In their second attempt to break above the overhead resistance at $0.38, the bulls once again failed. This caused the price to move towards the 50-day moving average line.

Technical Analysis

By Grizzly

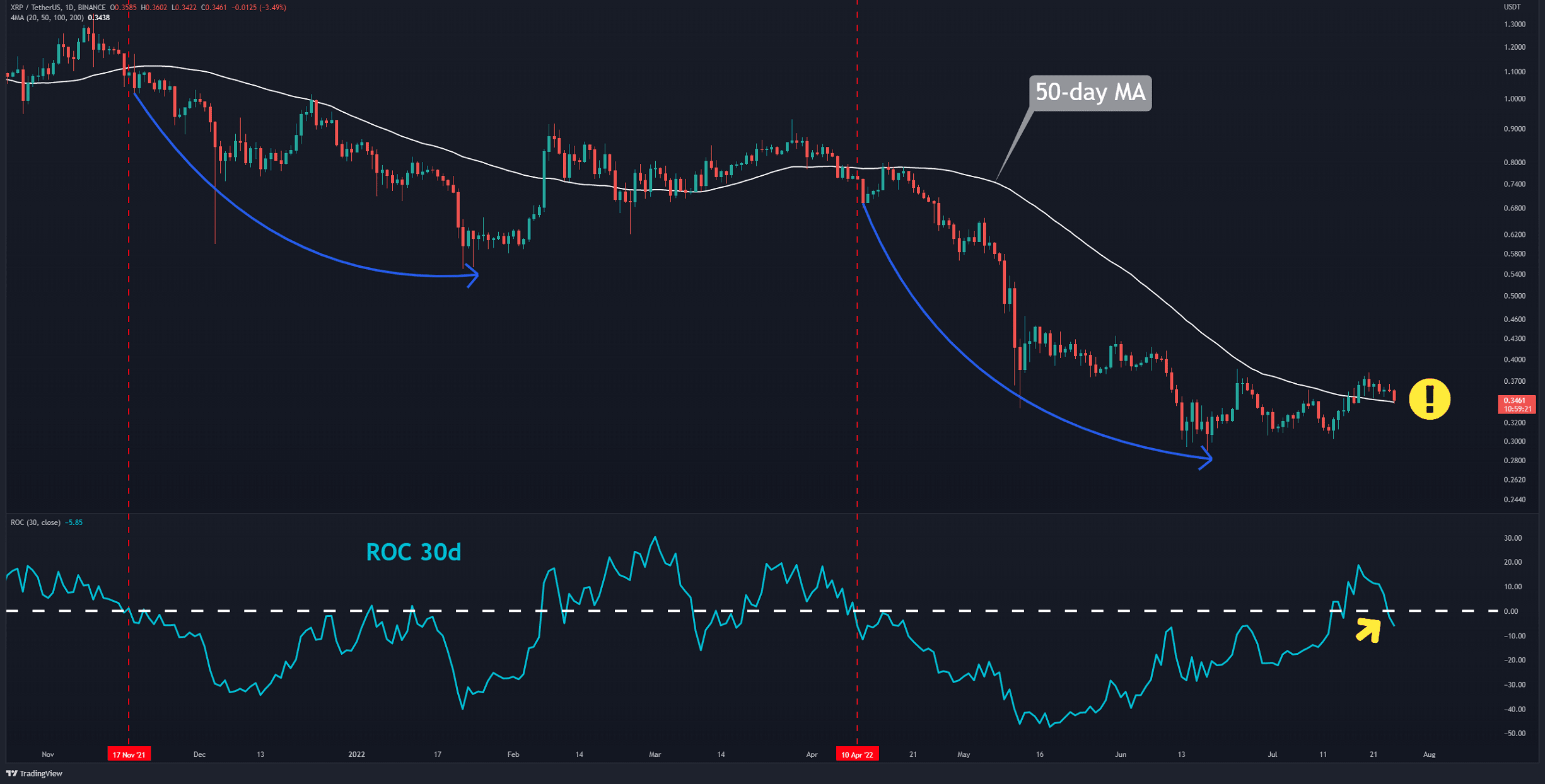

The Daily Chart

Although the weekly candle closed in the green yesterday, the long upper shadow shows that the selling pressure near the horizontal resistance at $0.38 is relatively high. The bears pushed the price down by 10% as of this writing. The price has now touched the 50-day simple moving average line (in white). On the other hand, the Rate of Change (ROC) 30d indicator broke below the baseline (in yellow) and entered the negative territory.

Taking into account the last two downward trends (in blue), it is evident that deep declines are triggered when the price penetrates below the MA50, and at the same time, the ROC gains momentum below the baseline. Therefore, it is crucial that the price does not revisit below $0.33. If the bears dominate the market again, the support at $0.3 is expected to be retested.

Key Support Levels: $0.38 & $0.42

Key Resistance Levels: $0.33 & $0.3

Daily Moving Averages:

MA20: $0.34

MA50: $0.34

MA100: $0.43

MA200: $0.59

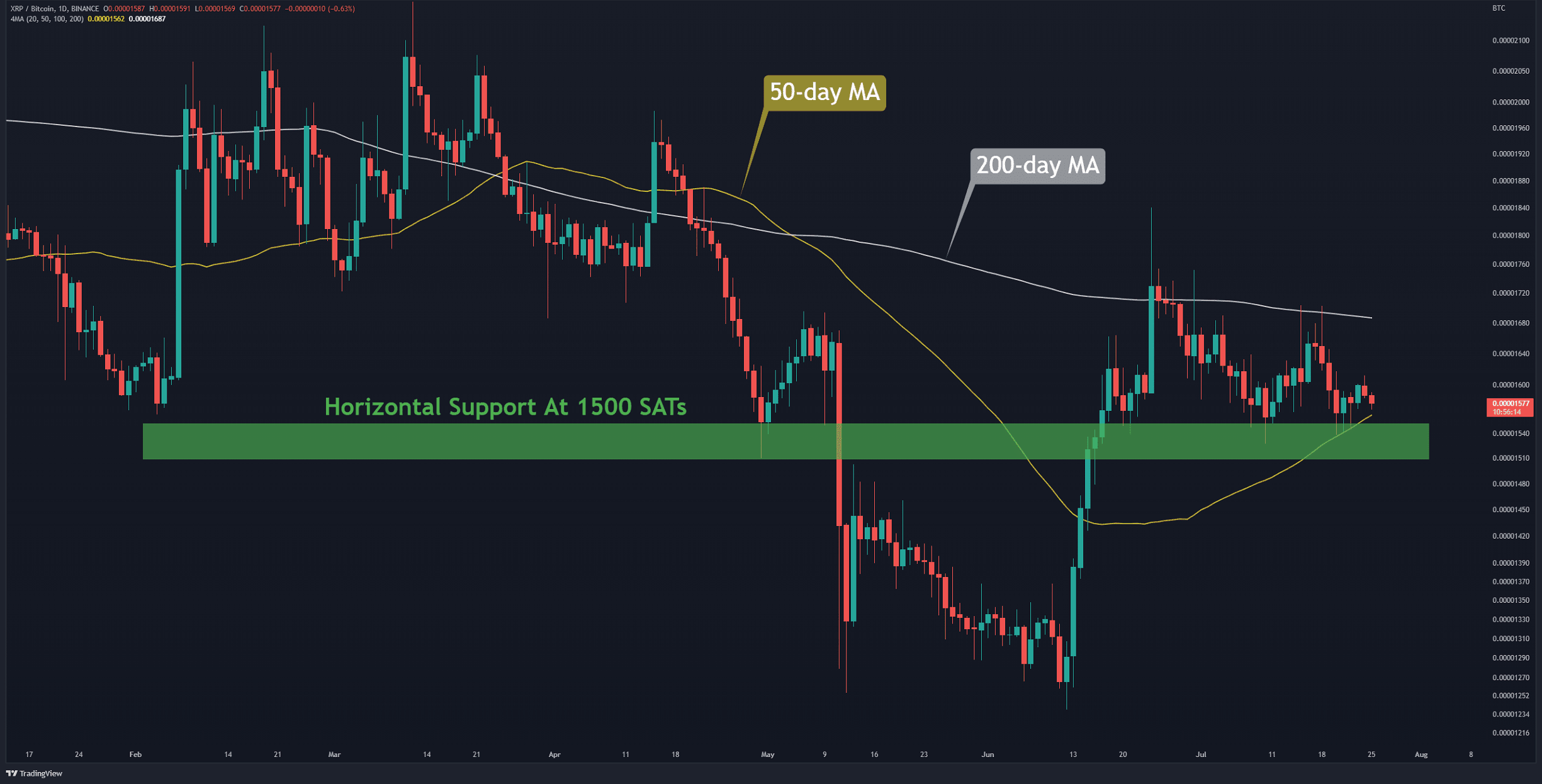

The XRP/BTC Chart

Against Bitcoin, the price is stuck between the 200-day moving average (in white) and the 50-day MA (in yellow). Meanwhile, the bulls have defended the horizontal support at 1500 SATs (in green) so far. Determination of direction in the coming days depends on claiming one of these two moving averages. No significant movement is expected if the price remains in the 1500-1800 SATs range.

Key Support Levels: 1500 SATs & 1370 SATs

Key Resistance Levels: 1800 SATs & 2100 SATs