The week beginning May 5 and ending May 11 witnessed one of the biggest crashes in the history of cryptocurrency. While the crash was devastating for retail investors, it seems like it was all but an opportunity for the institutional investors who made the most of it.

Institutions Take the Gravy

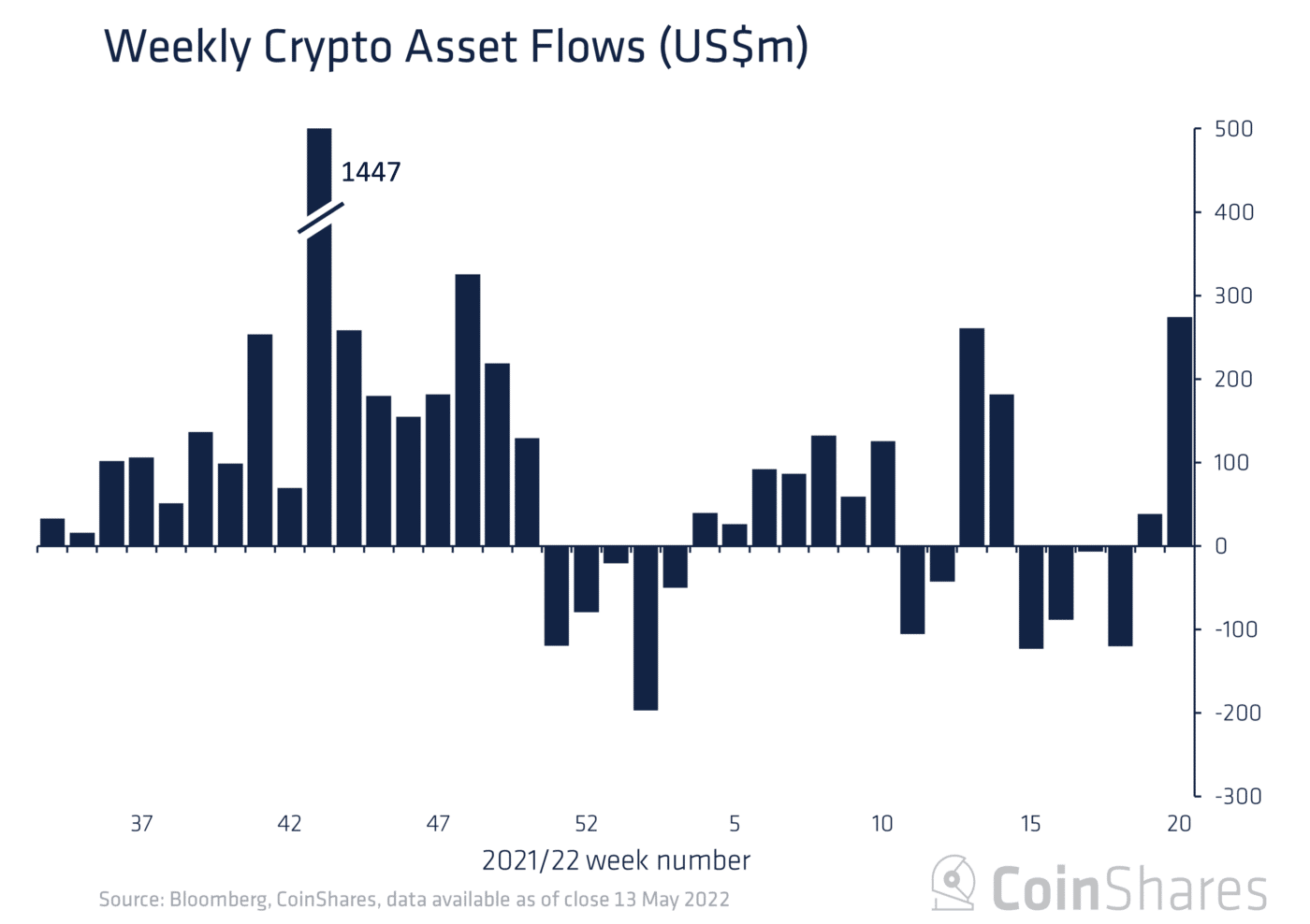

According to the CoinShares fund flow report, digital investments, in the week ending May 13, noticed the highest inflows from institutional investors in over five months.

Regardless of their statements, institutional investors are long on crypto as they do become suddenly around bullish or extremely bearish phases, just as they did during the March-end rally.

This week raking in $274 million worth of cryptocurrencies, this cohort of investors managed to flip the month-long trend from receding bearish to highly bullish.

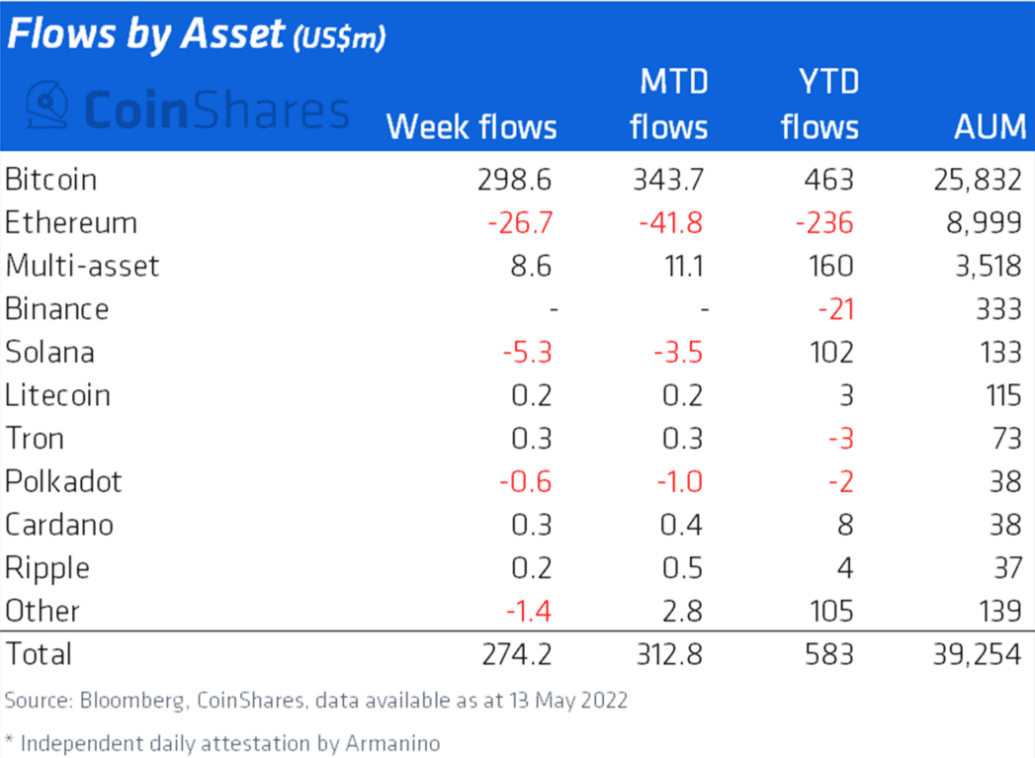

But even during this change, there was one repeated instance of a particular cryptocurrency noticing no interest from these investors – Ethereum.

The king of altcoins was not only not in their accumulation list, but institutions actually ended up dumping over $26.7 million worth of ETH over the week.

This brought the year-to-date flows of Ethereum to a staggering $236 million in outflows. Even the likes of Cardano and Litecoin are still noting inflows after five months.

However, this lack of interest isn’t recent, as Ethereum has been out of the institutions’ books since the beginning of the year.

The disinterest has metastasized to a point where Ethereum’s outflows are worth more than all other assets’ combined net flows.

Now there is a possibility that this disinterest is potentially originating from the upcoming Merge. The transition to ETH 2.0 to turn the blockchain into a Proof-of-Stake consensus from the current Proof-of-Work consensus has been an awaited moment in the crypto space for over a year.

Along with it will come something known as a “difficulty bomb”, which will basically increase the mining difficulty to a point where mining a block using proof-of-work will become impossible.

But while neither of the events’ dates has been announced, it is keeping investors, traders, and developers alike on their toes.

This is also what is keeping the institutions’ cohort worried, as the hype could end up turning Ethereum into another instance of Cardano right after the smart contract upgrade.

The arrival of DeFi on Cardano in September 2021 was hyped to the point where its anticipation placed ADA at a price of $3.16. But as DeFi development took time to take off, investors lost interest, and Cardano hasn’t stopped declining on the charts since.

If something similar occurs with Ethereum around the Merge, it could put investors in a lot of losses.

But the chances of that happening are slim right now.

Ethereum Still Has Some Time

Firstly as per the on-chain data, the network is not looking at any significant losses right now. Although the events of May 12 did take a considerable portion of Ethereum’s supply by surprise, most of it managed to recover from the losses.

Even at the moment of all of Ethereum’s investors, only 38% of them are in outright losses, while almost 60% of them are in profit. Although the 38% does represent over 30 million addresses, the concentration is still lower than many other altcoins.

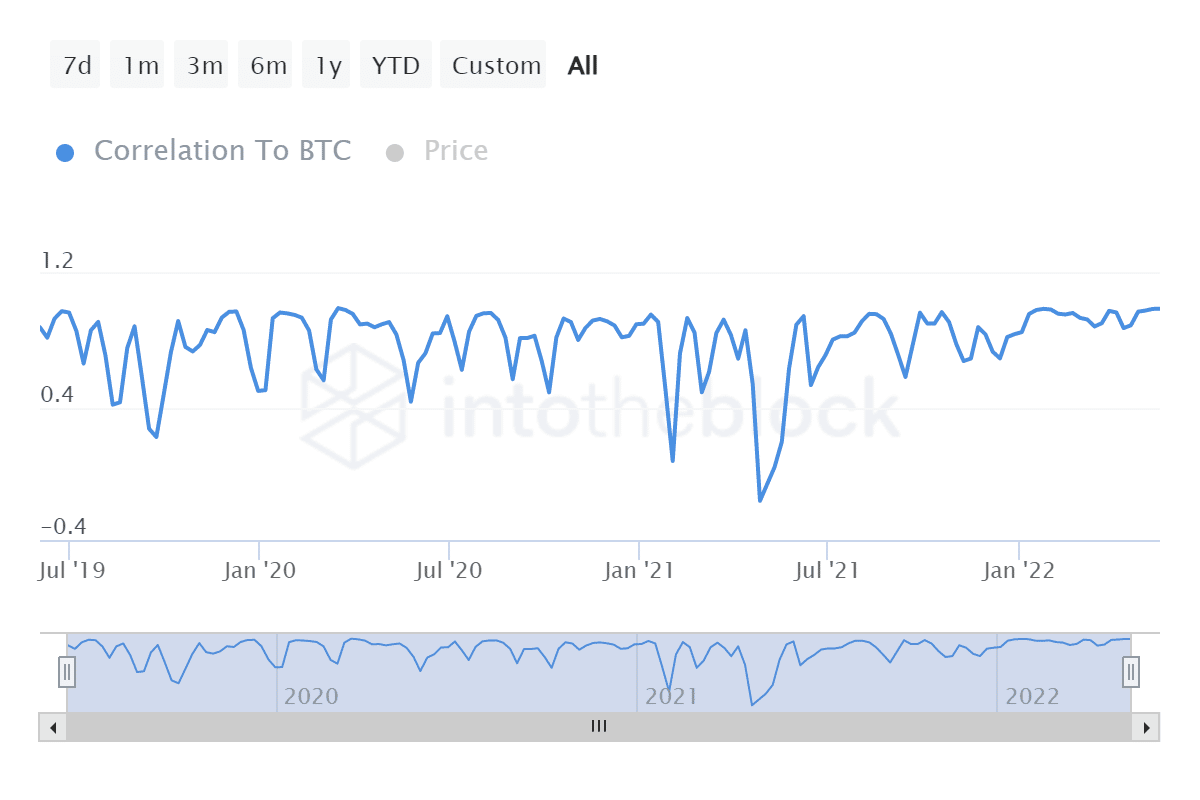

Secondly, strictly from an investment standpoint, Ethereum is bound to jump back, given its correlation to Bitcoin. The safest path for Ethereum during volatile periods is to follow the king coin’s lead, as that could help achieve quick recovery when Bitcoin rallies as well.

Thirdly, Ethereum’s investors are not giving up either. Despite all that has occurred since the beginning of the year, not one ETH holder has exited the market, which gives Ethereum the right support needed to bounce back.

Thus as long as Ethereum maintains its current position, it will successfully execute the Merge while still keeping its investors from deserting the network.

The post Institutional Investors Racked Up $274M Worth of Assets Amid Market Crash appeared first on CoinCentral.