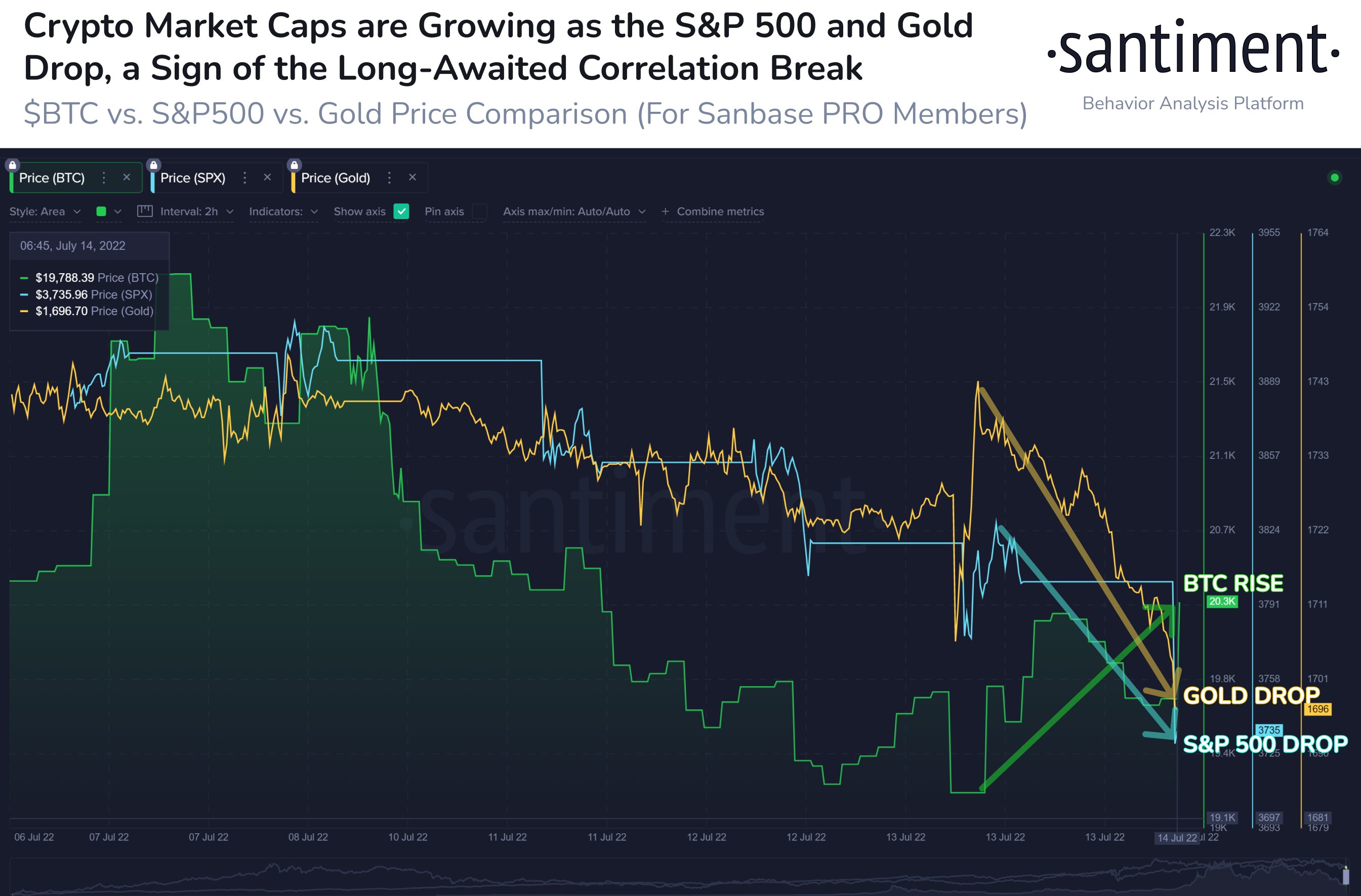

The relationship between Bitcoin (BTC) and the stock market is crumbling, according to crypto analytics firm Santiment.

Santiment notes Bitcoin and altcoins tend to surge when they have very little correlation with equities and that, following Wednesday’s release of the most recent Consumer Price Index (CPI) data, crypto has been recovering while the S&P 500 and gold have dropped.

“If they stay uncorrelated, it’s a good sign of a potential breakout.”

Bitcoin is trading for $20,637 at time of writing. The top-ranked crypto asset by market cap is up more than 4.6% in the past 24 hours.

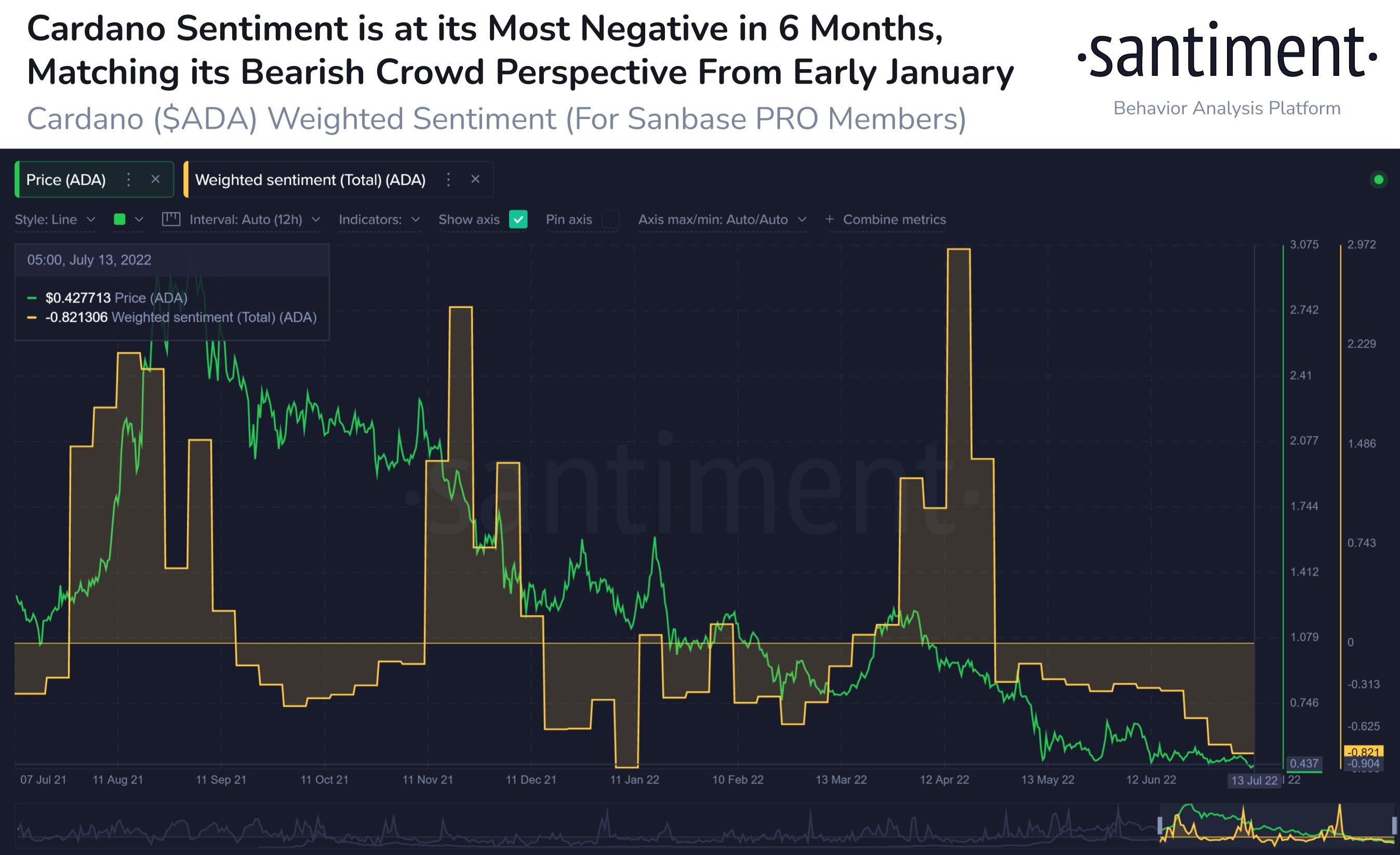

Santiment also notes the price of Cardano (ADA) is down nearly 70% since the beginning of 2022, spurring negative social sentiment toward the Ethereum (ETH) competitor.

This is a potentially positive development for ADA’s price in the short term, according to the analytics firm.

“The last time the crowd was this negative in January, ADA rebounded +24% in 5 days until sentiment turned positive again.”

Cardano is trading for $0.44 at time of writing. The 8th-ranked crypto asset by market cap is up nearly 4% in the past 24 hours.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/luxmi_3d_studio/PurpleRender

The post One On-Chain Metric Could Signal a Bitcoin (BTC) Breakout, According to Crypto Analytics Firm appeared first on The Daily Hodl.