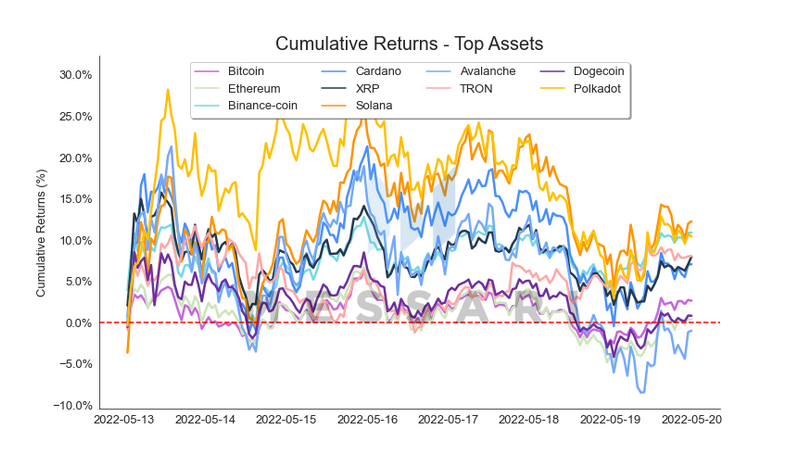

Top Assets

The top assets by market capitalization category traded with high volatility compared to previous weeks. Assets also did not trade in their usual synchrony, as some traded within the single-digit performance range and others visited the +25% range. This week’s best performer within the top assets category was Solana (SOL), which briefly sat on a 30% gain only to give more than half of it back, ending the week with a 12.3% return. Top assets only had one asset end in the red: Avalanche (AVAX), with -1.0%.

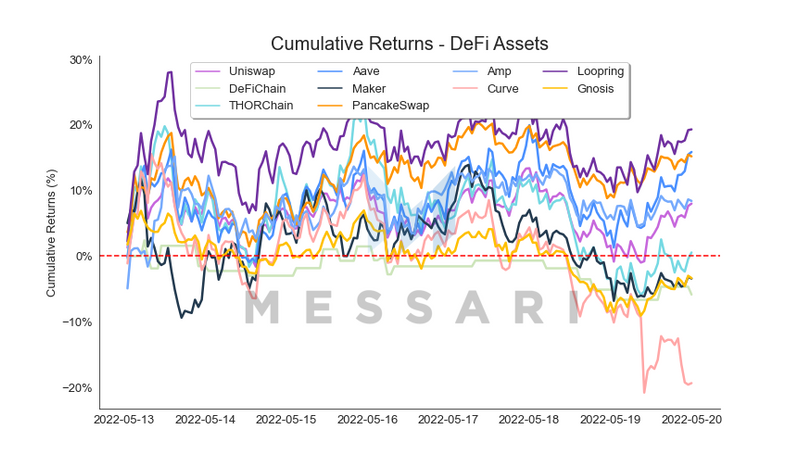

DeFi Assets

The DeFi asset sector traded similarly to top assets, with some briefly touching +20% territory. Assets also traded with lower synchrony than usual, and almost half of the assets ended the week with losses. The best performer this week was Loopring which had an early week spike that it wasn’t quite able to top again. The zk-SNARKs-based Layer-2 exchange’s token LRC ended the week with a 19.3% gain. Aave (AAVE) and PancakeSwap (CAKE) followed closely behind, with 15.9% and 15.2%, respectively. Curve was the worst performer, posting a 19.4% loss on the week.

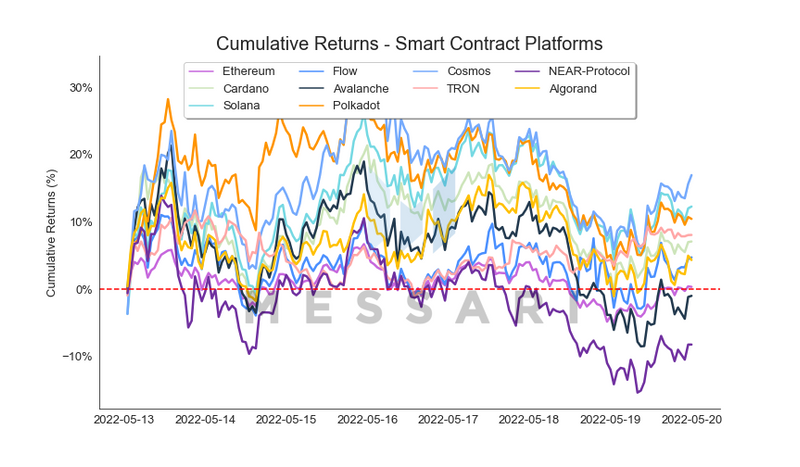

Smart Contract Platforms

This week saw the addition of Flow (FLOW) to the list of top 10 smart contract platforms after switching places with Ethereum Classic (ETC) and benefitting from the open spot that Terra (LUNA) left following its swift departure. The top performer of the week was Cosmos (ATOM) with a 16.9% gain, followed by Solana (SOL) and Polkadot (DOT) with 12.3% and 10.4%, respectively. NEAR lagged the group, ending the week with an 8.2% decline.

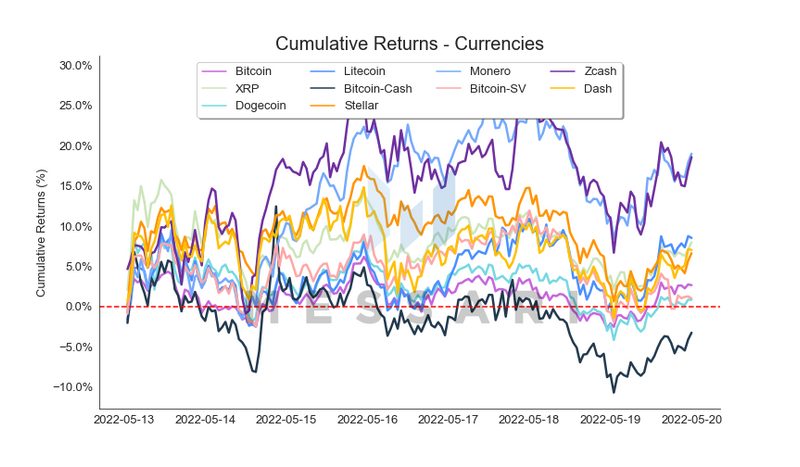

Currencies

Even currencies, one of less volatile sectors, saw significant swings in some of its top assets. Both Monero and Zcash broke away from the pack early on and dueled it out for the remainder of the week. Monero (XMR) came out on top with a 19.0% return, closely followed by Zcash (ZEC) with 18.6%. The rest of the currencies ended the week with single-digit positive returns with the exception of Bitcoin Cash (BCH), which posted a 3.3% loss.

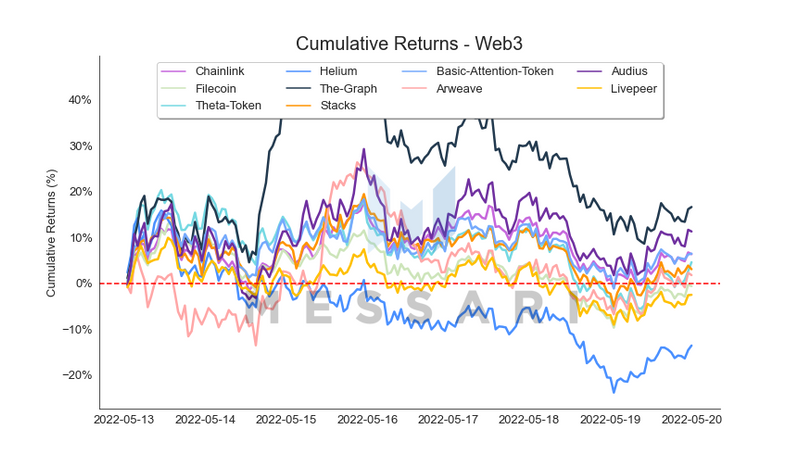

Web3

Web3, being a higher beta sector, saw a wider performance dispersion within its top assets this week. Namely, The Graph (GRT), which saw its token price reach as high as 56% before shedding most of it. However, it was enough for it to secure the number one spot within the sector with a 16.7% return. Audius (AUDIO) was the second best performer and the only other top Web3 asset to end the week with a double-digit positive return (16.7%). Helium performed menially with a -13.6% return.

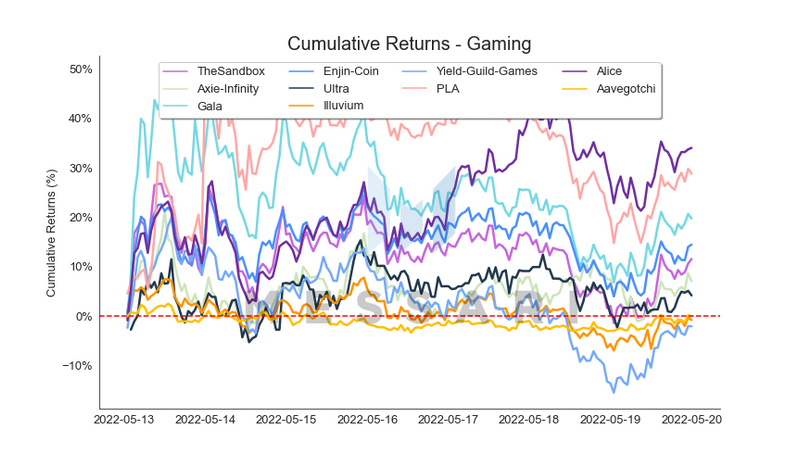

Gaming

It’s easy to notice how gaming was the best performing sector of the week. Half of the top ten assets had double-digit gains, with three of them having their prices go above the +40% mark at one point during the week. Alice (ALICE), the late bloomer of the pack, didn’t have such an explosive start to the week as PLA (PLA) or Gala (GALA) but ultimately secured the number one spot within the sector. It ended the week with a 34.0% return, followed by PLA (PLA) and Gala (GALA) with 28.8% and 19.8%, respectively.