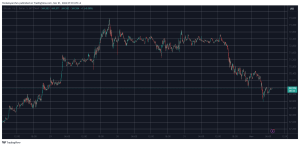

The ups and downs in the value of major crypto, including of course Bitcoin, combined with the debacle of the Terra (LUNA) ecosystem, has instilled worries in the Biden leadership.

Biden’s US returns to crypto regulation

With Bitcoin hovering around $29,000, the US President’s administration and executive branch are back in a hurry to regulate the crypto world.

Digital currencies and stablecoins are causing concern in the wake of the events of LUNA and UST that burned $50 billion in capitalization off the market.

Gary Gensler, chairman of the SEC told the Budget Committee:

“I wish we had more resources to dedicate to this goal: there was a crypto complex that went from a value of $ 50 billion to zero in three weeks. The public is not protected”.

The statement suggests that the 50 employees already working in the department on fraud in the world of virtual currencies are not enough and that more needs to be invested.

The Joe Biden-led executive is pressing Congress to revise the rules underpinning the crypto world with a view to protecting the end consumer, who seems to be a pawn rather unprotected.

The idea towards which they are moving is to oblige platforms to keep users’ instruments separate from their own possessions.

Coinbase itself recently took a clear stance on the subject, which gives a good idea of the risks involved.

Coinbase, the first crypto platform to list on Nasdaq and the most widely used in the world, had expressed itself in these worrying tones:

“In the event of bankruptcy, crypto assets held on behalf of users could be subject to insolvency proceedings and those users could be considered unsecured general creditors”.

Further on the subject, Gary Gensler stated that:

“You don’t think you are the real owner of your tokens when you open a digital wallet. If the platform goes down, you are nothing more than its counterpart. Line up in bankruptcy courts”.

There is a feeling of openness in Moscow

While New York is concerned about investors and is implementing more extensive and effective regulation from the point of view of protection, there is renewed sentiment in Moscow. Cryptocurrencies are appealing and it is time to incentivize them or at least deregulate them.

According to the Tass news agency, Russian Industry and Trade Minister Denis Manturov is optimistic about the liberalization of crypto in Russia.

When pressed on the subject, the minister stated that:

“The question is how much and how, and both the central bank and the government are working on it. But everyone understands that this is a trend of our time and that, sooner or later, one way or another, it will come to fruition”.

Elvira Nabiullina, Governor of the Russian Central Bank, believes that one of the reasons for the opening up to the world of cryptocurrencies is related to the Western sanctions against Moscow, which have made it necessary to rethink the Russian economy and the resources coming from it.

The post Biden imposes stricter rules on crypto while Moscow is liberalizing them appeared first on The Cryptonomist.