Anders Helseth, a Senior Analyst at Arcane Research, filed an entry on May 30th, claiming that Terraform Labs dumped LUNA tokens on retail users during the collapse of UST.

If the Terra Ecysostem was a sinking cruise ship, the captain and distinguished guests fled in superyachts, leaving most passengers behind without lifeboats. – Opens the post.

- Helseth tracks down the flaws of the Terra Classic Protocol back to its genesis, claiming that “no block rewards and a highly concentrated LUNA supply gave all power to the early holders.”

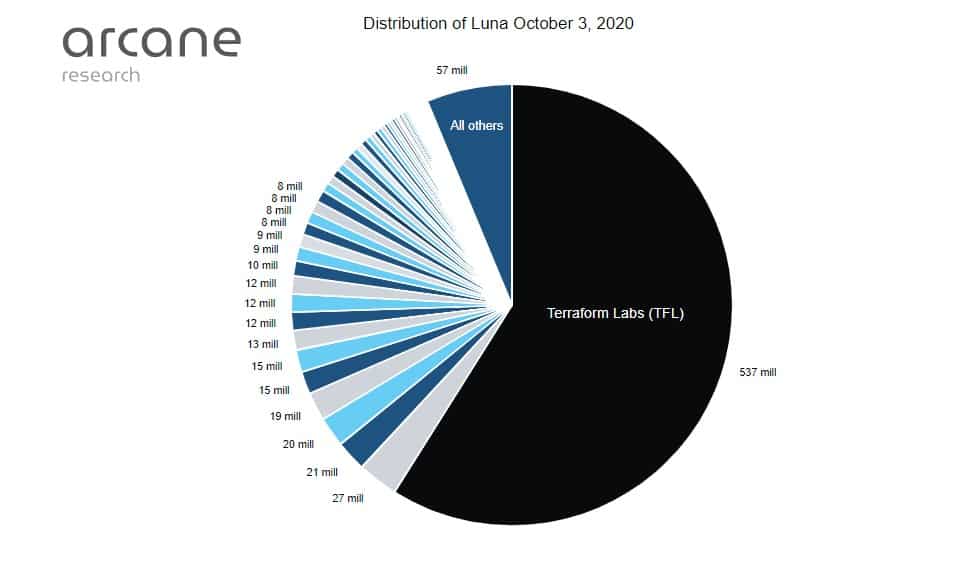

- Arcane Research shared a pie chart of LUNA’s distribution as of October 3rd, 2020:

- The analyst claims that he has analyzed value flows in the Terra Ecosystem and has accounted for transactions up to May 5th (right before the crash) to avoid obscurity.

The analysis reveals that sets of John Doe wallets interacting closely in clusters have massive net outflows from the Terra ecysostem to bridges and centralized exchanges.

- He claims that there’s a common denominator among these clusters – “one or more wallets in the cluster received significant transfers from Terraform Labs’ wallets.”

- From October 2020 to May 5th, 2022, said clusters comprise net outflows of over $6 billion through bridges and exchanges.

- On the other hand, “all the other hundreds of thousands of wallets have a net inflow of $6.5 billion.”

- What is more, he also argues that the clusters deposited large amounts of LUNA to exchanges when their price was still relatively low, making outflows “undervalued relative to inflows of LUNA.”

- The report also details that the algorithm behind UST allowed these LUNA whales to mint large amounts of UST and benefit from the 20% yield on Anchor protocol.

- That yield was what created the massive demand for UST, providing the necessary exit liquidity for the clusters – argues the research.