Key Insights

- The DODO ecosystem includes a liquidity aggregating DEX and NFT marketplace.

- DODO’s DEX is a proactive market maker (PMM) that actively forecasts market movements and adjusts liquidity pool metrics accordingly.

- DODO’s NFT ecosystem allows users to create, trade, and fragmentize NFTs.

Introduction

Automated market makers (AMMs)-based decentralized exchanges (DEXs) often suffer from capital inefficiencies. Unlike order-book style exchanges or centralized exchanges that can directly match buy/sell orders and quote specific prices, AMM liquidity pools struggle to directly optimize liquidity usage. Capital inefficiency generally refers to subpar liquidity usage and is often measured with values like the liquidity turnover ratio (LTR) or the utilization rate. DODO was developed in response to liquidity inefficiencies on other DEXs.

DODO is a decentralized exchange (DEX) and a liquidity aggregator. The protocol has two main functions: 1) it facilitates peer-to-pool trading between users on its own platform and, 2) it also aggregates liquidity from other sources to match buy and sell orders. As a liquidity aggregator, DODO employs its SmartTrade feature to leverage liquidity from other protocols and offer better rates than what DODO could have provided with its own liquidity. The protocol is deployed on 10+ chains, including Ethereum, BSC, Arbitrum, and Polygon, and plans to build on more chains; as such, it can also leverage traction across various Layer-1s. As the protocol continues to develop its DEX, it is also expanding into the NFT ecosystem.This report will explore the major features that make up DODO’s ecosystem, potential challenges, and its future plans.

DODO DEX

Proactive Market Maker (PMM)

A major selling point for DODO is its proactive market maker (PMM) algorithm, which is a market making mechanism that anticipates market/economic shifts and makes adjustments accordingly. These adjustments include modifying asset ratios, liquidity depths, fee rates, and other metrics. Because it’s a PMM, the protocol enjoys liquidity pools, including single-token liquidity, with high capital efficiency. The impressive capital efficiency allows DODO to minimize slippage and impermanent loss.

The PMM algorithm not only adjusts for market fluctuations but it does so in a manner that captures non-linearities in causal relationships between demand and prices. For example, a logical adjustment could be a linear increase in price according to rising demand. However, this linear model fails to capture two realities. First, a linear model assumes that liquidity is distributed evenly across different prices, but most liquidity congregates at particular prices, often close to the price’s mean. Second, a mathematical function defines a linear model that could return unfeasible values for price or liquidity. For example, one could plug in some price into the linear function and receive a value of zero. This answer would imply that liquidity doesn’t exist for that price, but there usually is some liquidity at any given price. To adjust for non-linearities, the PMM algorithm includes an additional coefficient to modify the price elasticity captured in the pricing curve. When the coefficient is equal to 1, or when the function reverts back to linear, the PMM generates a pricing curve that resembles an AMM bonding curve.

Crowdpooling

DODO’s Crowdpooling offering was introduced in Q1 2021. It allows projects to raise funds by splitting their token supply for crowdfunding and ask-side liquidity. Each project’s team decides on the initial offering price and the duration of the campaign. Campaign participants receive tokens based on how much capital they staked. When the campaign ends, the raised funds create liquidity pools to support trading. After the Crowdpooling campaign, the project’s team members have to lock their liquidity for a set amount of time. This feature helps ensure good intent from the founding team.

DODO Market Maker Pool (MMP)

DODO’s Market Maker Pool (MMP) offering allows projects to easily preserve their market making activities in house instead of going through the trouble of hiring third parties. With DODO’s PMM algorithm, projects can execute their own market making activities by directly influencing the pricing curve, distributing liquidity along the pricing scale, and more, all at their discretion. DODO’s MMPs allow market makers to adjust an asset’s price to what they believe more accurately reflects the asset’s fundamental or fair price. In the case where a user may believe that the asset is currently overvalued and will devalue, they could lower the asset’s price in the pool to avoid future impermanent losses. On the other hand, if the asset was actually undervalued and prices went up, then they would experience a steeper impermanent loss. DODO refers to this option as their “active price discovery” feature.

DODO Q4 2021 and Q1 2022 Updates

For Q4 2021, DODO deployed on Moonriver and Aurora. Additionally, the team rolled out private transactions, customizable data indexes, updated homepages, and a liquidity mining campaign. In Q1 2022, DODO started offering limit orders and gasless trading on its DEX. It also has a new token release feature for Crowdpooling.

DODO NFT Ecosystem

DODO’s NFT marketplace allows users to trade, create, and fragmentize NFTs. Users easily create ERC-721 and ERC-1155 NFTs by uploading JPG, PNG, TIF, or GIF files smaller than 40 MB. In Q4 2021, the DODO team launched their NFT fragmentation models. The NFT fragmentation process transforms the ERC-721 or ERC-1155 asset into an ERC-20 asset. On DODO, NFT fragmentation is categorized into the Buyout or Retail Models.

Buyout Model

Under DODO’s Buyout Model, the NFT collector or investor would theoretically buy out all the fragments of an NFT. This is theoretical because it is nearly impossible to purchase 100% of the fragments for a specific NFT because it is unlikely that every component would sell. This Buyout Model attracts investors who are looking to profit from a price increase in an NFT without purchasing the entire NFT, which could be too expensive. In practice, the Buyout Model allows investors and NFT enthusiasts more flexibility to exit their positions by simply selling the fragment.

Retail Model

Under DODO’s Retail Model, NFT collectors purchase NFT fragments with the intention of eventually owning the complete NFT. In this scenario, the fragments would start as ERC-20 and then are composed and converted into ERC-721 or ERC-1155 assets. Historically, assets of this kind have been particularly popular and sell at a premium on secondary markets.

Tokenomics

DODO

DODO is a multichain governance and utility token. DODO holders can propose and vote on protocol amendments where 1 DODO is equivalent to 1 vote. A recent proposal suggested allowing holders to participate in Crowdpooling and IDO allocations while receiving trading fee discounts. The DODO token is integral to every transaction in its ecosystem, from fees to liquidity pools. An estimated 60% of the 1 billion DODO tokens are distributed as community incentives. In addition, 15% of circulating tokens are allocated to DODO’s core team and future hires, and 16% is allocated to its investors. The rest of the token distribution includes 1% to the initial liquidity provision, and 8% to the operations and partnerships.

vDODO

The vDODO token is a transferable community token for DODO’s loyalty program. Like DODO, vDODO may become a governance token that allows holders to participate in Crowdpooling and IDO allocations and to receive trading fee discounts. But unlike DODO, 1 vDODO is equivalent to 100 votes. vDODO holders also receive exclusive perks like dividends from fee revenue and other membership rewards. DODO tokenholders can mint 1 vDODO token with 100 DODO tokens. If a vDODO tokenholder wishes to trade in their vDODO for DODO, they have to pay a fee in vDODO, the proceeds of which are distributed to other vDODO holders.

Traction

DODO DEX

Total value locked (TVL) across all of DODO’s DEXs on all chains is $140.54 million. Its TVL is highest on Ethereum at $51.44 million, followed by BSC ($47.18 million), Polygon ($21.48 million), and Arbitrum ($9.21 million). On Ethereum, the protocol’s 30-day trading volume in the month of April was $1.56 billion, while its year-to-date (YTD) trading volume is $5.5 billion. The majority of DODO’s trading volume lies on Binance Smart Chain and Polygon. According to CoinGecko,the most popular trading pair on Ethereum is USDT/USDC, which accounts for almost 80% of its total volume. Protocols that trade in more popular blue chip tokens and in particular, stablecoins, tend to maintain consistent traction through bull and bear markets. Although DODO already sports a large community on Twitter with over 150,000 followers, it has the opportunity to expand its community as they expand to more chains this year, including Avalanche, Boba, Fantom, Neon Labs/Solana Native, and Optimism.

Competitive Landscape

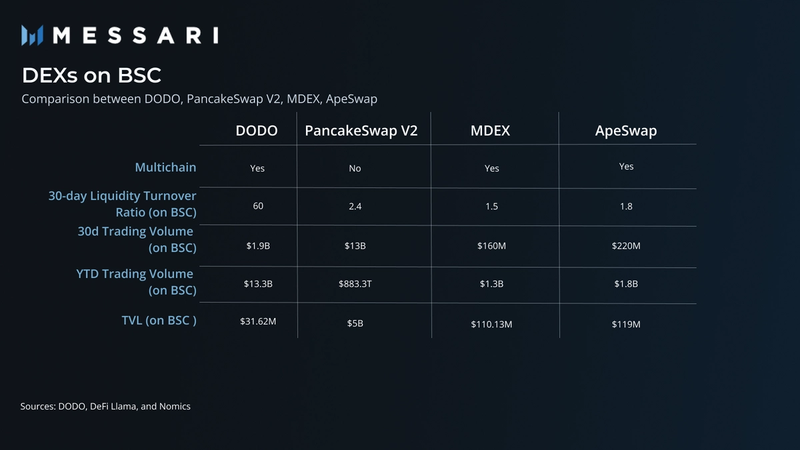

DODO is the only DEX that uses PMM, theoretically resulting in comparative advantage in capital efficiency. One measure of capital efficiency is the liquidity turnover rate (LTR), trading volume/TVL. A higher LTR indicates better capital efficiency or that the platform can support higher trading volumes with lower TVL. DODO’s LTR on Polygon is higher than many other leading DEXs on the layer one, including QuickSwap, UniSwap V3, and SushiSwap. DODO’s LTR is much higher than QuickSwap’s or SushiSwap’s. The metrics also indicate that DODO has a higher capital efficiency than UniSwap, an AMM DEX that rolled out concentrated liquidity to optimize capital efficiency. DODO also shows higher capital effiency compared to other leading DEXs on BSC. Finally, as evidenced by DODO’s internal study and Capital Efficiency Comparison graph, the PMM algorithm does achieve lower slippage and thus higher capital efficiency than the average AMM DEX.

Risks

Risks Associated with PMM

Many mathematical calculations on the PMM are performed off-chain due to their burdensome nature and then onboarded to the chain via oracles. Furthermore, raw data used in simpler PMM calculations, such as price feed data, is also fed on-chain through oracles. Because DODO’s PMM mechanisms are reliant on oracle data, they are exposed to oracle risks originating from malicious attacks to innocuous accidents. However, DODO’s PMM offers customized solutions that limit oracle risk exposure because they allow market makers to set their own prices and provide data feeds.

Roadmap

DODO’s roadmap focuses on improving user experience, optimizing liquidity, and rolling out new features. For Q2 2022, the team plans to upgrade its UI/UX, trading API, and tokenomics. The team is also developing a PMM-assisted calculation tool. Later in the year, DODO plans to introduce new asset liquidity control tools and an ecosystem DAO. The DODO team has adopted an agile approach to product development and will seek to revise the roadmap as needed. Therefore, the specifics of each roadmap update have not yet been released or finalized.

Conclusion

DODO was developed to address capital inefficiencies in traditional AMM-based DEXs. As DODO expands to more chains, its ability to leverage more liquidity and optimize capital efficiency with PMM increases. The team is also consistently launching new features to appeal to traders, such as limit orders. In addition to their developments within the DeFi space, DODO is promoting a new NFT ecosystem that will simplify the fragmentation of NFTs for collection and investment purposes. DODO’s agile approach to product development will allow for roadmap surprises and promote innovation in a fast-paced industry.