Law, markets, architecture and social norms are forces that constrain individuals’ behavior. Can governments take advantage of these to regulate Bitcoin?

Jesse Colzani is a regulatory specialist and Bitcoin researcher.

When asked whether the Bitcoin network can be regulated or not, people tend to answer in a binary way. On one side, there are those who say that everything can be regulated. On the other, there are those who believe that Bitcoin has already irreversibly separated money from the state. This article is an attempt to better understand what Bitcoin regulation depends on and what are the tools that regulators can reasonably use to limit its adoption.

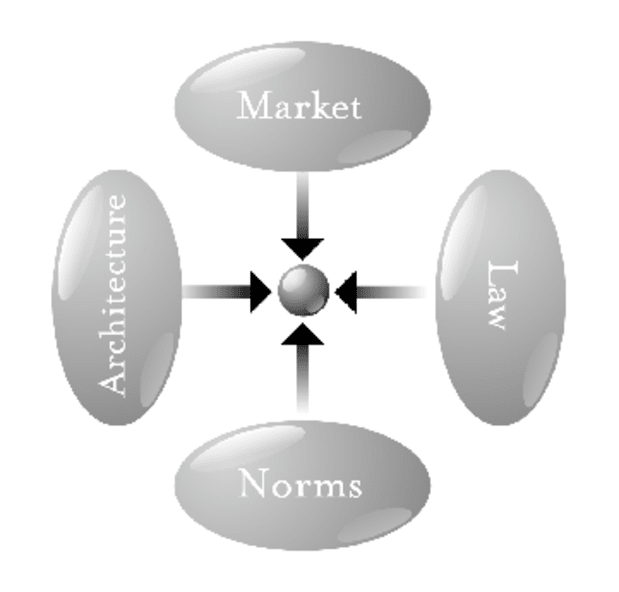

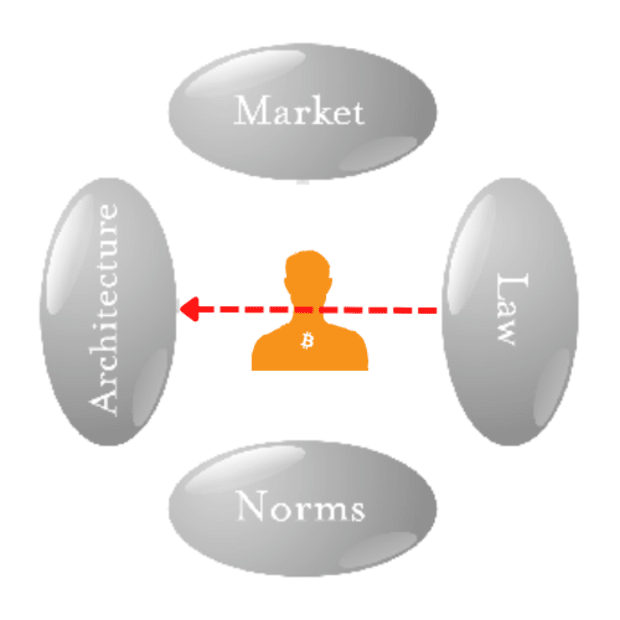

For the purpose of this article, regulation is considered as state-mandated legal restrictions. But laws are not the only forces shaping society. In what is often referred to as the “pathetic dot theory,” Professor Lawrence Lessig identifies three other forces that constrain the action of an individual.

- Markets regulate through the device of price and cost-opportunity.

- Social norms represent an intricate set of standards of behavior that are widely accepted within a community (like tipping a server in a restaurant).

- Architecture includes geographical, technological and biological barriers to human behavior (like laws of physics preventing us from levitating or a web app preventing us from accessing an online service).

Each force can — intentionally or not — influence other ones. Laws can limit deforestation (architecture), social norms can shape markets, and weather (architecture) can affect agricultural production and food prices.

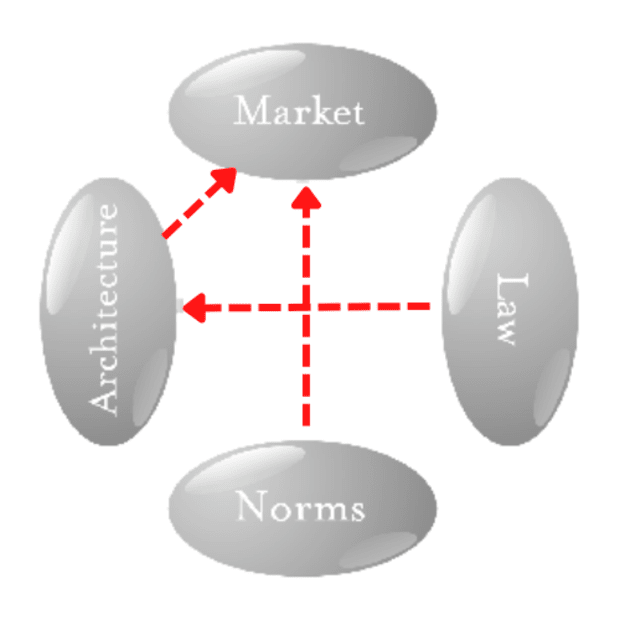

When a law cannot directly target individuals, lawmakers look to regulate other forces. This happens when the government causes the price of cigarettes to increase (market), when it prohibits the use of specific words on TV to influence citizens’ behavior (social norms) or when it builds concrete barriers to create pedestrian zones (architecture).

But can laws always influence architecture? Can laws make a virus disappear? In today’s world, highly contagious viruses cannot be eradicated due to a combination of biological reasons (architecture), financial constraints (market) and hostility to restrictions (social norms).

Like a virus, Bitcoin spreads globally (mutating when necessary) and depends on the right market incentives or socio-political momentum. Lawmakers can’t shut down Bitcoin nor can they eradicate a virus, but they can use legal restrictions to mitigate the risk of specific undesired outcomes.

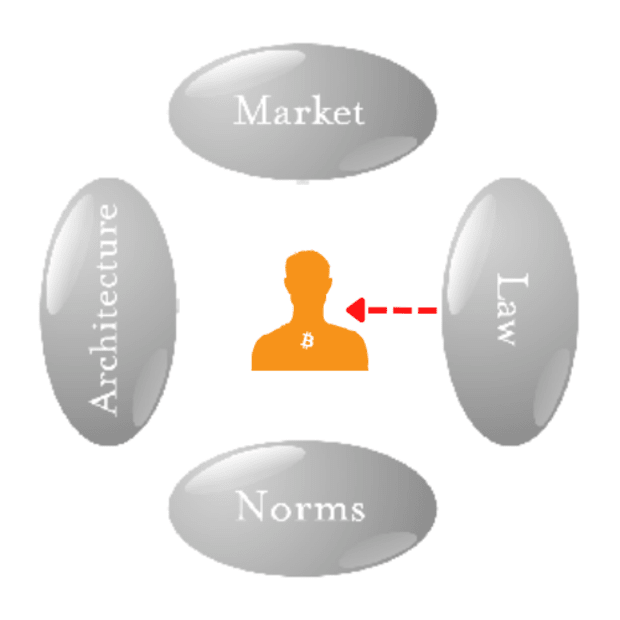

Direct Enforcement Through Users

As long as one has a phone and an internet connection, she will be able to use Bitcoin. The efficacy of direct enforcement therefore depends on the jurisdiction where it takes place. In fact, only a disproportionate restriction of individual freedom might limit Bitcoin adoption in the short term (underground peer-to-peer markets will probably emerge in the long run).

Also, individuals tend to be more willing to violate laws when their money is at stake. That’s why the past decade is full of instances where software developers, political activists and criminals used more or less sophisticated techniques to escape the government’s scrutiny on their bitcoin.

Enforcement Through Architecture

Although John Perry Barlow’s “Declaration of Independence of Cyberspace” is still relevant to some people’s lifestyle today, governments generally exercise a certain degree of control over the internet architecture. In fact, the data that flows through devices goes through centralized bottlenecks that make it possible for public authorities to shut down websites, identify anonymous users and control online traffic.

Bitcoin is different because it’s significantly more decentralized than most web applications we use today. Thanks to a strong network of nodes and mining rigs, changing the blockchain would be a Herculean task for any government.

At the same time, Bitcoin does rely on the internet infrastructure for nodes to communicate. In theory, this gives lawmakers a regulatory access point over the technical infrastructure. For example, since Bitcoin transactions are not encrypted, internet service providers could use special techniques to recognize them and even decide to not process them. However, even with the most draconian measures in place, experienced users will always have ways to broadcast transactions to the network (including last resort options such as SMS and Morse code).

Another solution would be to target core developers. This is a bad idea for at least two reasons. First, if threatened, identifiable developers could easily disappear and continue their work anonymously. Second, because the Bitcoin community relies on wide consensus, even the most influential developers wouldn’t be able to push government-imposed changes into the code.

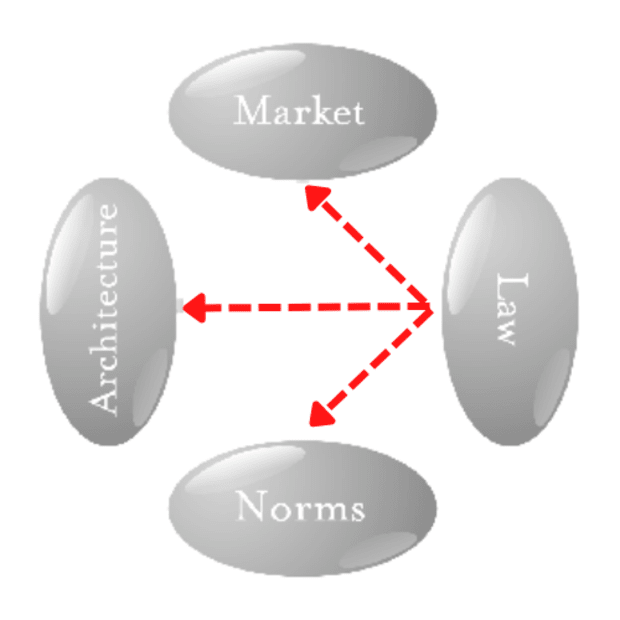

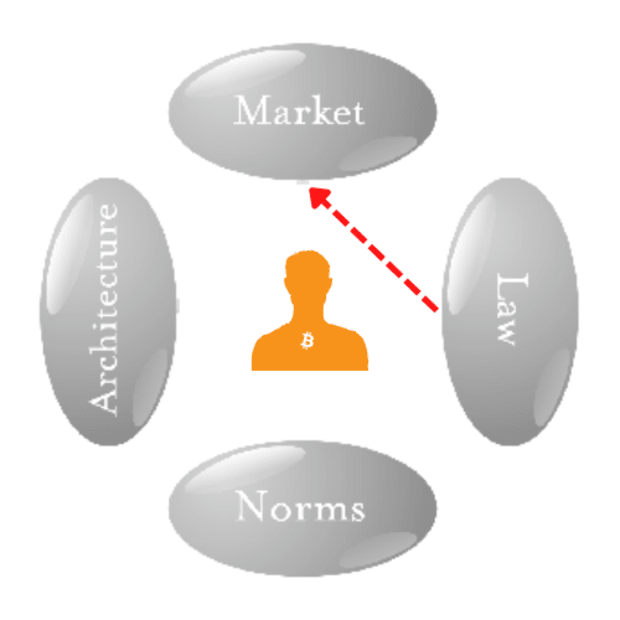

Enforcement Through Market Incentives

Governments can offer their citizens compelling market incentives to slow Bitcoin adoption or maintain control over the money flows. For example, the government of El Salvador offered $30 to every citizen who downloaded the Chivo wallet — a custodial solution where the government has full control of the funds.

The most popular way governments currently attempt to regulate Bitcoin is through exchanges, liquidity providers and other intermediaries. By complying with know your customer (KYC) and anti-money laundering (AML) regulations, these new banks are able to offer compelling prices and attract the most inexperienced users. This has important consequences for the fungibility of the bitcoin supply and probably constitutes one of the greatest threats to Bitcoin’s promise of individual self-sovereignty.

It is not clear if, when and how governments will introduce central bank digital currencies (CBDCs) into their economies, but just like a government could promote the use of its CBDC through economic incentives, it could disincentivize bitcoin payments. For example, fees to access public services or local taxes could be reduced when using a government-issued digital currency while being full-priced or even more expensive if using bitcoin. This is important because while CBDCs will not have an impact on the network per se, they can slow down the adoption of bitcoin. Such an approach is often defined as libertarian paternalism, since individuals can freely choose whether they want to opt in or opt out of a specific system.

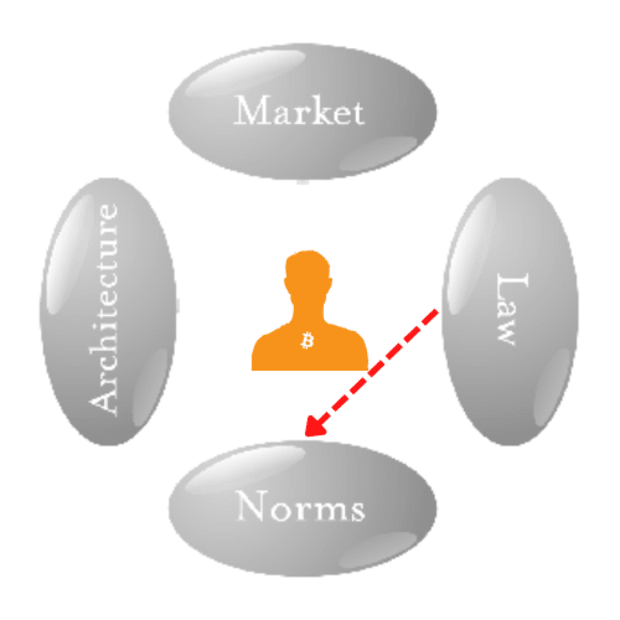

Enforcement Through Social Norms

It’s undeniable that a lot of institutional skepticism shaped the public’s perception of Bitcoin in a negative way. In fact, laws can attempt to shape the public perception in a variety of ways. For example, banning Bitcoin-related words on TV or establishing school programs that focus on the risks of using bitcoin.

Policymakers could even go a step further and promote “bottom-up” campaigns as an attempt to change the Bitcoin code. Although not backed by any public authority, a rather unconventional coalition is attempting such a strategy.

Bitcoin’s Main Vulnerability

Just like we can assume that no government thinks it can completely eliminate a virus from its country, regulators finally understood that the same applies to the Bitcoin network, and their best option is to try limiting the way it spreads. Rather than taking the risk of watching their monetary power slowly erode, governments will likely experiment with different combinations of the tools described above to slow down the hyperbitcoinization process.

Bitcoin was engineered to be an extremely secure and decentralized system, but one needs to remember that its most important components are humans, which can be unreliable and unpredictable. Governments are not always ahead of the curve on understanding technology, but they do have a successful track record in driving human behavior.

This is a guest post by Jesse Colzani. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.