It’s been two days since the Terra development team launched the new Phoenix-1 blockchain with the network’s native token LUNA. While the token dropped significantly in value during the first day of trading, the new LUNA has jumped 8.8% in value during the last 24 hours. Amid the token’s 24-hour rise, controversy continues to plague Do Kwon and Terraform Labs. Moreover, the old token, luna classic (LUNC), has been climbing in value as the crypto asset has gained more than 70% during the last day.

New LUNA Coin Jumps Over 8% Higher on Monday, Token Is Still Down More Than 64% From the Recent Price High

It’s been roughly more than 48 hours since the birth of the new Terra blockchain and crypto asset LUNA. During the first couple of hours of trading, the new LUNA changed hands at an all-time high (ATH) at $18.87 per coin. Presently, the price is 64% lower than the ATH, even with today’s gains. According to coinmarketcap.com stats, there’s 210,000,000 LUNA tokens in circulation, but the web portal notes the number is not 100% verified.

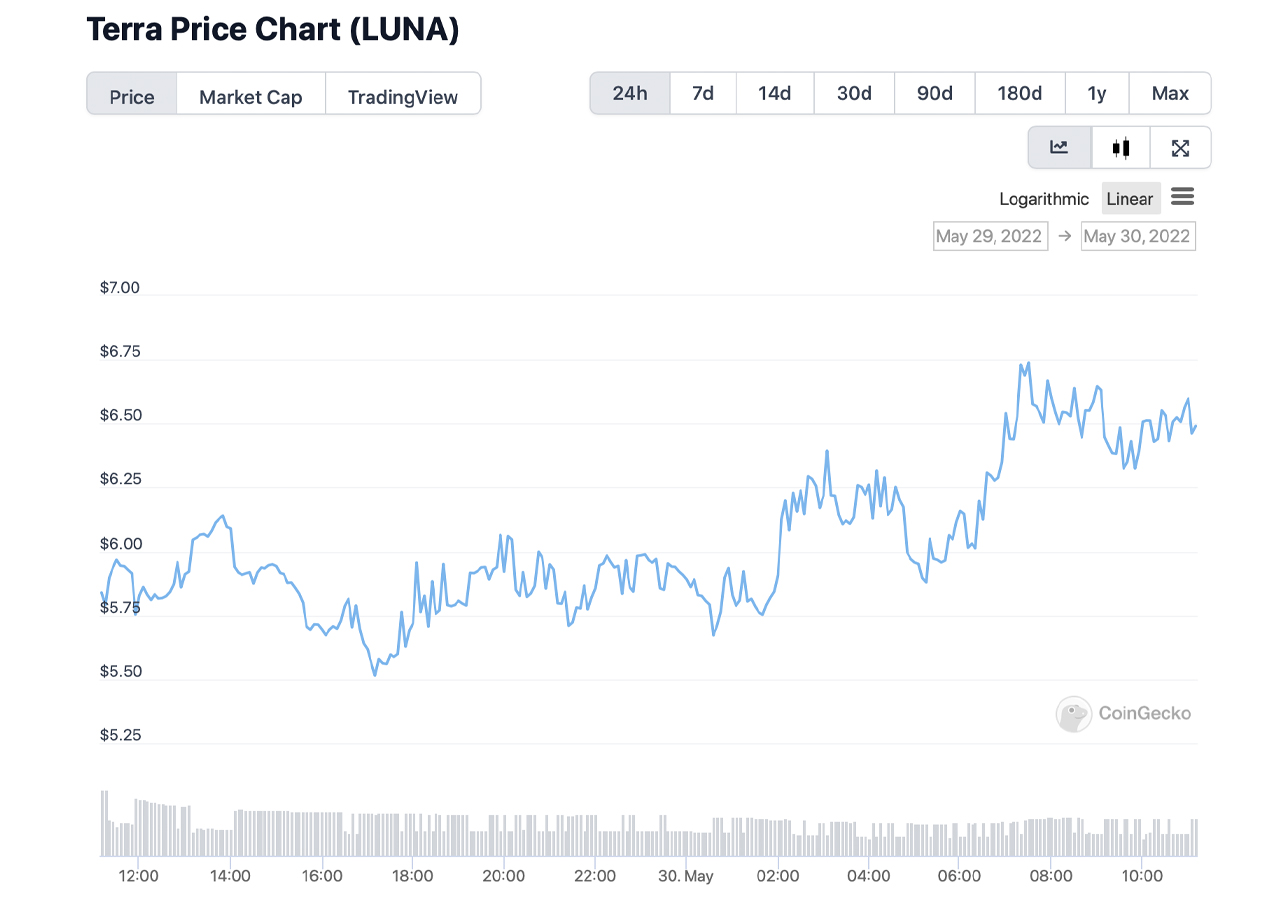

The number of coins in circulation times LUNA’s current value shows that the coin’s market capitalization is around $1.35 billion today. The coin’s 24-hour trading range has been between $5.51 and $6.74 per unit on May 30, 2022. Currently, LUNA has around $145 million in global trade volume over the last 24 hours, but that’s down 48.6% since yesterday. The most active exchanges trading LUNA today include Gate.io, Okx, Bybit, Mexc, and Kucoin, respectively.

A great majority of LUNA is vested and this was explained prior to the airdrop. While many people were airdropped the new LUNA, a majority of people’s stake was airdropped bonded and the coins cannot be spent for a specified amount of time. The new Terra chain does not have an algorithmic stablecoin anymore, and many of the defi protocols that were once operational are now broken. In fact, the purpose of the new Terra coin is unknown because without UST and defi applications like Anchor, there are arguably very few use cases for the new LUNA.

Terraform Labs Summoned, Company K, and Accusations of Funneling a Premine Through CHAI

In addition to launching the new Phoenix-1 blockchain, Terraform Labs co-founder Do Kwon and the company have been slammed with significant criticism and controversy. On May 17, Bitcoin.com News reported on South Korean law enforcement officials investigating the Terra blockchain project and the company Terraform Labs. Local media is now reporting that the entire Terraform Labs staff has been summoned by South Korean officials. Bitcoin.com News also reported on Do Kwon dissolving Terraform Labs before the UST de-pegging incident and LUNC’s death spiral.

This tweet did not age well.

The guy who wrote this? His buggy code was committed into Mirror Protocol in June 2021, creating a hole that allowed an attacker to drain $88m from users just a few months later. https://t.co/NaFDvYnUZo https://t.co/wdjMUtZZC3

— FatMan (@FatManTerra) May 29, 2022

Furthermore, there’s the Twitter account called “@fatmanterra (Fatman)” that has explained a lawsuit is being planned in order to compensate Terra victims. Furthermore, Fatman has been accusing the team behind Terra of rigging things like Mirror Protocol, a decentralized and synthetic stock exchange. Fatman detailed that the application was “really just a farce designed to enrich Do Kwon/VCs.” Just recently, Fatman published another thread that discusses a Terra-related organization called “company K.” Fatman claims that company K was a “’blockchain consultancy firm’ they spun up in order to launder money and evade taxes.”

Company K was also covered by the South Korean local news outlet KBS. “Employees from company K had great overlap with employees from Terra and often shared the same spaces,” Fatman wrote on Twitter. “Both were incorporated in 2018. Most in company K’s employ were straight-up Terra developers. Company K’s CEO, Mo Kim, vehemently denied any major affiliations.” Fatman added:

Why is this interesting? Well, Korea’s tax authorities reported that last year, Terra sent 6 billion won ($4.8m) to company K’s CEO. This was reported on the books as ‘other expenses.’

Fatman has also published a thread about Do Kwon being involved in a premine project that allegedly worked in unison with Daniel Shin’s CHAI. According to Fatman’s claims, Do Kwon and Terrform Labs (TFL) premined a coin called SDT and the team was reportedly able to cash out the coin using Terra’s KRW stablecoin.

This chart perplexes me. The CHAI x Terra partnership that settled real world transactions on-chain with $KRT ended in 2020 yet there is no corresponding hiccup in $KRT transaction volumes. Why? pic.twitter.com/iLaVr27OsU

— FreddieRaynolds (@FreddieRaynolds) May 28, 2022

“A cheeky little system was set up: when SDT is burned, Terra’s KRT (a KRW stablecoin) can then be issued to stores through CHAI,” Fatman said. “This can now be cashed out off-platform via an exchange. As long as there’s enough retail volume to mask it, it’ll go unnoticed.” Fatman continued:

While there was some genuine CHAI usage, the vast majority of it was simply TFL cashing out tens of millions of dollars through the SDT/KRT scheme, hoping nobody would notice. It was a way of turning their printed internet money into real money – retail demand.

LUNC Pumps 70%, Supporters Hope It Will Hit $1

In addition to the accusations and controversy surrounding Do Kwon and his team, luna classic (LUNC) has jumped 70% higher in the last 24 hours. Vertical trends on Twitter show a lot of people trying to shill and pump the classic coin, and a few of them seem to believe the token — that trades well below a U.S. penny — will someday be $1 per unit. LUNC trading has been very active during the last 24 hours as numerous crypto exchanges have resumed luna classic trading after suspending the coin since the second week of May.

What do you think about the new LUNA token and recent LUNC gains? What do you think about the accusations concerning Do Kwon’s Terraform Labs? Let us know what you think about this subject in the comments section below.