Key Insights

- THORSwap is a cross-chain decentralized exchange (DEX) aggregator built on the THORChain network. It supports native cryptocurrency assets from different blockchains without the need to rely on bridging or wrapped assets.

- THORSwap’s native token, THOR, incentivizes trading activity by providing handsome yield, revenue fee sharing, and trading discounts. It also compliments THORChain’s native, RUNE, which incentivizes liquidity.

- THORSwap distinguishes itself from other automated market maker (AMM) protocols through several features. It offers powerful APIs, low slippage and deep liquidity pools, impermanent loss protection, and unique tokenomics.

- THORSwap expands upon THORChain’s Layer-1 (L1) native integrations through cross-chain DEX aggregation.

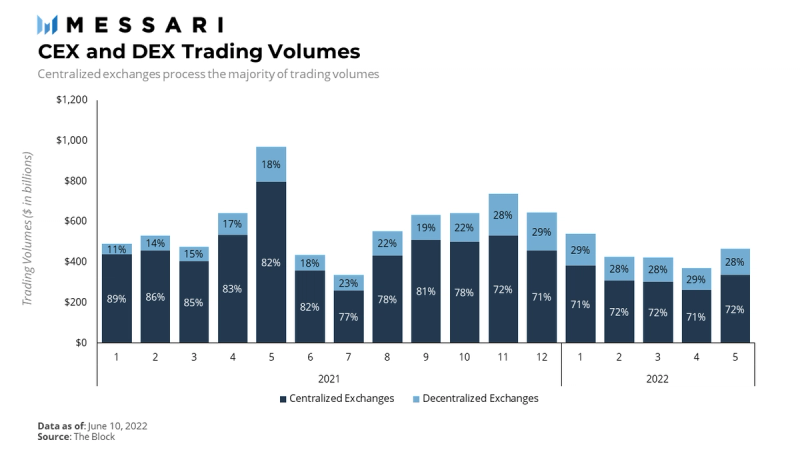

The great paradox of today’s “decentralized” economy is that centralized exchanges process most cross-chain asset swaps. A censorship-resistant economic system requires decentralized exchanges (DEXs). While there are many decentralized exchanges, like Uniswap, most support only a handful of assets native to a single blockchain. For instance, SushiSwap, a popular DEX, operates on the Ethereum blockchain and only supports ERC-20 tokens. Although these single-chain DEXs are useful, their inability to swap native assets across chains limits the growth of decentralized economies.

THORSwap builds off the cross-chain capabilities of THORChain to give users the ability to swap native assets across multiple chains. Its features, tokenomics, and roadmap position THORSwap to be one of the first multichain DEXs.

Introduction to THORChain

THORChain and THORSwap are complementary protocols, providing liquidity and trading activity, respectively. While THORSwap is independent of THORChain and offers many unique services, it benefits from technical innovations established by the THORChain protocol. The innovations and tokenomics of THORChain will thus be influential in driving the success of THORSwap.

Background

THORChain is a decentralized liquidity protocol that enables trades of native cryptocurrencies from completely different blockchains in a permissionless setting. It was founded by a group of pseudonymous developers in 2018 and developed on the Tendermint and Cosmos-SDK.

THORChain, like other automated market makers (AMMs), builds off the model of liquidity pools where participants deposit assets to earn rewards. Smart contracts defined by the protocol then determine the price of each asset and provide liquidity to traders. Most AMMs have been developed on top of existing L1 infrastructure, meaning the DEX cannot swap assets between chains without using a bridge. That characteristic prevents DEXs like Uniswap from communicating with assets outside of the Ethereum ecosystem without using a bridge.

While THORChain uses many of the same AMM mechanisms, it can interact across chains using THORNodes, which includes a node for the THORChain blockchain itself (Tendermint/Cosmos SDK), and a node for each supported asset on THORChain (i.e., Bitcoin node, Ethereum node). Functionally, these nodes act as THORChain’s “vaults,” such that when ETH is exchanged for BTC, the validating nodes will first detect and agree that ETH has been received. Then, the BTC node will collectively approve an outbound transaction equivalent to deposited ETH. On a simple level, THORNodes allow the protocol to read, understand, and sync inbound transactions from external blockchains.

THORChain Features

Instead of limit-order books, THORChain uses continuous liquidity pools (CLP). First developed by protocols like Bancor, these CLPs create a trustless pool of liquidity that never requires the pairing of a buyer and seller. Participants are incentivized to provide liquidity in exchange for handsome rewards. The liquidity and trustless exchange combination enable a well-oiled decentralized market with limited volatility and price manipulation.

To address the drawbacks of interacting with multiple blockchains, THORChain recently introduced Synthetic Assets (“Synths”), which are fully collateralized representations of an asset and backed by THORChain’s liquidity pools. Synths enable cheap and instant settlement of assets with no risk of impermanent loss or liquidation.

Since each Synthetic Asset is partially backed with RUNE, the native token of THORChain, the introduction of Synths creates more demand for the token while simultaneously increasing the network’s Total Locked Value (TLV). Moreover, since THORChain runs on the Cosmos SDK, Synths will eventually be able to interact with applications across the Cosmos ecosystem natively.

For more information on THORChain, see our previous coverage of the protocol.

THORSwap Protocol Features

THORSwap is a cross-chain decentralized exchange (DEX) aggregator built on the THORChain network. It supports native cryptocurrency assets from different blockchains without relying on bridging or wrapped versions. As a decentralized application on the THORChain network, THORSwap benefits from THORChain’s revolutionary AMM model and the tokenomics of its utility and governance token, RUNE. However, THORSwap offers additional functionality beyond THORChain. First, it offers a user-friendly way to swap native assets across multiple blockchains. It also acts as a DEX aggregator to support a broader range of assets. Moreover, it is developing third-party API integrations and cross-chain decentralized wallets.

Cross-Chain Swaps

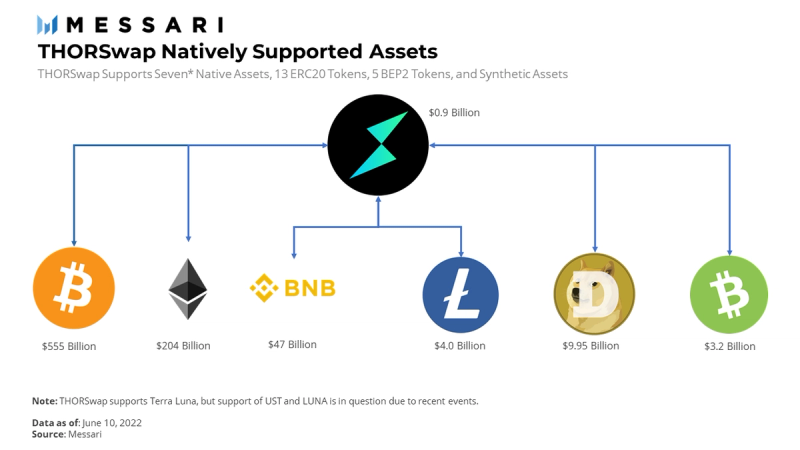

THORSwap supports native assets across eight blockchains: Bitcoin, Ethereum, Binance Chain, Bitcoin Cash, Litecoin, Dogecoin, Terra, and THORChain. Additionally, it supports a host of ERC-20 and BEP2 tokens, including major stablecoins like DAI, USDC, USDT, and BUSD. In total, the available assets on THORSwap represent nearly $900 billion, a significant share of the crypto market capitalization.

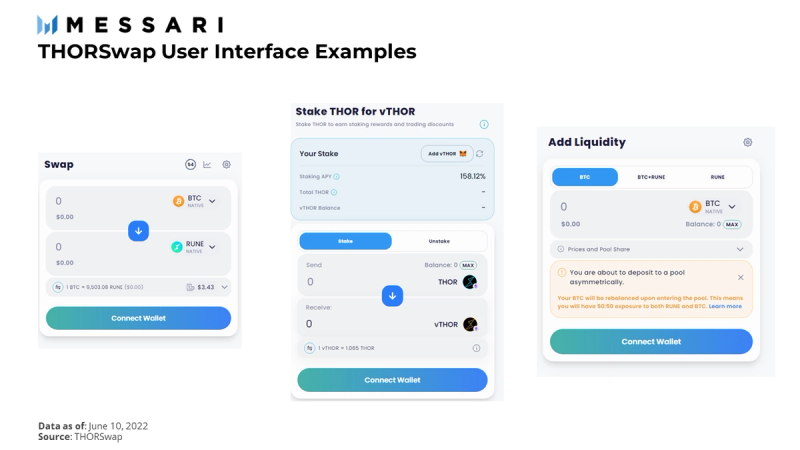

THORSwap recently unveiled an updated version of the protocol (THORSwap V2), which enhanced the user experience. The updates include better UI/UX for swaps and liquidity, a smoother experience for resolving pending liquidity deposits, and new ways to connect to wallets. THORSwap V2’s simplicity mirrors major exchanges like Coinbase without sacrificing any Web3 charm.

THORSwap also offers more advanced trading options. For instance, users can manually enter the desired slippage and transaction speed, which determines, in part, required gas fees. The simple and usable UI/UX will likely make THORSwap a key player in onboarding more users to THORChain and decentralized finance in general.

Cross-Chain DEX Aggregation

Currently, THORSwap utilizes THORChain to enable transactions between supported digital assets. While THORChain will evolve to support an increasing number of assets, it is not designed to support long-tail assets like the variety of ERC-20 tokens on Ethereum.

THORSwap, however, will take on the role of a DEX aggregator, tapping into different liquidity sources to support a wider range of digital assets from multiple blockchains. Initially, THORSwap will integrate with 1inch to access liquidity on Ethereum, Polygon, and the Binance Smart Chain from over 50 liquidity sources. This “aggregator of aggregators” functionality will provide users with an unrivaled number of native assets to swap.

Impermanent Loss Protection

One drawback to automated market makers is a phenomenon called “impermanent loss.” This occurs when an AMM’s formula for algorithmically driven token rebalancing creates a difference in price between an asset staked in a liquidity pool and the same asset held outside a liquidity pool. Impermanent loss introduces the risk of financial loss and is often a concern for liquidity providers. To mitigate losses, DEXs often pay trading fees to liquidity pools or reward liquidity providers (LPs) with airdrops.

THORSwap protects users with “Impermanent Loss Protection” (IPL). This program guarantees that LPs will always be better off providing liquidity rather than holding the underlying assets. IPL is paid out if the impermanent loss exceeds the LP’s revenue from providing liquidity. However, if an LP made enough fees and rewards to cover the IL, that revenue will subsidize the protection. Notably, on THORSwap, LPs receive linear IL protection over 100 days, meaning that they receive an additional 1% protection every day they provide liquidity.

Liquidity Pool Dynamic Rewards

Liquidity providers earn rewards in the form of RUNE and the pool’s connected asset. Yield is made up of trading fees and rewards from the predetermined schedule of token emissions. These rewards are calculated for liquidity providers every block and paid out when liquidity providers remove assets from the pool. The APY for each pool is influenced by the following:

- Swap Volumes: Determines the transaction fees;

- Size of Swaps: Influences the magnitude of slippage;

- Incentive Pendulum: A characteristic of the THORChain protocol and THORNodes, which provides dynamic rewards to LPs and node operators depending on the supply and demand of deposited assets;

- Change in Asset Prices: May influence yield if the yield is being priced in a third asset (i.e., USD).

Currently, THORSwap offers liquidity providers between 8% and 25% APY, depending on the pool. These rewards will likely contract as the network matures and observes greater adoption. As token emissions slow, yield will become increasingly composed of revenue from fees.

THORSwap API and Hammer Wallet

THORSwap will also introduce a third-party API, which will allow external parties to access the protocol’s services easily. The API will include functions for third-party wallets to enable in-wallet cross-chain swaps and for coin trackers, such as CoinGecko, to enable cross-chain swaps. It will also enable automatic liquidity transfer to the highest yielding THORChain liquidity pool, similar to dynamic yield-aggregators like Yearn Finance.

Like the THORSwap API, the introduction of Hammer Wallet — a mobile application that supports cross-chain swaps — will increase trading volumes on THORSwap and further benefit community members. Hammer wallet will enable an accessible multichain future, with all compatible chains integrated and consolidated into one mobile wallet application that will allow for direct management and exchange of native and long-tail assets. The transaction swap fees will be significantly less than competitors at 0.3%, and the application will have 24/7 customer support, reflecting THORSwap’s community focus.

Traction

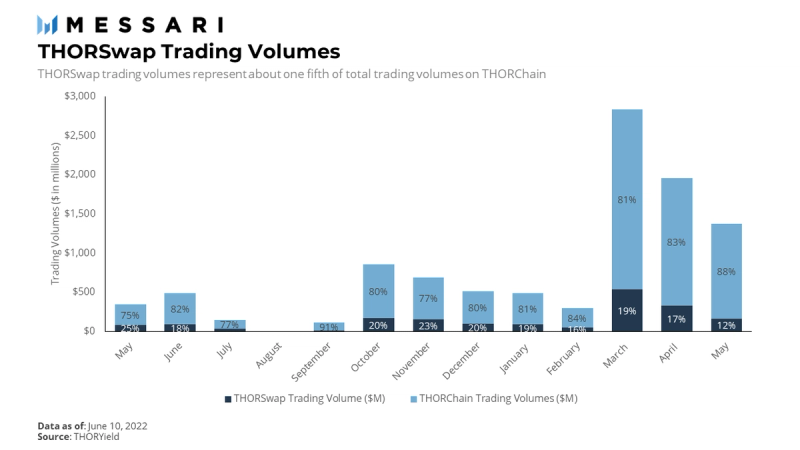

THORSwap is one of the first multichain DEXs. In the 14 months since the THORSwap DEX official launch, the exchange has processed a total of 2.7 million transactions and $1.85 billion in volume, representing about 20% of the total volume on the THORChain network. The remaining transactions are processed primarily by arbitrageurs running custom bots and smaller alternative DEXs like Asgardex and DefiSpot.

The protocol’s trading volumes ballooned to $540 million in March, nearly a 7x increase compared to previous months. Despite this monthly surge, the trading volumes on THORSwap are still less than 1% of DEX volumes across Ethereum, xDai, Polygon, Optimism, BSC, and Solana, reflecting a large addressable market. Moreover, because THORSwap supports native assets on multiple chains, it competes with decentralized and centralized exchanges, with the latter having roughly $400 billion in monthly average volumes. If THORSwap captures just a fraction of centralized exchange (CEX) trading volumes, it would be one of the largest decentralized exchanges by traded volume.

Tokenomics

Dynamic markets require liquidity and trading activity. The THORChain ecosystem meets these requirements with the RUNE and THOR tokens, respectively. RUNE is designed to incentivize liquidity. However, THOR is the native governance and utility token of THORSwap, and it incentivizes trading activity. These tokens are thus complementary, creating a balanced market where participants are properly incentivized.

RUNE Tokenomics

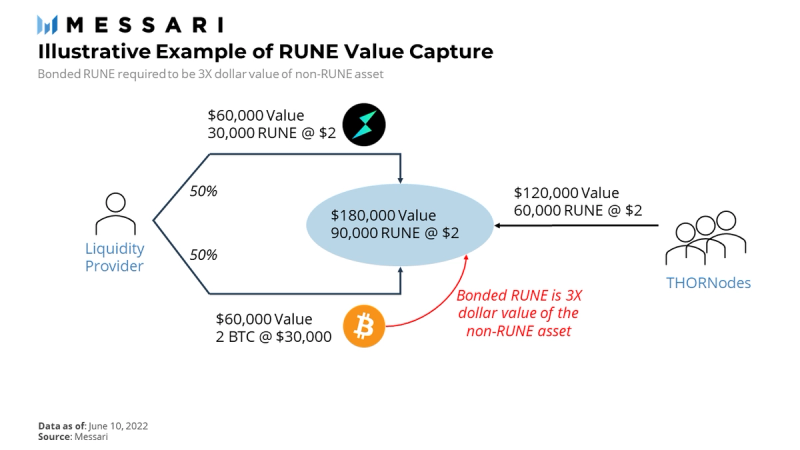

The pairing of RUNE in THORChain’s liquidity pools creates a unique value accrual mechanism for the token. Within each liquidity pool, $1 of RUNE bonds to every $1 of non-RUNE deposited assets. For instance, $100 of deposited Bitcoin is matched with $100 of RUNE. However, to ensure network security, THORChain requires validators to deposit additional RUNE such that $2 of RUNE bonds to every $1 of non-RUNE assets. Therefore, the RUNE from the LPs and THORNodes is 3x the dollar value of non-RUNE assets. In other words, every $1 of assets is overcollateralized by $3 of RUNE (reflecting RUNE from LPs and THORNodes).

This feature has significant implications on the price of RUNE and the incentives to hold the token. For example, if two bitcoin (assuming $30,000/BTC) are deposited to a liquidity pool, an additional 30,000 RUNE (assuming $2/RUNE) will be deposited. The liquidity pool will thus have 50% BTC and 50% RUNE, where the non-RUNE and RUNE assets are collectively valued at $120,000. If, for instance, the price of BTC increases to $40,000, an additional 10,000 RUNE will be bonded to match the dollar value of the price appreciation for two bitcoin ($20,000). Put simply, the more liquidity is added to pools, the more RUNE bonds, which reduces the total RUNE supply, creating value for tokenholders.

THOR Tokenomics & Staking

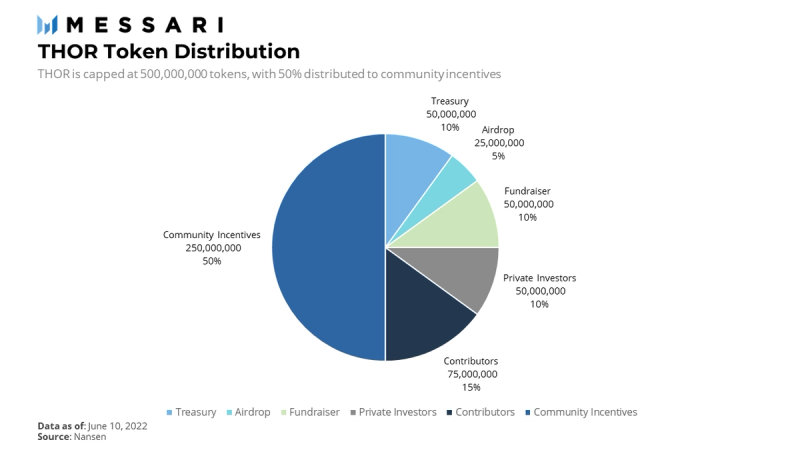

While RUNE incentivizes the creation of liquid markets, THOR incentivizes trading volumes. THOR is largely community-owned, with 65% of its tokens allocated to the community. This subset of tokens will be emitted over four years via airdrops, LP rewards, staking, trade mining rewards, trading fee discounts, and more. The 25% of tokens owned by private investors and core contributors will be vested for 24 months and 36 months, respectively. The THOR supply, which is capped at 500 million tokens, will increase during the first four years after token launch, translating into an average annual inflation rate of 125 million tokens. Most emissions will be diverted to community incentives.

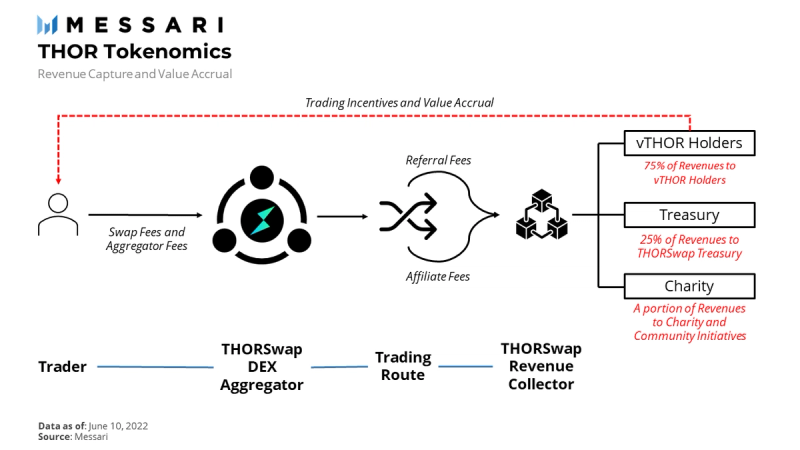

THOR can be staked in a vault to receive vTHOR, allowing stakers to accrue 75% of the protocol’s revenue. The remaining revenue will accrue to the THORSwap treasury and support community-driven charity initiatives. The revenue is generated from traders’ swap fees, affiliate fees from trading on THORChain, referral fees from aggregators, and value accrual from other projects like THORName and THORChads.

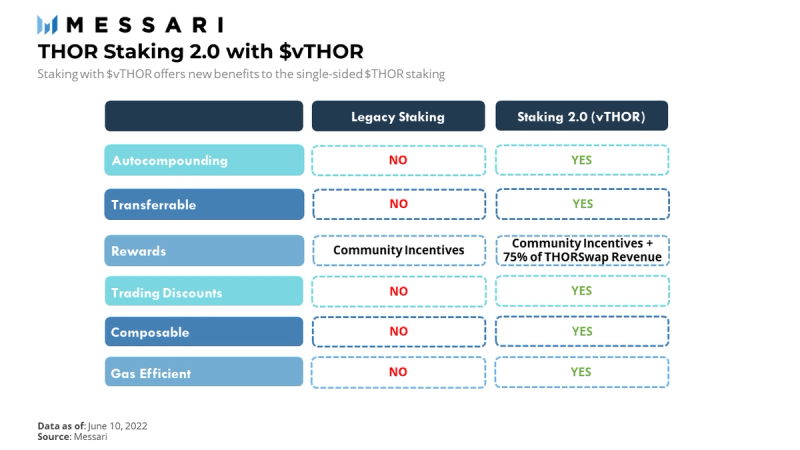

The migration to vTHOR staking provides several other key benefits. First, the legacy staking rewards came purely from emissions of the “Community Incentives Pool” which was not sustainable in the long term. Using trading, referral, and affiliate fees to generate revenue creates a more sustainable yield for tokenholders. THORSwap users holding vTHOR will also be entitled to trading fee discounts. Moreover, those users staking vTHOR will receive daily rewards that auto-compound without any user action. Finally, vTHOR also is a composable and transferable representation of a user’s staked THOR position, further enhancing the asset’s utility.

THORswap Roadmap

Currently, THORChain supports a limited basket of economically significant native cryptocurrencies like Bitcoin and Ethereum. It does not support smaller assets siloed across independent blockchains (“long-tail assets”). THORSwap will ultimately support thousands of long-tail assets by integrating new liquidity sources in addition to those already available in THORChain pools. In other words, THORSwap will expand on THORChain’s native L1 integrations to support a broader range of long-tail assets by leveraging deep liquidity of DEXs across multiple chains. This update could unlock billions in annual trading volumes from newly supported assets.

THORSwap also is supporting the development of Hammer Wallet, a mobile-native, decentralized, and non-custodial wallet for all chains. The development of Hammer Wallet, and other associated applications, will provide a single mobile wallet with cross-chain functionality and create additional revenue for THOR stakers. Finally, THORSwap’s development of a third-party API will provide one-stop access to all of THORSwap’s aggregated liquidity sources.

Conclusion

Centralized liquidity is problematic for the long-term viability of digital assets. Centralized exchanges like Coinbase or Binance can seize assets, succumb to regulatory scrutiny, or, at worst, shut down. Providing cross-chain liquidity in a decentralized manner is, therefore, the “holy grail” of digital asset development. THORSwap and THORChain offer a solution to the problem of centralized liquidity and, in doing so, attempt to solve one of the most fundamental issues in the cryptocurrency landscape.

THORSwap has demonstrated success, but there is still a long and risky road ahead, considering that THORChain has suffered multiple attacks. These attacks serve as a general reminder that cross-chain processes introduce significant complexity and risk, but THORChain has also responded accordingly. During the build up to the recent Mainnet launch, THORChain has been doubling down on its security focus. Security-focused measures included formalizing the $1 million bug bounty program with ImmuniFi, audits by Trail of Bits and Halborn Security, and building out live monitoring tools. THORswap itself has commissioned audits across multiple components of their system.

And while THORChain is decentralized, the number of active nodes will never exceed 300 in total, raising the question of whether THORChain is sufficiently decentralized. Finally, THORSwap’s success is conditional on the future being multichain. There is a non-zero chance that the digital asset ecosystem will consolidate around a handful of blockchains.

Despite the risk, THORSwap provides real utility, allowing users to swap effortlessly between native assets. Its simplistic UI/UX will help drive adoption and offer accessible alternatives to centralized exchanges. Moreover, it benefits from top-notch tokenomics from the RUNE and THOR tokens. These tokens will incentivize sufficient liquidity and trading activity. As commonly stated in the protocol’s community, this combination could result in THORSwap creating a trading black hole.

Looking to dive deeper? Subscribe to Messari Pro. Messari Pro memberships provide access to daily crypto news and insights, exclusive long-form daily research, advanced screener, charting & watchlist features, and access to curated sets of charts and metrics. Learn more at messari.io/pro

This report was commissioned by the THORSwap, a member of Protocol Services. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. Paid membership in Protocol Services does not influence editorial decisions or content. Author(s) may hold cryptocurrencies named in this report.

Crypto projects can commission independent research through Protocol Services. For more details or to join the program, contact ps@messari.io.

This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. The past performance of any asset is not indicative of future results. Please see our terms of use for more information.