Notable Messari Intel Updates

- Terra Proposal 1623 has been passed. With the passing of this proposal, a new Terra chain will be created without the algorithmic stablecoin. The old chain will be called Terra Classic with its token LUNC, and the new chain will be called Terra with the token name LUNA. The new LUNA token will be airdropped across LUNA Classic stakers, holders, residual UST holders, and essential app developers of Terra Classic.

- Tether Operations Limited announced the launch of Tether tokens (“MXN₮”) pegged 1:1 to the Mexican Peso. Initial blockchain support will include Ethereum, Tron, and Polygon.

- The Tendermint team released the beta version of Tendermint v0.35.5. This release includes a series of minor bug fixes, with an exhaustive list of changes available in the changelog.

- Secret Network v1.3.1 has been released. This release modifies the client to use all available cores to serve queries, introduces various mempool optimizations, and includes a docker image with automatic node registration and state sync. All node operators are encouraged to upgrade as soon as possible.

- The Injective team announced that Injective is integrating with Wormhole to bring ten new blockchains to their network. Injective is natively able to connect to Ethereum, Cosmos, and a number of IBC-enabled chains. With this integration with Wormhole, Injective allows for cross-chain native assets from Solana and other Layer 1 chains to enter the Cosmos universe.

Notable Messari Governor Updates

- The Illuvium DAO has submitted a proposal that seeks to introduce the following changes to the Illuvium governance process:– Modifies Epoch length from 3 months to 6 months.– Changes Council Payments to Stablecoin (USDT), rather than ILV.– Implement an Official ‘Governance Forum’ on the Illuvium website for better IIP Organization.Voting is currently active.

- The Paraswap DAO has submitted a proposal that aims to deposit a minimum of 1M PSP tokens into the Paraswap Hats.Finance bug bounty vault. The deposited funds will be available to hackers who disclose vulnerabilities in the Paraswap smart contracts. Voting is currently active.

- The Ribbon DAO has submitted a proposal that seeks community approval to issue and sell to lenders $3M of convertible bonds backed by $15 million worth of RBN collateral. Ribbon DAO will issue the bonds through Porter Finance. The capital raised will get used for bootstrapping Ribbon DAO protocol-owned liquidity, stablecoin supply in the Ribbon Fuse pool, or undercollateralized lending through Maple Finance. Voting is currently active.

- The SpookySwap DAO failed to pass a proposal that aimed to reintroduce the protocol-owned liquidity (POL) acquisition program that was recently paused to prioritize the buyback of BOO tokens. Reinstating the program would halt the BOO buyback program and either direct 15% of trading fee revenue toward POL acquisition or direct 10% towards POL acquisition and 5% to the team for development costs.

- The BeethovenX DAO has submitted a proposal that aims to allocate $250 thousand worth of BEETS to incentivize Balancer LPs on the Optimism chain for two months, or until the veBAL integration is completed for the Optimism chain. Balancer Labs will also allocate 31,250 BAL towards incentives on Optimism. Voting is currently active.

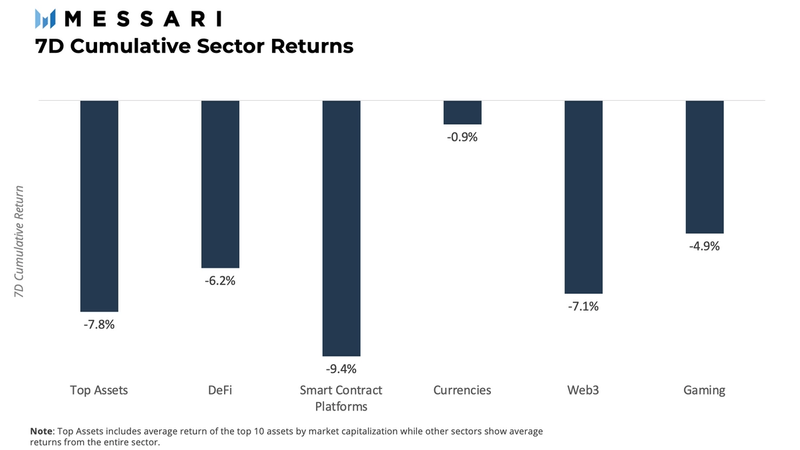

Sector Returns

This week’s performance has seen crypto sectors experience a decline. However, declines have not been as drastic as to erase the gains secured by last week. Assets traded in a more synchronous manner compared to the heavy volatility seen last week. Currencies was the clear outperformer as it was the sector with the least decline by a large margin. The sector only declined 0.88% while the next runner up (Gaming) declined 4.89%. The smart contract platforms sector performed menially compared to the rest of the group and took the last spot with a -9.40% return.

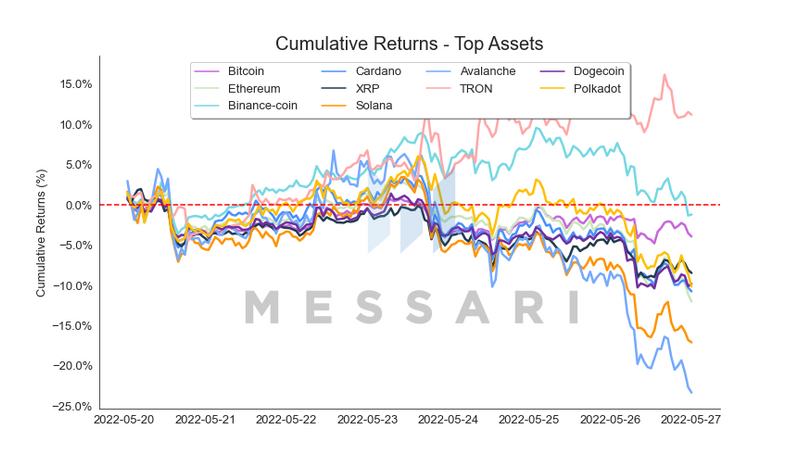

Top Assets

Top assets began trading in a fairly packed pattern, exhibiting high correlation. However, the correlation progressively broke down as the week passed, resulting in performances posted within a 34.5% range. This week’s top performer was TRON (TRON) – the only top asset that ended the week in the green and with a double-digit gain of 11.2%. Aside from TRON; smart contract platforms made up the bottom half of the list as the worst performers within the category, all posting double-digit losses. Avalanche was the laggard of the week with a 23.3% loss.

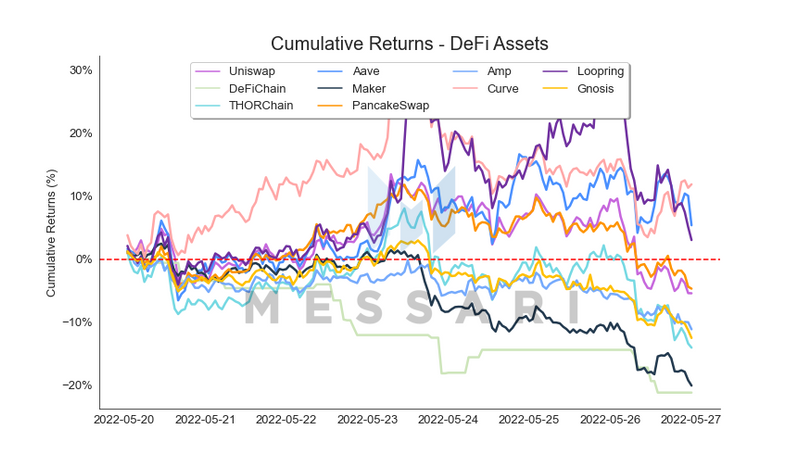

DeFi Assets

DeFi assets also posted fairly spread out performances as hardly any maintained noticeable correlations. Curve (CRV) was off to a solid start at the beginning of the week but lost its top position to Loopring (LRC). The Layer-2-based exchange’s token underwent two price spikes that gave it the lead during the second half of the week, however CRV was able to regain the top position at the last moment. CRV ended the week with an 11.9% gain while Aave (AAVE) and Loopring (LRC) finished with 5.4% and 3.0% respectively. The rest of the assets had negative returns, with DeFiChain (DFI) securing the endmost position (-21.2%).

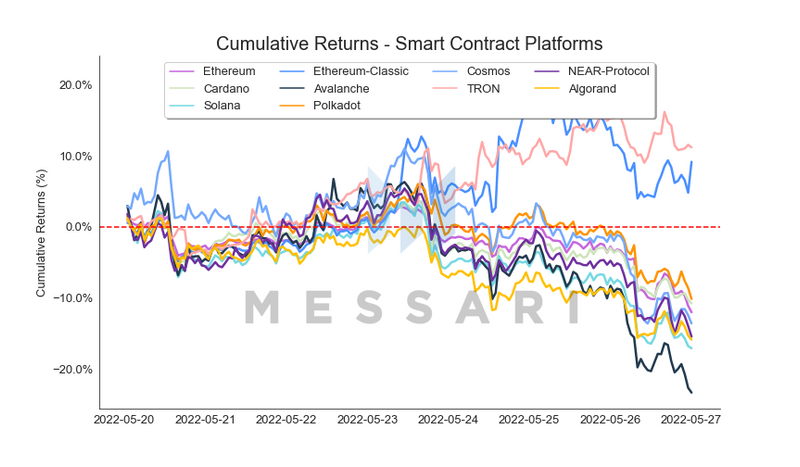

Smart Contract Platforms

The smart contract platform assets traded with higher synchrony this week with the exception of two outliers – TRON (TRX) with 11.2% and Ethereum Classic (ETC) with 9.1%. TRON has seen a 30%+ increase in its TVL over the past week, while most of its close competitors have seen declines in their TVL over the same time period. In fact, TRON has seen a 41%+ increase in TVL over the past month, while the other top ten chains have seen 30%+ declines in their TVL. TRON currently sits in the third spot between chains with most TVL, ahead of Avalanche and behind BSC. Avalanche declined the most within top smart contract platforms this week (-23.3%).

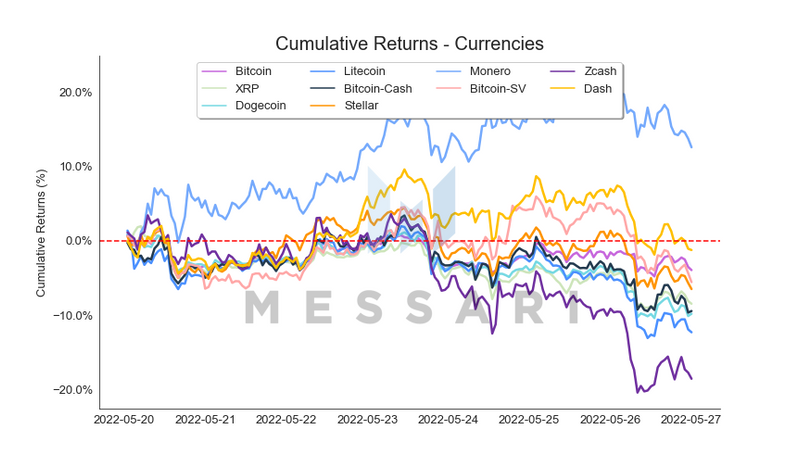

Currencies

It is common to have the two top privacy tokens perform similarly on a weekly basis; however, Monero (XMR) stood out this week as the only currency that ended in green territory while Zcash (ZEC) took the last spot. XMR left the other top currencies behind since the start of the week and posted a double-digit return of 12.6%. ZEC ended the week with an 18.5% decline.

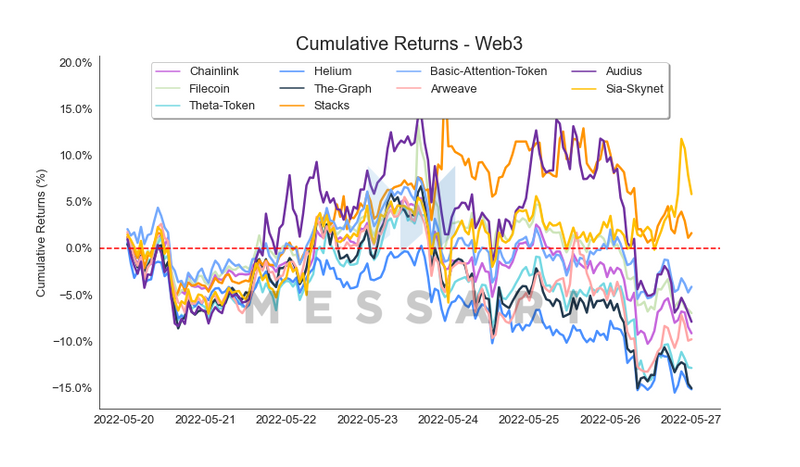

Web3

The Web3 sector only had two of its top assets finish the week above water, with some of the higher market cap assets being the heaviest decliners. Sia Skynet’s (SC) performance this week was enough to bump the decentralized cloud data storage and content distribution network’s token into the top ten list and gain the top spot in terms of return for the category. SC ended the week with a 5.8% gain and Helium (HNT) took the last spot with -15.2%.

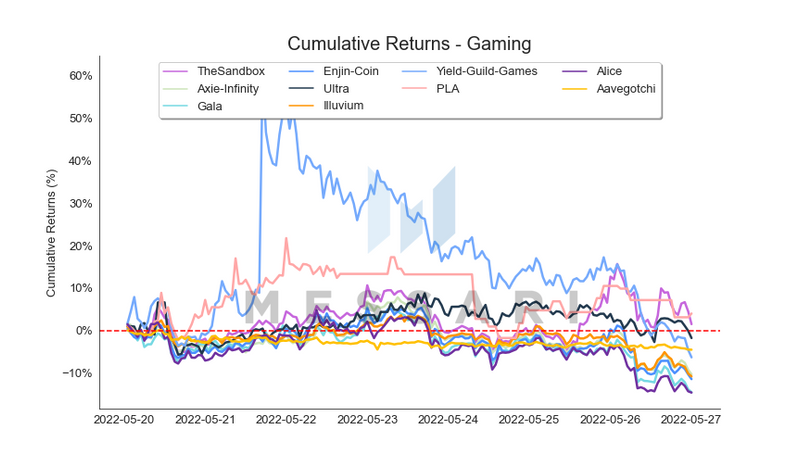

Gaming

Similar to the Web3 sector; gaming also only had two of its top ten assets by market capitalization end the week with positive returns. The two winners were PLA (PLA) and The Sandbox (SAND) with 4.0% and 1.5% respectively. Yield Guild Games (YGG) had a substantial 74% spike in its token price on May 21st which left it in the top spot among the category for most of the week. However, the token has returned virtually all of the gains made and is currently around the same price pre-rally. Alice (ALICE) was the worst performer of the sector this week and ended with a -14.6% return.