The cryptocurrency market is showing signs of a minor relief amidst the bloodbath, but Synthetix (SNX) has emerged as the clear winner today.

Synthetix (SNX) Takes the Lead

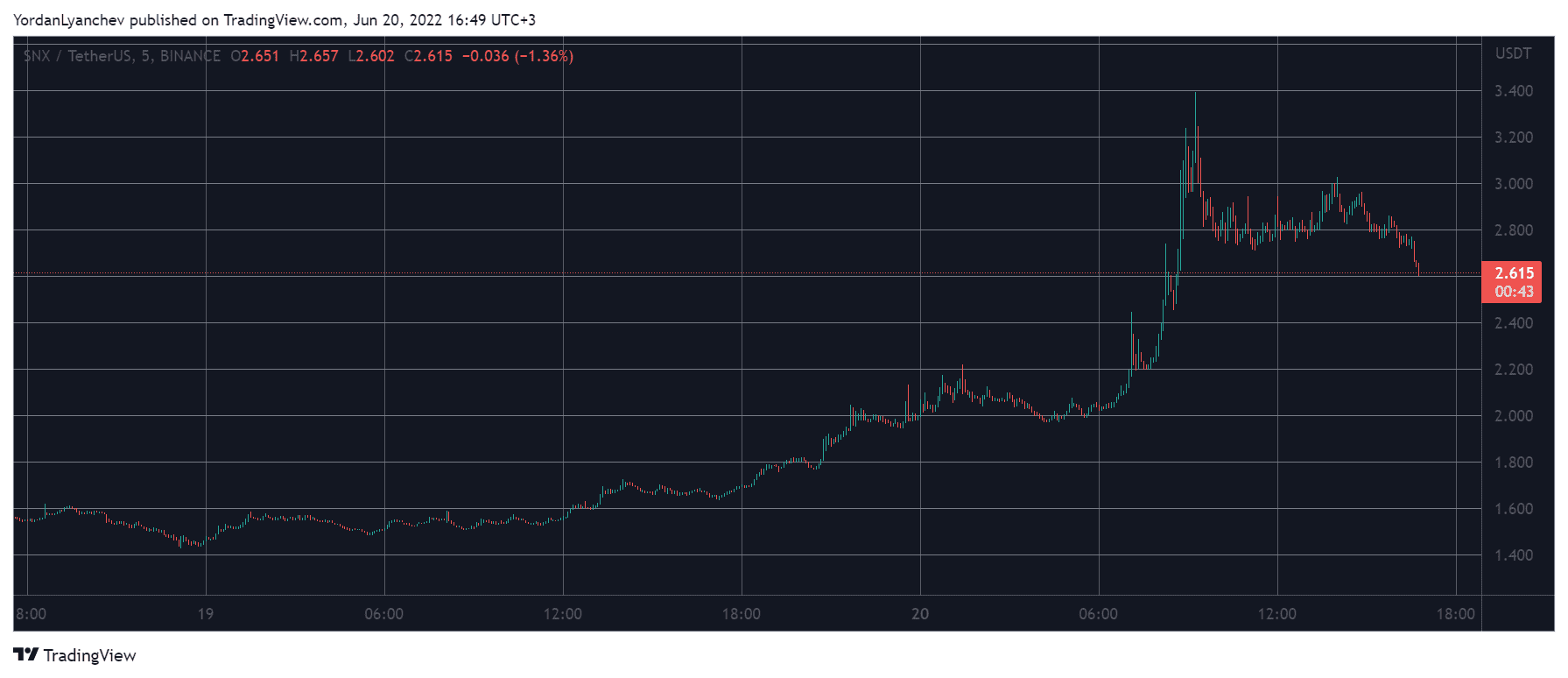

The native utility and governance token of the layer-2 scaling solution Synthetix attempted to reclaim the previous local top formed around the $3-resistance area. SNX briefly witnessed a triple-digit surge of more than 100% in the last 24 hours, climbing to $3.4 before retracing to around $2.6.

Additionally, SNX’s trading volume skyrocketed by an astonishing 1,200%. This massive come-back in trade volume, in turn, spurred the rally for SNX. Subsequently, Synthetix became the third-largest protocol accounting for the most trading fees, just behind Uniswap and Ethereum.

Often described as a “blue chip” DeFi project, Synthetix was one of the first projects to launch on the Ethereum network.

But Why the Sudden Traction?

The native token got a boost after Synthetix collaborated with liquidity provider Curve Finance. The aim is to develop Curve pools for Synthetic Ether (sETH)/Ether (ETH), Synthetic Bitcoin (sBTC)/Bitcoin (BTC), as well as Synthetic USD (sUSD)/3CRV. This would enable market participants to convert synthetic assets such as sETH to ETH in a significantly cost-effective way.

The introduction of the atomic swap function with the SIP-120 proposal is one of the catalysts driving the ongoing traction. Meanwhile, the integration with Curve Finance, and the decentralized exchange aggregator 1inch, was focused on helping users conduct large-scale trades between different asset classes with minimal slippage.

This feature has been functioning since November last year, but Synthetix’s upgraded atomic swaps, with SIP-198 that was introduced last month, have proved extremely helpful in providing the necessary leg-up for the ecosystem’s flagship token’s bounce.

The main focus of the SIP-198 is to enhance the user experience. Therefore, the upgraded atomic swaps enabled users to execute large swaps on 1inch in a single transaction by leveraging Synthetix’s zero-slippage trades as well as Curve Finance’s deep liquidity and cost-efficient fees.

Since the upgrade, the user adoption has hit the roof, due to which the protocol observed its trading volume steadily averaging above the $100 million mark before topping out at $396 million on the weekend.