The first time we interviewed Alex Mashinsky was in July 2018 in the heart of a bear market. Bitcoin was about $6,500. The Celsius app was about to launch.

The second time was in May 2020. Bitcoin was still under $10,000, but by this time, Celsius had passed over a billion dollars in assets.

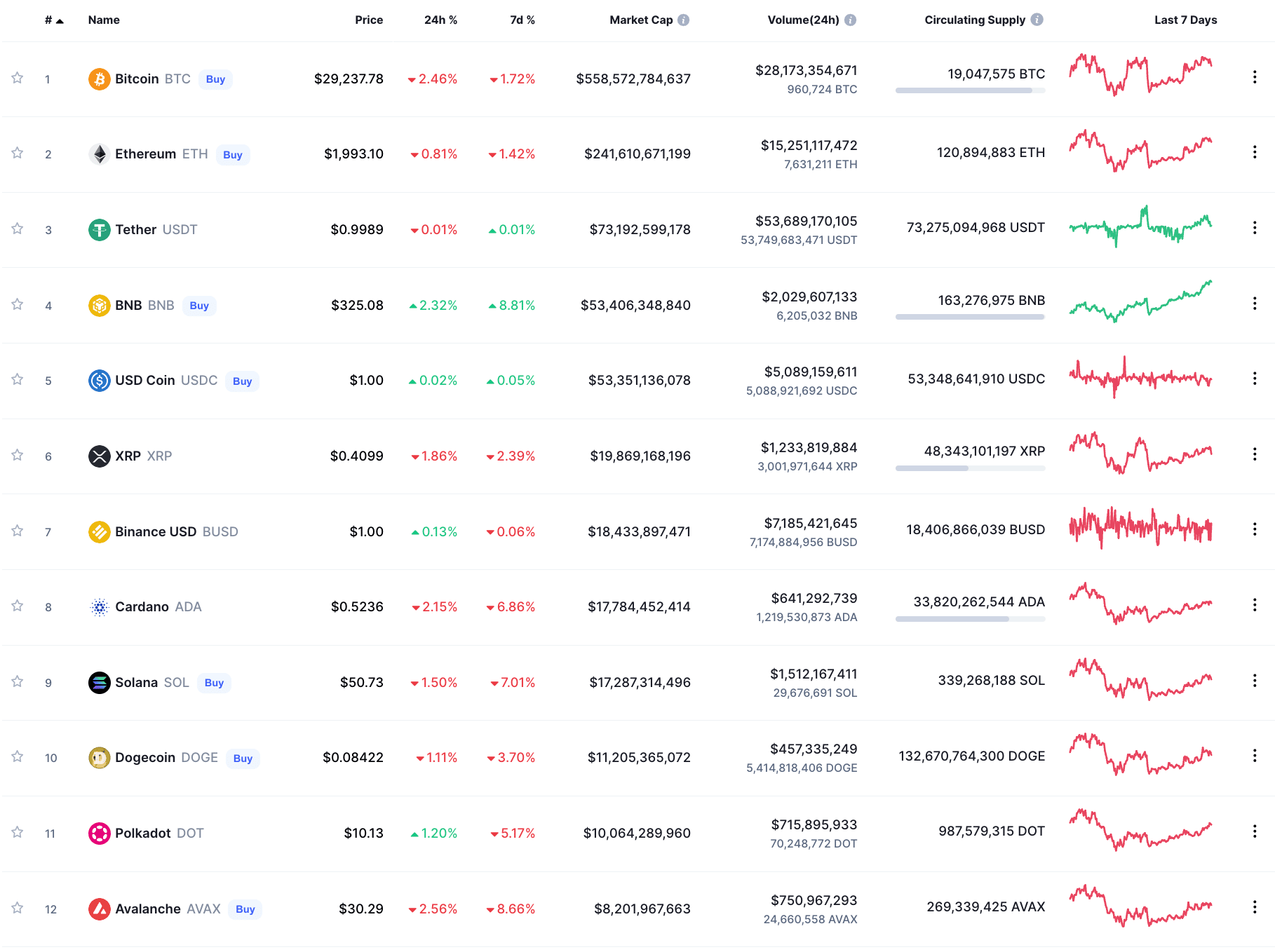

Today, we’re in the midst of another bear market. Bitcoin is down by over 50% from its all-time high, and it’s getting off pretty easily compared to other projects.

Celsius is considered one of the top cryptocurrency interest accounts and is the eighth startup company as a founder for Alex. Two of Alex’s prior companies, Arbinet and Transit Wireless are two of New York’s largest venture-backed exits ever ($750M and $1.2B respectively.)

Alex and Celsius have had to navigate a slew of factors to navigate in recent months:

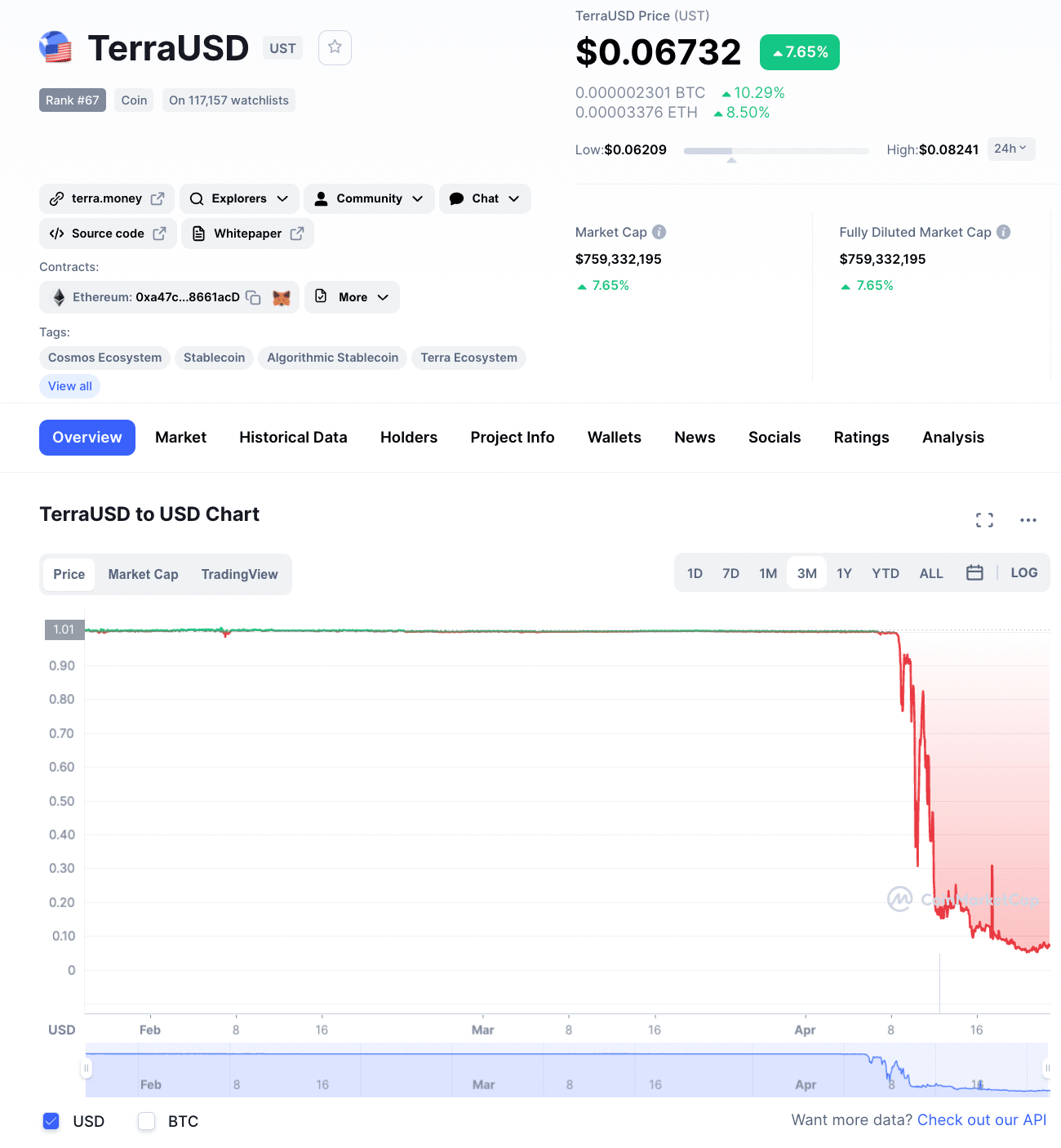

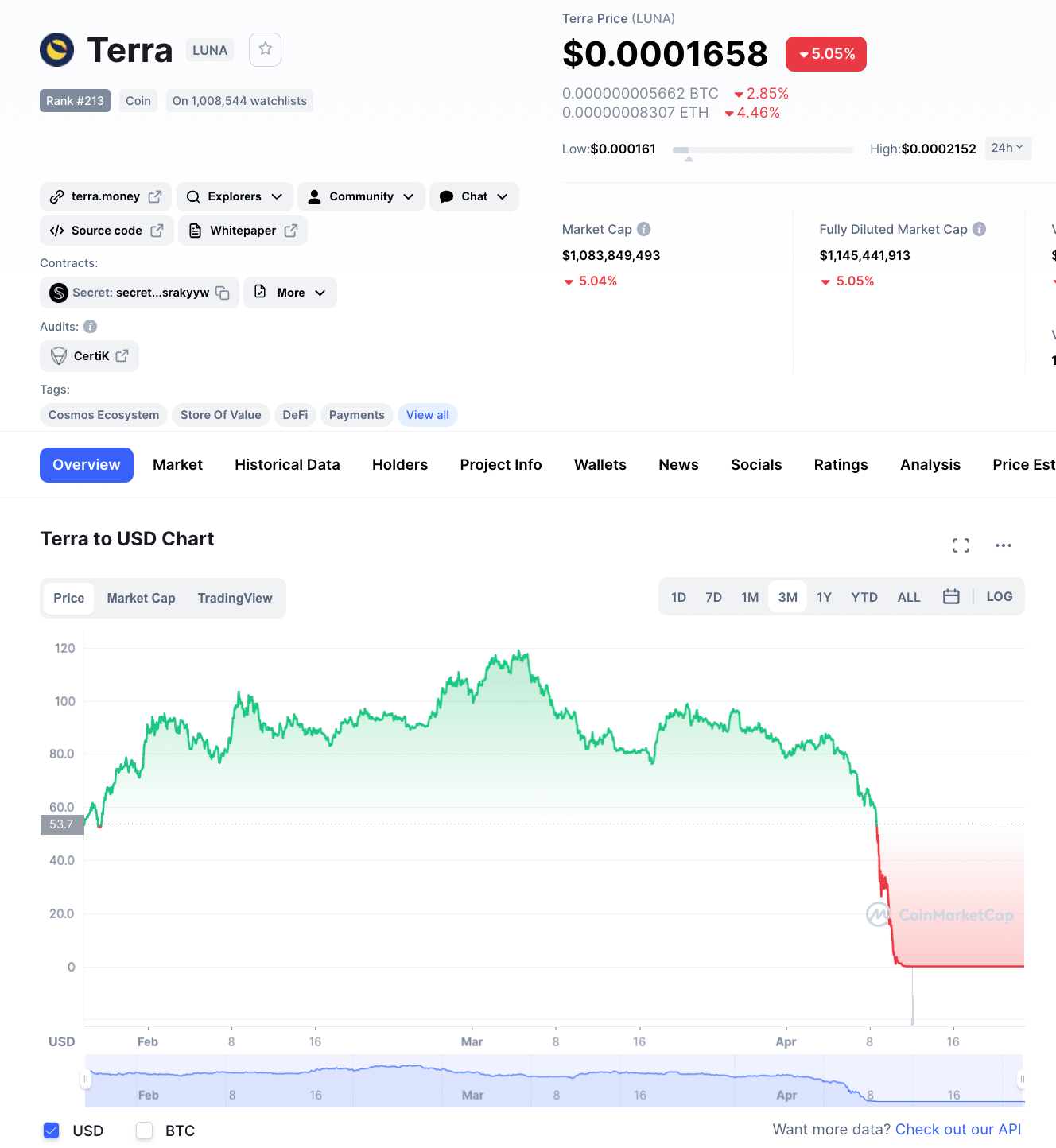

- The UST depeg and subsequent crash of UST and Luna. What many thought to be a stable dollar-pegged coin ended up imploding, wiping out billions of dollars of market value and causing a flood of users to sell their crypto.

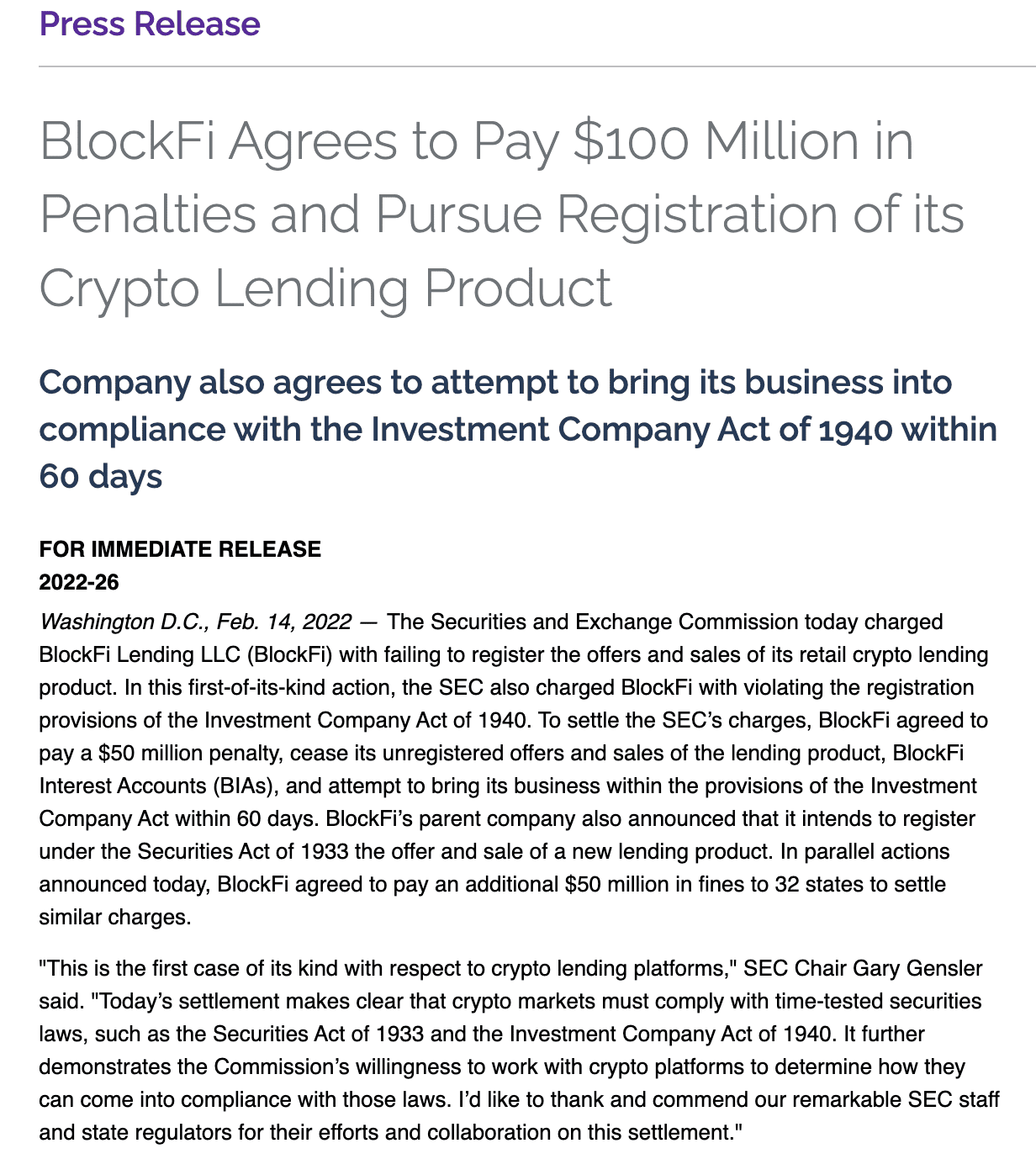

- The $100 million SEC and state fines on BlockFi, sending a shockwave throughout the cryptocurrency interest account space.

- The movement towards DAOs and decentralized yield generation products has enlivened the discourse of DeFi vs. CeFi yet again.

Alex Mashinsky joins CoinCentral to explore how Celsius is facing the challenges ahead, and how today’s bear market is different from the ones in the past.

How is Today’s Bear Market Different?

Each bear market tends to have higher highs and lower lows. Even though we’re going through these corrections, we’re still moving upward. Bitcoin did very well if you plot a Bitcoin versus the S&P 500 over the last 10 years.

The cryptocurrency market at the time of interview.

People have to understand that despite the volatility, the direction is clear and that they need to take advantage of these drawdowns to expand their exposure to this asset class.

But obviously, it’s scary that the fear index is at an all-time low. I think it’s nine it’s below 10. I haven’t seen it below 10, so we are at max fear.

But, we’ve tested all scenarios, and I think there’s a lot of support for these levels.

Algorithmic Stablecoins, the Luna & UST Depeg Fiasco, Celsius Network’s Involvement with Anchor Protocol

Just because somebody calls themselves a stablecoin does not mean that they are a stable coin.

People have to understand that the stable coin comes in three different formats:

- Fully backed by Fiat currencies like USBC, TUSD, and USDT. There is a dollar sitting in a bank in the US bank or trust company. Anyone who shows up with a token is going to get a dollar.

- Over collateralized stablecoins, like DAI. For those, you have to look at what is the collateral. DAI, for example, has Bitcoin and Ethereum as collateral. They can be assets not correlated to the crypto market. When crypto crashes, those other assets don’t lose their value.

- Algorithmic stablecoins. The problem with this group is that algorithmic stablecoins are backed by an asset that is even more volatile than Bitcoin and is directly correlated to the performance of the underlying stablecoin itself. So, this makes it inherently not stable.

People assume that UST was a stable coin, that it will never depeg, and that they can always get their money back.

The UST depegging price chart

That was proven not to be the case. The issue is not about the algorithmic nature of the stablecoin; it’s with the collateral. Even a combination of Luna and Bitcoin wasn’t enough to keep the peg when Bitcoin started crashing.

Celsius has 55 different assets in our wallet, including Luna and UST. And when people give us their tokens, we have to stake it. When people give us Luna, we have to do something with it.

So I don’t understand why people are surprised that we are participating in every DeFi protocol. We hold these assets on behalf of our community, and we stake them or move them around to maximize yield.

LUNA’s price after the depeg

Celsius monitors all of these markets 24/7. When we saw a risk of a depeg, we were one of the first to pull out of these protocols while most people were either asleep, at the job, or watching a movie.

Most people don’t have the skills or the coverage to watch markets constantly. Celsius has over 800 employees, 50 of them are in our network security team, and almost 20 of them are in our risk team. They monitor all the markets so you don’t have to, and that’s why Celsius now has almost 2 million customers and billions of dollars.

We pulled funds before the crisis, not during the crisis.

We had a lot of withdrawals; we regularly handle transfers in hundreds of millions of dollars every day. Our volume was higher [during the UST depeg week], but there isn’t anyone who wanted to withdraw assets from Celsius who is still waiting for their assets. Everybody who requested withdrawals got serviced very quickly.

Sometimes the blockchain was slow, like Terra stopped running its blockchain, and we can’t operate when the blockchain doesn’t operate. Despite the slowdowns, I feel that we did an exceptional job for our customers. We are the only guys in the industry with an 800 number. You can call us six days a week, at 1-866-HODL-NOW, and talk to someone.

We had record calls [during the UST depeg week]; we had two or three times as many phone calls inbound with people asking questions or asking for us to help. I’m very proud of our 800 team that helped make sure that we helped our customers better than I think anyone else during this event.

How Does Celsius Deal with a Flood of People Trying to Exit Simultaneously?

We have ample reserves. If you’re planning for a day like this, then you don’t have a problem. If you aren’t planning for a day like this, then you’ll have a problem. You’ll have difficulty trying to fill all the orders.

Normally, we would see a lot of withdrawals of Bitcoin and Ethereum; this time it was primarily stablecoins. People were worried that after UST went under, Tether would be next, and then it would be something else. They were trying to de-risk and get out of their stablecoins because they were worried. They weren’t concerned about Celsius; they were worried about these issuers not being able to convert these stablecoins into dollars.

And they were proven wrong, like people who sold their USDT for 95 cents on exchanges. You sold it to someone who then took that same token to Tether and got a hundred cents on the dollar. Tether didn’t depeg; the only thing that depegged was the price of Tether on exchanges.

USDC didn’t depeg either. Anybody who went to Silver Gate or Circle got a hundred cents on a dollar on USDCjust like they got a hundred cents on the dollar from Tether.

People have to understand that these are two different things. They can get nervous when they see the price on an exchange, but the price is just a willing buyer and a willing seller doing a transaction below the value of the assets. It doesn’t speak to the value of a stable asset like USDC or USDT that has fiat reserves equal to the total value of the stables.

Thoughts on DAOs, Would Celsius Ever Decentralize?

The mission of Celsius from Day One was to bring the next 100 million people into crypto.

We don’t believe that you decentralize; we believe that you build the roads and bridges.

If you think of a two-span bridge where one span goes to TradFi, and one span goes to DeFi, Celsius, as a CeFi company, is to build those bridges. With Celsius X, and other services launched, like we invented yield on the blockchain, we’ll continue to innovate in building and expanding these bridges.

Our job is to solve the KYC AML, cross-chain, security, and key management problems. It isn’t to run away from those problems.

DAOs are amazing; they serve a certain function, but no regulator will allow you to perform the function that we perform for our customers if we just become a DAO. You won’t be able to do what we did during the UST depeg, where we provided hundreds of millions of dollars in withdrawals. You just can’t do that as a DAO.

We must provide A to Z services to our community.

We just launched on-ramps in 40 states. We have swaps across the world, not just in the United States. We are issuing a credit card next month. We have loans. We have a yield product. We have staking products. You cannot do most of these things as a DAO.

We have to stay what we are and continue working with regulators and lawmakers to make sure that the laws act in the best interest of the American people and the rest of the world. We want to offer services that protect the consumers, protect the corporation, protect the institutions, and allow them to use the future of finance instead of relying on TradFi.

What Does Celsius Working with Regulators Entail?

Unlike many other companies that might be hiding offshore where they don’t have an address and you can’t visit their offices, our main office is in the United States, and we have offices in Israel, Serbia, London, and other places.

We continuously talk to regulators, lawmakers, Senators, and Congresspeople. We’re a part of many different organizations that are either lobbying organizations or non-profit communities that promote the use and the functions of crypto and the blockchain.

They do an excellent job educating and pushing the agenda for all of us; it’s not just for Celsius, right. It’s an agenda that we are all trying to achieve because otherwise, there are plenty of the same people from the banks and from financial institutions who don’t want crypto to be here. They don’t want any competition or innovation because they’re doing exceptionally well, not paying you any yield, charging you 24% on your credit card, charge you for your ATM, charging you for inactivity, overdraft fees, you name it.

We’re here to change all of that. If you vote with us, vote with your pocket. You have to vote with your pocket. You can either go for crypto and help the community grow, or you’re stuck with TradFi for the rest of your life.

Outside of that, there are several blockchain associations you can Google– some are blockchain-centric, some are crypto-centric. You have to choose what you believe in. You can also reach out to your Congressman or woman and voice your opinions.

Today, if you want to get elected as mayor, governor, or Congressman and you say bad things about crypto, you’re not going to get elected. At least a quarter of your constituency is holding crypto assets. It’s already too late for crypto to disappear or be squashed, or even not to move forward.

What we really need is for people to get educated on the benefits. Yes, there are some downturns like we’ve seen with Luna and UST. We should regulate around stable coins, but there’s a lot of potential for innovation.

The last thing we want to happen to us, the United States of America, is to see China or some other country create all that innovation and then us be the last ones to the game because we were afraid to innovate. We are the country that created the internet. We are the country that created we created Web 1.0 and Web 2.0. We should definitely be the ones creating Web 3.0

In February 2022, BlockFi got hit with a $50 million penalty to the SEC and another 50 million in fines in 32 different states. How has that affected the cryptocurrency yield generation industry? How has Celsus had to deal with the repercussions?

On April 15th, we segregated retail accredited and retail unaccredited. If you’re unaccredited, you cannot earn yield. But if you’re accredited, you can continue using all the services that we had before.

An excerpt of the BlockFi SEC penalty

For the unaccredited, they can still use loans, do swaps, and use on-ramps. Everything else is still available; they just can’t earn yield. In July, we will be introducing staking rewards. If any of your coins are stackable, you will be able to stake them through Celsius and earn staking rewards. But, if you’re unaccredited, you cannot earn a yield on assets like BTC that are not stackable.

This is just what the regulators asked us to do, and we followed. We always follow the regulatory regimes around the world, and we will continue to do so

Editor’s note: It seems that regulators mostly have an issue with loaning assets to third parties, hence the protection for unaccredited investors.

What Can We Expect to See in Celsius’ Rates This Year?

There’s less competition right now. I think a lot of the smaller players probably getting out.

Institutions will have to pay more to take loans, so I think we should be able to see rate increases instead of rate reductions for depositors.

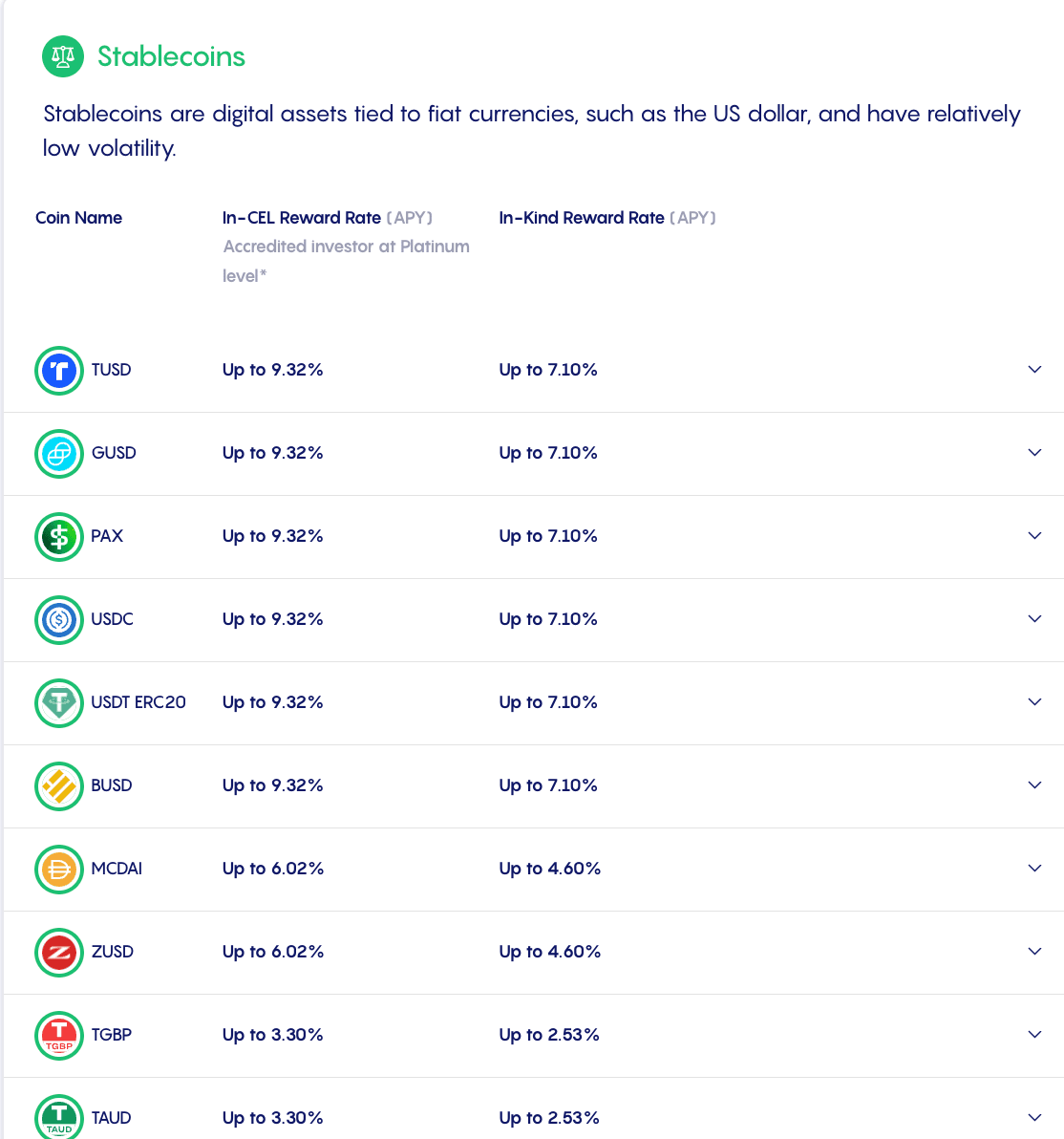

Celsius Network’s stablecoin rates (source: https://celsius.network/earn)

What is the Psychology of a HODLer?

It’s very difficult if this is your first winter and you’re down 50, 60%. If you’re in alts and you’re down 80%, you feel like an idiot; you feel like oh my God, what was I thinking? I FOMO’d in, I put too much money in, I wish I could do this, I wish I could do that.

None of that matters. You just need to make a decision right now.

Do you have too much allocation considering all your other assets?

My quick measure for that, is how do you sleep at night?

If you sleep well at night, that means you probably don’t have enough allocation. If you don’t sleep well at night, that means you have too much allocation and you might need to sell more to get yourself to be able to sleep at night.

That balance is different for each person because each person is willing to take different risks and has a different portfolio of assets.

I don’t provide investment advice, but this is a thermometer with Celsius. It’s a good thermometer to measure your exposure to these different assets.

What is the End Goal of HODLing? What are People Holding Crypto For?

We’re definitely not trying to create billionaires or help people become the richest people in the world. What we’re trying to do is make sure that people who have a hundred percent of their assets in the dollar or fiat denominated savings, understand that they need to detach. They need to put five or 10% in something that is not dollar-denominated because they’re printing dollars like crazy, right? And it’s not going to stop.

We’re going to go through a recession soon, and you want to have exposure to other types of assets that have their own economy and their own momentum, and get to financial freedom.

So, financial freedom doesn’t mean that you’re a millionaire. It means you have enough money earning enough income to live on that income. You don’t have to rely on your kids or social security or things that are probably not going to give you the comfort you need.

Our path to success is all about making it across that finish line.

For each one of us, we need to have a dream. We need to have a plan of what our retirement looks like and make sure we save enough so we can live off that money for the rest of our days.

How Can Crypto Interest Accounts and Yield Generation Platforms Help Everyday People Brace for Inflation?

I don’t think the banks will fix the inflation issue anytime soon.

The best yield account that I know pays 0.5%. This isn’t about crypto; this is a problem that exists in TradFi.

Crypto is doing a much better job of at least attempting to solve some of this problem. It’s giving you a non-correlated asset that is hopefully earning several percentage points.

I think inflation will come down. I don’t think we will have 15 to 20% inflation. I think we’ve already seen it down from 8.5 to 8.3. Every we will see lower and lower inflation.

You have to understand that the crypto market is watching the stock market, the stock market is watching the fed, and the Fed is watching inflation until inflation is tamed.

We will not see the fed refocusing on helping the economy. Right now, they’re laser-focused on inflation. Inflation is like a three-headed dragon and we need to slay the dragon. Every month we get a lower inflation number; that’s us slaying one head. When we get three months of lower inflation rates, the Fed can refocus on the economy. They can do all these things they’re saying they’ll do because they’re more comfortable that inflation is not raging out of control.

What Can We Expect to See in Cryptocurrency 2022?

If you look at the last several crypto winters, Bitcoin was always the first to bounce back before the stock market, the bond market, and commodities.

I expect us to go sideways for a while, maybe even retest the lows. But then I expect us to go up.

When we go up, we go up 5x. As you mentioned, with the last few levels in 2020 and 2017. It goes up much more than the stock market or any other index when it goes up.

I don’t know where we’re going, but I’m projecting the next bull run, [Bitcoin], will be over $100,000.

I don’t know how soon that’s going to happen. I know that all the coins held by weak hands and tourists have been sold and are going to the strong hands. There’s not that much selling. All the leverage is out of the system. Now the question is how many new people are we adding and how quickly is that accumulation. There’s not much Bitcoin being created.

What New Products Can We Expect from Celsius?

Celsiusx.io is our DeFi initiative where you can go cross-chain and do stuff with smart contracts.

CelsiusX– the DeFi arm of Celsius

We’re also launching a credit card next month; our website has a waiting list.

Watch our YouTube channel or Twitter, @Mashinsky or @CelsiusNetwork. Just download the wallet, and try it out. We also launched a web app, so you can try our services on the web.

Thank You, Alex!

———

You can follow Alex Mashinsky on Twitter, where he regularly comments on happenings in the industry. He also publishes market updates on his YouTube and Celsius newsletter, rain or shine.

You can also get $50 upon signing up for Celsius and depositing $400 and holding for 30 days with this code.

The post Celsius CEO Alex Mashinsky Interview: UST Depeg, Bear Markets, DAOs appeared first on CoinCentral.