TerraUSD (UST) is an algorithmic stablecoin pegged to the US dollar. It’s designed to maintain 1:1 parity with the dollar automatically, via a stabilizing mechanism that takes the form of another token, called LUNA – a native token of the Luna blockchain.

One UST is meant to be redeemable for $1 worth of LUNA, and the way TerraUSD is designed to work, if the value of UST fluctuates below $1, users can buy UST at the lower price, and trade it for $1 of LUNA, which should ultimately keep the price of UST pegged at or very close to 1:1 with the US dollar, while providing an attractive return for traders.

The process that brings Terra Luna to a total collapse

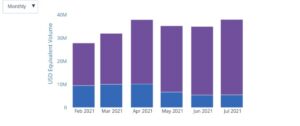

How it works is complicated, but all anyone is really talking about right now is that evidently, it doesn’t. Over the past five days, LUNA has seen its market capitalization collapse from over $30 billion to $10 billion, while also losing a whopping 98% of its value in just a week. In the past 24 hours, UST depegged dramatically from the US dollar twice, dropping at one point to only 30 cents, before recovering somewhat to around 75 cents, after Terraform Labs liquidated $1.3 billion worth of Bitcoin in an effort to stabilize it.

Cue the twitter screenshots of “I told you so’s” from some crypto market participants who saw this coming.

Tezos co-founder Arthur Breitman has been warning about undercollateralized stablecoins for a while, and two weeks before the collapse, here’s what he had to say about UST in a Reddit AMA held last month (relevant discussion starts at 01:05:10 in the video at the top of this article):

On UST’s ‘success’

“On the one hand […] people are going to say ‘well look at the LUNA market cap, clearly they’ve been very successful, but I think that they’ve been very successful in terms of marketing […] If you ask me from a financial perspective, does UST make sense, then absolutely not. Does it make sense now that they’re backing it [with] Bitcoin? Absolutely not.”

“So the general idea of Luna and UST is they say ‘look, we have an oracle […] that’s gonna tell us the price of Luna in dollars, and we’re going to mint coins by having anyone that comes to the chain [able] to burn some Luna to get some UST, or burn some UST to get some Luna, and we do that at the price [according to] the current oracle and – there you go – stablecoin. And we’ll pay some interest rate.”

On UST’s sustainability

“The first question you should ask yourself is where is that interest rate coming from? Who’s actually paying that? And if you think about it, it’s the Luna holders. They hold this thing, and it gets converted at a certain price, and it could earn interest at a later point. You could say ‘why would Luna holders want to subsidize people holding UST at 20%?’ Well maybe because it looks good for their ecosystem and as a result [it results in] a higher market cap.

Which in terms of narrative might work for a while, but it’s not something that’s really sustainable [because] if most of the supply is held by people who want to collect 20%, then essentially the supply isn’t being used. Your L1 token holders are basically paying a bribe to people to hold a stablecoin that they don’t really want to hold.”

On UST’s vulnerability

“I think you could take it down, but they’re big enough that if you want to take it down at a profit, you’d need to have very very deep pockets. […] Or you can wait until the hype dies down, and at some point this thing collapses by itself. The weird thing is that no one cares – everyone’s just like “so innovative! So innovative!”

Financial ‘innovation,’ indeed.

The post Tezos Co-Founder Arthur Breitman predicted UST fiasco last month: “at some point, this thing just collapses by itself” appeared first on The Cryptonomist.