Each bear market is notably different than the last. The categories of projects imploding and the most significant opportunities all vary, but a common thread emerges.

The “hot thing” of the preceding bull market typically experiences an existential hit. This catalyzing moment, provided the project or industry survives, is soon replaced by the next “hot thing” of the following bull market.

The first bear market (January 11, 2012 — July 11, 2012) saw Bitcoin’s future threatened linked to early exchange TradeHill shutting down due to regulatory issues, and the Bitcoinica hack where 18,000 BTC were lost.

Ethereum was founded in 2013 by programmer Vitalik Buterin, and additional founders Gavin Wood, Charles Hoskinson, Anthony Di Iorio, and Joseph Lubin.

Members of the “Ethereum Mafia” would split off into their own ventures:

- Charles Hoskinson launched Cardano in 2017.

- Gavin Wood founded Polkadot in 2016 and Kusama in 2019.

- Joseph Lubin would found ConsenSys in 2014, helping build cohorts of dApps in a variety of smart-contract enabled niches.

- Anthony Di Iorio would launch Jaxx wallet in 2014.

Bitcoin would experience another existential shock, birthing a “crypto winter” (November 29, 2013 — Jan 7th, 2015); shutting down of the Silk Road and the 2014 Mt. Gox hack of 740,000 bitcoin were the primary incidents. The Ethereum DAO hack in 2016 wasn’t substantial enough to cause waves across all crypto assets, but it’s worth mentioning.

The bursting of an ICO bubble is often credited for accelerating the 2018 bear market; this was a time when projects were doing massive token sales with vaporware whitepapers and roadmaps– not too dissimilar to the NFT wave in 2020 and 2021.

In this bear market, DeFi projects like Compound and MakerDAO would mature, and new DeFi explorations like Curve, Aave, and Terra would launch. Further, the NFT boom started– with marketplaces like OpenSea providing a user-friendly front-end, and a variety of other Layer-1s like Solana building around the NFT concept.

And here we are in 2022, in the midst of another bear market, and we have a few predictions. The following article attempts to make sense of the patterns we’ve seen thus far, using companies such as Nansen, Zurp, 1inch, and Aave to explore developing trends.

A Distillation of Data and Information: Featuring Nansen

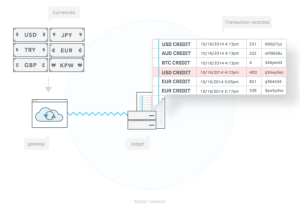

Since the blockchain is a public verifiable ledger, there is an immense pool of data being created every second.

Dealing with multiple blockchains, international timezones, and dozens of centralized and decentralized cryptocurrency exchanges, the task of turning these mountains of data into something actionable and useful weights heavy.

Chainalysis, a blockchain forensics company, was founded in 2014, targeting law enforcement as its primary demographic. Today, everyone from institutional investors to bloggers references its data.

Nansen, another blockchain analytics company, was founded in 2019 and backed by companies like a16z, has been on a marketing tear this year, sponsoring events like Permissionless 2022.

Our prediction:

- With so many cryptocurrency wallet addresses but minimal color behind them, there will be an explosion of data analytics companies seeking to translate blockchain activity into actionable insights.

An Abstraction of the Crypto Layer, for Both Consumer and Business Customer Demographics: Featuring Zurp

Have you ever counted the number of steps it takes to earn rewards by providing liquidity in a liquidity pool?

We’re looking at an average of 9 to 14 steps depending on the assets. It may surprise you that it took roughly the same amount of steps just to buy some BTC in 2011 when Bitcoin was just a baby. Today, it takes about 3.

Consumer friendliness always tends to lag behind crypto innovation, but it’s almost guaranteed to cover lost ground– and bear markets are usually the prime time to do so.

Zurp, for example, is a company building its suite of products and services with the aim of reducing as many cryptocurrency-related steps as possible.

“We believe that crypto adoption will be a transition and not a binary shift,” says Michael Lisovetsky, Zurp Co-Founder. “With that, Zurp’s vision is to build the first consumer ‘bank’ equivalent with crypto tooling as its infrastructure. We’re working on swapping out traditional components of banking piece by piece to bring innovations and efficiencies from crypto to end consumers, passing down those savings to the user.”

The transition to mass crypto adoption will be a mix of individual actors and an integration with TradFi, as opposed to a sudden mass societal leap.

“We believe much of this next wave of innovation will be a swapping out of individual banking components with their blockchain counterparts,” says Troy Osinoff, Co-Founder of Zurp. “It’ll be a massive undertaking, but we’ll get there. Finance 1.0 was invented in the early 1900s, and we iterated and ended up where we’re at today. Cryptocurrency is an infrastructure-grade solution, but we still must build around the convenience, safety, and preferences of the end-user.”

The Zurp Founders postulate that neo-banks need plug-and-play solutions to accelerate the shift. Or, startups could go direct to people, marketing the individual components as standalone services.

“Zurp will be starting with lending and spending, followed by borrowing, and then expand from there,” adds Lisovetsky. “The average user won’t care that we’re built on crypto, but they will care about the new opportunities we’ll be able to introduce to them.”

Our predictions:

- An increasing number TradFi businesses will offer crypto features to refresh their brands and services.

- More CeFi businesses will grow to absorb traditional banking functions. Ultimately, we’ll reach two types of hybrid business models converging towards the same end-utility.

An Aggregation or Compiling of Services: Featuring Celsius, Crypto.com, 1inch, Aave

You’d be hard-pressed to find a well-established centralized cryptocurrency company that doesn’t offer a wide variety of features– everything from a crypto exchange, wallet, NFT marketplace, and yield-generation features built into a single app.

Customers also don’t want to download a dozen cryptocurrency apps to immerse themselves in the crypto ecosystem.

In CeFi, we’re seeing the evolution of “super-apps” that offer exchange services, wallets, opportunities to earn yield, new project discovery, and education. Think Celsius and Crypto.com.

In DeFi, we’re seeing collections of disparate parts, like DeFi aggregators, NFT marketplace connectors, and so on. DeFi is its own maze of interconnected apps and chains, and we predict there will be further development or absorption of “aggregation” tools.

1inch, for example, is a decentralized exchange evolving to be a one-stop shop for a variety of earn mechanisms (pools, staking, farming), and links to bridges for cross-chain transfer of assets.

Aave is a decentralized liquidity protocol enabling people to earn interest and borrow assets on a variety of chains.

Our prediction:

- Crypto super-apps and aggregators are mostly “feature-agnostic” and hell-bent on acquiring as many users as possible. We’ll keep seeing “Fortune Favors the Brave” commercials targeting mass retail audiences.

- We imagine there is no shortage of potential back-room efficiencies, setting the scenes for “big fish eat small fish” acquisitions.

A Standardization of Crypto Yield

The recent UST depeg was not unlike a hurricane terrorizing and ripping through a city for about a week. The weakest and most dependent infrastructure is left tattered, whereas the stronger more established buildings may have only faced cosmetic damage.

Similarly, the UST depeg was a shock test for the crypto yield and cryptocurrency interest account industries.

To quickly recap the UST depeg’s impact on crypto yield: Anchor Protocol, a dApp on Terra, gave users around 20% APY for their UST. This lasted for about two years, which is a large enough time window for a myriad of startups launching to attempt to arbitrage the yield.

The idea was simple: take in user funds, swap for UST, put into Anchor, earn 20%, pay customers something like 8%, and make a 12% margin– in theory, everyone wins.

However, the horrible lack of disclosure here is going to get many startups in trouble– especially in the wake of a doomsday scenario like the baseline asset UST imploding. It’s not a matter of a certain borrower defaulting, but of the underlying asset falling apart. Anchor Protocol was even being used to hold startup treasuries– earning 20% on capital raised offers an extra wiggle room for growth without having to give out more equity, borrow, etc.

A business model built on the arbitraging of yield on a protocol printing 20% APY out of thin air in a bull market isn’t sustainable for obvious reasons.

But, there is a silver lining– Anchor Protocol was still largely unexplored by the vast majority of consumers and institutions. It was a niche product nestled into a very new ecosystem, so its collateral damage was limited. It also serves as a lesson to cryptocurrency entrepreneurs to both build for bear markets and to adequately disclose the risks of digital assets to their users, should they be taking in user funds.

And if they dont, let us be the first to warn you that cryptocurrency is a very volatile ecosystem– don’t invest in anything you can’t afford to lose.

It’s not that these startups launched with malicious intent (at least compared to some NFT rug pulls which are literal theft), but the lack of regulatory clarity or frameworks for disclosing risk in cryptocurrency entrepreneurship leads to a proliferation of startups, dangerous when dealing with people’s money.

So, the crypto yield industry finds itself at an interesting crossroads.

BlockFi, a CeFi crypto yield company, paid a $100 million penalty to the SEC and 32 states in February 2022– fines amassed from a lack of adequately disclosing the risks of digital assets and BlockFi’s yield generation practices.

And then the world of DeFi tagged into the relay, with the UST depeg raising new questions on how cryptocurrency yield should be regulated and how risks should be disclosed.

“Building a FinTech company is hard, and it should be,” comments Troy Osinoff, Zurp Co-Founder. “Consumer protections exist for a reason, but as a country, we need to be really careful to not throw out the baby with the bathwater– clamping down on the actual value-add projects can be detrimental.”

Our predictions:

- The clearest regulation thus far seems to be focused on the lending of crypto rather than the yields generated by staking. So, non-stakable coins like BTC will have fewer opportunities to generate yield. We may see the evolution of a “yield-generating premium” factored into the price of some assets for their unique utility of earning yield.

- Blue-chip CeFi yield companies like Celsius will bear the brunt of working with regulators, and smaller shops may be forced to cease operations due to a lack of appropriate disclosures.

Final Thoughts: Closing Some Feedback Loops and Starting a New Ones

Cryptocurrency’s bear and bull markets should be viewed from a different lens than traditional markets; downward trends in price seem to be inversely correlated with innovation that lasts. Looking at companies like Nansen, Zurp, 1inch, and Aave, we can follow which features are being prioritized, and what companies will emerge from the 2022 bear market with a dense cohort of active users.

A bull market is an inherently deceitful foundation to build a company, and in an industry as new as cryptocurrency, we may have to learn this lesson over several cycles. With each shake of the pan, we begin to realize the gold from the soil and sediments.

Each bear market gives us the gift of closing the feedback loop on various technological and marketing experiments, allowing the industry to readjust its collective focus to the projects changing the world for the better.

The post 2022 Bear Market Product Features to Watch: Nansen, Zurp, 1inch, Aave appeared first on CoinCentral.