The past 24 hours brought even more pain to the cryptocurrency market, with bitcoin dumping to a monthly low of just over $27,000. However, the alternative coins suffer even more. ETH, for example, plummeted below $1,500 to the 2018 ATH levels.

Bitcoin Goes Down Again

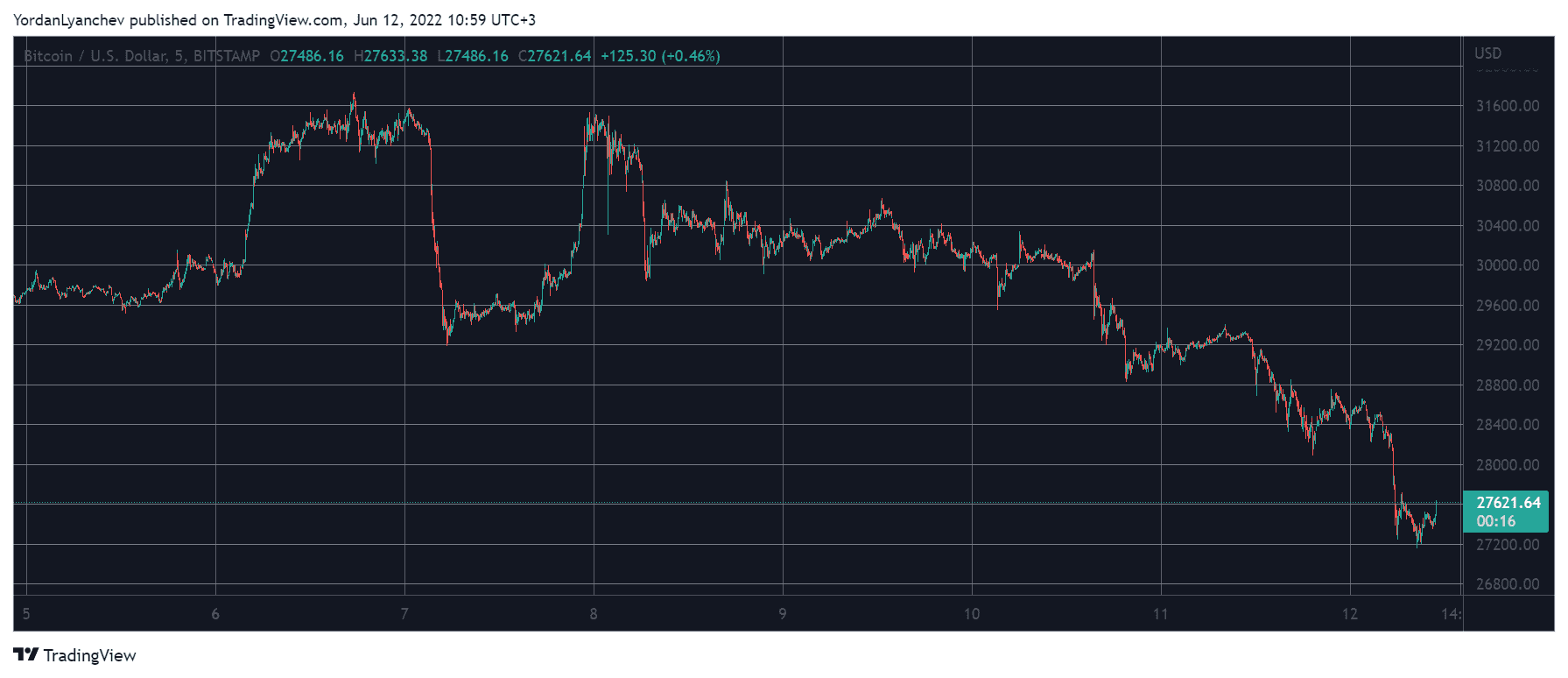

After a few brief and unsuccessful attempts to overcome $32,000 last week, the primary cryptocurrency started to lose value gradually. The last rejection at that level brought it down to $30,000, where the asset stood for a few days.

The landscape changed on Friday when the US inflation numbers went out (8.6%). The 40-year-record brought enhanced volatility for BTC, which dropped to $29,000.

Nevertheless, the worst was yet to come as bitcoin started to drop even more vigorously hours later. This culminated earlier today when BTC slumped to $27,200 (on Bitstamp) – the lowest price position seen in a month.

Consequently, bitcoin’s market capitalization is down to $520 billion. The silver lining for the BTC bulls is that the dominance over the altcoins is up to almost 48%.

Bitcoin News

The aforementioned adverse price developments have not deterred traditional hedge funds, as a recent report claimed they continue to pour funds into the market.

deVere Group’s CEO is still bullish on bitcoin and believes the asset will skyrocket by the end of the year.

Alts in Deep Red

While bitcoin has declined by around 5-6% in the past 24 hours, most altcoins are down by double-digits.

Ethereum is among the most substantial losers. ETH is down by more than $200 in the past 24 hours and over $500 in a week. It not only dropped below $1,500, but it has declined to the 2018 all-time high levels of around $1,450.

BNB (-12%), ADA (-15%), XRP (-11%), SOL (-14%), DOGE (-14%), DOT (-14%), and Avalanche (-20%) are also deep in the red from the larger-cap alts. TRON has taken this retracement with a bit less pain – a more modest 7% decline.

With the lower- and mid-cap alts in similar or worse positions, the total crypto market cap has dumped by another $100 billion in a day. The metric is down by $200 billion in a few days and is under $1.1 trillion now.

Crypto News

The Bank of Canada believes the cryptocurrency market needs to be regulated before it becomes big enough to cause a macro-financial meltdown.

Crypto exchange Huobi went deep into DeFi and Web 3 by launching a $1-billion investment vehicle.