Key Insights

- Ethereum represented 89% of total volume traded on 1inch in the quarter.

- Polygon accounted for 52% of total transactions across the Aggregation and Limit Order Protocols.

- Layer 2 scaling solutions led growth across total transactions and users.

- USDC was the most actively traded asset with over $19 billion in volume.

- The 1inch Foundation allocated an additional 10 million 1INCH to the gas consumption refund program during Q2.

A Primer to 1inch

The 1inch Network is designed to be an all-in-one decentralized finance (DeFi) service provider operating on Ethereum, Arbitrum, Optimism, Polygon, Avalanche, BNB Chain, Gnosis, and Fantom. Launched in 2019, 1inch’s Aggregation Protocol (AP) allows users to route trades across various markets and realize the best available rate compared to any individual decentralized exchange (DEX). In late 2020, the 1inch Liquidity Protocol introduced a native automated market maker (AMM) to the network which enables users to provide liquidity and earn passive liquidity mining rewards. The network’s third product, the 1inch Limit Order Protocol (LOP) was introduced in June 2021 to support conditional limit and stop-loss orders with no fees. All three protocols are governed by the 1inch DAO using the network’s native 1INCH token.

There have been many unprecedented events that occurred in Q2 2022 driving fear, uncertainty, and doubt (FUD) in the crypto markets. Crypto endured adversity brought on by mounting regulation exacerbated by the failure of centralized financial lending institutions (CeFi), the implosion of Three Arrows Capital, and the collapse of UST.

Contrary to the overall market downturn, 1inch’s growth in trading volume signals a strong demand from users to reposition their portfolios to weather the market. Ethereum continued to facilitate the majority of the activity on 1inch, whereas tokens denominated in stablecoins USDC and USDT along with stETH were key drivers of volume quarter-over-quarter.

This report includes data from Ethereum, BNB chain, Polygon, and Optimism which contribute the majority of activity on 1inch. Data from Avalanche, Fantom, Arbitrum, and Gnosis are currently not included. Additionally, the Liquidity Protocol has been omitted due to a lack of high-quality data from publicly available sources. We will be working in the coming months to improve access to this data.

1inch Performance Analysis

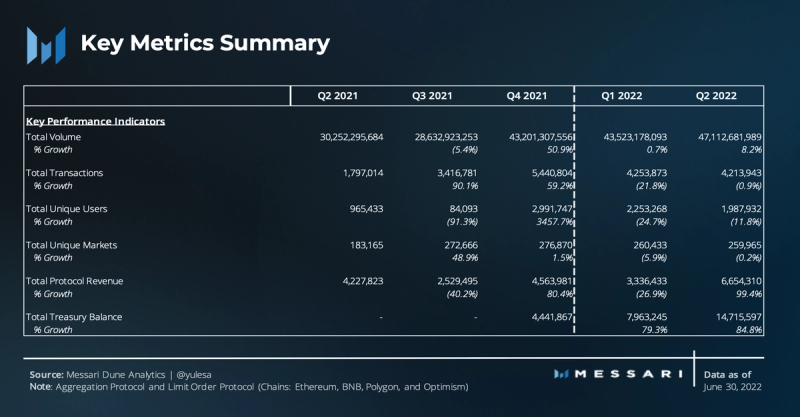

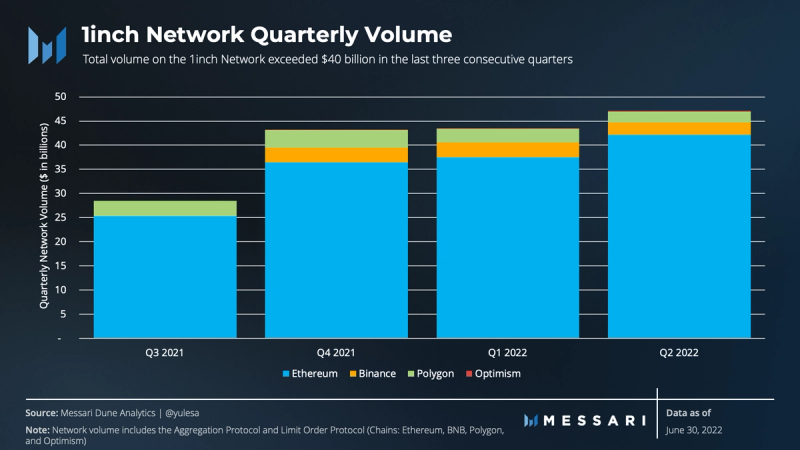

As Q2 2022 wrapped up, the 1inch Network amassed $47 billion in total network volume, up 8% from $44 billion in Q1. 1inch managed to exceed $40 billion in total volume each quarter since Q4 2021, despite the negative shift in sentiment since the end of the year. Total volume was mostly driven by activity on Ethereum, followed by BNB chain and Polygon. Ethereum had over $42 billion in total network volume making up a staggering 89% of total volume for the Aggregation and Limit Order Protocols. The spike in volume corresponds with the volatility in the market from the UST and stETH depeg events. Whereas BNB chain and Polygon represented a meager 6% and 5%, respectively.

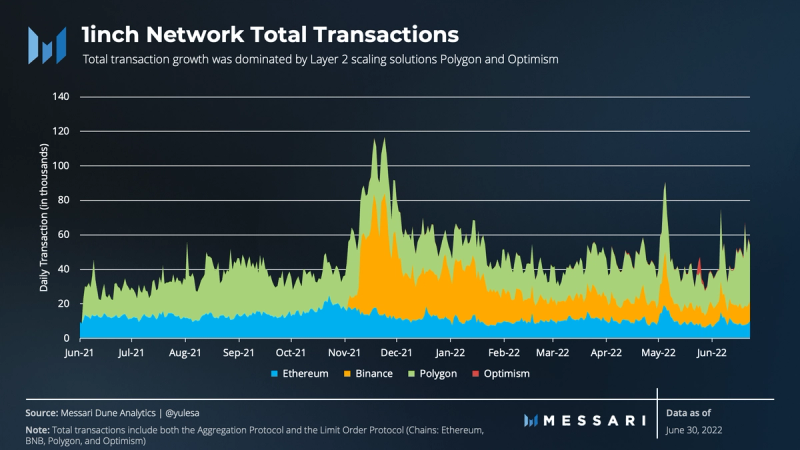

In Q2, the 1inch Network processed 4.2 million transactions across its four largest chains. This value is relatively consistent compared to previous quarters and represents less than a 1% decrease from Q1. Polygon processed 52% of total transactions, dominating total transaction activity. Additionally, Polygon transactions quarter-over-quarter grew 35% to 2.2 million transactions, from 1.6 million.

BNB chain and Ethereum processed the second and third most transactions on the network. The BNB chain transaction activity declined by 37% quarter-over-quarter, reflecting 1.1 million in transactions compared to 1.7 million in Q1. Total transactions on Ethereum fell by a modest 2% to 896,000, compared to 914,000 in Q1. There is something optimistic about Optimism, despite representing under 2% of total transactions. In Q2, total transactions on Optimism grew by an eye-opening 719%, or 56,000 from 7,000 transactions in the prior quarter.

However, when analyzing the average daily transaction by volume, Polygon underperforms compared to other chains. Ethereum’s average daily transactions by volume was $45 million in Q2, compared to $41 million in Q1. Despite accounting for less than 2% of total transactions and 1% of total volume in the quarter, Optimism outperformed both BNB chain and Polygon averaging $4 million in daily average transactions by volume in Q2, down from $20 million in Q1. For comparison, BNB chain and Polygon daily average transactions by volume were $2.2 million and $1 million, respectively.

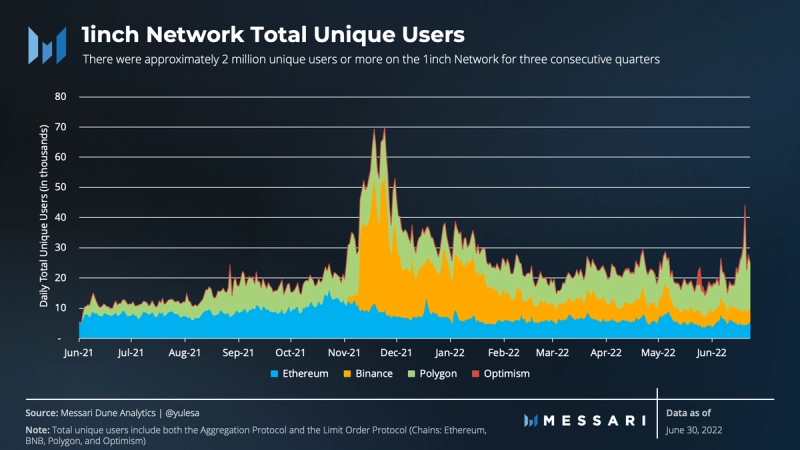

Total unique users declined 12% quarter-over-quarter to 2 million users, from 2.3 million. This was the second consecutive quarter where the total user base declined, likely a result of new users on the sidelines due to the current market volatility. Polygon took the throne from the BNB chain and is the dominant force bringing unique users to the protocol in Q2, reflecting 46% of total unique users. Unique users on the BNB chain declined by 47% to 514,000 in the quarter, compared to 967,000 in Q1.

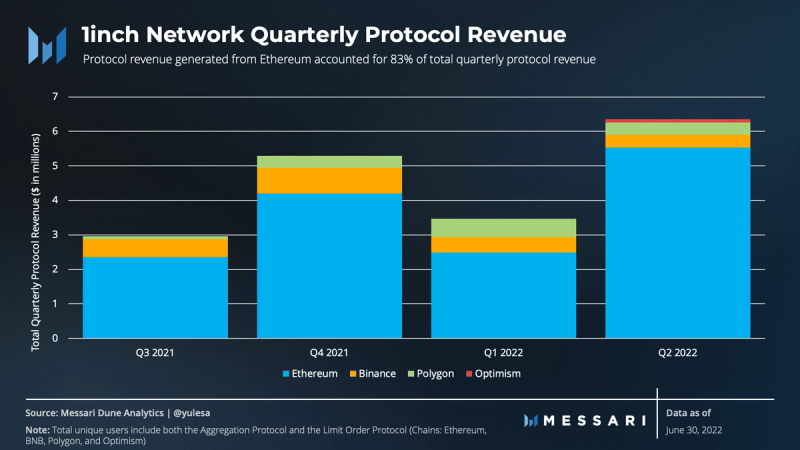

The protocol revenue is a product of positive price slippage on the network. When a rate changes in a favorable direction during the execution of a trade, the surplus of tokens is returned for the swap. Currently, 100% of the “swap surplus” is split between the 1inch Network DAO Treasury (80.55%) and Referrers (19.45%).

The 1inch Network generated $6.7 million in protocol revenue in Q2, virtually doubling the prior quarter revenue of $3.3 million. Approximately 42% of total protocol revenue in the quarter was generated on May 11th and 12th, coinciding with the collapse of UST. Additionally, during the stETH depeg on June 13, protocol revenue grew 14x more than the 7-day average representing 4% of quarterly revenue. The market inefficiencies caused by UST and stETH holders scrambling to exit their positions were likely the cause of an excess in “swap surplus”, and ultimately the spike in protocol revenue.

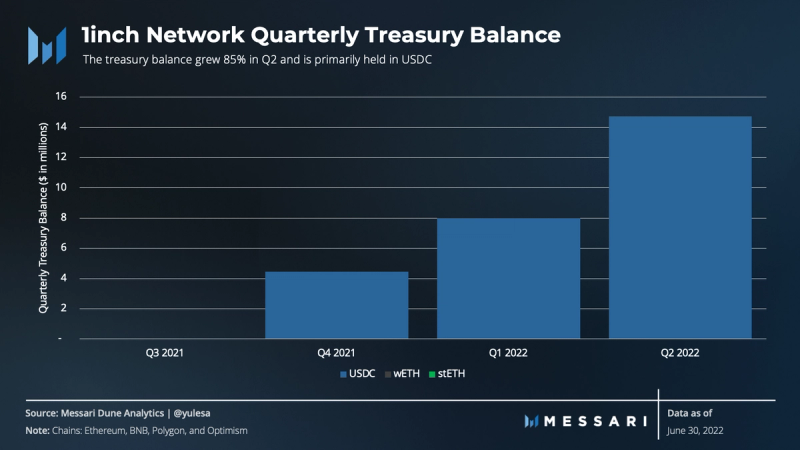

This increased the 1inch DAO treasury balance by 85% from $8 million in Q1 to $14.5 million. Consistent with the overall volume, Ethereum represented $5.5 million, or 87% of total protocol revenue, followed by BNB chain and Polygon. The BNB chain and Polygon accounted for $378 million and $340 million, respectively. In Q2, Optimism contributed protocol revenue for the first time, accounting for less than 2%, or $107,000.

Aggregation Protocol Overview

The Aggregation Protocol’s total volume grew over 7% in Q2 to $44 billion following a flat first quarter. Although relatively flat in the quarter, total transactions declined for the second consecutive quarter to 3.9 million transactions from 4 million. Total unique users and unique markets declined quarter-over-quarter to 1.9 million users and 216,000 markets, respectively.

Despite the negative performance of the market since the end of 2021, the Aggregation Protocol experienced robust volume growth in Q2. Total quarterly volumes exceeded $40 billion for the last three quarters, with this quarter seeing an 8% increase from $41.2 billion in Q1 to $44.3 billion. Ethereum represented 89% of total AP volume, whereas BNB chain and Polygon only accounted for 5.4% and 4.8%, respectively. Ethereum volume alone was $40 billion in Q2, a 12% increase. BNB chain volume declined 19% in the quarter to $2.4 billion from $3 billion. Polygon also saw a decline of 20% in Q2, to $2.1 billion from $2.7 billion. Total volume on Optimism grew 58% quarter-over-quarter but only represents $206 million in Q2, or less than 50 basis points.

There were extreme spikes in daily volume peaking at a record $2.9 billion on May 12. This spike in volume aligns with the the timing of the depeg of UST and eventual collapse. Subsequently, the spike in volume on June 13 appears to be correlated with the depeg of stETH, which depegged to 0.93:1.

The most common assets traded on 1inch were tokens denominated in stablecoins and blue chips. In Q2, USDC experienced the most volume, followed by USDT and ETH. Representing 25% of total volume, USDC almost topped $20 billion, an increase of 17% from the prior period. USDC was the most actively traded asset quarter-over-quarter. USDT flipped ETH in Q2, with a total volume growing by 32%, to $14 billion from just under $11 billion in Q1. Lastly, ETH trading volumes declined to $9.6 billion from $11 billion in Q2, a 13% decrease.

Since the peak of nearly 5 million in total quarterly transactions in the fourth quarter of 2021, total transactions have declined 21%. In Q2, quarterly transactions were primarily flat, falling 1.4% quarter-over-quarter to 3.96 million. Polygon saw a 35% growth in transactions in Q2 and accounted for 52% of total quarterly transactions. In the trailing twelve months (TTM), Polygon represented 46% of total transactions, followed by BNB chain with 28%. BNB Chain’s total transactions in the quarter declined 39% to 975,000 from 1.6 million, whereas Ethereum transactions declined by 2%. Although total transactions on Optimism were negligible, on a relative basis Optimism saw a massive 719% increase to 56,000 transactions, from 7,000 in Q1.

The total quarterly unique users on the Aggregation Protocol fell 13% from 2.2 million in Q1 to 1.9 million users in Q2. The decline in unique users is likely correlated with the overall market being down approximately 66% since Q4 2021. Unique users on the BNB chain declined by almost 50% in Q2, to 487,000 from 942,000. A similar story to quarterly transactions, Polygon was the driving force behind total unique users, accounting for 46% of all unique users in Q2. Polygon and Optimism were the only two that experienced growth in the quarter, with 28% and 694% growth, respectively. Ethereum unique users have steadily declined each quarter since Q4 2021.

Limit Order Protocol

The key features of the Limit Order Protocol include flexibility and high gas efficiency which are achieved by using two different orders, a limit order and RFQ order. The limit order enables users to set orders by expiration using block time or time stamps, and by a predetermined price. RFQ orders operate similarly but are geared towards market makers and enable gas-optimized orders with restricted capabilities.

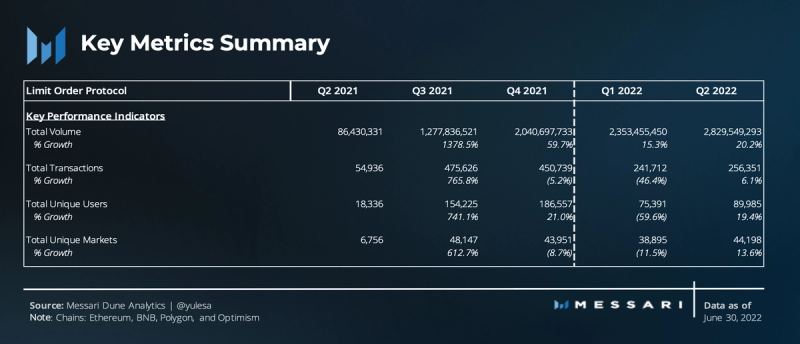

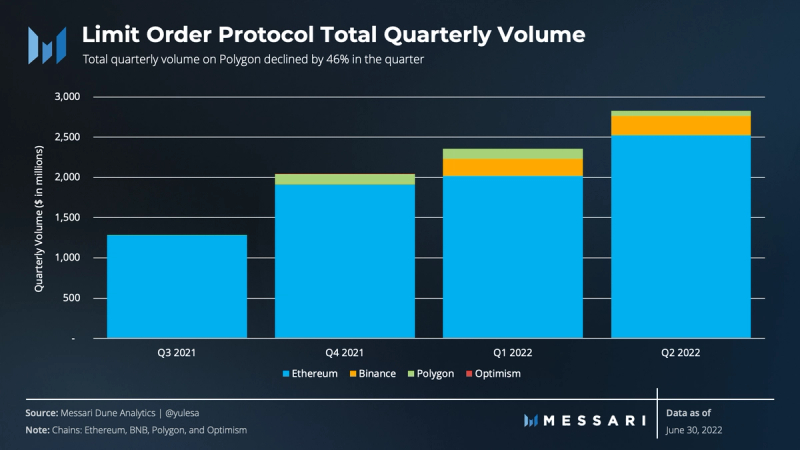

Unlike the Aggregation Protocol, the Limit Order Protocol experienced growth in every metric in the second quarter. Total trading volume grew by 20% to $2.8 billion, from $2.3 billion in Q1. Trading volumes on the LOP have experienced growth every quarter in the last 12 months. There were over 256,000 transactions in Q2 or 6% increase from the prior quarter. Sophisticated users are likely interested in executing orders with more precision and at scale during a market that shed over 60% in market cap year-to-date.

Since the launch of the 1inch Limit Order Protocol (LOP), total quarterly trading volumes grew by double-digit percentages every quarter, trading over $8.6 billion in volume since Q3 2021. Total quarterly volume grew 20% to $2.8 billion in Q2 from $2.4 billion in Q1. Limit orders accounted for 57% of total transaction volume compared to RFQs with 43% in Q2. Ethereum drove the quarter-over-quarter increase in volume, seeing a 25% increase. Binance, Polygon, and Optimism accounted for less than 11% of overall volume in the quarter. Optimism had virtually zero volume in the LOP.

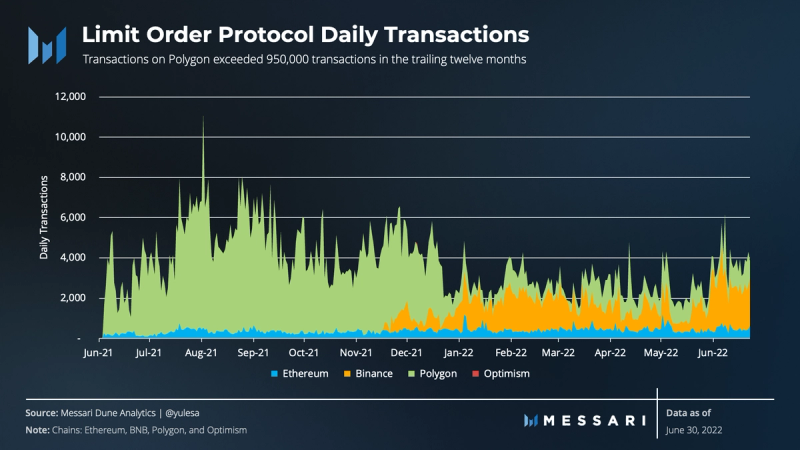

Although we see Ethereum dominating overall volume on the LOP, the total transactions on a quarter-over-quarter basis paint a clearer picture of protocol usage. In Q2, BNB Chain processed 121,000 transactions, down 10% from the prior period. Polygon was the second chain of choice, processing 95,000 transactions in Q2, a 41% increase from Q1. Ethereum sat in the backseat accounting for a modest 2% of total transactions in the quarter. As a result, transactions grew to 256,000 from 241,000 ending the quarter.

There were virtually zero LOP transactions on Optimism in the quarter. In a market where price volatility has been rampant, users can have peace of mind setting limit orders to execute transactions within their preferred price targets.

Looking at both LOP volumes and quarterly transactions illustrates that Ethereum is facilitating larger transaction amounts by volume relative to its peers, likely driven by whales. Ethereum’s average daily transaction in Q2 was $58,000, 32x larger than Binance’s average daily transaction of $1,800. Despite an increase in BNB chain daily unique users seen below, the daily average transaction size has been trending downward since the prior quarter. Similarly, the decline in Polygon’s daily unique users corresponds with the decline in daily average transaction size, year-to-date.

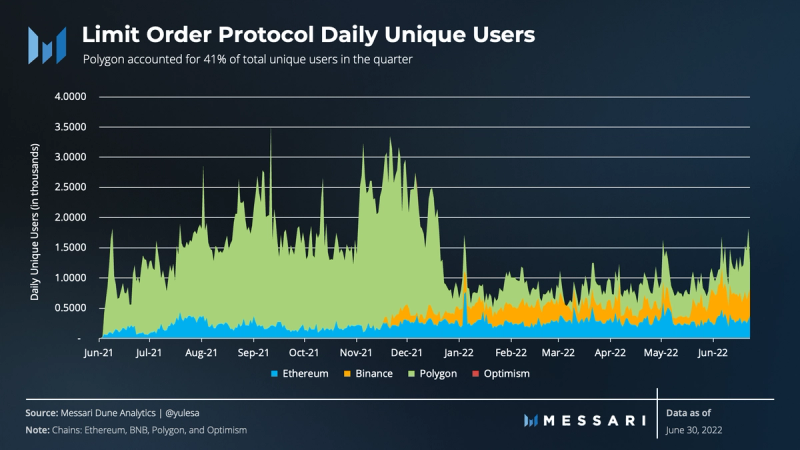

Total unique users in the quarter grew 19%, from 75,000 in Q1 to 90,000 unique users. Polygon accounted for 37,000 or 41% of total users, rising 45% in Q2. This demonstrates the clear relationship between the increase in Polygon users and its corresponding increase in transaction activity in the quarter. Binance and Ethereum represented 27,000 and 26,000 unique users, an increase of 8% and 5%, respectively.

In Q2 2022, there was over $81 billion in total volume across the largest DEXs. Volumes have declined since Q4 2021 by 31%, or $36 billion. Uniswap historically has dominated overall DEX volumes but for the first time, 1inch represented the most volume across the largest DEXs accounting for 39%, or $31 billion in Q2. In contrast, Uniswap had 28% or $23 billion in volume. In the prior quarter, 1inch and Uniswap were almost neck and neck reflecting 36% and 37% of Q1’s total volume of $90 billion. The influx in volume could be attributed to users scrambling to reallocate assets during the unprecedented events that took place in the quarter. 1inch’s ability to perform efficient trade execution is indicative of the growing trend seen year-to-date.

Qualitative Analysis

Key Events

June 1, 2022 – 1inch rolled out the integration of Snapshot into the governance process. This allows participants to cast a gasless vote off-chain and delegate their votes to other addresses.

May 19, 2022 – Bitstamp Listing enables deposits and withdrawals for 1INCH.

April 14, 2022 – The 1inch Aggregation Protocol and Limit Order Protocol have been deployed on Fantom.

Summary Governance Proposals

In the Q2, there were a total of three successful governance proposals and six key preliminary governance discussions outlined below.

[1IP – 09] Collect 1inch DAO Treasury revenue in 1INCH in addition to USDC

July 11, 2022 – The proposal seeks to modify the existing Swap Surplus revenue stream. Currently, various tokens are swapped to USDC before being sent to the 1inch DAO Treasury. The proposal will instead swap these tokens to 1INCH only when the market price is below the $1.30 to $1.70 range.

[1IP-08] Simple diversification mechanism for 1inch DAO Treasury

July 11, 2022 – The proposal aims to whitelist ETH, WETH, WBTC, DAI, and USDT tokens for treasury collection. This is meant to bring a risk-on diversification allocation outside of holding solely USDC.

[1IP-07] Integrate Balancer Boosted Pools in the 1inch Aggregation Protocol

May 3, 2022 – The proposal is meant to grow the liquidity sources that are compatible with the 1inch Aggregation Protocol by integrating Balancer Boosted Pools.

Key Governance Discussions

June 29, 2022 – a preliminary discussion discussing the second stage of decentralizing the 1inch DAO. It outlined the operational and membership hierarchy of the DAO, where goals are defined and request operational budgets via snapshot, and to declare the 1INCH token as the base currency used to pay eligible members of the DAO.

The Operational Hierarchy would have a flat structure dividing working groups by guild and grants committee:

- Developers Guild

- Writers Guild

- Treasury Guild

- Marketing Guild

- Grants Committee

The Membership Hierarchy would comprise five levels as follows:

- Guests

- Enthusiasts

- Contributors

- Core Contributors

- Genesis Members

May 23, 2022 – a preliminary discussion aiming to develop a website for 1inch delegations and incentivize the delegation role.

May 21, 2022 – a preliminary discussion aimed at implementing a conservative asset management program to Earn Conservative Yields on idle USDC in the DAO Treasury began circulating. The proposal discusses how 1inch can use an Enzyme vault to effectively manage the treasury. The vault allows operational flexibility without sacrificing trustlessness and control via Gnosis multi-sig, Snapshot, and SafeSnap on Ethereum Mainnet.

May 21, 2022 – a preliminary discussion to improve governance engagement through meta-delegation using university organizations. This approach is meant to draw insights into current practices, highlight various pathways to implementation, improve and increase thoughtful governance participation.

May 13, 2022 – a preliminary discussion to kickstart a permissionless and transparent 1inch community grants program. The annual budget of $2 million would be broken down by a maximum of $500,000 per season through a committee of 7 elected by the 1inch DAO. The committee members would be elected for two seasons (6 months) and oversee the annual allocation through a 4/7 multi-sig.

May 10, 2022 – a preliminary discussion to implement a treasury management strategy by allowing the DAO to vote on a treasury allocation, establishing The Triad committee, and selecting protocols to engage with. The Triad Committee is composed of three triads, the 1inch High Table, 1inch Committee, and 1inch Investigators.

1inch Foundation Grant Program

The 1inch Foundation launched a $3 million grant program to fund the future development of the Network, Community, and Research and Analytics. The foundation released approximately $781,000 in 1INCH in 2021 to grant recipients. In Q1 2022, the second batch of grants equivalent to $634,000 in 1INCH aimed to grow the 1inch ecosystem and improve the user experience. Recipients include LI.Finance, SyntiFi, Where is Dino, Alexey Devyatkin, and Erigon.

Grant recipients are spearheading a variety of efforts to grow the ecosystem and improve the user experience by driving multi-chain strategies, improving the Anti Money Laundering processes, developing a 1inch cold wallet with built-in features, aiming to achieve efficiency and modularity, and lastly creating an animated video for 1inch depicted in Cyberpunk style.

Gas Refund Program

In Q2 2022, the 1inch Foundation decided they will revamp the gas consumption refund program and allocate another 10 million 1INCH to the program that originally started in Q4 2021. Ethereum users who stake 1INCH through the 1inch application are eligible for a gas consumption refund. The refund program will run until 10 million 1INCH are refunded. Refunds are based on a percentage of staked 1INCH and limited to $10,000 in 1INCH per user, per month.

Roadmap

The primary item on 1inch’s Roadmap is to eventually have full-fledged DAO functionality with the end goal of becoming fully decentralized, giving ownership and direct control over extended governance mechanisms.

There were several successful proposals and forum discussions in the quarter that contributed to the very idea of becoming a DAO. Proposals like outlining a DAO hierarchy and onboarding thoughtful contributors are great steps towards this goal. It will require a continued effort from the community to stay engaged, start meaningful discussions, and work together to make this a reality.

Closing Summary

Despite what many would consider crypto winter and all the chaos resulting from the collapse of centralized entities, UST, and a notorious crypto hedge fund, users are still very actively trading on the 1inch Network. Overall trading volumes, also a driver of protocol revenue, increased since the end of 2021, whereas the overall market cap has declined. Ethereum has continued to be the main driver of revenue and sophisticated users continue to leverage the LOP to execute trades according to their strategies.

Understandably, emerging users may shy away from entering the space while the market gains its footing. Due to 1inch recently flipping Uniswap in total DEX volume, coupled with the growing network volumes quarter-over-quarter in a harsh macro environment, it could be said 1inch is on its way to becoming a household name.

Let us know what you loved about the report, and what may be missing, or share any other feedback by filling out this short form.

Looking to dive deeper? Subscribe to Messari Pro. Messari Pro memberships provide access to daily crypto news and insights, exclusive long-form daily research, advanced screener, charting & watchlist features, and access to curated sets of charts and metrics. Learn more at messari.io/pro

This report was commissioned by 1inch, a member of Protocol Services. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. Paid membership in Protocol Services does not influence editorial decisions or content. Author(s) may hold cryptocurrencies named in this report. Crypto projects can commission independent research through Protocol Services. For more details or to join the program, contact ps@messari.io. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. The past performance of any asset is not indicative of future results. Please see our terms of use for more information.