The CEO of leading on-chain analytics firm CryptoQuant says one metric is flashing a massive red flag for Bitcoin (BTC) bulls.

Ki Young Ju tells his 292,600 Twitter followers that historical data shows Bitcoin could plummet all the way down to $14,000.

“So here’s hopium for bears.

If BTC crashed so hard due to the macro crisis and all Bitcoiner institutions go underwater, it could go $14,000 based on historical maximum drawdown.”

At time of writing, Bitcoin is down 3.58% and priced at $29,240. A move to the analyst’s bearish price target suggests a 52% downside risk for BTC.

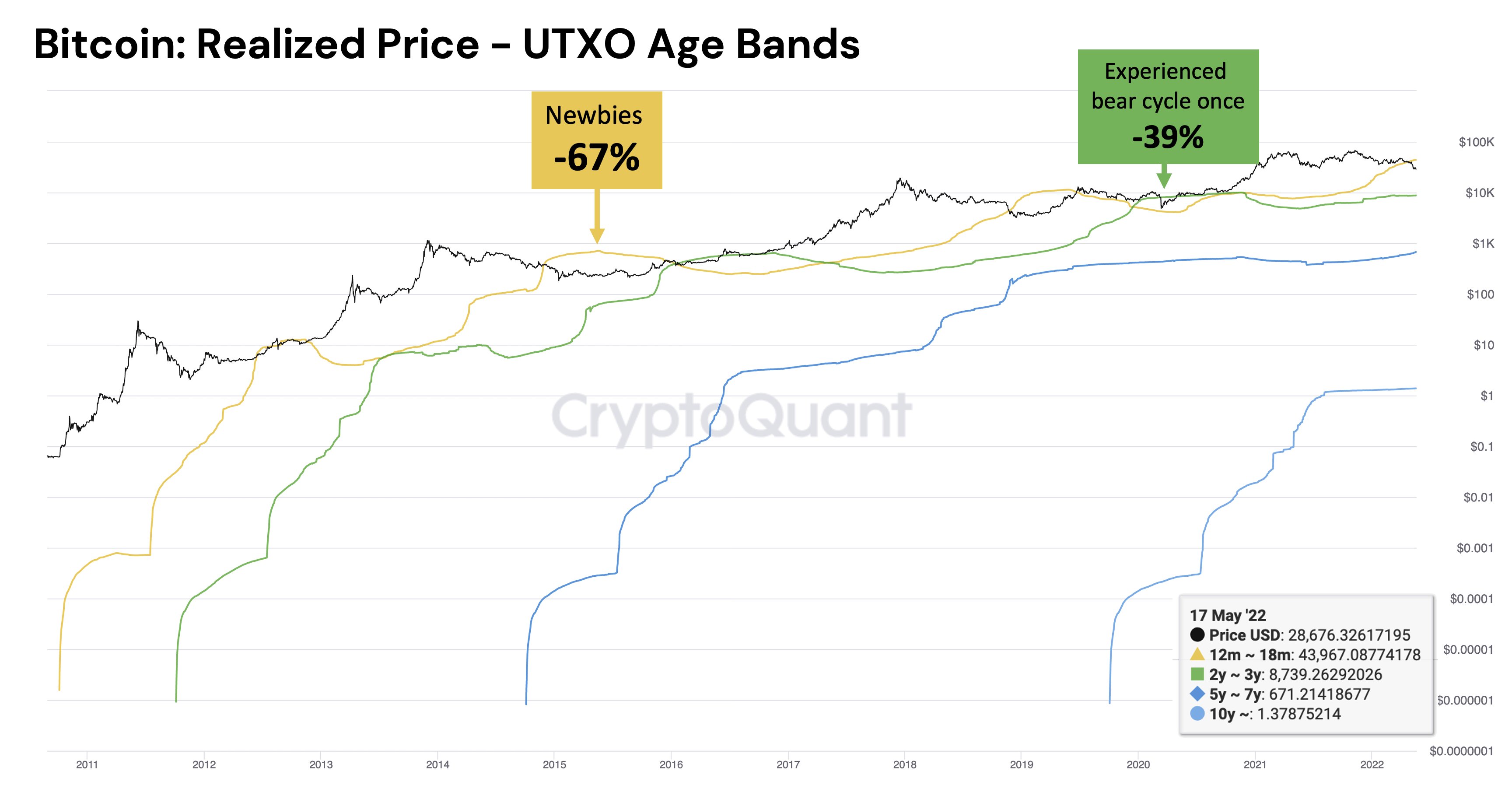

According to the quant analyst, the most recent Bitcoin investors will likely be deep underwater should market prices fall into his worst-case scenario.

“Bitcoin maximum drawdown in worst-case scenario.

Newbies down 67%.

Experienced one bear cycle – down 39%.

Experienced two bear cycles – profit guaranteed.

Experienced three bear cycles – profit guaranteed.

Today, newbies who joined last year are in -34% loss.”

Ki Young Ju next provides the average entry price for each generation of Bitcoin investors over its 11 years in existence by following the UTXO age bands metric, which tracks the potential price level where long-term holders accumulated BTC.

#Bitcoin OG’s Entry Price:

1st gen – $1.3

2nd gen – $653

3rd gen – $8,717

4th gen – $43,582I’m the 3rd gen. Hang in there, 4th gen. pic.twitter.com/iWkEwFO4zV

— Ki Young Ju (@ki_young_ju) May 14, 2022

The analyst also recently observed that institutional investors are now the dominant force in Bitcoin trading.

“Retail investors are leaving the crypto market. Not bad for accumulating Bitcoin with institutions, but still worried about overall volume, which is significantly decreased compared to last year.”

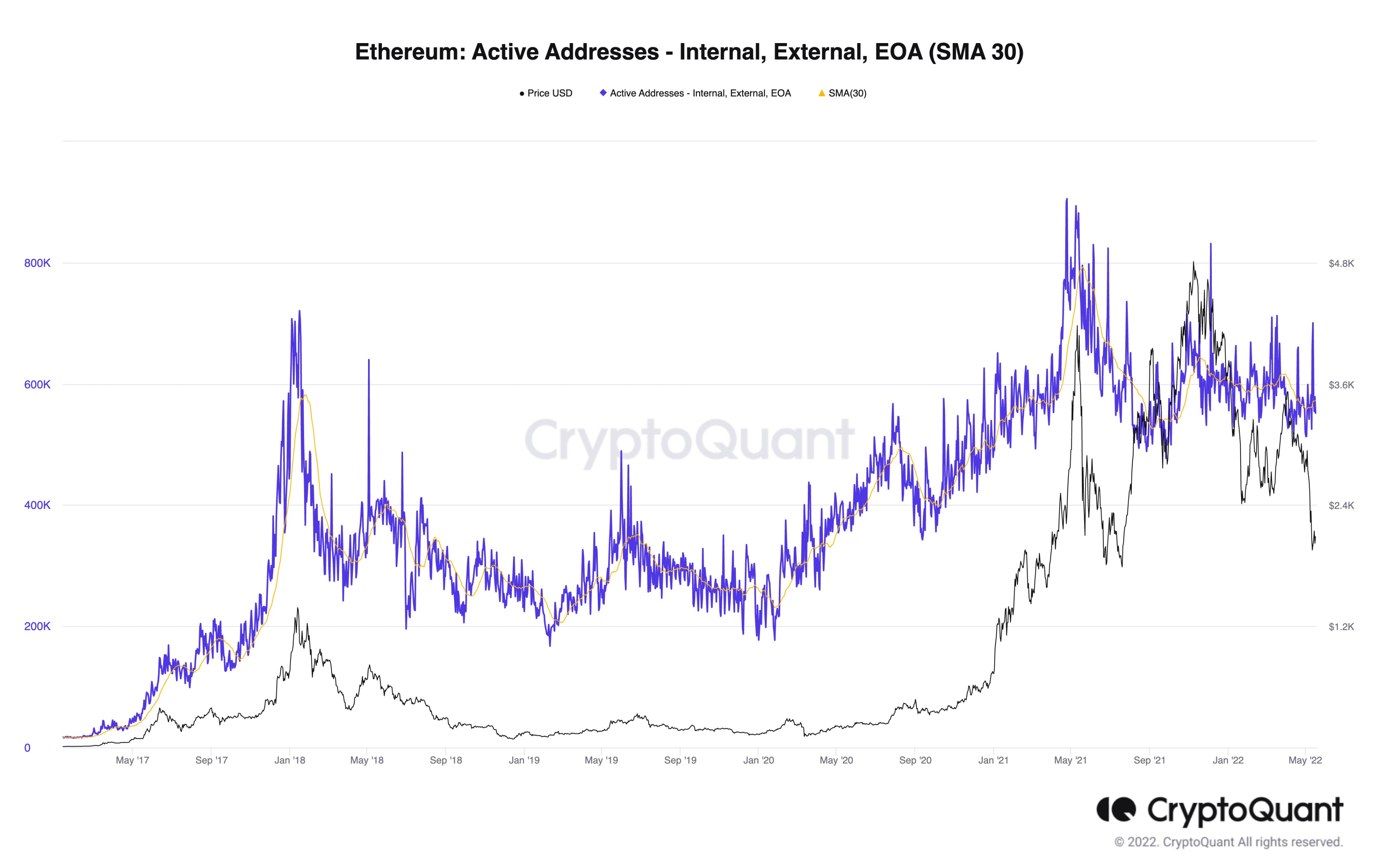

The CryptoQuant CEO next looks at leading smart contract platform Ethereum (ETH). He highlights that the ETH ecosystem remains strong despite a massive decline in price due to heavy interest in new blockchain niches like decentralized finance (DeFi), non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs) and play-to-earn blockchain games (GameFi).

“ETH price dropped -56% from the top, but the number of active addresses just decreased by 7%.

If we consider each address as a user, Ethereum has 551,705 DAU (Daily Active Users) today.

These degens don’t care about ETH price but ape into DeFi, NFT, DAO, and GameFi projects.”

Ethereum is also down by 2.57%, changing hands for $1,965.

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/kilshieds

The post One Metric Indicates Bitcoin (BTC) Could Crash by Over 50% As Macro Environment Worsens, Says CryptoQuant CEO appeared first on The Daily Hodl.